"In conclusion, this is a company that really has a huge growth business as their core business and many more lines in the water. This is definitely a huge growth business. They are creating future revenue streams that we couldn't envisage now, encouraging staffers to be creative (certainly rewarding them for it) and making life easier each and every day."

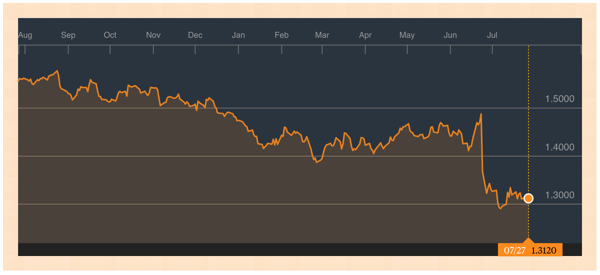

To market to market to buy a fat pig Stocks started stronger in the morning on the local front and then slid away during the course of the afternoon. Central banks in focus, there is also the pesky idea that the SABMiller and AB InBev deal is not exactly on the rocks, it is sailing in choppy waters, however. There may be SABMiller minorities who are jostling for a higher Pound price, on account of their Dollar value looking weaker, that should not really concern the global beer giant headquartered across the English Channel now, should it? Belgium is a wonderful country, they just so happen to also use the Euro, now don't they? The deal will go ahead in the end, the options for SABMiller shareholders are to take the money and run, or to see a much lower share price if they pulled the plug.

Locally we saw some softer unemployment data in recent days, sadly more jobs have been shed. Eish, there is some sort of Indaba today in the rich part of Johannesburg to solve the unemployment problems. Better than not looking for any solutions at all, the EOH sponsored event includes all folks from all quarters and will deal with internships at businesses, the money is there from government and I certainly welcome this initiative. Resource stocks were up three-quarters of a percent, the rest was all down heavily.

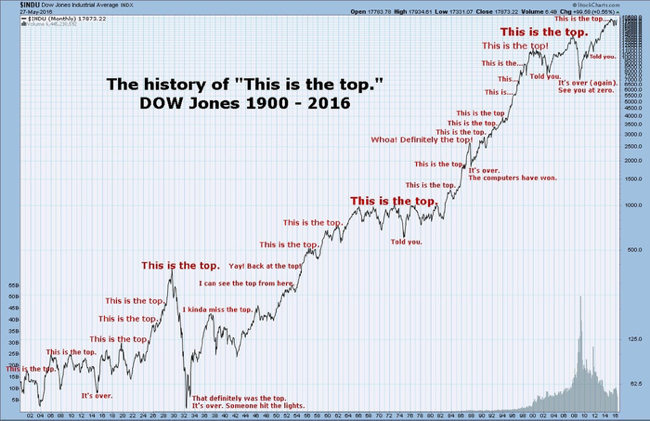

Across the seas and far away on Wall Street, stocks rallied into the close, the Dow Jones Industrial Average still ended marginally in the red. Down a smidgen, off 0.09 percent by the close. The broader market S&P 500 and the nerds of NASDAQ were buoyed in part by another strong day by Apple, and well received results from Facebook too, both stocks coincidently up 1.35 percent. Earnings central continues to produce by far and away the busiest and most exciting time of the year for us. So, without further ado, let us jump head first (onto a trampoline) into these numbers released after-hours.

Company corner

Alphabet reported numbers last evening, this is for the second quarter to June 2016. The half year too, something that we are a little more accustomed to around these parts. Revenues for the quarter grew 21 percent over the comparable quarter in 2015, and 6 percent better than the previous quarter. Yowsers, that is some pretty exceptional growth. In constant currencies, as we still live in a world of relative Dollar strength to everything else, revenues increased 25 percent relative to the quarter this time last year. For comparisons sake to Facebook, who reported yesterday, Alphabet clocked revenues of 21.5 billion Dollars, more than three times that of Facebook.

Non-GAAP income bolted on another billion Dollars versus the prior quarter, clocking 5.864 billion US Dollars. On a per share basis that equals 8.42 Dollars. Reminder, the stock price is at 797 Dollars pre market (up half a percent in normal trade and another 4.1 percent after hours), the analyst community currently estimates that somewhere in the region of 33 and a half Dollars worth of earnings for the full year next year, and nearly 40 Dollars a share the year thereafter. Anyone can do that math, the stock trades on just less than 20 times earnings to the end of 2018. Got it? As we all know well, the company does not pay dividends yet, having embarked on a weird share buyback program for the first time, a very recent event.

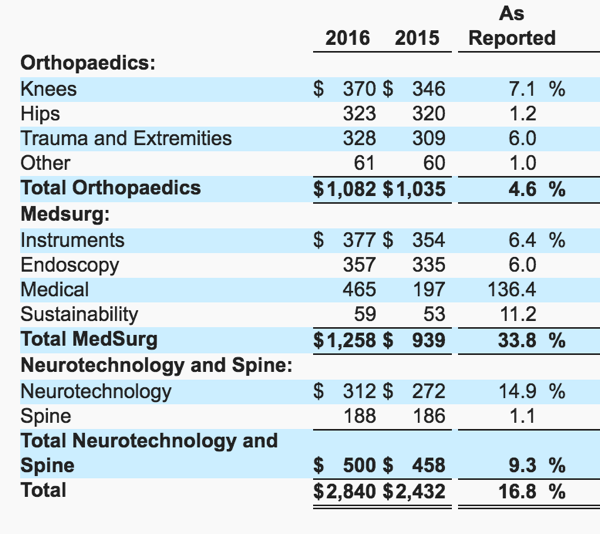

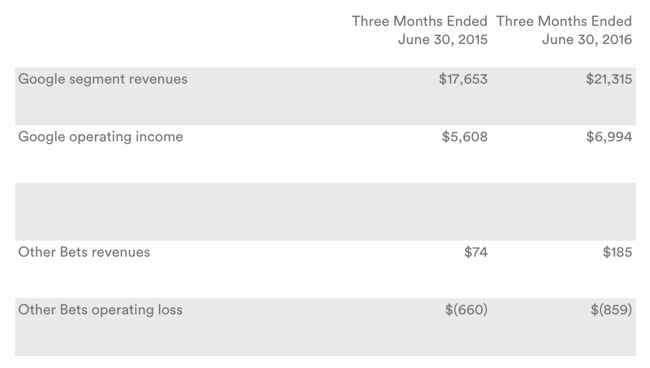

The company may as well be called Google, if you see this table below you can see that the segment "other bets" generates paltry revenues of 185 million Dollars, relative to Google which generate 21.315 billion Dollars. And of course, with many of the "other bets" being in startup and ramp mode, they are going to suck a lot of cash, and obviously make a loss. It goes without saying. Ruth Porat (the CFO) said on the conference call that many of these "efforts" are pre-revenue. i.e. in development phase. Mostly Nest (the camera and home automation business), Fiber (you want more of that, right?) and Verily (healthcare and technology).

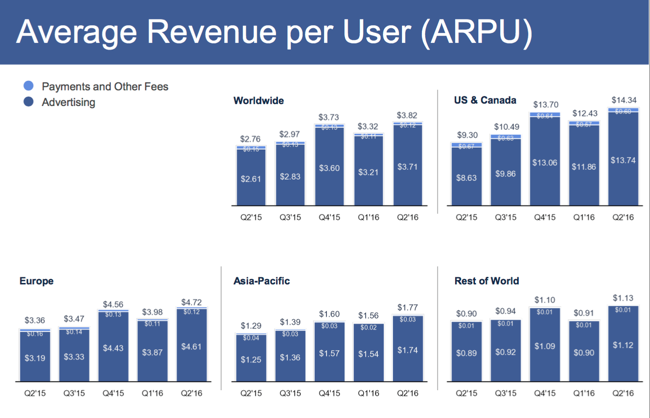

Cash on hand, at the end of the quarter swelled to 78.4 billion Dollars, again, a little over three times the cash that Facebook currently has. Added to the swelling cash balance is a swelling staff compliment, up to 66,575 Googlers. Err .... Alphabetters? The cost per click reduction rate seems to be levelling off, the rate of decline that is. This can be measured against ARPUs, where trends differ from geography to geography, emerging markets still finding their meeting, developed markets are possibly almost all data. Who calls anymore, right? Most of the new hires, according to Ruth Porat, the CFO, are engineers and product managers, to support (and I am almost copying and pasting from the earnings call) growth in priority areas like cloud and apps. Percentage wise much more at "other bets", numbers wise, still dominated by Google.

Talking of calls, the most juicy information that I find is almost always inside of the earnings call. The after the market get together when the analysts and the management get to present a few smart looking questions to impress their peers (in the case of equity analysts) and the answers from management to stick them on the straight and narrow. Everyone asking the questions and invited to participate wants to be Benjamin Graham. Here goes, sign up (for free) to read Alphabet (GOOG) Q2 2016 Results - Earnings Call Transcript.

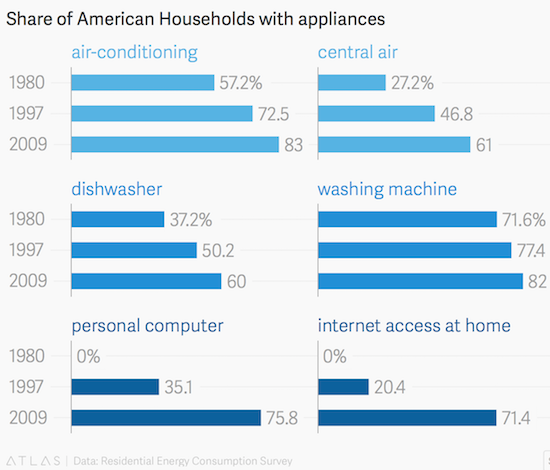

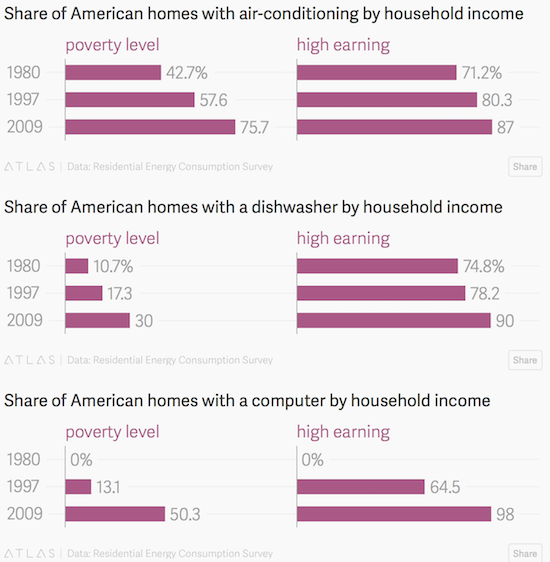

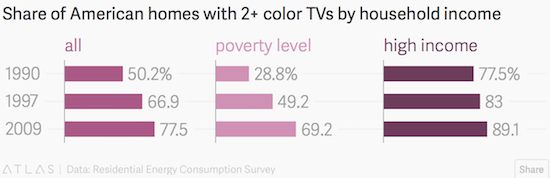

So what does one learn here? YouTube (without giving an absolute number) revenues continue to grow "at a very significant rate". Strong growth in mobile search, use your own smartphone experiences to confirm that, it is clear that this is a strong growth engine right now. I couldn't quite figure this out, it seems that YouTube has been acquiring original content at a quicker click. Machine learnings and Artificial Intelligence spending will position the business well for the future said Google (the core business) CEO Sundar Pichai. That will build the engine to drive the future, he said. I really liked this line, I believe it with all my heart (dangerous when analysing businesses, I know), from Pichai: " ... building for everyone; since the Internet is one of the world's most powerful equalizers, we are committed to building technology and making information available for everyone, wherever they are." The ability to learn anything, no matter where you are in the world is an important step for humanity.

In conclusion, this is a company that really has a huge growth business as their core business and many more lines in the water. This is definitely a huge growth business. They are creating future revenue streams that we couldn't envisage now, encouraging staffers to be creative (certainly rewarding them for it) and making life easier each and every day. The company shares today the same vision that the founders created early on. We continue to buy, with a great deal of conviction, what is an incredible company with an amazing future. Own more, buy some for the first time. The stock traded as high as 810 Dollars a share (near an all time high) in the aftermarket, post the results release.

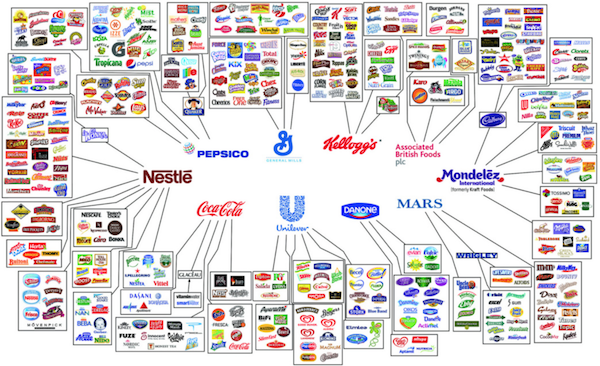

Amazon reported numbers after-hours yesterday. This is an incredible business too. The founder has pretty much tried everything, you may recall the infographic from the Visual Capitalist - How Jeff Bezos Built his Amazon Empire. There are tons of things that the fellow has started and failed at, it is better to have tried and failed rather than to have never tried at all, as they say in the classics. Straight into the new age retailer's results - Amazon.com Announces Second Quarter Sales up 31% to $30.4 Billion.

Just wow. Revenues up 31 percent year-on-year, 30 percent forex adjusted. Like with Alphabet, the forex translations are starting to unwind a little. In other words, relative Dollar strength is all that. Relative, and having been flatlining now for a full year, the comparable over the next two quarters should flatten. Sales at a geographical level are represented at 59 percent North America, Amazon Web Services at 8 percent (I suppose that has no boundaries, the internet) and the balance, 33 percent, one-third, is international. Delivered to places like Mzansi. I use them, do you?

The last four quarters rolling revenues are 120 billion Dollars. Phew, that is sizeable now. Net income clocked 857 million Dollars, we have massaged ourselves to expect very little in terms of profits from the company, so I guess this is going to morph from a "pleasant surprise" to a more regular occurrence is my sense. Earnings on a per share basis clocked 1.78 Dollars. Still, a share price at 768 Dollars after hours (up 2 percent after the earnings release) and 2.16 percent during regular trade, earnings look stretched. I suspect that quarterly profits will have to increase by a factor of three for the stock to trade on a reasonable multiple, relative to their peers. The trick is balance massive investment growth versus expectations of shareholders, you cannot have it all.

Web Services is a small and growing business (relative to the core US business), it is extremely profitable. The media part of the business is growing across the globe (including the US) at low double digits, the business is relatively mature, everyone knows music, books, movies can be downloaded very easily. Electronics and other general merchandise, those sales are growing like gangbusters, 32 percent in the US and 38 percent up year-on-year in the International segment. People want the things online nowadays, you see.

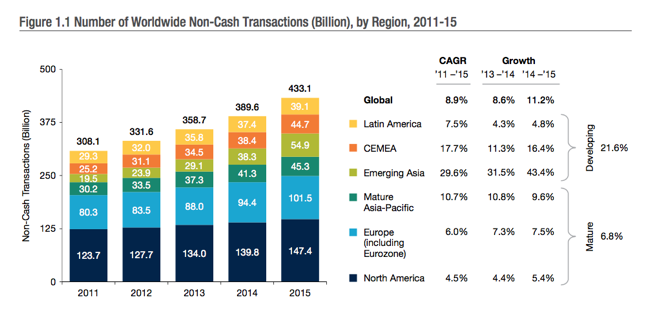

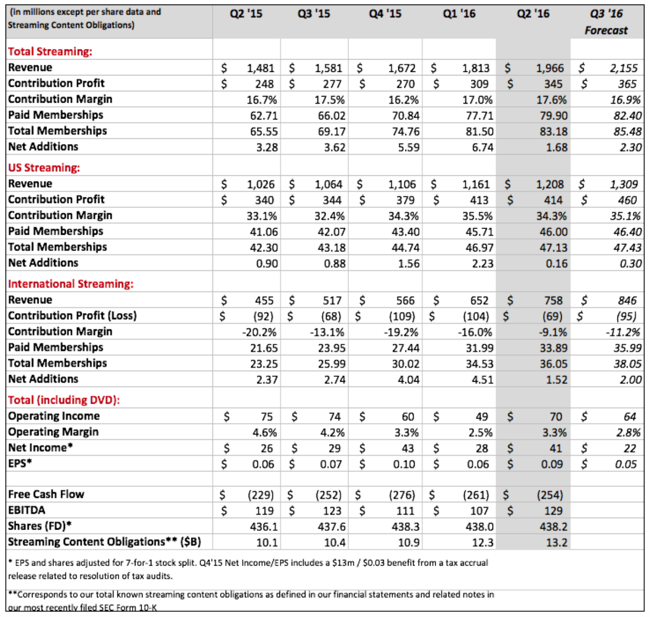

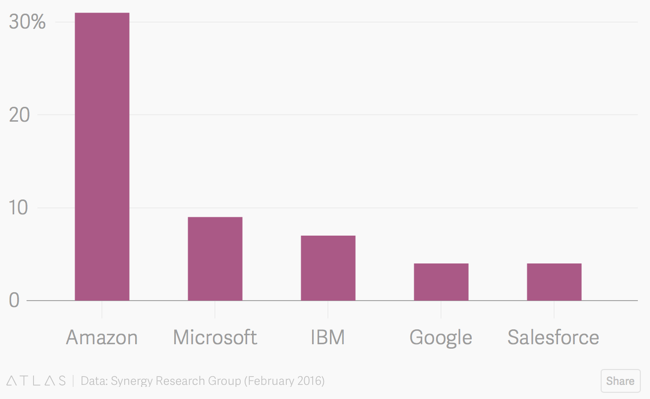

See Quartz and their take on it - Amazon's least sexy business now brings in $10 billion a year. As you can see, people talk about the cloud business of IBM and Microsoft, as well as Google, Amazon dominates, see graph below (thanks Quartz).

The quarter included a big launch in India, Prime (members get shipping free) was introduced with much aplomb into 100 cities, next day or the day after delivery. Which much be harder in India than in many other places, vast population, busy cities and inferior infrastructure to many other parts of the world. Well done for having taken on that amazing challenge. As you can see from the earnings release, follow the link in the first paragraph, the company is incredibly busy.

Churning out original content, AmazonFresh is going to grow like gangbusters (Whole Foods are piloting something similar, announced overnight), even something called Career Choice. Added to new initiatives, all the newer existing businesses are also doing well, the assistant hardware Echo and software Alexa is growing well. Cool product, not available here yet - Amazon Echo.

You are equally owning a part of the future with this company as with Google. This is the future and evolution of data, content and general retail.Buy it with fresh money, buy it if you are underweight the stock. The forecast is really interesting, the profit forecast is very wide (50 to 650 million Dollars operating income) on net sales guidance of 31 to 33.5 billion Dollars. Still ratcheting up really quickly.

Linkfest, lap it up

Sasha found this stat yesterday, there are around 400 trees for every person on earth - Five forest figures for the International Day of Forests

How would you spend 13 weeks if you got that as a summer holiday every year? Children are no longer needed for the harvest season, does the holiday still need to be that long? The children probably love the break, parents less so - School's Out For Summer

You will find more statistics at Statista

Being a Youtube star is a profession that wasn't around at the turn of the century, can you imagine growing up telling your parents that your career path is making videos for Youtube? - This YouTube star made $8 million last year

Home again, home again, jiggety-jog. It continues to be all about earnings for us. Japanese and other central banks may do what they need to or want to, for us we will get to all the stocks that are reporting right now. This includes Amgen too, we also owe you results from L'Oreal, the thesis for both is still intact. We will revert in the coming days, we certainly thus far have been very pleased at how earnings for the majority of the businesses that we own for clients has turned out, it has been good.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063