" ... the Apple chief is quoted as saying "People always doubted us. That's not a new thing and that ebbs and flows with the stock market, so we don't get too uptight about that." Don't get quarteritis. Own the company, a company that still has great prospects."

To market to market to buy a fat pig Stocks were higher through the day, better as the afternoon progressed and we closed strong into the bell. The Jozi all share index is working the way up to an all time high, stocks as a collective ended two-thirds higher in the city founded on gold. Whilst the JSE may have messed up on some flows numbers, nobody patted them on the back for the successful implementation of T+3. Well done chaps, a historical mess up on the aggregating of the flows, who cares in the end. The implementation of the shorter settlement times, no mishaps there and completely seamless. It is funny that when nothing happens, we expect that, when something bad (in this case not even "terrible"), we are quick to jump up and down. Who cares who owns what and who bought what. What data is not as important as we think it is. We all used to rely on emissions data from a certain German car manufacturer, we don't anymore. Does this correct information change your views on buying that brand now, probably not.

Stocks leading the charge at the top end of the leaderboard were the resources, Amplats, Sibanye, AngloGold Ashanti all up smartly. In the down column there was Richemont which sank in sympathy with LVMH (see - LVMH Profit Meets Estimates as Spirits Offset French Decline). Sasol sank as the oil price continues to come under pressure, I saw that the estimates are for Russian output to exceed the daily target achieved at the height of the Communist era. There certainly is this love/hate relationship with the Russians, their opinion of themselves and the option of them by others are certainly entertaining at best. Let us just say that in the crowded metro areas of the world you can spot the Russian.

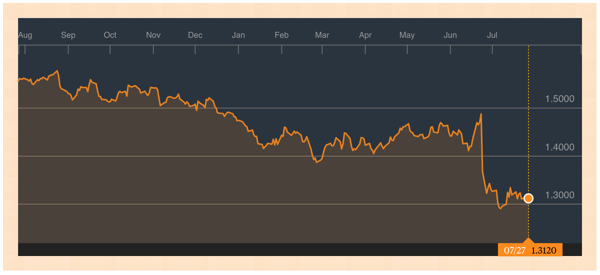

And then the announcement that seemed like it meant something significant at face value, upon further inspection it meant very little. AB InBev announced that they were upping their price for SABMiller from 44 to 45 Pounds, that is Sterling to you and I. I mean Great British Pounds, which may or may not be great, depending on which side of the Brexit fence you sit. The original deal, when AB InBev approached SABMiller was 108 billion Dollars, this boost to 45 Pounds a share takes the absolute amount to a little over 103 Billion Dollars. Huh? What gives? No worries sports lovers, here is a graph of the Pound to the US Dollar over the last 12 months that explains it better than I could, thanks Bloomberg for the one year view - GBPUSD Spot Exchange Rate:

So there you go, more Dollars are less Pounds, which means that AB InBev can up their offer, without really upping their offer, if you know what I mean.

Over the seas and far away, stocks in New York, New York were mixed at best. The Dow sank as McDonald's delivered a mixed set of numbers, it looked OK to me - McDonald's Reports Second Quarter 2016 Results. McDonald's sank over four percent, sending the Dow lower, down one-tenth of a percent. The results in China and Russia looked just fine, growing there, mainland US comparable sales were up 1.8 percent. The broader market S&P 500 added 0.03 percent, the nerds of NASDAQ added around one-quarter of a percent. 3M had results too, those looked good, the stock was marginally lower. Caterpillar beat on cost cutting, the stock rallied over five percent. More results today and tomorrow, exciting times friends. Apple results post market covered here below.

Whilst we (the broader community we) often are quick to "tell" management that they should do this, or that and perhaps try this or that, it is very worthwhile noting that there is a lot to be said for experience. And level heads. I captured this piece from the founder of Luxottica, Leonardo Del Vecchio, in his Letter to shareholders:

"My dream, as an entrepreneur, has always been to make the best eyewear in the world and see everyone wearing them. I have personally experienced, for over forty years, the passionate adventure of turning this vision into a reality with a strong and dynamic company like Luxottica. The pillars of our strategy have never changed: product quality, strong brands, efficient factories, widespread distribution and growing our direct relationship with the end consumer. They will not change now, but we will adapt them for the times."

His parents were so poor that his widowed mother handed him over to an orphanage. That did not deter him from being able to build one of the greatest businesses in that space. His point is well made. Too many people want action all of the time, ignoring the fact that it takes a very long period of time to build a business. What are you doing next quarter or next year or give me colour on x or y, or other stuff that analysts say on conference calls certainly keep management on their toes (and investors have a right to be demanding), equally, give management room to build a business and not focus on meeting market expectations. Shareholders come and go, often people who work for companies are lifers who steer the ship.

Company corner

It is that time of the year again, when the largest company by market capitalisation, Apple, reports numbers. I get the sense that it used to be the most hyped and anticipated set of numbers on Wall Street, I sense a shift to Facebook. There was very little expected from the maker of fine things, the maker of devices that you may, or may not have thought that you needed. Yet, once you had them, you wondered why you had not used it before. The other thing about Apple products is that they just work. My Mac is indispensable to me. People will spend hundreds of thousands of Rands and finance a vehicle over a period of time, to use the vehicle for five to ten percent of the day, yet a product that they are likely to use for 40 to 50 percent of the day, they just "need it to work". It is actually the same with a bed. Perhaps apply the same logic to a motor vehicle, get a better computer (get a Mac, really, you will thank me later) and a better bed, you spend more time with those two things.

You can read the numbers here - Apple Reports Third Quarter Results. The highlight was at the top of the pile, the annuity income, the services business grew revenue at 19 percent on last year. That business accounts for 14.1 percent of sales, and has generated sales of 23 billion Dollars for the last twelve months. According to Google finance, if that Apple services was a standalone business, it would have revenues equal to that of German Software giant SAP. Yes. That is how big iTunes, Apple Music, Apple Pay and the App store is. Bigger than you thought, right? Oracle, another giant of the Software world has annual revenues of 37 billion Dollars. With Apple services revenues growing at that rate, how long until that division eclipses Larry's empire? Tim Cook mentioned on the conference call that as a standalone business, the Services segment will be the size of a Fortune 100 company next year.

The flagship product however, the iPhone, saw sales fall to 40.399 million units, a 15 percent fall year-on-year in unit numbers and as a result of cheaper handsets, a 23 percent fall in revenues. How do the other divisions match up? iPad sales, at a units level fell 9 percent, at a revenue level increased by 7 percent year-on-year. Why? Obviously the higher priced iPad pro is having an impact. Half of the current iPad pro purchases are done for work purposes, intrenching their product as a business tool is important in this category. The Mac (on which I type this message), that fell too both at a revenue and unit level, indicating that broader PC weakness is across the market. Here, there and everywhere to borrow that literary genius Dr. Seuss.

From a geographical perspective there was weakness everywhere, apart from Japan. The Americas, meh, China, not good. To put those China metrics into a two year view, which Tim Cook suggested was important to do (he has just visited there and he is large and in charge), total revenue over two years from mainland China is up 55%. iPhone unit sales in China are also up sharply over the last two years, up 47 percent. When comparing the same numbers year on year, the numbers look less pretty, I get what he is saying though, a bit of perspective is needed at times. In another country he visited, and got to catch a little IPL if memory serves me correct, iPhone sales in India grew 51 percent year-on-year.

All the other metrics seemed to be against the maker of fine electronic things, gross margins lower at 38 percent (still more than just good). Cash on hand is still a whopping 231.5 billion Dollars. Total debt is equally eye popping, 72 billion Dollars. The company is 177 billion Dollars through their 250 billion capital return program, having delivered 13 billion in the last quarter alone through share buybacks and dividends. Cash is not a problem here. Whilst the sales were lower, profits were lower, they were better than people anticipated. On the earnings call after the market, Tim Cook said that "Today we're pleased to report third quarter results that reflect stronger customer demand and business performance than we anticipated just 90 days ago and include several encouraging signs."

The outlook was OK, I suspect better than analysts had expected. The cheaper handset has been well received. Tim Cook said that the demand had outstripped supply. Attracting more people into the ecosystem. What is interesting is that Tim Cook said that first time buyers and switchers represented the lion's share of buyers of the iPhone in this quarter. Why would that be the case? Of course everyone is waiting for the refresh, the new phone, the iPhone 7 coming later this year. Then next year, according to some of the analysts that I follow on this score, the phone may well change form. In other words, a dramatic refresh to celebrate the 10th year of iPhone. On the 'new and up coming' front, are all sorts of changes to the operating systems, the biggest refresh ever in the form of iOS 10, new operating system for the Mac, the Apple Watch, the TV too.

On the conference call Tim Cook gave some insight into how Apple Pay is currently working. According to the data he has, Apple Pay is used in 3 out of every four transactions at contactless ready locations across the US, the service has been launched in France, Switzerland and Hong Kong and in his own words, "Adoption outside the U.S. has been explosive, with over half of transaction volume now coming from non-U.S. markets." Nice.

Smartphone penetration across the globe is 42 percent. Not 82 percent. Not everyone can afford an Apple smartphone, even the 399 Dollar version, they are expensive. Ha ha, I was looking for the quote that Tim Cook made in the WSJ about growth, so I searched for the word growth in the earnings transcript, wonderfully transcribed by SeekingAlpha, and I found the word 15 times. And then I thought I recalled the quote had to do with worries around the share price performance and the doubters, so I searched for "worry". And there were zero results.

I think it is important to know that Tim Cook is aware that investors haven't had the best of times lately, I wouldn't be too concerned. The stock price is one thing, the company is another, the two reflect something in the middle. In the WSJ article titled Apple Earnings Fall on iPhone Slump, the Apple chief is quoted as saying "People always doubted us. That's not a new thing and that ebbs and flows with the stock market, so we don't get too uptight about that." Don't get quarteritis. Own the company, a company that still has great prospects. We maintain our buy recommendation on this company and continue to accumulate. The stock is mooted to open nearly 7 percent higher at 103.25 Dollars. Still, the one year performance has been less than breezy, all headwinds, at that level it would still be down mid teens. We are confident that the heavy lifting will happen.

Linkfest, lap it up

A great read (mostly pictures) about road tripping with a Tesla. The one aspect that I forget as a person using a petrol powered car is that recharging a Tesla takes over an hour, not the 5 min we are used to - We took a Tesla Model S on a road trip and learned the hard way how it's different from every other car

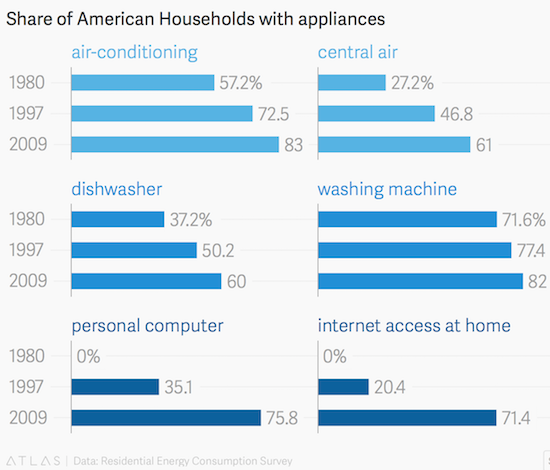

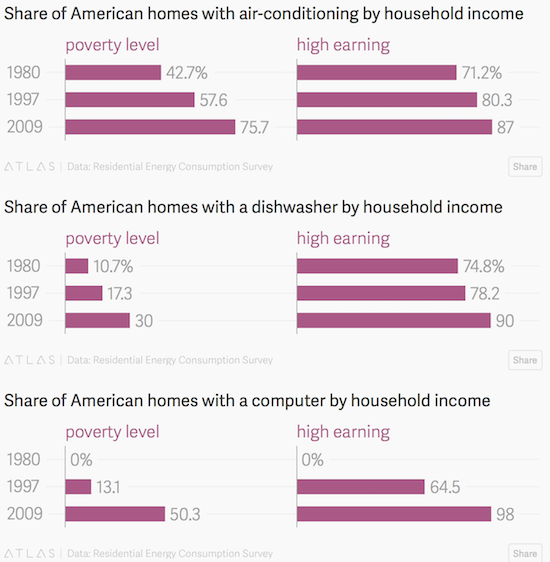

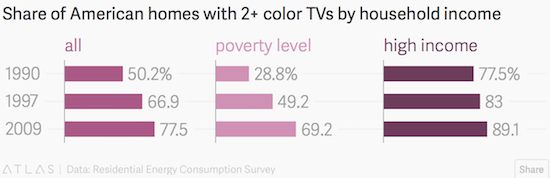

As statistics show that global wealth inequality is growing, the counter argument is that life quality for all is also growing. This blog hints that one of societies problems is that no-one is content or satisfied with what they have, made worse by how amazing peoples lives look on social media - Are we consuming too much?. The one stat that shocked me was: "In 2013, the median financial asset balance of middle-earning Americans (including retirement savings accounts) was only $5,500."

Want a return that is uncorrelated to the sentiment of the market? Byron found this very interesting and fun read about using sport betting as an asset class - Sports betting as a new asset class: Can a sports trader beat hedge fund managers from 2010- 2016?. Long term investing the odds are in your favour, with betting the odds are in the favour of the house.

Home again, home again, jiggety-jog. Twitter also reported after-hours, the stock has taken a beating for guiding lower. I actually continue to think that the metrics are all moving in the right direction, even if user adoption has plateaued. Sales are up, it is just taking too long for Mr. Market's liking I am afraid. We will cover that and more in the coming days, including Under Armour, that company had their results poorly received, they continue to make great progress however in their respective space, we like that!

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment