"For Brait on the other hand, the market is expecting the British shake up to hurt the growth from New Look and Iceland Foods. With a compounding factor being the weak Pound, which means when those earnings are translated into Euro's there are less of them."

To market to market to buy a fat pig BOOM! WALLOP! It was ugly on our local market yesterday, the TOP 40 finishing down 1.8% being lead by stocks with exposure to Britain. It would seem that the market forgot about the Brexit vote last week and this week (after a long weekend in parts of the world) realised that there may be a real impact on asset prices as politicians wrestle with how to "Brexit". There is no real road map for a nation to leave, so this process will not be quick and will probably include a couple missteps along the way. The current tally is 7 property funds who have closed their doors to withdrawals, I'm sure that this is bringing back 2008 flashes for many.

Two of our more widely held stocks who currently have different fortunes are Brait and Mediclinic. Both have significant operations in Britain but Brait is down 10% over the last 2 days and Mediclinic is up around 2%. Why the differing fortunes if they both have British operations? The Pound has acted as a buffer for Mediclinic, being listed on the London Stock Exchange means that all their offshore operations (in this case Switzerland, South African & UAE) have their profits converted to Pounds. Weaker pound means more profits for Mediclinic when those offshore earnings are brought home. For Brait on the other hand, the market is expecting the British shake up to hurt the growth from New Look and Iceland Foods. With a compounding factor being the weak Pound, which means when those earnings are translated into Euro's there are less of them.

Having a weak Pound is not all bad though, Online holiday queries spike after Brexit vote. Having a weaker currency means that things get cheaper for tourists and in particular tourists looking for luxury products (Now is the time for tourists to grab bargains on UK luxury brands like Burberry). Why not, holiday and shopping all with a 15% discount. Talking of a weaker currency, where is the Barmy Army now after singing 23 Rand to the Pound, at the Wanders stadium last year? As I write it is 18 odd Rand to the Pound.

As you can see above, The US markets started their trading day with red on the scorecard but then did an about turn thanks to some better than expected manufacturing data and the release of minutes from the last FED meeting. The minutes indicated that the FED is cautious to raise rates due to the last jobs number. Do you remember what the figure was for May? The economy only added 38 000 jobs, which was a HUGE miss on, estimates and what a healthy looking job market resembles. What all of that means though is that interest rate hikes for this year have been put on the back burner. Well at least until June's jobs number comes out this Friday. There will be some revisions to the May number which might be material and we will get a look to see if the May number was a once off or not. I have seen reports saying that the data out Friday is this years most important data point, but I remember reading the same thing about the previous number just before reporting day. Make no mistake, the data out Friday will move markets but after a bit of volatility attention will move to the next 'biggest data point for the year'.

Company corner

One stock that divides people is Tesla, mostly because either you think the company is worth holding or you think it is vastly over valued and you should short it with all you have. They have been getting a large amount of press recently because of their autopilot function in the car where one of the drivers died in May and then a number of other accidents have surfaced in the media since then (none resulting in a death though). These two articles capture most of the aspects in the debate (Tesla's Autopilot Vexes Some Drivers, Even Its Fans and Tesla blasts Fortune reports about fatal crash of Model S on autopilot).

I think the media is blowing this out of proportion, something going wrong at a company that many people know and love sell newspapers I suppose. Byron made the point yesterday, imagine if there was a news article and company statement every time someone was killed in a Toyota? As Tesla points out, there has been one death in the car in over 130 million hours driven on autopilot, much much safer than normal cars. If the truck that turned in front of the Tesla, resulting in the death, had an autopilot mode the accident probably would have been avoided. Basically as the number of self driving cars increase, the safer the roads will become and the more data is collected to improve the current systems. Tesla's autopilot system is collecting data which will make it possible to have fully autonomous vehicles on the road. A win for humanity.

Linkfest, lap it up

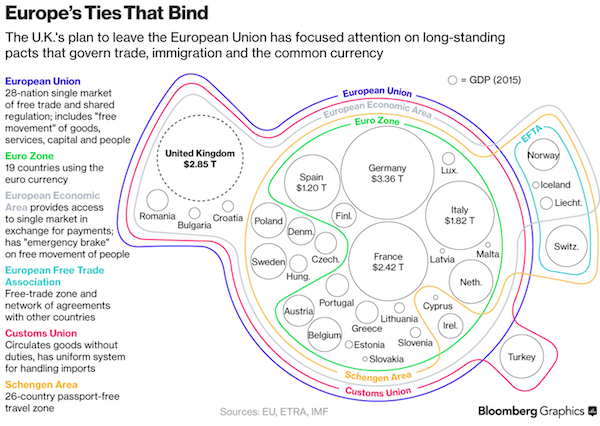

If you are wondering why a Brexit will takes years to hammer out, have a look at the complex web of relationships in the area - QuickTake Q&A: How U.K. and Europe Might Relate After Breakup. How many voters understand this relationship? Also what outcome was envisaged by the out camp?

It is no surprise that robots are being built to take over very repetitive jobs. I'm sure that in developed markets where labour is more expensive you will in the not too distant future place an order on a computer and then have a robot in the back prepare your order and only have one person around to make sure the system functions - This robot-powered burger joint could put fast food workers out of a job

Home again, home again, jiggety-jog. Our market is off to a great start this morning, up over 1% being lead by resources. The Rand is also catching a bid this morning, stringing to the USD.

Sent to you by Sasha, Michael and Byron on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment