"Famous Brands, relatively ungeared, i.e. not much by way of borrowings, plan to fund this through cash resources. This will fit really, really nicely into the manufacturing part of the business. Tomato paste is used in the manufacturing of their sauces. As the press release points out, they have 2600 odd restaurants across all the brands, this will fit. Perfectly. "

To market to market to buy a fat pig Markets across the seas and far away are closed, at least in the "financial capital of the universe" as the late Mark Haines used to call it. It is with amazement that I looked up how long he had been gone for, it has been over half a decade now. Markets there are closed for Independence celebrations, happy 4th, their own Brexit vote, all of 240 years ago. You will recall that piece that Michael posted last week about which jobs have declined in the US and which jobs have become more sought after - How Machines Destroy and Create Jobs.

If you follow the link to the NPR, you get a fleshed out bunch of graphs, 4 Graphs which cover how mechanisation meant less farm jobs and more blue and white collar jobs. And then how jobs like bookkeeping are less sought after, thanks in part to the office environment being automated. Excel and all the associated powerful software programs. Fewer secretaries (thanks to automated calendars and email), fewer factory workers with greater automation. Factories with no more people in them, just the ones looking after the machines. Surely there must be jobs that are growing like gangbusters? It turns out that the likes of cooks and bakers (people eat in less and less), nurses, police and firemen, doctors, barbers and beauticians, all services related jobs are growing.

The jobs that have absolutely crashed are professions like Blacksmiths (Bright even asked for a second, what is that). Carpenters, sailors, cabinetmakers and shoemakers and the like. Why? Those things have all gotten dirt cheap, as a result of globalisation, automation and continued productivity, sweating what you have a whole lot harder. Shoes made in Indonesia (or any where else) can be shipped across the globe to be sold for 50-100 Dollars. And there are many more people who can afford it than at any time in history.

People make a habit of telling you how much better "things" were back then, how stupid we are now, how disastrous this or that policy is. Being pessimistic sounds far smarter and the morbid in us all sits and takes notice, this person bearing bad news must have the secret sauce. We rubberneck when we see an accident, after all, it could happen to us. We know how safe flying is, we know that you are more likely to die from food poisoning than an airline crash. You have a greater chance of dying falling off your bed or a chair than in an airline crash. Perhaps this misses the point that the bearers of bad news always attract the headlines more than those that tell you everything is going to be OK. That is left for the health professionals and religious leaders. Bet against humanity at your own peril. Bet against human innovation at your own peril.

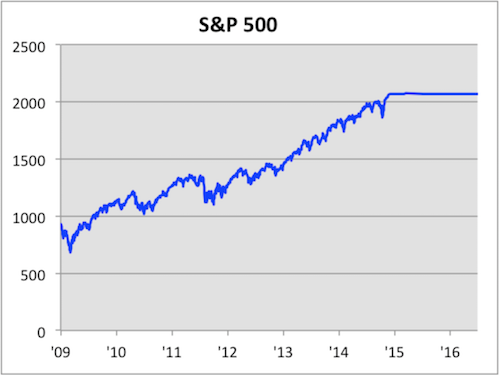

Scoreboard check here quickly. Markets "stateside" are closed today, Friday Wall Street closed a little higher, the Dow was up 0.11 percent (it had touched 18000 points again, for the first time since the "Brexit" vote. So it turns out that the best thing to do was nothing. See in the links below that Michael has inserted. The broader market S&P 500 is back over 2100 points, and only a percent and a half away from the all time highs now. So much for disaster, doom and gloom. The nerds of NASDAQ closed just over four-tenths of a percent better on the day, nearly 8 odd percent away from the highs though.

On the local front the story of the day was the Rand, continuing to gain momentum. Emerging market currencies and bonds were #winning as yields across the globe plunged, some to all time lows. In the search for yield, as long as you can maintain a decent enough currency hedging strategy, that is not too expensive. If you have obligations to your pension holders, they may need to be massaged lower in a world of next to no inflation (at least in the developed world). Our market closed a little over one quarter of a percent up on the day. Resources were the main drivers again!

Company corner

News from Famous Brands this morning, they are buying a tomato paste manufacturer down in the Windy City. That is Port Elizabeth to you and I. The factory was bought in liquidation, Famous Brands also points out that the facility was manufactured for a total cost of around 200 million Rand. There is a shortage of tomato paste in the country, a pretty significant one at that. The country imports between 30 to 35 thousand tons of tomato paste, the company itself is responsible for 1500-2000 tons of that. Michael asked the best question. Sitting here next to me he said, then why did the company go bankrupt? Indeed. Good question, it must have been a pretty nasty experience.

Famous Brands, relatively ungeared, i.e. not much by way of borrowings, plan to fund this through cash resources (Kevin Hedderwick was on TV this morning saying that they paid around R35 million). This will fit really, really nicely into the manufacturing part of the business. Tomato paste is used in the manufacturing of their sauces. As the press release points out, they have 2600 odd restaurants across all the brands, this will fit. Perfectly. This is not their first business down there, the company bought the Coega Cheese Factory in 2013 in PE, changing the name to the Famous Brands Fine Cheese Company (FBFCC). As Kevin Hedderwick (former CEO and now Group Strategic Advisor) reminds us, the production at that facility has grown sharply. It has taken in more than double the amount of milk since they bought it.

The new plant will provide jobs for the community, partnering with local growers of tomatoes. As Hedderwick is quoted as saying: "As soon as possible, we will actively recruit previously disadvantaged farmers in the area for our supplier network. We will also tap into our existing FBFCC farmer base to gauge their interest in this new opportunity." Good work Famous Brands, I would love to know how and why the venture did so poorly before. Expect this to continue to drive manufacturing costs for Famous Brands lower, and that is an excellent thing for all shareholders of the business.

This trend is going to continue. Food preparation and making things easier for consumers is increasingly a big investment theme. The most amazing closed WhatsApp group in the world (called the Vestact Superheroes) was discussing food trends over the weekend, with reference to this piece - Whole Foods Is Getting Killed by Aldi. Is a Millennial Grocery Chain the Fix? The conclusion from Paul was as follows: "That Whole Foods article makes me wants to buy more Starbucks, Amazon, Bidcorp and Famous Brands shares. Why bother to buy groceries? Just buy healthy prepared foods." Got that sportslovers?

Linkfest, lap it up

Like many things in life, keeping things simple is normally the best route to take - 3 Ways to Make Money in the Markets. When it comes to the markets, saying that your competitive edge when investing is "being patient", seems very boring and unglamorous.

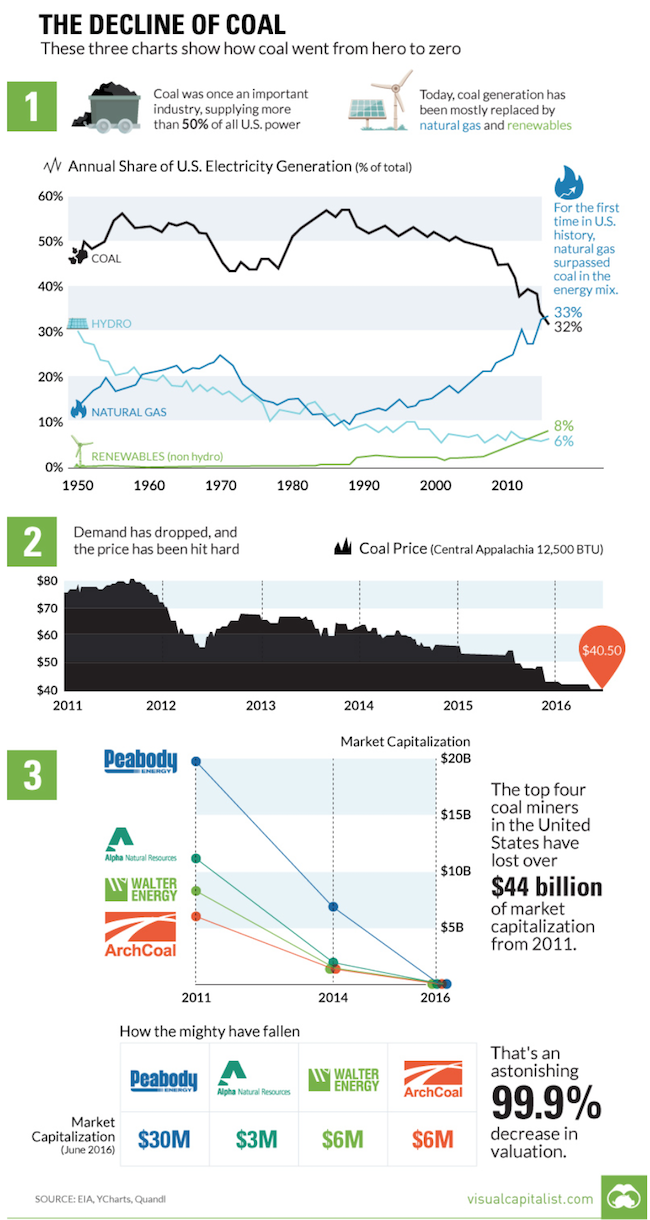

The fracking boom lead to a dramatic drop in oil prices, another commodity was also hit hard, Coal. Lower natural gas prices means that more and more people are generating energy through natural gas instead of coal - The Decline of Coal in Three Charts

Equity markets have gone sideways since 2014, one of the only ways that you have made money over that time period has been to buy during market pullbacks - How It Looks With Partial Data. This is what the graph looks like if we ignore the temporary market corrections.

Home again, home again, jiggety-jog. It is going to be one of those very quiet days, the networks will show some rehashed magazine content. Happy 4th y'all. Australia is struggling to find a government, too many prime ministers in a short period of time. Meanwhile, markets across the rest of the world and most noticeably China (Hong Kong is actually in China) is higher. It is also a holiday in Zambia today and tomorrow. The saddest part of humanity continues to put their agendas forward, at the expense of ordinary lives that are extinguished. Sigh. And the rest of us have become conditioned to just shrug our shoulders, that might be the worst part of it.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment