Sports lovers, why haven't you watched latest Blunders video yet? Why? Don't worry, you can do it now - Blunders - Episode 23. This week: IMF gives SA a zero forecast, Melania Trump's dress, Uber for dogs**t and Joy Air fails to launch.

"The reason to own Starbucks is due to their very powerful brand. Thanks to the very strong global brand they are able to open new stores with almost no limit. Currently there are 24 395 stores in 74 countries."

To market to market to buy a fat pig We squeaked into the green here locally on Friday, stocks rose marginally to be above 53 thousand points. Just. A smidgen. I was interested to note that Shoprite had made another 52 week high and was closing in on 200 ZAR, a level last reached at the beginning of 2013. All this in the environment where the Reserve Bank expects zip (nil) growth, or as close to that as possible in the medium term outlook hardly looks rosy. Shoprite of course have done some heavy lifting and continue to make progress in a stodgy growth environment. If you needed another reminder that the stock market is not the economy and the economy is not the stock market, look no further than the recent price action of Shoprite.

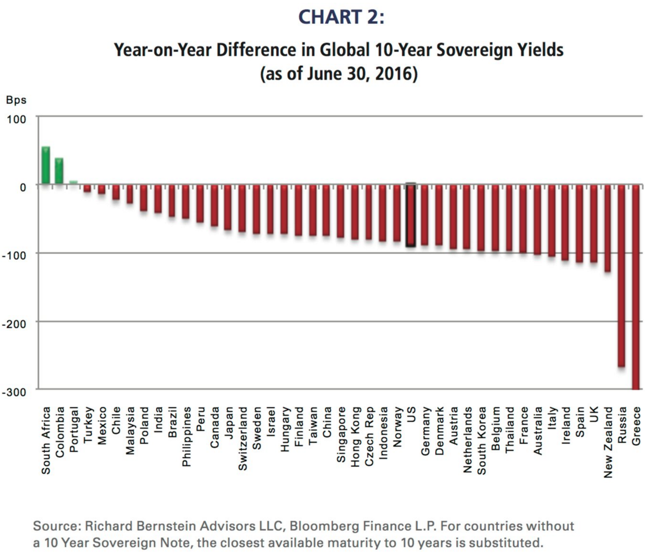

Resources sank over a percent, the rest was up a little which saw us marginally up on the day. The Rand remains strong, gosh, it must be as a result of great electioneering, right? It must be as a result of all the politicians saying such wonderful things, right? No. It always turns out that nobody says the reverse. The reason for strength across all emerging markets is as a result of the global push for yield once again. Higher yielding government bonds, on the brink of junk or not, as long as the currency risk can be neutralised, will be sought after. I found a graph the other day which I tweeted (of course we read each others tweets all of the time), which showed why South African bonds would be attractive. Most especially recently.

So what does that graph show you? Mostly that Russia and Greece one year ago were finished and now they are a little better. Russia in part as a result of being a little more on a stable footing, Greece having come through their Oxi (No) vote and told, we hear you however ..... this is how it is going to be. South Africa, Colombia and Portugal? Would they, in a time of lower global inflation, be riskier on a relative basis? Notice that notwithstanding the turmoil in Brazil, their debt is marginally more attractive over the year. It doesn't tell a full story, what it mainly tells you is that in a world where most yields went down over 12 months, ours didn't. Perhaps with things having settled a little, the fact that there seems to be NO yield in Europe or the US for some time to come, we should benefit. I am guessing that we have seen flows recently, it will be confirmed in due course. Inflation should be lower, and ZA inc. stocks will benefit again. That is why the Rand has been strong.

OK, off to markets on the other side of the world, stocks in New York, New York found their footing after lunch time. Once again it was earnings that dictated to Mr. Market, there was another closing high for the S&P 500, if not quite for the other indices. The Dow Jones Industrial got close, the General Electric results at face value looked decent enough. Mr. Market always expects a little more, the stock sank over a percent and a half. Visa had a good day after the results that they had produced in the session prior, up nearly a percent and a half, closing in on that all time high. Not too far to go in that regard.

This is another big earnings week, Luxoticca reports today, Apple tomorrow night after the bell, McDonald's before and I think in terms of the reporting cycle, Caterpillar before too. BP Plc reporting in the UK too tomorrow. Facebook, Coca-Cola and Amgen on Wednesday, Glaxo and Boeing also reporting on humpday! Boeing having a tough time of late, Facebook are always primed for perfection. All speeds up on Thursday, there is no slowing into the end of the week, it will be the holding parent company for Google, Alphabet reporting on Thursday. Amongst our stocks, there is also Amazon and in terms of stocks of interest there will be British American Tobacco too, as well as MasterCard. Easing into Friday, AB InBev as well as a whole host of pharma companies, Merck, Sanofi and AbbVie. UPS also on Friday, they are always a good barometer for the health of the US economy. Big week sports lovers.

Company corner

At the end of last week we had 3Q numbers from Starbucks, which missed some analyst estimates. To say that they missed estimates is not to say they had a poor quarter, they still grew revenues by 7.3% to $5.24 billion and grew EPS by 24% (not too shabby hey nige).

They missed analysts estimates on same store sales. In the USA they had growth in same-store sales of 4%, the first time it was under 5% in 26 quarters. There was very strong growth out of China, where same store sales were up 7%. There are currently 2 300 stores in China with the goal to have 3 400 by 2019. The expectation for China is that it will be a bigger region for Starbucks than the USA over the long term. Currently Revenue from 'America' is $3.6 billion for this quarter and the 'China/ Asia Pacific' region is much smaller on 768 million, so it has to more than quadruple to be at the current figure.

The reason to own Starbucks is due to their very powerful brand. Thanks to the very strong global brand they are able to open new stores with almost no limit. Currently there are 24 395 stores in 74 countries. They opened 1 876 stores over the last 12 months, just over 5 new stores a day! To put that into perspective, Famous Brands "only" has 2 614 stores globally. In the USA they are much closer to saturation point, where they won't be able to open new stores but in the global market we are still very far away from that mark.

The brand is also a status symbol, their products are not at the cheap end of the consumables segment. When visiting Bangkok last year, the Starbucks there had queues out of the door even though the cost of a drink was well over 3 times what you would pay 100m down the road. South Africa is another prime example of how powerful the brand is, there were long queues for weeks after opening.

The strong brand and huge store growth means that the stock is not cheap, currently sitting in the low 30s on a P/E basis. The company has stated a goal to grow EPS at a minimum of 15% per annum which means going forward the P/E unwinds rather quickly. As long as the brand commands a premium in the markets that they operate in and particularly those markets where they are rolling out new stores like 'gangbusters', the stock is a buy.

Linkfest, lap it up

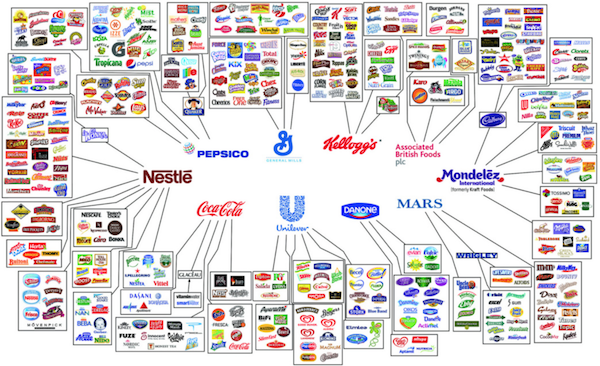

How many consumer brands do you think the top 10 companies own? Probably more than you thought - The Illusion of Choice in Consumer Brands.

As the Amazon share price continues to rise so does the fortunes of its founder - Amazon CEO Jeff Bezos just passed Warren Buffett to become the 3rd-richest man in the world. Amazon reports numbers on Thursday and in true Amazon fashion expect a large sharp price move either up or down.

London in terms of economic value is huge for Britain, I didn't realise how important it was - London's total dominance of the UK economy, charted. London is the same as the next 37 cities combined!

Home again, home again, jiggety-jog. Nintendo, the maker of Pokemon Go stock is down over 17 percent this morning. Still, over a single month, since the hysteria has gripped nerds who have seen the sun for the first time in half a decade, the stock is up a whopping 68 percent. Over ten years, what has been your Yen return? 13.2 percent. And a yield that is next to nothing, better than negative Japanese Bonds however. The stock is still a long way away from the all time highs, down nearly two-thirds of the go-go days of late 2007. Those were the days my friends, of faxes and business cards. Oh wait, those things still exist in Japan. Stocks across Asia are a little mixed, in Japan about flat, slightly down in Hong Kong.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063c

No comments:

Post a Comment