"The business is split into three segments, a devices and diagnostics business (as a standalone the biggest in the world), a well known pharma business which most investors associate with and lastly a business that consumers know and trust well, that covers every thing from bandaids to child care."

To market to market to buy a fat pig Another day on the local front with stocks falling, there was a little more than usual going on the in the market, with an operational update from Shoprite and a trading update from MTN, as well as a sales update from Massmart. In terms of the ZA inc. giants, they are both in terms of stock prices comfortably off their best levels for different reasons. Shoprite has certainly been re-rated by the market, the stock used to trade above 200 Rand a share back at the beginning of 2013, fast forward over three years and the stock is trading at 175 Rand. Backwards in Rand terms and definitely backwards in Dollar terms.

For Shoprite, all the metrics have been moving in the right direction, earnings and dividends increasing alongside increasing revenues. There has been what is termed multiple contraction, the opposite of multiple expansion. Multiple contraction is when the stock price goes nowhere or backwards yet earnings still increase. It is subtle, yet it happens almost in slow motion. The stock used to trade on nearly 29 times earnings back in the middle of 2013, we are nearly at the point where the company will report their year end results, forecasts suggest that the stock is likely to trade on 20 times historic earnings. Which at best with low teens earnings growth looks hardly appealing. Equally worrying for those bullish on ZA inc. and the rest of the continent expansion, is that every year for the last five, investors have paid a lower multiple for the stock at the bottom end of the trading range.

Let me try and quantify that. The 52 week low for Shoprite is 124.06 ZAR according to Google Finance, that was the washout in mid December as the finance minister was replaced with someone that nobody had ever heard of, not to worry, we are lead to believe that there were no long lasting (or short term) repercussions of that well thought out decision. It was also a factor of multiple "other" events ongoing at the time. Anyhows, water under the bridge, that is one of the things that you cannot control in investing, governments and their actions. That low from December, in terms of where the multiple trades, historically, is the cheapest that Shoprite has been in five years. Or possibly longer, the stock has basically flat lined for almost four years as higher inflation and a trickier local and regional environment has caused investors to re-rate the stock lower. At the same time, all the work that they are likely to do internally in these tough times will no doubt bode well in the years ahead.

The operational update was not really comparable, there was an extra trading week this year when compared to the prior financial year. Nonetheless a sales increase of 14.4 percent to 130 billion Rand for their full year must be applauded. The second half sees improved performance in the local outfit, equally inflation fell. Results are expected on the 23rd of August. I wonder how much longer Whitey Basson has at the helm of the group, he is 70 years old and has been at the helm of the retail giant for half of his life. In many senses, it is possibly all that he knows. His "boss" Christo Wiese thinks he is the best of the best, check out his bio at the company website - More about Whitey Basson. A lifer at the company, a rarity these days.

We will see in over a month, the sense may be that whilst the outlook is still misty, foggy and patchy, major share price weakness could be an opportunity. It is not one that we are likely to buy, we admire the business. Charlie Munger (Warren Buffet's right hand man) is right, in the same sense that he said that Costco (where he is a shareholder and board member) had done more for society than any other charitable organisation that he knows, Shoprite has equally done the same for South Africa. To stretch the proverbial Rand further, the group has fought inflation and offered cheaper prices to consumers, thus putting more Rands in their pockets. See that? Capitalism doing good with the intentions to be profitable and offer the best possible service.

In large part Massmart has followed a similar trajectory for their shareholders, a huge rerating and Walmart must be wondering what it is that they have done. The purchase of 51 percent of Massmart by Walmart back in November 2010 was done at 148 Rand a share. The share price after a tepid, yet well received trading update was at 140.45 Rand. They are down more on the currency, by around 50 percent since then in Dollar terms. Flat on the Rand purchase consideration (the dividends have been OK), the Dollar share price has been rubbish. Massmart is not a bad business, they are obviously servicing a consumer that is also going through some pains, jobs are not easy to hang onto out there. I suspect that in a decade's time we would see this time as an opportunity to have acquired these stocks on weakness, the worst point for the stock was in January of this year, the stock reached a multi year low of 83 odd Rand. Year to date the stock is up 40 percent. Wow.

OK, to finish this segment (we will check the MTN trading update below in the company bit), the Jozi All Share index closed off the worst level, losing nearly three-tenths by the end of the session. With commodity prices coming off the boil a little across the globe, resources were the main losers, down over half a percent. It was a weird top and tail scoreboard, the gold stocks at the top end of majors, Sibanye, Goldfields and AngloGold Ashanti dominated the "winners" with Glencore, BHP Billiton and South32 the biggest losers.

Dow dunnit again. The Dow Jones Industrial Average in another chapter of marching higher and setting another all time high closed last evening a smidgen higher. The other two major indices fell, the S&P 500 lost 0.14 percent (the Dow Jones gained that percentage amount), the nerds of NASDAQ lost 0.38 percent, no thanks to Microsoft which fell ahead of earnings, which clearly surprised to the upside. The reason I know this is that the stock is up over four percent in the after/pre market, depending on whether you are sleeping. If you catch my drift.

Netflix stock was hammered, it has been a great performer for those that were early and have stuck the course. Primed for perfection again, the stock missed on subscriber numbers, yet grew earnings more than anticipated. Not good enough apparently. Down 13 percent and some more, try harder. I do see that many notes, for what it is worth, suggest that one buys the stock on weakness. With more subscribers than some of the old majors, new content and the ability to scale the model across the globe, it certainly has an attraction as a business. We will cover it in the coming days.

Company corner

MTN released a very mixed trading statement for the first six months of their financial year, it required very careful reading in order to catch all of it. Since the Nigerian fine resolution and payment terms have been finalised, there has been a certain amount of relief for shareholders. That does not remove the fact that trading conditions in some of their core territories are likely to be become any easier. There are unintended consequences of the way that they dealt with the fine that are potentially negative to the business, if only from a short term consumer perspective. We can't quantify the damage. Having said that, those with the infrastructure and ability to meet consumer needs, as a result of having spent heavily on a network when others were late, win in the end.

Here is a copy and paste of the important part of the trading update from yesterday: "Shareholders are therefore advised that MTN expects to report negative basic headline earnings per share (HEPS) and basic earnings per share (EPS) for HY2016. In the prior year comparable period MTN reported HEPS of 654 cents and EPS of 653 cents." That sounds terrible. Why? Mostly as a result of the Nigerian fine, the group quantifies: "The Nigerian regulatory fine is expected to have an estimated negative impact of 474 cents on HEPS and EPS, respectively." And the rest? Where does that come from? "Foreign exchange losses in a number of operations, losses from joint ventures and associates and hyperinflation adjustments on MTN Irancell are also expected to have a negative impact on HEPS and EPS for HY2016." I guess the best thing about this is that these events are in the past, they are events that have happened.

I am afraid it doesn't end there, they are still battling even in their home market: "HY2016 results are further expected to be negatively impacted by the under-performance of MTN Nigeria and MTN South Africa. MTN Nigeria's performance was impacted by the disconnection of 4,5 million subscribers in February 2016, the final batch of subscribers to be disconnected in compliance with the Nigerian Communications Commission subscriber registration requirements." So whilst more clarity will emerge with another trading statement before the results on the 5th of August (I think that is breakup day for my kids), this looks like a leaky ship at best. We are always continually reviewing the stocks we own, it could be argued that being wrong immediately does not mean that the thesis is still intact.

In fact there is a strangely encouraging sign in the trading statement that forces you to do a double take: "MTN South Africa is expected to report a decline in the EBITDA margin, impacted by the marked increase in handsets sold during HY2016." A marked increase in handsets sold? Does that sound like, in the end, a bad thing? Remember that these handsets are subsidised on the basis that there will be more and more people consuming data over the coming years. And whilst data prices are still decreasing, we are using a larger amount than at any other time in history. And are likely to use more in the future.

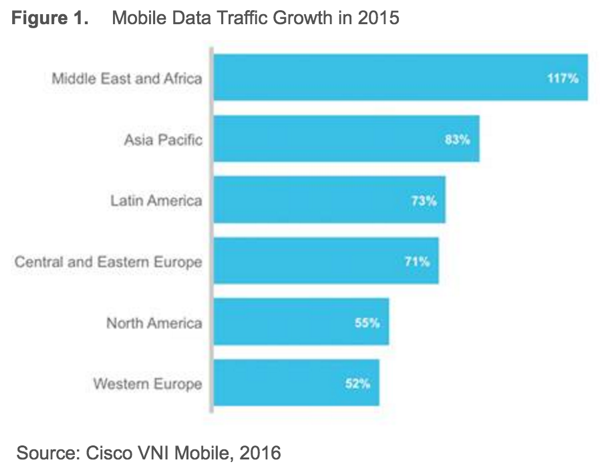

Cisco are pretty big in projecting what the internet of things is likely to do for their business. There is quite an interesting piece here - Global Mobile Data Traffic Forecast Update, 2015-2020 White Paper, in which cisco reckons that "Mobile data traffic will grow at a compound annual growth rate (CAGR) of 53 percent from 2015 to 2020" and "By 2020 there will be 1.5 mobile devices per capita. There will be 11.6 billion mobile-connected devices by 2020, including M2M modules-exceeding the world's projected population at that time (7.8 billion)." And you can bet your bottom Dollar/Naira/Rand/Rial that in the territories that MTN operate in, that the growth will be ahead of the global norm. In fact, let us leave this with a graph from that paper, which needs little explaining:

Johnson & Johnson reported numbers yesterday, before the market opened. I recall whilst reading the history of the company that there were three brothers Johnson who started the business, it could just as easily have been called Johnson Bros. I guess history may have been different and afforded the company a less spectacular path. The business is split into three segments, a devices and diagnostics business (as a standalone the biggest in the world), a well known pharma business which most investors associate with and lastly a business that consumers know and trust well, that covers every thing from bandaids to child care. If you have had a kid in the last five decades I am pretty sure that you have used the clear yellow tinged shampoo and the baby powder. In the US of course Tylenol is a big seller in the children pain department, not without their fair share of issues. Their brands are instantly recognisable, Listerine, Neutrogena, as well as the aforementioned brands.

The CFO came on the box yesterday, he seems like a solid fellow and seemed to suggest that all of their businesses were firing on all cylinders. It is great that a diversified business can see you through all season, although you would expect a business of this nature to not necessarily be prone to business cycles. You are not going to use fewer plasters, less shampoo, less hand cream, not go for that hip operation, or not take that medicine that you need. Those businesses equally don't share the same upside when the cycle turns and consumers buy more "stuff", not necessarily that they always need it, it must be said. And the company never sits still, they have recently acquired a business in their consumer division called Vogue, which catapults them to fourth biggest in haircare, remembering that L'Oreal are the biggest on the planet. Unless everyone decides to stop washing their hair (or shaved hair becomes a thing), the future of the business is pretty bulletproof.

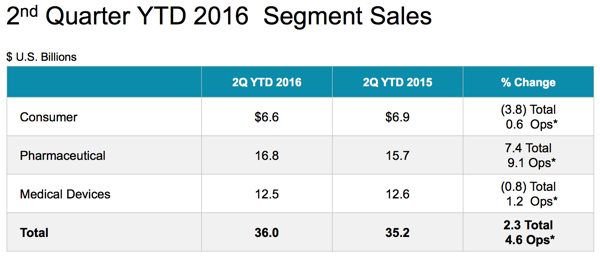

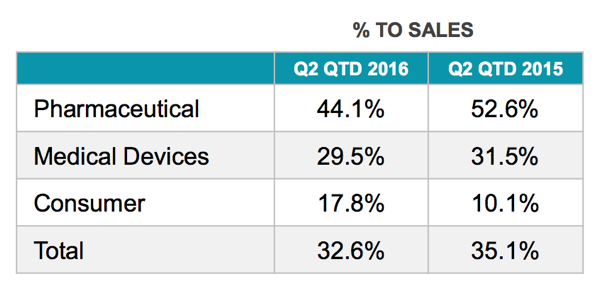

There is a very strong pipeline too, nearly two dozen products in the coming half a decade. As mentioned in the TV interview, the UK is a small territory, less than five percent of total sales, which clocked 18.5 billion Dollars. Adjusted earnings were 4.9 billion Dollars, adjusted EPS clocked 1.74 Dollars, ahead of expectations of closer to 1.68. And whilst both numbers were not heavily ahead of the comparable numbers last year, it was certainly a beat. Pharma has been driving the business, to give you an idea of the divisional split, here is an image grabbed from the presentation -

Amongst all the divisions the company is certainly diversified, inside of those consumer division quarterly sales baby care is 500 million Dollars of sales. 2 billion Dollars a year. Skincare is nearly a one billion Dollar business, OTC trumps the lot, at a little over 1 billion Dollars per quarter. In amongst Pharma, the biggest jumps are immunology and oncology which are their growth businesses, both clocking around 20 percent growth. Immunology is the biggest single contributor, over 3 billion Dollars out of 18.5 billion. In the medical devices department, orthopaedics (knees and hips) and surgery (of the general kind) are nearly 2.4 billion Dollar a quarter businesses.

Check the contributions from the separate divisions:

Net income margins have been ticking up over the last five years, ahead of their peers. Research and development expenses are really ahead of their peers. JNJ spends 12.9 percent of their revenue relative to their competition, which spends 11.4 percent. The company doesn't plan to split the business, which may unlock shareholder value in due course, their plans are to continue to expand across their OTC business, Oral Care, as well as Baby and Skin Care. In Pharma, as discussed, their pipeline looks strong. Medical Devices, that is an amazing business, that would continue to grow in time with new and innovative products.

Guidance was decent too, the overall growth is expected with the return to shareholders to be in the high single figures. We like this company a lot, the share price has had a terrific turn lately after a long period of underperformance. Whilst the stock always looks expensive, it possibly is as a result of the unique nature of the split. We continue to accumulate on weakness.

Linkfest, lap it up

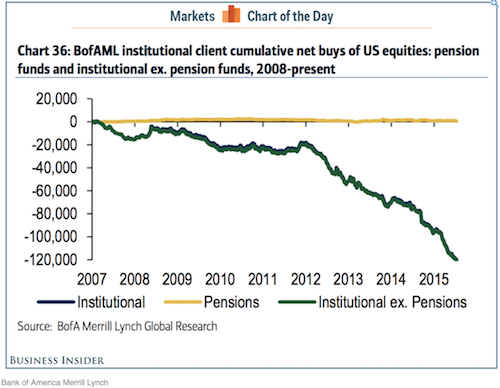

Sasha made the point this morning, what happens when the big boys start buying stocks again? Can these big institutions do an about turn now or will they have to wait for that big correction that they have been waiting for? - Bank of America's big-money clients hate stocks, which is a great sign for the future

Uber is experiencing some amazing growth - Interesting fact of the day: Uber completes 2 billion rides!. As the article points out, it took 6 years to get to 1 billion rides and then only 6 months to get the next billion!

Tourism is one sector that African countries still have a big opportunity to grow in. Growth will mean more jobs and prosperity for the local population.

Home again, home again, jiggety-jog. Stocks are mixed across the globe, SAP the German software giant managed to beat expectations which is a good thing. Microsoft, that is a good thing too. Further to that long winded "thing" yesterday, historical multiples may start falling shortly, that would be a good thing.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment