"The company has monster margins, remembering that their job is to process the payment, they are neither a bank or financial institution, they are a technology business that benefits from increased consumer payments. They have the payment networks and whilst Bitcoin and some other "unique" payment methods may be adopted by out there consumers, the internet shopping and ecommerce shift is a huge opportunity for them."

To market, to market to buy a fat pig. There was a period, like the Grand old Duke of York, when we were up (we were up!) and then we were down (we were down). There were also periods of being neither halfway up or down, in equities markets it is one or the other, I remember a day when the local market was around flat, that hardly ever happens. By the end of the local session we were off, pretty much across the board. There was of course the small matter of the new(ish) Reserve Bank Governor Lesetja Kganyago delivering the deliberations of the MPC. He is from the Eastern Cape, from a small town by the name of Alexandria. If I am not mistaken, that is the region where Woolies sources their long life milk. Those in the know will confirm that it is before Kenton-on-Sea, if you are coming from the Port Elizabeth side. When there is enough rain, it is certainly a beautiful part of the world. It is a great story, the rise through the ranks (for the SARB governor), a masters from the London School of Economics through to ultimately his appointment as chief of the bank last November. I have not seen a note with his signature yet, Michael pointed out yesterday, have you?

If you are interested in the deliberations and the statement of the MPC you can read them here -> MPC statement January 2015 final. Fuel prices retreating as a result of lower oil prices, thanks to technological advances. The near term inflation outlook has improved significantly. He mentioned load shedding. Shloading as I like to call it. The inflation outlook for this year has been revised sharply down, expected to average just 3.5 percent over the course of the year, when compared to a previous forecast of 5.3 percent. The lowest it is expected to get, with regards to internal calculations is 3.5 percent in the second quarter. As a result of their base being so low, an assumption that the oil price will recover and that the Rand will weaken, inflation next year is expected to be around 5.4 percent. Well, like all of us, all central bankers are data watchers and will act accordingly. Unlike being a whale watcher, this inflation and growth beast is less beautiful to look at, equally more frequent and sometimes nasty.

The Rand strengthened, perhaps the outlook for the domestic economy has improved over the last six months with lower petrol prices. That is good for everybody. Whilst the broader market is only up 2.3 percent for the year (not bad if you annualise that), retailers as a collective have been on fire, up 14.3 percent collectively. The Food retailers have also had a great time of it, the only other sector in double digits (and out of the blocks like crazy again this year) are the gold mining companies, up 29.1 percent as a collective. Well done, hurrah. Over the seas and far away, in what has really been a volatile month, the US markets closed comfortably in the green, the broader market S&P 500 nearly up a percent, ditto the nerds of NASDAQ, whilst blue chips, the Dow Jones Industrial Average added 1.3 percent. Energy was the only sector to end in the red.

Visa takes you places. It seems that it has taken you further as an investor in its not so long period as an investment, the company has only been listed since March 2008, March 18 to be precise, be sure to put that into your calendar as the day BEFORE my birthday, OK? Accepting all presents now, we are open. Just a refresher in terms of ownership structure, the Western European operation is a separate business under the same brand, principally owned by the member banks in that region. Since it listed back then, the company has returned an astonishing 285 percent to their shareholders, that is nothing short of remarkable.

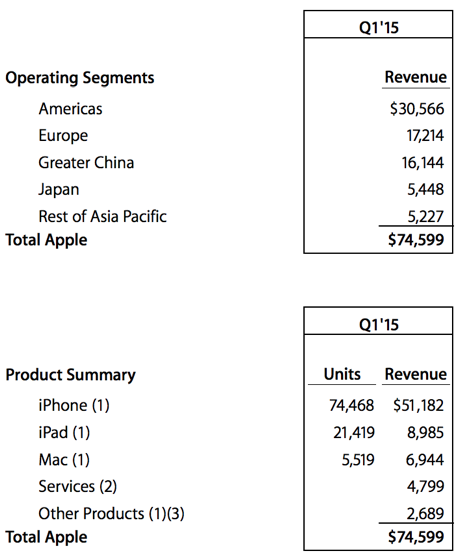

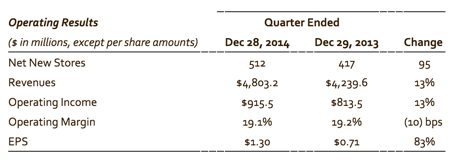

Let us hammer straight into these numbers -> Visa Inc. Reports Fiscal First Quarter 2015 Net Income of $1.6 billion or $2.53 per Diluted Share and Announces a Four-for-One Stock Split. That just about says it all, the headline that is. Payments processed increased 10 percent to 17.6 billion inside of the three months, the company is capable of processing a lot more than that, around 56 000 transactions a second. That is a whole lot of swipes. They have that processing power for a reason. I can think that many governments and societies would want to be cash free, take the awful events at the Bedford centre yesterday for instance, no cash = no cash in transit heists. It would eliminate crime activities if there was a trail, it is a "no brainer".

As you also saw from the link to the investor relations page, the company will do a 4 for 1 split, meaning that the share price will adjust accordingly too. In other words, on the 19th of March (its my birthday!) you will see four times the number of shares, equally you would see the share price trading at 60 odd Dollars, factoring in an after hours bounce of 4.64 percent (at 259.5 Dollars) it is likely to be closer to 65 Dollars. The dividend, which was declared yesterday at 48 cents a quarter, will adjust to 12 cents a quarter, the earnings per share will simply be divided by four times more shares in issue. It is simple. Why do companies do share splits? As a member of the Dow Jones, which is a price weighted index (i.e. the bigger the share price, the more the influence over the index), it makes sense when your share price gets "too high" that you adjust. Equally for retail investors it makes sense. It is basically for more liquidity, although with average volume, around 2.37 million shares swapped hands daily, that does not seem like too much of a problem.

Share buybacks, why do companies do that? There is still an amount of 4.2 billion Dollars outstanding, the company bought back in the region of 5.6 million shares so far in the first four months of the fiscal year. Or around one percent of stock. If you are a committed holder of the shares of the business, this has a positive impact, provided that the company does not issue too many shares to their staff. Although, as a holder of the business, you want the staff to be incentivised. It is a tricky balancing act. In the transcript call (you have to sign up, it is free, I often point to these, it is worth it: Earnings Call Transcript) the company talks about the currency headwinds and in fact lower gas prices in the US shaved a little off. Lower gas prices = less money spent to fill up the same tank.

The company has monster margins, remembering that their job is to process the payment, they are neither a bank or financial institution, they are a technology business that benefits from increased consumer payments. They have the payment networks and whilst Bitcoin and some other "unique" payment methods may be adopted by out there consumers, the internet shopping and ecommerce shift is a huge opportunity for them. Apple pay for instance is where you store your credit card details. This is a great business, which trades at a premium to the market, for a reason. There are still many more growth prospects across all territories on the planet, if you are positive on the prospects for all economies, look no further than Visa as a firm buy.

Not enough! I want more, just like Oliver Twist. This is a cry for help from the readers of our daily newsletter, thanks to all those who tweeted in the affirmative, I need more votes though! This is in order to secure a semi final spot in Share Shootout. It is very simple, if you have a Twitter account, follow the link (via the image below) and then click on the retweet button. If you do not know what a retweet button looks like, then here ->  . OK, help please! Follow the link via the image and then retweet.

. OK, help please! Follow the link via the image and then retweet.

Byron beats the streets

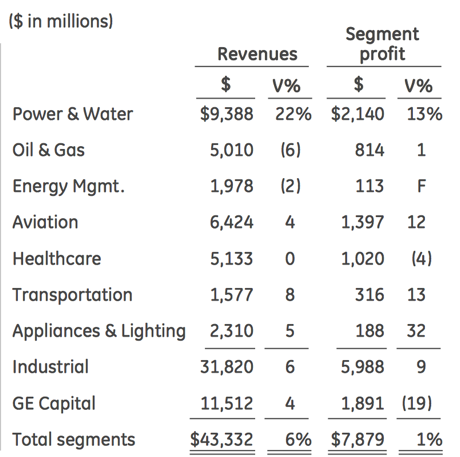

Last week we received fourth quarter and full year results from GE. I must say their investor presentations are great. I guess they have to be for such a complicated business with so many moving parts. Here is the presentation if you would like to have a look. Lots of images, graphs and tables to simplify things.

Sometimes GE's diversification is its curse. As you can imagine, oil and gas orders have declined yet their aviation business has shown solid growth. Both are a direct impact of movements in the oil price. Here is a table which illustrates all of GE's businesses and comparisons to Q4 of 2013.

As you can see GE capital is slowing. This has been done on purpose as they sell off segments of this business and become less reliant on banking activities. The company believes that more stable and predictable industrial business is far better for the company. GE capital was still responsible for 24% of profits in the quarter and 42% of profits for the year. Management want to get this down to one quarter of earnings in 2016.

For the full year the company made $16.7bn in operating earnings. This equated to $1.65 per share which was up 1% from the previous year and came from $148bn of sales (up 2%). The share trades at 14.5 times earnings and a solid yield of over 3%. The company is not growing very quickly but it's price correctly reflects that.

There certainly are positives to take out of the release. The order book is growing at 3% and the cost cutting they are doing has done wonders for margins (up 50bps for the quarter). GE is still very much a US company and the strong economy is expected help GE grow sales by 2-5% for the year of 2015. With strong cost cuts this should bode well for earnings growth. Expectations are for 6% growth in earnings per share to $1.73 for 2015. That is solidly above inflation in this low interest rate environment.

The business is moving in the right direction with more focus on aviation, medical devices, transport and their biggest segment, power and water. The power segment involves the supply of electrical power which actually benefits from lower oil and gas prices. As you can see from the table above, Oil and Gas contributed 10.3% to profits. Not tiny but the company will certainly be able to deal with a slow down in demand for drilling products.

The company has also been very active in the acquisition department. The much publicised $17bn Alstom deal is still awaiting competition approval from the European competition authorities. They are buying the French companies energy division which again targets power generation, a segment you would expect to constantly grow as populations get bigger and people get wealthier.

All in all the company is working very hard at managing the the things which they can control. Operationally and strategically I feel they are moving in the right direction. Unfortunately the demand for their many products remains volatile. I wouldn't call it a conviction buy but I'd be happy to hold and benefit from the solid yield.

Home again, home again, jiggety-jog. Stocks are up! Across the board. This is seemingly a good January, you must bear in mind that last year was pretty sloppy, stocks were up only 7.6 percent, we are up about 3 percent already this month. Go January!

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

087 985 0939