"I managed to convince him that whilst these events and interventions may have an impact on the markets as a whole in the short term, in the long term central bankers do what they have to do whilst in the background investors continue to hold and maintain quality companies. So what mattered most, I said, was rather that you made sure that the companies that you bought had good prospects rather than what Mario Draghi and the ECB were about to do. I have no way of knowing whether it would be good or bad, the impact of the ECB's bond buying program on the market."

To market, to market to buy a fat pig. It was quite fun, I spoke to a fellow dad at the girls school last evening and we had a chuckle as he said all this volatility, up sharply and down sharply was making his trading mates mad. This is a guy that trades volatility for a living, or used to. So volatility turns out to be OK, too much is not OK. It just goes to prove that once again you cannot please everybody all of the time, it is impossible. Yesterday was another strong day for the local equities markets, perhaps "things" are normalising a little after the Swiss National Bank last week with their "surprise". I remember how shocking it was when they introduced the peg, this was equally shocking I guess on the way out.

I had a conversation with a young professional yesterday that was concerned about European QE and the impact on the markets and in the end I managed to convince him that whilst these events and interventions may have an impact on the markets as a whole in the short term, in the long term central bankers do what they have to do whilst in the background investors continue to hold and maintain quality companies. So what mattered most, I said, was rather that you made sure that the companies that you bought had good prospects rather than what Mario Draghi and the ECB were about to do. I have no way of knowing whether it would be good or bad, the impact of the ECB's bond buying program on the market.

It would not stop Bidvest, or Aspen or MTN or Richemont with their plans. It might be a discussion point around what currencies might or could do, at the end of the day it would be a discussion. Remember when investing, when buying a business, there are things that you can control (what it is that you own) and there are things that you cannot control, like the interest rate cycle, central bank actions, politicians actions and economic policy. Companies work around that, the better the company, the more likely that the same said companies succeed in finding solutions. Makes sense to me. To end off with, yesterday there was a CPI figure here locally, an inflation read for December from StatsSA, which indicated that inflation had eased to 5.3 percent. 0.5 percentage points lower than the prior month, the annual rate of the transport index was now only 1.7 percent higher, dropping from 4.2 percent in November. Excluding petrol interestingly, it came in at 6 percent. As the hyper excitable Rick Santelli says, do not exclude food and transport, I need one to get to work, I need the other to live. Transport is basically responsible for the fall in inflation.

Who to thank for that? Innovation I guess. Innovators and risk takers who enabled and pioneered new drilling techniques, the so called frackers. The fracking community with their newer methodology have reached previously unreachable and too expensive stores of fossil fuels. Whilst we might feel that it is a good idea to be more green, the long and the short of it all is that the economics of gasoline still dictates that we get around using fossil fuels. And whilst Milk, eggs and cheese are more than 12 percent higher over the year, a litre of milk (via the Woolies website), a fat free long life 1 litre of milk costs 11.95 Rand on special. Normal price, 12.95 Rand. A litre of petrol/gasoline? According to the Petrol Price, the basic fuel price (calculated this way -> BASIC FUEL PRICE).

Did you see that you pay a lot in taxes, after all is said and done, you cough up 11.24 Rand for a litre of Petrol on the highveld, including all the taxes, around 342 cents. A litre of fuel is less than a litre of milk. More astonishing is that a half a litre of water costs 7.95 Rand at Woolies, in bulk you can get 6 litres for 34.95 Rand = 5.825 Rand a litre, more than the basic fuel price, which is 5.3325 Rand a litre of 95 Unleaded. How is that possible? Milk is harder to extract, you would think, than water. Fuel needs to be refined, get here from halfway around the world and you demand cheaper. The reason why I compared this to local prices is that I saw this piece in the US, from one of my favourites, Professor Mark J. Perry -> It's something of a miracle that gas is only $2 per gallon and cheaper than any other liquid consumers buy. Check out that Soy milk and most importantly, HP Printer ink at 4500 Dollars a gallon. You knew that already, that the ink itself costs more than the printer.

So, to end the markets piece, US markets ended the session in the green, the broader market up nearly half a percent, whilst both blue chips and nerds could only manage one quarter of a percent. This time of the year is tough, humans are hard wired to the idea of evaluating what they want to or need to do this year, and seeing as humans set the levels of the market (the machines company analysis trading company is not something I have seen yet), it will always be volatile. Even though machines might trade on some sort of algorithm, those numbers were written by humans, mathematicians, for now. The other big thing on the go right now is an imminent ECB announcement and Davos, both of which do not really impact on any of our companies, really. Warren Buffett has never been to Davos. Apparently one of the very few of the wealthy to have never been there, perhaps as a big shareholder in his own business, he cannot justify the cost and whether or not there is anything that transpires out of those conversations.

Company corner snippets

FirstRand and MMI, what happened there yesterday? The companies both issued new shares, a Reuters story titled S.Africa's FirstRand shares fall after new stock issued says that the stock was allocated to staff, an empowerment deal. In the Reuters story, an emailed answer: "Existing shares that were allocated to staff are being sold and new shares are being issued to normalise the NAV (net asset value)." The Business Day story titled FirstRand shareholders cash in R3.4bn. Ownership has been around 10 years since February 2005, is that at a corporate level a long time to be locked in and owning shares? My next question is, this specific windfall, how is it likely to impact on consumer spend, that is not nothing at all, that is a lot of money in the hands of not that many people.

In short, if I understand the Business Day article properly, 12 thousand staff received 171 million shares at 12.28 Rand each. I went back and looked in the original SENS announcement: FirstRand intends to make available 171.4 million shares representing approximately 3.1% of FirstRand to its black South African employees. The total funding required at 12.28 Rand was 2.1 billion rand. That is why the employee scheme had to sell a lot of shares, to settle the associated debt, 64 million shares. At around 50 Rand in December, that equates to 3.2 billion Rand. The balance of the shares, the 107 million odd shares, 66.7 million were sold, leaving 40 odd million shares left, or less than 25 percent of the original staff allocation. How many share options and shares the Black Non-executive Directors Trust has received over the years, the annual report suggests that there can never be more than 62 million shares. Or so I read.

I guess all you need to know in the end is that if you were at FirstRand and had been inside the net, in the empowerment deal, you would a) have 23.7 percent of the original shares left b) own them free and clear and c) have sold 38 percent of your original shares at 3.74 times the original price paid. Sounds simple! If you had 500 shares at the beginning (which many people did), they would have around 5700 Rand in shares left, 118 or so shares, have extracted 8950 Rand from the sale of 194 or so shares. When you put it that way, not nothing at all, as they say in the classics, it is better to have something than nothing.

BHP Billiton production report yesterday, perhaps the biggest focus point for many people was (as anticipated) a strong fall off in the amount of oil spend, with regards to their business. The full operational review can be downloaded from their website. The must knows are that overall group production increased by 9 percent, driven primarily by Met Coal, Iron ore and Petroleum, Copper showed a decline, as a result of lower grades. The sad truth is that whilst we see all of these production ramp ups, they come in the face of a really precipitous fall in iron ore and more especially petroleum prices. Equally copper, albeit by not as much as the others. The company chief, Andrew Mackenzie said that the cost saving initiatives are faster than anticipated and will help against lower prices. Equally however the number of rigs operated across their US onshore business (read Shale) will drop 40 percent (around 10 rigs I think) and that the higher margin Black Hawk acreage will be all the company focus. The cost for the company (and you the shareholder) is 200-250 million Dollars, US.

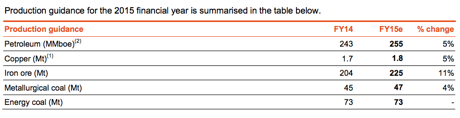

Guidance? Here goes, a screen grab from the report:

The first thing that you will notice is that the business guidance is given without the South32 business, which will be unbundled during the course of March, around 60 days time. Important in all of this is the ability of BHP Billiton to meet their dividend. I have seen research reports suggest that BHP might see earnings fall to the region of 140 US cents this year and then 130 US cents next year (2016), the dividend of around 120 cents might be met. Normal dividend cover of 2.1 times cover would go out the window, this would be a case of using almost all earnings to payout shareholders, borrowing aggressively to meet the projects that make most sense. So, at current levels of around 250 Rand, with an exchange rate of around 11.50 to the US dollar, Rand earnings and dividend expectations (from what I have read and seen) are around a yield pretax of 5.5 percent (very good) and a price to earnings multiple of 15.5 times, a bit out of whack historically with an earnings plunge. As ever it is very hard to predict where to next, with regards to commodities prices.

Things we are reading, we think that you should read them too

The best way to mine gold may not be going underground - Millions of Dollars Worth of Gold And Silver Lurk in Sewage. The yields are high and it is probably a lot safer than being under the earths crust, "nearly 2 kilograms of gold in every metric ton of ash left from burning sludge, making it more gold-rich than the ore in many mines."

Here is what the richest man in the world thinks about the future - OUR BIG BET FOR THE FUTURE. If you were going to take anyones word for what the future will look like, I would say that Bill and Malinda Gates have one of the clearest views. The one thing they mention is mobile banking which is good news for the likes of MTN, Vodacom and Visa.

This blog piece looks at the Franc trade from both sides - Maybe You Shouldn't Do That. This is trading and not investing but gives some insights on how we can get focussed on price and pat ourselves on our backs when prices move in our direction.

Home again, home again, jiggety-jog. The local market is back over 50 thousand points, still around 2000 points from the highs. Wall to wall coverage of the ECB and Mario Draghi and Davos today, the cricket series is won with two to go, that is pretty astonishing. Sorry East London for the short match, blame Tahir, Steyn and Philander, Amla and du Plessis. AB watched the batting. Wow. I am starting to believe that we can win the world cup cricket, I have held that since 1992, when last we were in Australia for such an event. Remember McMillan and Richardson getting close and then the rain came, how sad, 22 runs to win off 1 ball. Sigh. Please can we exorcise the ghosts of world cups past.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment