"Not so pleasing was the Richemont trading update, that is out this morning. We expected a weak update on the basis that their Hong Kong stores, which represent a large portion of sales in the greater Chinese reporting area."

To market, to market to buy a fat pig. Woo hoo, we finally won a T20 match yesterday, with two of the most sparkling performances from a set of chaps not even in the mix. And the footballers, our own national team starting the African Cup of Nations, crushed the folks from Mali, three zip. In the real world, the world that I eat, sleep and breathe and far away from the welcome escapism of national sporting teams, it looked more like a one sided battle of Dale Steyn bowling with his "crazy eyes" against the u10 B team from Upington prep school (if there is such a thing). A worse day for the commodity stocks on the local bourse I am sure I will have to go as far back as the financial crisis to see. It was absolute carnage out there and none of the resource stocks were spared.

The World Bank having downgraded global growth saw the copper price sink sharply, the oil price continued to sell off too, meaning that it did not matter which one of the majors you were in, it looked really bad. This was the worst price that I had seen for Anglo American (down 8.79 percent) since February 2009. This was the lowest level that Glencore had ever reached, the stock was shoved down a whopping 9.49 percent on the day. BHP Billiton lost 6.37 percent, Sasol was sold off 4.92 percent, Anglo American Platinum was down 4.82 percent and Impala Platinum was clobbered 8.21 percent. The pain did not end there, Kumba Iron Ore lost 5.88 percent, African Rainbow Minerals sank 7.16 percent, the list goes on and on, the gold stocks couldn't even escape the wrath of the sellers. It is not often that you see such a day.

The resource stocks as a whole slipped nearly six and a half percent on the day. The rest of the market fared not as badly, it was a case of, to use a golfing analogy, you shot 90 and your mate shot nearly 100, at least you were not that bad. Mind you, I would be lucky to break 100, I last picked up and swung a golf club in anger over ten years ago, perhaps 11, it could even be 12. I am rubbish. After the final bell rang for markets here locally the market had registered a two and three quarter percent sell off, the level back at 48 thousand points. It has been tough out there, it is certainly not easy for anyone.

Not helping was a worse than anticipated US retail sales report, December was not all it was cut out to be, perhaps the real impact of lower energy prices is something that takes a number of months, rather than weeks. You would have thought that the positive impact would have filtered through to better than anticipated retail sales, however some folks are suggesting that due to seasonal reasons, there could be revisions higher. Also, the biggest impact of the evening was the release of the Fed Beige Book, something that is published 8 times a year which surveys all the districts Current Economic Conditions. Oil prices spiked hard in the wake of this new news, we could call it.

In Texas, lower oil prices are not all good, from the Beige Book: The Dallas District indicated that growth slowed slightly during the reporting period and that several contacts expressed concern about the effect of lower oil prices on the District economy. And then further to the East: Industry contacts in the energy sector reported that the downturn in the price of oil has influenced their outlook and strategic planning for 2015, including a heightened focus on cost management, more prudent investments, and faster, more efficient drilling techniques. Exploration and production firms shared plans to continue drilling operations across the Gulf Coast and in Louisiana in 2015, though they intend to approach projects more cautiously.

Most of the oil price fall was due to a great research report from Goldman Sachs, from a chap by the name of Jeff Currie. The interview with Bloomberg's Tom Keene (one of my favourites) is worth a look, it is absolutely fabulous: Shale Fundamentally Changed Oil Market: Goldman's Currie. It explained how the time taken to allocate capital and then start getting oil out the ground has collapsed (as Currie says) from 3-4 years to 30 days!!!! He suggested that if OPEC took supply out the market, the shale folks would hit it hard immediately. What has happened here for consumers globally is that technology and not oil gatekeepers have changed the supply side. Long live capitalism. Capitalism does more for humanity than any organisation or government organisation. That is just my opinion. ("But it is a fact" - Byron)

Company corner snippets

Woolworths have released a sales update for the first 26 weeks of their financial year to end 28 December. So I guess no New Years sales in there. Excluding the impact of David Jones, group sales increased 12.5 percent. Total sales, including David Jones were up 55.2 percent, just showing you how huge the shift has been for the company. The ability to change the landscape of Australian retail should not be underestimated, David Jones could be huge, no doubt there are big plans afoot. So far the market likes the sales update, the stock is up 2.8 percent in early trade. Results are expected to be around the 12th of February. Exciting times, wait for more analysis when it comes!

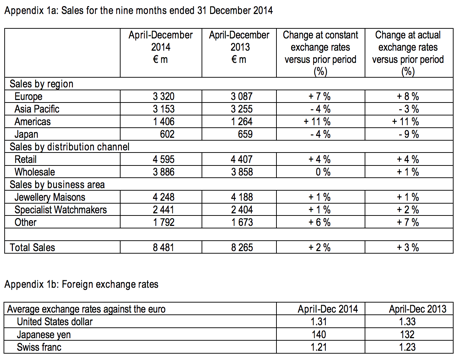

Not so pleasing was the Richemont trading update, that is out this morning. We expected a weak update on the basis that their Hong Kong stores, which represent a large portion of sales in the greater Chinese reporting area, were affected by the protests. Download the trading update: TRADING UPDATE FOR THE THIRD QUARTER ENDED 31 DECEMBER 2014. Asia pacific was really weak, and that has been the growth engine. There were strong bounce backs in Europe. Here is the table below for the nine months, the second table which would to some extent neutralise the impact of the Umbrella Revolution is the more important one for the 9 months:

The stock has reacted negatively to what clearly is a miss and is light on the revenue front. I do think that this is an opportunity, this is a quality business and will continue to remain compelling from an investment point of view. The current sell off may take a day or two to settle.

Massmart cracked a sales update that surprised the markets, "total sales increased to R78.2 billion, representing total growth of 10.4% over the prior 52 week period, with product inflation estimated at 4.8%." Massbuild, the Builders Warehouse stores, increased 14.6 percent. People love that place, long queues, people getting stuff that they don't need. I am kidding, the warehouse model works really well. Masswarehouse, the Makro brand, increased 11.9 percent, it seems that the higher end element of their stores have done better. Results around the 26th of February. The stock traded positive on a day that the market got thumped, there has been an element of PE unwind, since all the retail stocks peaked at the beginning of 2013, since then it has been tough going.

Shoprite released a sales update yesterday, here is a copy and paste from the SENS release: For the six months to December 2014 the Shoprite Group increased turnover by about 12.5% from R51.1 billion to R57.5 billion. Growth on a like-for-like basis was 5.1%. South Africa increased sales by 12 percent, Non South Africa grew sales by 15 percent. Results for the six months to end December? Expect those on the 24th of February. The stock price did not exactly react positively, it was however MUCH better than the rest of the broader market which was taking a pounding.

An Apple Inc. graphic via Barry Ritholtz's blog just to confirm what you knew already: Where Apple's Money Comes From. Astonishing that the business is still very much an iPhone business, equally astonishing is that it used to be an iPod business and that sales as a stand alone of that device (when last did you see one?) is 2.286 billion Dollars. I saw something yesterday about Apple, remembering the Wii and also the motion sensors from the Xbox and Playstation, this is interesting: Apple Inc (AAPL) Patent Shows Off Futuristic 3D Gesturing. What always matters however is how comfortable you would feel doing something in an office, relative to the home. Would you want to distract your fellow employees waving your hands in the air (like you just don't care)? As they point out however, this is possibly for Apple TV, no remotes, only gesturing. Watch out for sport however, do not shout at the screen and gesture when your least favourite batsman (did I say Behardien?) has a low strike rate in a high scoring match.

Byron beats the streets

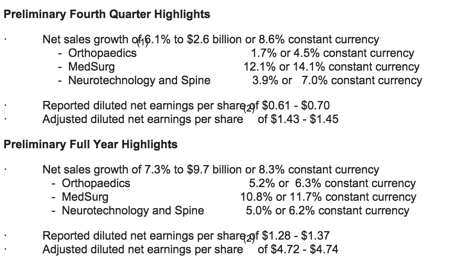

Yesterday we received 4th quarter and full year results from one of our recommend healthcare stocks in the US namely Stryker. I've taken a screen grab from the presentation which summarises sales growth amongst the business's divisions. MedSurg is the devices and equipment division, the other 2 are self explanatory.

As you can see, the growth has been solid. The US which is responsible for 68% of sales saw sales growth of 9.6% for the year while their international sales which represent 32% saw an increase of 2.6%. Notice a pattern there? Yes the US economy is outperforming everyone else but don't forget that the US companies who manufacture locally and export their goods are getting hit hard by the ever strengthening dollar. I guess that is a function of a growing US economy which is still Stryker's main market. I'd say an overall net positive macro environment for the company. A much better scenario than having a weaker dollar due to a weaker US economy.

The company made $4.74 for the year which trading at $94 gives it a historic PE of 19.8. Forecasts are for $5.17 for 2015 putting the business on a forward multiple of 18 which is not bad for a company with a strong balance sheet, operating in an exciting sector.

The company is certainly in acquisitive mode. The sector is fragmented and we saw lots of M&A activity throughout 2014. Stryker's most recent activities include a strategic partnership with a stem cell company called Osiris to develop bone matrix tissue and special wound repairing technologies. Sounds exciting! Another deal was to acquire assets in a Canadian hospital beds manufacturer. Talk of other big deals are always floating around.

In the US healthcare has been thriving. The healthcare index was up 22.3% last year. Stryker is a big benefactor if the industry is spending. If hospitals are making good money and increasing their capex spend then the devices businesses will be benefiting. In this fast growing environment Stryker are stealing market share, growing organically and sit with plenty of growth via acquisition opportunities.

Developed markets are riddled with old and overweight people. They will be Stryker clients. So will the fitness freak who has run his hundredth marathon. The company sits in a sweet spot and we continue to accumulate.

Things we are reading, we think that you should read them too

This is the average amount of interest that an American will pay over their lifetime - The average American pays $280,000 in interest. A large chunk of that comes from interest on mortgages which hopefully was on houses that went up in value. As the saying goes, "Those who understand interest earn it, those who don't, pay it". The saying has been attributed to Einstein, along with may others, but from what I read he never said it. Something sounds better when you say a really smart person once said it.

Value creation is what companies and individuals strive to do. If we create value under a capitalistic economy we get rewarded by resources we have freed up in society, this article looks at the value being created by next generation software - The "Uberization" of the economy is really about building a better trap for ideas

Why are Australian jobs numbers important? Apart from most people knowing someone who lives there, Woolworths now gets 46% of their earnings from Downunder - Australia's Biggest Jobs Gain in 8 Years Defies Doves: Economy.

To raise or not to raise that is the question - Will Lowflation Delay The Fed's First Rate Hike?. On the one hand you have solid jobs and GDP numbers but on the other hand there is the spectre of deflation hanging around. Deflation is almost as scary to economists as the words "The Great Depression".

We leave a trail of data everyday when we use the internet - Facebook data knows you better than your own mother. Your response can either be one of privacy violation or connivance because marketers know you so well that it will be easier to find what you are looking for. The marketers probably know things that you "need" that you don't even know that you need.

Home again, home again, jiggety-jog. Markets are higher this morning here in Joburg, commodities have bounced somewhat, and I have seen some upgrades for some of the commodity companies.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment