"The highlights include higher gross margins, 39.9 percent, 65 percent sales outside of the US, most impressive was the fact that the company managed to sell 74.5 million iPhones (74.468 million to be precise) in a single quarter, a record. The results were littered with records like AB de Villiers and a Wanderers one day match, revenue for the quarter was 30 percent higher than the prior quarter at a whopping 74.6 billion Dollars, earnings of 18 billion Dollars. Basic earnings per share clocked 3.08, above 3 Dollars a share for the first time, a whole Dollar stronger than the same reporting period last year. Those are expected to be stronger (the impact) in the current quarter as hedges expire and the Dollar remains strong."

To market, to market to buy a fat pig. It was interesting to see the headlines against the backdrop of loads of snow in the Northwest of the US which suggested that the stronger Dollar was starting to weigh on some specific company results and their outlook specifically. So, the conundrum for the Federal reserve, if they raise rates, that would make the Dollar more appealing (in a search for yield) and as such be more of a drag for businesses reporting in the US. I just guess that you have to roll with the punches, you have to take the good with the bad, the Dollar used to be too weak, now it is too strong. People still buy "stuff", currencies do have an impact, you probably find higher taxation has a bigger impact in the long run.

3M reported numbers inline with estimates, they face currency headwinds in the coming year, nothing that a post-it can't paper over. Perhaps more likely a scotch guard, or a whole array of products actually, everything from boat care through to animal care. You might have had to put a "bucket" on your dogs head, that was more than likely made by 3M. Products that have a broad range of uses across multiple industries, healthcare to electronics, transportation to manufacturing. It is a monster global company, sales of 31 billion Dollars, run by a Swedish chap by the name of Inge Thulin, he is 60 years old and oversees operations in 200 countries globally, where around 89 thousand people are employed, it is truly a global giant. The share price has doubled in the last five years, the stock (for a steady as you go industrial company) looks a bit stretched at 23 times earnings.

That was the good, 3M, the bad and the ugly in the US markets were Caterpillar and Microsoft respectively, the companies share prices hammered. Guiding in the wrong direction. Microsoft sank 9.25 percent, I have been seeing reports for ages suggesting that the company is overvalued, it is still as we speak on a higher rating than Apple. In other words, the market is willing to pay more for the current earnings of Microsoft (future too) than they are willing to pay for Apple. A whole lot more on Apple in a second or two, their results were spectacular. Microsoft, that once off upgrade (new operating system) was a once off, sales slowing, they are certainly struggling, not too dissimilar to IBM. A much younger version of IBM. Earnings! My favourite season.

Caterpillar? Down over seven percent, lower energy prices are hurting their energy and transportation units, natural gas and oil businesses pulling back on capex. First it was the mining companies, which were more than offset by a surge in their energy business, now sadly oil and gas producers are pulling back. And a stronger Dollar, did we not mention that part?

How can everyone get their estimates on Apple so wrong? So very, very wrong. In a good way for the company that is, and by extension their shareholders. The company absolutely blew away any expectations that "the street" had for the last quarter, crushing it. Last evening Apple inc. presented their results for the quarter to end 27 December 2014, their first quarter of the current financial year. Check it out: Apple Reports Record First Quarter Results. This was the most successful three months of any company in corporate history.

The highlights include higher gross margins, 39.9 percent, 65 percent sales outside of the US, most impressive was the fact that the company managed to sell 74.5 million iPhones (74.468 million to be precise) in a single quarter, a record. The results were littered with records like AB de Villiers and a Wanderers one day match, revenue for the quarter was 30 percent higher than the prior quarter at a whopping 74.6 billion Dollars, earnings of 18 billion Dollars. Basic earnings per share clocked 3.08, above 3 Dollars a share for the first time, a whole Dollar stronger than the same reporting period last year. Those are expected to be stronger (the impact) in the current quarter as hedges expire and the Dollar remains strong.

Other highlights during the quarter were that the company shipped their one billionth iOS device, which happened to be a Space Gray (or Grey) 64 Gig iPhone 6 Plus. The company saved the iPhone for prosperity, how many other companies can you think of that have sold that many units? Bearing in mind that they are not cheap, the devices that is. The results would have been much better if there had not been, as the company put it, fierce foreign exchange volatility. Cash on hand? 178 billion Dollars and a sequential (from the prior quarter) of 22.7 billion Dollars. That amount is just mind blowing.

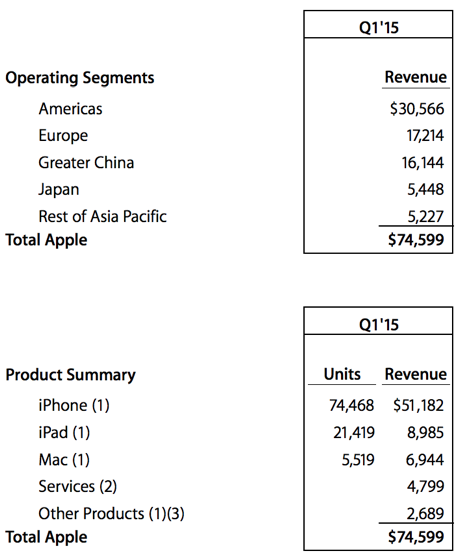

Let us match these results up against expectations, one of the very best known analysts covering the company, a fellow by the name of Gene Munster from a firm called Piper Jaffray expected the company to sell 65 million. He got it wrong by a whopping ten million and he is amongst the best. Why? I think that if you look at this graphic it is easy to see that the Chinese influence is the key here to the big jump, revenue up 157 percent when compared to the prior quarter, it is now their second biggest market and potentially, as soon as next quarter, the biggest. And...... Bearing in mind iPhone 6 only was released in October in China. Astonishing. For a detailed look at their sales by territory and absolute product sale, check out the Q1 2015 Unaudited Summary Data. Here is the last quarter only, revenue numbers are in millions, units in thousands:

As you can clearly see, it is not all about the base, it is all about the iPhone. Still. Inside of the new iOS, CEO Tim Cook on the conference call (sign up and read it for free -> Earnings Call Transcript) spoke of the positive impact of developers adding Healthkit to their apps. Apple could change the future of health with their technology. Obviously Apple Pay has been well received too, in total, thus far, 750 banks and credit unions have signed on, 200 thousand points of sale already. Just to remind you, you load the details on your phone, your fingerprint is the key as to authorisation. Reminder, in case you forgot, your fingerprint is unique. Apple watch? When is that coming, my eldest daughter wants one, I asked why? She said for being able to tap it and let me know she is there. April folks, April. That is definitely a growth product, from a zero base. It will be one to watch, that is for sure.

Where is the growth likely to come from? Well, good question, I am pretty sure that in the coming days folks will predict that this is as good as it gets. That always happens. A survey crowd called ChangeWave suggested that iPhone owners had a 97 percent satisfaction rating in the US. The other three percent obviously cannot use it and prefer a Nokia 3310. No, that last part is not true. Obviously the key here is to outsell all the other smart phones, the same said company, ChangeWave had more than 55 percent of people who intend to buy their phone are likely to buy an Apple iPhone.

Also, and this is pretty mind-blowing, there were more than half a billion physical and landing page (www.apple.com) visits inside of the last quarter. There are currently 447 store locations, only 182 outside of the US with 40 store openings expected by the middle of next year in China alone. 72 percent of global subscribers through 375 carriers sell phones, whilst there may not even be 1000 Apple stores, these companies account for 210 thousand point of sales. Where you can walk in and sign a contract, get a new phone, happy days!

The products are so good that the Mac is growing in the face of a slowing PC market. Having said that, Mac revenue for the quarter was "only" 6.9 billion Dollars. iPad sales fell, the excitement about the product remains, the renewal cycle is not that often. For instance, I have an iPad, the original, I feel no haste to renew, as it does everything that I want. For now. I am pretty sure that I might be pressed to get a newer smaller one, the light one which I will be able to read too, sorry Kindle. Makes me think ....

Guidance for the current quarter, post the hip-hip hurrah of the Christmas period is as follows: revenue between $52 billion and $55 billion, gross margin between 38.5 percent and 39.5 percent. That was marginally ahead of expectations too. The dividend will possibly get a review soon, in the coming months. We continue to hold and accumulate the stock, there will no doubt be a slew of reviews moving their 12 month target price higher and higher. At the moment the company, more importantly their product, looks unstoppable. The stock is up 5,74 percent pre market (after having been down 3.5 percent in the normal session), perhaps it is going even higher in the normal trading session. The stock is up 5.8 percent in Frankfurt, after having a poor day yesterday.

Sasol have just stuck out an announcement, something that I guess was to be expected a little. In response to lower oil prices, the decision with regards to give the final phase of the Louisiana investment, the gas to liquids plant (and not the Ethane cracker, that part IS going ahead) has been put on the back burner. David Constable said in the release: Albeit at a much slower pace, we will continue to progress the U.S. GTL facility. This will allow us to evaluate the possibility of phasing in the project in the most pragmatic and effective manner. The Sasol share price is up over two percent, even whilst the oil price is falling, this is quite possibly a response from the market suggesting that the dividend is going to be OK, for the time being. I guess it is not great news for global expansion, it is a reminder that their prospects in the medium term are determined by energy markets.

Things we are reading, we think that you should read them too

The thought of only having one card in my wallet is very appealing - This is Swyp, the latest card that wants to store all your other credit cards. This technology might be dead in the water before it even gets going due to people adopting payment systems like Apple pay.

Timing the market is very tricky and probably a fools errand - Video blog: How Keynes gave up on market timing. I would agree that you can't time the market, that is why we are "actively passive".

An interesting look at the margin expansion of US companies - Technology and Finance: Drivers of a Profit Margin Explosion

This is interesting -> Why Greece Won't Leave the Euro. It turns out that this might set a precedent and Germany certainly does not want that!

Home again, home again, jiggety-jog. Markets are up! Earnings were poor yesterday, that is OK, they are good today! There has actually been a whole host of production reports and exciting sales reports that we will have to deal with tomorrow unfortunately, we have run out of time today. That is the sad truth, we cannot cover it all in one day, that is what Twitter is for. We are well aware that our phones have been on the fritz, many apologies, you know how to contact us if needs be, our voIP provider has been very patchy with their "service".

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment