To market to market to buy a fat pig. All focus yesterday in the US was on politics. The scale of Russian involvement in the US election is coming to light; I have heard political commentators start using the words 'impeachment' and 'Watergate' again. The comparison, of course, is to Nixon who resigned after his meddling in elections came to light.

More important to markets though is the talk of Trump's tax plan being phased in slowly instead of a big tax cut off the bat. For companies, a big tax cut up front would be preferred. There is still much 'politicking' to be done between all stakeholders. For now though, we will wait and watch to see how the cards fall.

Market Scorecard. After bouncing between green and red yesterday, our market pushed higher in afternoon trade to finish in the green and at a record high. The Dow closed down 0.36%, the S&P 500 closed down 0.32%, the Nasdaq closed down 0.03% and the All-share closed up 0.28% Naspers is fast approaching the R3 500 mark, currently sitting at R3 451; its year to date return is 71%! For comparison, Tencent is up 85% since the beginning of January.

Company corner

Michael's Musings

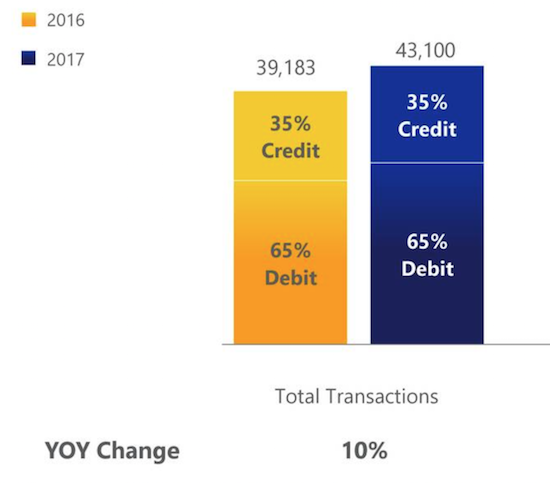

Last week Visa reported their 4Q and full year numbers, beating market expectations on the top and bottom line. Reading through their earnings call, it is amazing to see the insights that they get globally, thanks to seeing spending changes. They have noticed a spending drop off in areas hit by recent natural disasters. More developed regions spending returned to normal in a shorter period when compared to less developed areas. Another thing they pick up is the impact of currency changes on spending and travelling. Speaking of travelling, they saw a 10% rise in the number of cross-border transactions; high margin business for them and good news for our investment in Priceline.

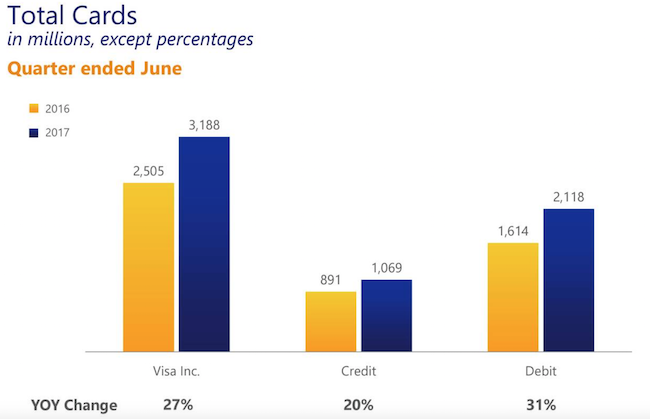

Arguably the most important number, indicating future business potential is the number of cards in issue. The number is huge! With around 3.2 billion cards, that is almost enough cards for one in every two people on the globe to have one. I had a look in my wallet, there are 3 Visa cards in there, which I guess is the average for most people?

Onto the numbers. Revenue for the full year came in at $18.4 billion, an increase of 22%. Net income clocked $6.7 billion also an increase of 22%. The growth was driven by the purchase of Visa Europe last year, which is performing better than expected, both in terms of revenues and in terms of lower costs. As more people become comfortable with not using physical cash, the number of swipes go up. For Visa, they processed 43 billion transactions in only three months.

Management is ploughing money into share buybacks; using cheap debt to buy back shares. Depending on the direction of the share price, this can be a great idea. If you are an Anglo American shareholder, you would rather forget all the buybacks done at R450 a share, back in 2008. As a Visa shareholder, the strategy is working well. Over the last financial year, Visa spent $6.9 billion on share buybacks, at an average purchase price of $90.31, translating into a 22% return for shareholders. For the current year, management plans to spend $9 billion on buybacks and dividends, around 3.5% of Visa's current market cap.

One of the questions we get asked regularly is if Visa will be around in the future due to cryptocurrencies. As it stands at the moment, using Visa is cheaper, quicker, safer, easier and uses less electricity than purchasing with the likes of Bitcoin. Going forward, I think we will operate in an environment where cryptocurrencies play a role but the network Visa has built will still be the dominant player for payments. Happy to continue holding this company for decades to come.

Linkfest, lap it up

One thing, from Paul

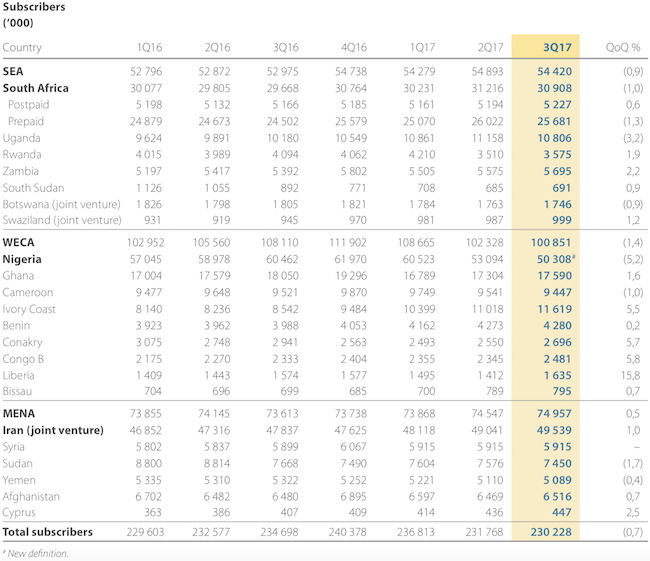

President John Magufuli of Tanzania has been giving private companies operating there a hard time.

Elected at the end of 2015, Magufuli made a stir by announcing sweeping anti-corruption measures, cutting expenditure on his inauguration, curtailing the number of ministers in his cabinet and banning first-class air travel by government officials.

Since then, enthusiasm for his rule has waned, because he has curbed media freedoms, jailed HIV-activists and attacked foreign companies operating in Tanzania. For example, he ran some numbers and announced that based on the historical value of gold concentrate exports by UK-listed Acacia Mining dating back to 2001, that company owed back taxes of tens of billions of US dollars (including interest and penalties).

Acacia unveils blueprint for cash inteeth of Tanzania crisis

The ruling elite in Tanzania probably think that this is all marvellous, and that foreign companies are being given a good lesson, but of course the long-term impact will be that Tanzania will be a no-go area for future foreign investment. In the long run, it's an own goal.

Bright's Banter

Today I am listening to Prof. Scott Galloway, I've said before that he's a professor at New York University Stern School of Business, author of The Four: The Hidden DNA of Amazon, Apple, Facebook, and Google (all companies we own).

I have written about Prof. Scotty before but I didn't do it justice. He's an investor, marketing consultant, author amongst other things. He's founded many companies including Red Envelope and Prophet. His most recent company is L2 Digital a business that tracks and ranks the top brands in the world according to their Digital Performance. Visit his website for more info on that.

Below is his interview with Barry Ritholtz on Bloomberg's Masters In Business Podcast Series. He discusses all the companies in "the four" and basically articulates why we here at Vestact prefer to invest your hard-earned cash in these businesses.

- Scott Galloway Discusses Four World Conquering Companies (Apple iTunes Version)

- For those who do not have an iPhone:Scott Galloway Discusses Four World Conquering Companies (Other Version)

Home again, home again, jiggety-jog. Despite the US markets being red yesterday, our All-share is green this morning; breaking into the 59 000's for the first time. Later today, we get an unemployment read from South Africa, where data is expected to show unemployment running at a sad and dismal 27.7%. Then while you are biting down on a sandwich for lunch, the EU releases their CPI figure; it is expected to be 1.5%, still well below the ECB target of 2%.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063