To market to market to buy a fat pig. September will be marked as the month where the Norwegian Sovereign Wealth Fund passed the $1 trillion mark in assets under management. Norway set up the fund to smooth out the effects of a fluctuating oil price and to allow future generations to benefit from their oil resources.

I listened to a podcast from one of the creators of the fund; he speaks about Norway having learnt the hard way. Twice, about how oil prices don't always go up. Oil prices soared during the 70's and early 80's but then at the end of 1985, oil prices went from $31 a barrel to $10, and their economy floundered. Prices then recovered over the next two years to around $20 a barrel, but in 1988 they dropped again to around $13 a barrel. That spurred the government into action and after paying off the nation's debt in 1990, they then set up the sovereign wealth fund. Accumulating $1 trillion in the space of 27 years is an impressive feat, even more so if you take into consideration that there are only 5.2 million people in Norway. If you take the value of the fund and divide by the population, it means each person's share of the fund is around $192 300.

Not a great start to the week for local stocks, we were playing catchup from two down days in the US. Here is the scorecard, the Dow was down 0.05%, the S&P 500 was up 0.01%, the Nasdaq was up 0.15% and the All-share was down 1.35%. Telkom had a terrible day out; they were down 7% to a 12-month low due to the reality that government will sell their entire stake (Telkom shares hit by government's looming share disposal). If the PIC were in a position to buy the entire stake, the share probably wouldn't be down as much. But due to the prospect of government needing to go to the market to sell their shares, it results in a sudden increase in the supply of shares, pushing down the price.

There were 1Q numbers from Nike last night, which showed they had a tough time in their biggest region, North America, but their Chinese division more than compensated. The stock is down 3% in after-hours trade, meaning that the stock is only up around 1% since the start of the year. More on the numbers tomorrow.

Linkfest, lap it up

One thing, from Paul

My favourite airline, Kulula.com scored another win yesterday. The North Gauteng High Court slammed the Air Services Licensing Council (what is that anyway?) with punitive cost orders and set aside an earlier decision to suspend their parent company Comair's domestic license to fly. Laughably, the court found that when considering whether Comair had too many foreign shareholders, the Council thought that shares held by Allan Gray (the very well known Cape Town asset management firm) belonged to the founder, Allan Gray who lives these days with his family in Bermuda - Council gets punitive cost orders for bullying Comair

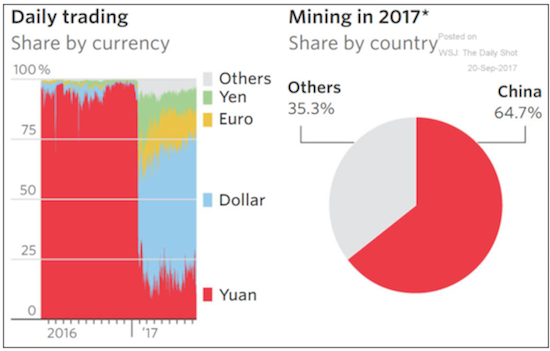

Byron's Beats

The way tech in China has developed is very interesting. They have basically banned all the US giants and allowed Chinese versions to fill the gaps. When you have over 1.3 billion people you already have the scale for these companies to succeed. Of course there is heavy competition to tap this market and the companies that have succeeded have done incredibly well to offer a service that has pulled in the users. Alibaba, Tencent and Baidu come to mind. This Business Insider article titled China is reportedly blocking WhatsApp explains that the main reason for this move is because Facebook (owner of WhatsApp) cannot see all the content of the messages that pass through their severs. Tencent, the owner of WeChat do however have the ability to sift through the content. Sounds pretty big brother to me. This regulatory environment may seem like a risk to Tencent but in truth it creates a huge moat around their business.

Michael's Musings

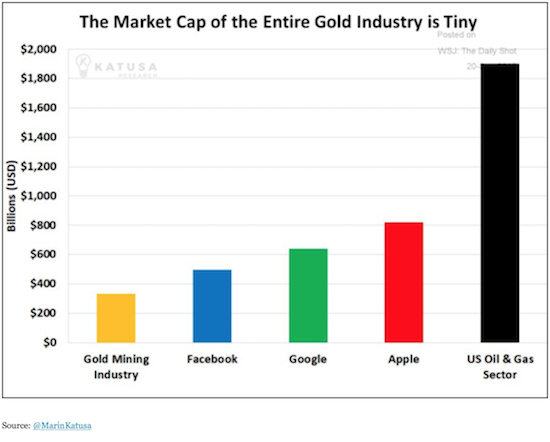

I was amazed to see how small the gold mining industry has become. Based on the below graph, Facebook should get much more attention from financial media than gold?

Price discovery is one of the most interesting things for me given my background in Economics. Cryptocurrencies are still in the early stages of figuring out what they are worth. This means that small changes in demand and supply have a big impact on the price - The price of bitcoin has a 91% correlation with Google searches for bitcoin.

Bright's Banter

Discovery is one of our most widely held stocks and we keep a close eye on them. Discovery's biggest potential will come from its JV with Ping An Insurance where currently one in three lives that Discovery insures is now in China through Ping An. I came across this really interesting article on Ping An - Ping An Valuation Analysis

Home again, home again, jiggety-jog. The JSE had another glitch this morning, meaning that markets only opened at 9:30. Since then our market is in the green and Telkom has rebounded, currently up 3.7%. Later today the US reports on the level of oil inventories, giving an indication of demand levels.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment