To market to market to buy a fat pig. Business Insider has a daily blog, called Closing Bell, which gives a quick summary of the day's events and links to top stories. Here is how they described yesterday:

"Thursday didn't get off to a good start. On Thursday morning, Apple was down as much as 2.8% on reports of the company cutting production orders linked to the new iPhone 8. Apple led the S&P 500 down as much as 0.5% in early trading. But, the markets weren't going to let a single stock drag them down, so at about 10:15 AM, the S&P reversed course and started a long march upward to end the day above its break-even point."

Market Scorecard. Locally most of the market was red yesterday, the only 'bright' spot were the gold miners, up 1.45% as a whole. The Dow was up 0.02%, the S&P 500 was up 0.03%, the Nasdaq was down 0.29% and the All-share was down 0.44%.

Company corner

Michael's Musings

On Friday last week, before the US market opened, Wells Fargo reported their 3Q numbers. Whenever I read their results, I am amazed at their size and the size of the US economy as a whole. Here are some of the massive numbers, for reference bear in mind that South Africa's GDP last year was $295 billion. Over the previous quarter, they had applications for $73 billion in home loans, $59 billion were approved. Over the period, the average deposits in the bank were $1.3 trillion and the average outstanding loans were $952 billion. Shifting to the Wealth and Investment Management division, it had $1.9 trillion in assets! When people talk about the most prominent asset managers, Wells Fargo is never mentioned, even though there are only a handful of firms with over $1 trillion in assets.

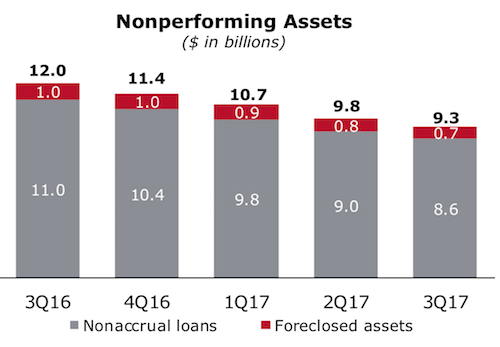

A sign that the US economy is back on track, is the number of nonperforming loans is decreasing. Half of the improvement comes from their commercial and industrial customers, and the other half comes from what they call 'Real estate 1-4 family first mortgage' segment. Even though they have $9 billion in nonperforming assets, it is less than 1% of their loan book.

Unfortunately, the number overshadowing the results was their $1 billion they had to spend in legal costs. To make matters worse, it is not a tax-deductible expense. Thanks to that $1 billion expense, Net Income was down 18% to $4.6 billion. When you type, Wells Fargo and scandal into Google, there are a few that pop up from the last year. Wells Fargo employs just short of 300 000 people, the hope is that there were a few bad eggs that have now been removed and that it is not a company-wide culture problem. It seems that the strategy from management is to comb through the company, find the practices that are questionable, stop them and then refund customers any potential damages. By doing this, it may be costly upfront, but they then get to start with a clean slate.

The reason to own Wells Fargo is that their performance is closely tied to that of the US economy, which should continue to grow for generations. Added to the growth of the US economy is the ability of Wells Fargo to cut costs by encouraging customers to go electronic. Over the last year, they have consolidated 145 branches into existing branches; they still have around 6 000 retail branches in their network. Americans love using cash though, less than 1 in 2 customers have a credit card. There has also been a big push to move customers online; you can now apply for a home loan through their webpage, and they have made doing an EFT easier. Management is starting to see behaviour shifts in clients, who are beginning to embrace electronic channels.

Wells Fargo is a juggernaut that keeps rolling forward, despite all the scandals swirling around them. If they can cut out the cancer of putting profits above the customer, they will survive and probably be stronger down the road for it.

Linkfest, lap it up

Byron's Beats

I love seeing modern, extravagant, large buildings popping up around Johannesburg. It just smells like progress! The new Discovery head office in Sandton is the largest single-phase commercial office development in Africa. It also has a 5 Star green rating for its environmentally friendly design and infrastructure.

As you can imagine, it features a fully equipped gym, a running track, yoga decks and multipurpose courts which encourage health and well-being. You have to practice what you preach.

This cool article explains all the features and green credentials - New Discovery Head Office is Certified Green.

Bright's Banter

A few days ago, I was watching a Bloomberg interview of one of my favourite Professor Entrepreneurs, Prof. Scott Galloway. They asked him about his new book The Four, Or How To Build A Trillion Dollar Company and his thoughts on Amazon. Below is what he had to say about the company, and here at Vestact we kinda liked what he had to say because Amazon is one of our biggest holding for our offshore portfolios.

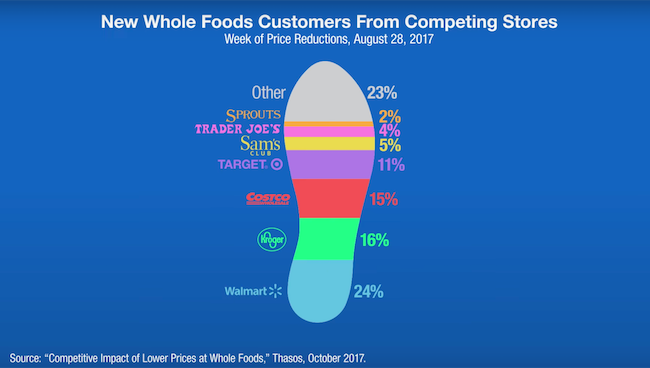

Supermarkets in the U.S. are declining fast at the hands of the Amazon and Whole Foods tie up. Foot traffic to Whole Foods has increased tremendously, up 17% year-on-year following the acquisition. Here is the split of where they're stealing the customers from.

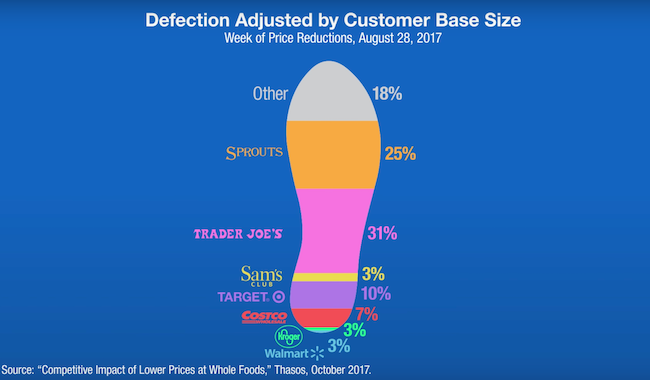

However, if you control for the size of the competitor, Trader Joe's and Sprouts were clearly the losers.

Amazon is not just stealing foot traffic they are disrupting the grocery market. The past few months have shown that they're masters at storytelling and have found different ways to rise to the top in markets they play in. When Nike announced it was going to start distributing on the Seattle Giants website, its shares were up 2% on the day, compared to shares of traditional sports retailers like Footlocker, Finish Line, Dicks Sporting Goods tumbled.

On the 6th of this month when Amazon announced they might be entering the prescription drugs market; shares of CVS and Walgreens dropped by 4% and 5% respectively, while Express Scripts is now trading at its lowest point since 2013.

Even Swatch shares flattened when negotiations between the watchmaker and Amazon stalled. As Prof. Scott Galloway observes, we may be on the precipice of a Singularity but not the good kind. . . The Amazon Singularity!!!

Prof. Galloway said that one of the key components of the free market is that no one individual or firm controls the market. However, concerning the consumer market or specifically the market capitalisation of consumer companies, it's not interest rates, consumer trends, not even the underlying performance of the company that matters. The one factor driving shareholder declines right now is whether or not Amazon is planning to come into your category or distributor your products.

Home again, home again, jiggety-jog. Our market has bounced back from yesterday, currently up 0.8%. US data out today includes existing home sales and Baker Hughes oil rig count. Get your rest this weekend, next week is going to be busy; most of our US holdings report and we have the South African mid-term budget.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment