To market to market to buy a fat pig. Yesterday was the 30-year anniversary of Black Monday, which stands as the biggest one-day percentage drop for the Dow. The index fell 22.6% in one day! Imagine going to bed tonight with your portfolio, your hard earned cash, being worth 22% less.

One of Bright's favourite thinkers, Nassim Taleb, was on Bloomberg yesterday talking about what he had learned, having been in the market during the turmoil. He said many things but the one thing he said, and then many guests after him, was that these things happen and investors need to accept that big drops are part of equity investing.

The main component to investing is ensuring that the money invested in the market is long-term capital, money that you don't need in the next few months. Having only long-term capital invested allows you to ride out these pullbacks. As far as possible you need to prepare yourself mentally for drops and then try to remove as much emotion as possible from your decision-making process. When emotion gets involved, your decision becomes hijacked by either fear or greed, which more often than not leads to a bad outcome.

Barry Ritholtz has a brief piece on the events leading up to Black Monday and the correlations between now and then - Echoes of the Black Monday Crash of '87.

"George Santayana's great maxim was that those who do not learn from history are doomed to repeat it. Perhaps there should be a corollary about learning the wrong lessons from history as well."

Market Scorecard. Nothing to see here, just your usual slow creep higher in record territory. The Dow was up 0.37%, the S&P 500 was up 0.18%, the Nasdaq was up 0.28% and the All-share was up 0.50%. Aspen closed yesterday higher by 0.16%, despite the investigation and having started the day down almost 2%. It looks to me like the market has rerated Aspen's earnings higher, thanks to them weathering the growing pains of becoming an international company. Netflix's 3Q numbers showed more subscriber growth than expected and higher revenue than expected, the stock was up 1.6%. We will have a more detailed breakdown for you in the coming days.

Linkfest, lap it up

One thing, from Paul

Paul is spending the week in New York, with our broker Seaport Securities. In the picture below are Paul and Ted, the principle of Seaport.

Byron's Beats

Blockchain is best known as the fundamental system behind cryptocurrencies. But it's potential is far-reaching. This article explains how blockchain can be used to redistribute renewable energy.

Think about it, if each house starts producing its own excess electricity, it can provide power to other homes that need it. The problem is that the current redistribution system is clunky and inefficient. Imagine Eskom trying to facilitate such a task? I don't think so; especially considering that these systems will result in a loss of clients for Eskom.

Blockchain is undoubtedly the answer. This technology will continue to develop, and as more houses leave the grid, the beast just becomes bigger, better and more efficient - How Blockchain Could Give Us a Smarter Energy Grid

Michael's Musings

The age of fighting robots has finally arrived. Can you see this taking off as a sport? With over 7 billion people on the planet, I'm sure this sport will find a niche - US vs. Japan: Giant robots are about to face off, fighting for their country

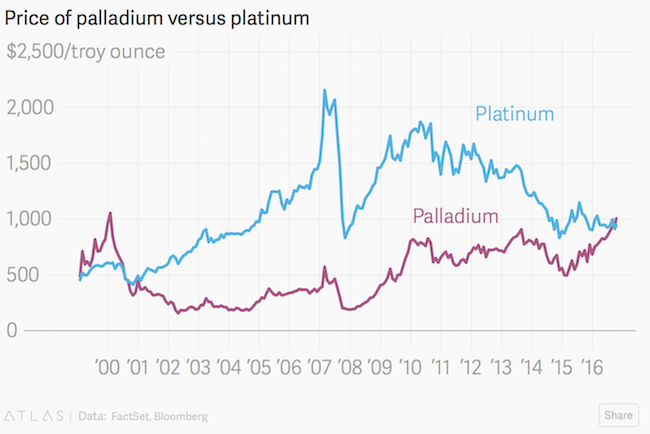

The platinum price has remained under $1 000 for most of the year, which is not great news for our local miners. The good news though, palladium which is part of the PGM group, is up around 50% this year - Curbing car emissions has made palladium the most precious of metals

Bright's Banter

We consume information in many different ways here at the Vestact Head Quarters; we read financial statements, books (autobiographies) and we listen to podcasts, to name a few. I enjoy listening to podcasts because you can use the time that you spend stuck in traffic, sitting in the Gautrain or spinning at the gym to borrow the brains of the investment greats, entrepreneurs, and founders; learning from the source, which is very rare if you ask me. As Warren Buffett put it, "its good to learn from your mistakes but its better to learn from other people's mistakes".

Podcasts allow you to consume a lot of content in a very short period and they remove the broken telephone effect because all the material comes from the source and not from a blogger or a ghostwriter.

Here are my top three podcasts that I am subscribed to and listen to daily:

Home again, home again, jiggety-jog. Asian stocks are mixed this morning; our market has opened in the red though. Mediclinic came out with a trading statement this morning which was a bit worse than the market expected, the stock is down 3%. There are many moving parts in the business, so we will have to wait until the 16 November to see more detail. Later today, the EU releases their CPI number for September; the key consideration of 'Super Mario's' monetary policy going forward.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment