To market to market to buy a fat pig. We have had many students come through our office, the number one thing we tell them is that we can't accurately forecast the future. The only thing you know for certain when you make a forecast is that it will be wrong. Broadly speaking, stock markets go up because more wealth is created globally, through a function of us becoming more efficient with our resources and through population growth. We can be fairly sure that global population will reach around 10 - 12 billion people (big margin of error in that estimate) and that humans will continue to innovate.

Based on two assumptions above, if you are in the market long enough you will make money. Buffett points out, one of the only things that could derail the global wealth creation machine would be something like a nuclear war. If the Northern Hemisphere starts dropping atomic bombs on each other, the value of your Apple shares is probably not very high on your list of problems? The key to successful stock market investing is not to chop and change. Add regularly and then be patient; let compounding do its thing.

Market Scorecard. Another day and the records keep tumbling. Yesterday our market opened the day in the red but gradually drifted higher. Around lunch time we broke into the green and then pushed on higher. It was great to watch, every time I refreshed my heat map it would change colour; from a light red to a light green and then finished off with a dark green. The Dow closed up 0.7%, the S&P 500 was up 0.07%, the Nasdaq was up 0.01% and the All-share was up 0.47%.

Company corner

Byron's Beats

On Monday we received great results from Netflix. What a story it has been so far, you could even make a series about it. . . Streaming revenues increased 33% year on year, operating income doubled, and they added a record 5.3 million members in the quarter, much higher than their own expectations of 4.4million adds.

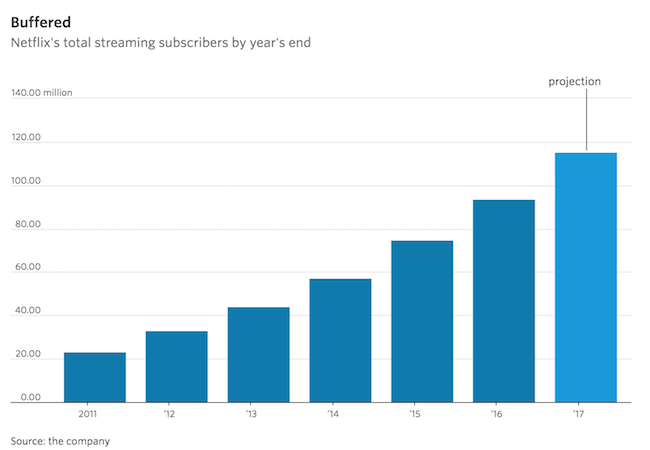

Year to date they have added a whopping 15.5 Million subscribers, 29% higher than last year. Most of this growth is coming from the international business. Many countries have just gained access to the wonders of Netflix and users are coming in fast. Estimates predict 115 million global users by the end of this year. The image below highlights the magnificent growth in subscribers over the years.

A streaming business like this may sound like a profit machine with low capital expenses, but that is not the case unfortunately. It is a very competitive industry and the only moat these businesses possess is their content. Netflix plan on spending a massive $7bn on content creation over the next year. Compare that to revenues for the full year of just below $12bn and you realise how much capital needs to be deployed here.

However, I fully agree with this strategy of quality content before profits. If you do not have your clients locked in, they will easily move on to the next provider. The other providers are also getting more stingy with their content. Hence original content is vital. It also gives you pricing power, Netflix increased their prices just before the release of the hit series, Stranger Things Season 2. If you're hooked, an extra $2 a month is worth every penny.

The share price has had a phenomenal run, up 58% so far this year. The forward PE sits at 86 times earnings; expectations are certainly high. I love the business model and I love the company as a consumer. I think the valuations may be a bit stretched at these levels. Mainly because I believe the desire for quality original content will never end and the competition will increase (Apple and Amazon getting on board). Netflix will have to spend big bucks on content as long as they are in this industry.

On the other hand, 115 million subscribers are just a blip in the ocean, of series hungry consumers. I expect subscriber additions to continue to explode over the coming years. There is certainly a place for Netflix in more risk tolerant portfolios.

Linkfest, lap it up

Michael's Musings

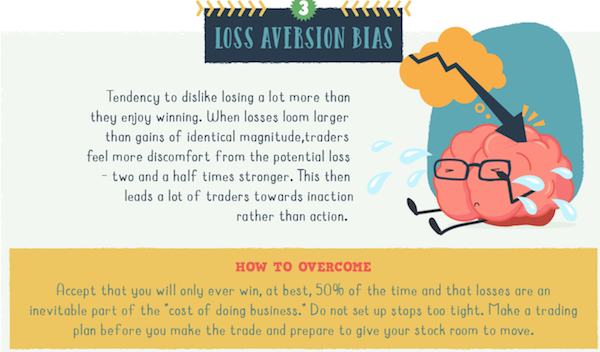

With Richard Thaler winning the Nobel prize of economics this year, our inherit cognitive biases is a popular topic - These Five Cognitive Biases Hurt Investors the Most

Bright's Banter

The media has portrayed hedge fund managers as crooks, liars, corporate gangsters, greedy, fat capitalist pigs that prey on the rest of society. Even the best investor of our time Warren Buffett (a person who started as a hedge fund manager) doesn't like these guys. So what's the story? To try remedy this perception of an ugly fat man in a speedo, I will be sharing a story of a very charitable hedgie. Remember that hedge fund managers are human too, they also have varying human characteristics!

What the media doesn't tell you is that hedge fund managers, as a profession are the most charitable people, when compared to any other profession on earth. They contribute more towards fixing the inequality gap than most government will ever achieve.

George Soros has endowed $18billion of his personal net worth to his charitable foundations, dubbed the Open Society Foundation. It takes its name from a philosophical theory, by his all-time favourite philosopher, the Austrian-British Karl Popper. Open Society has been active all over the world, combating issues ranging from human rights, public health, gender inequality, education, promoting democracy, supporting refugees, fighting hate crime etc.

George Soros is a Hungarian emigre who lived through communism and Nazi occupation of his home country, Now you can understand why all of the causes above are so close to his heart. He really cares about changing the world. The Open Society Foundation is probably the second biggest charitable foundation after the Bill & Melinda Gates Foundation.

Thanks to Stanley Druckenmiller, who used to work for Soros, for calling all of these billionaires out for not giving away their riches to charity. There is no point in hoarding that much cash. There's an old saying, "he who dies rich dies a disgrace!" A wise man once said, "If you're in the luckiest 1 percent of humanity, you owe it to the rest of humanity to think about the other 99 percent."

Karl Popper would be proud!

George Soros Transfers $18 Billion To His Foundation Creating An Instant Giant

Home again, home again, jiggety-jog. Things are heating up in Spain, global markets are red across the board. Data out this morning showed China grew 6.8% over the last 12-months while their retail sales are growing faster than estimated. Uk retail sales on the other hand, shrunk by 0.8%, not good news for the likes of Brait and Steinhoff. Then later today, we have US Jobless Claims data out.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment