To market to market to buy a fat pig. Earnings season is now open! Blackrock kicked things off yesterday with a top-line and bottom-line beat, hopefully a sign of things to come over the next few weeks. Today the big names are Citigroup and JPMorgan, and tomorrow the first Vestact stock reports in the form of Wells Fargo.

The expectations for this earnings season is something along the lines of, most companies should beat their guidance. Generally management set guidance at the low end, to manage expectations and give themselves a fighting chance to beat expectations. The Dollar is weaker than it was this time last year, which for multinationals means their foreign profits are worth more in Dollars. Do you remember in 2015 when most US companies were missing their profit numbers because of the strong dollar? See below the movements of the Dollar over the last 5-years; you can see why 2015 reporting numbers struggled.

Market Scorecard. More green and more records across the the board, albeit small gains, gains none the less. I am reminded of the market adage, 'The bull takes the stairs and the bear takes the lift'. When things go up, our human instinct is to be sceptical and wait a bit to see if we can buy it at yesterdays price, meaning we generally don't see pricing rapidly increasing. When prices drop though, our survival instinct kicks in; 'sell now ask questions later' leading to prices dropping quicker. The Dow was up 0.18%, the S&P 500 was up 0.18%, the Nasdaq was up 0.25% and the All-share was up 0.24%.

Linkfest, lap it up

One thing, from Paul

Blackrock has more assets under management than Vestact. Its true, we only have R3.2 billion of aggregated client funds to look after, and they have almost $6 trillion.

They are the world's largest asset manager, with headquarters located in midtown Manhattan. A big part of that is the money they run for the US government, the US Federal reserve and other bond investors. They also offer lots of pension funds, and retail equity funds. In addition, they own the iShares exchange traded funds (ETF) business, which Barclays stupidly sold to them just before ETF investing really took off. That's bringing in lots of money now - BlackRock closes in on $6 trillion in assets as index funds boom

Byron's Beats

It's all about content! Yesterday Apple really stepped up to the challenge by announcing the remake of Steven Spielberg's science fiction series Amazing Stories. The company plans on spending $1bn on original productions next year after hiring a few big hitters in the industry. A far cry from the $7bn Netflix plan on spending but still a start. Apple have over $250bn in cash and over 1 billion devices online. If this starts to take off, expect more amazing tv shows available that you never have the time to watch - Apple's Steven Spielberg deal shows it's going big in it's original programming push.

Michael's Musings

I think this is a great idea from Microsoft. For Microsoft these firms will be future customers and for us, technology is being pushed along - Microsoft is holding a $3.5 million competition to find the next great garage startup - 'like American Idol'

If you own a tax free investment account, make sure that your funds are going into the lowest cost ETFs - ETF: TER wars. For retail investors, increased competition has been a great thing.

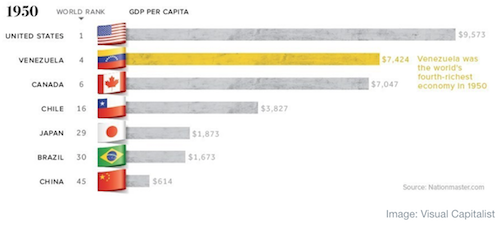

I didn't realise how far Venezuela has fallen. Money was easy because they had large oil reserves, there was no need to be prudent with spending and no incentive to diversify the economy - Venezuela was once twelve times richer than China. What happened?. The final paragraph of the article sums things up nicely:

- "And while the current condition of Venezuela is a tragedy in itself, the country's inability to live up to its true economic potential is nearly just as devastating."

Bright's Banter

On my "Beers & Small Caps" WhatsApp group this morning someone posted the tweet below by Nick Leeson. Those who do not know who Leeson is, he's the trader that single handedly sent the Barings Bank straight to purgatory when working for a division of the bank in Japan. For more info on how he did it you can read the book Rogue Trader and for those who hate finance jargon (snorefest) you can just watch the movie Rogue Trader which wasn't that bad if you ask me. Here is the trailer .

The joke on the tweet is of course that had Barings Bank held its positions, they still would've broken even at the Nikkei's most recent all time highs.

Home again, home again, jiggety-jog. Asian markets are green this morning along with our market. The gold price is just shy of the $1 300 mark, currently at $1 297; later today South Africa's gold mining production number is released.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment