To market to market to buy a fat pig. Imagine going to your bank to apply for a home loan and the bank tells you that they will pay you to take out the loan. Up until 2014, it was generally thought that interest rates had a floor at zero; in economics class, negative interest rates was talked about in the same breath as unicorns and Bigfoot.

Here is how the mechanics work for governments, Country G goes to the markets saying they want to borrow EUR 100 million for a year. The market comes back to them saying, thanks to the significant amount of cash sloshing around and low inflation rates, we will give you EUR 102 million now, and in a years time you pay us back EUR 100 million.

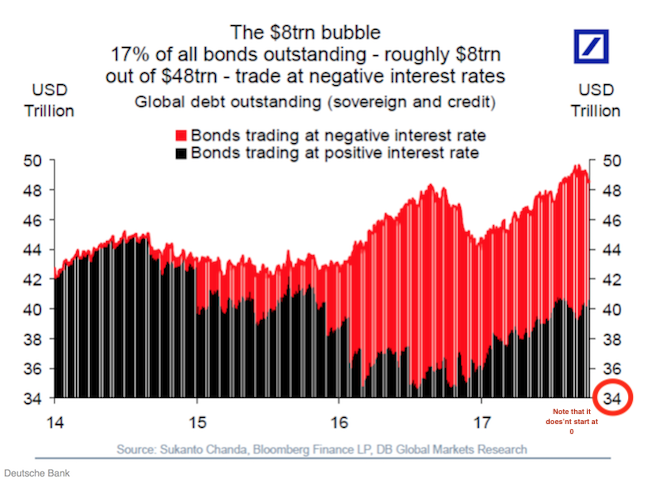

Some people are blaming central banks for the current situation, but the reality is that, if central banks were out of step with underlying economic forces, inflation would be spiking. Given that inflation has been nowhere in developed economies, shows that demand and supply forces for cash are still heavily overweight supply. Around 17% of all government debt currently has a negative yield; hard to believe.

The best argument I have heard for the current situation is that due to new companies not needing as much capital to grow, there is a much higher supply of cash than there is a demand for it. In the last century, your largest corporations where capital-hungry industrials, who were building cars, aeroplanes, power stations and oil rigs. Now your most valuable companies are high margin, low capital requirement companies. Take Facebook for example, even though they are a very young company, it has $35 billion in cash. Even with revenue growth of 60%, they can't spend the cash coming in fast enough!

Market Scorecard. Markets inched their way forward again on Friday, to close at fresh record highs. The Dow was up 0.13%, the S&P 500 was up 0.09%, the Nasdaq was up 0.22% and the All-share was also up 0.22%. Reporting their 3Q numbers today is the high flying Netflix, the stock is up 61% YTD.

Moving closer to home, after the market close on Friday Aspen reported an investigation by the UK Competition and Markets Authority. The investigation is still in its information-gathering phase and may not go further than that; depending on what they find. From where we sit it looks like governments are just jumping on the 'investigate Aspen' bandwagon, score a few political points. The drugs in question had revenues of around GBP 11.1 million (around R185 million) out of group revenues of R42.1 billion, making them less than 1% of group revenues. Even though it is minimal for them, it is still frustrating to have this cloud hang over the company.

Linkfest, lap it up

One thing, from Paul

This week on Blunders: Kobe Steel not up to scratch, Kaspersky anti-virus software sends your files to the KGB, SAA has sucked in R50bn of our cash, and McDonalds screws up launch of "Rick and Morty" Szechuan sauce - Blunders - Episode 76.

Byron's Beats

Corporate America is obsessed with Amazon at the moment. Many businesses are worried that Amazon will come after their sector and completely dominate. This Quartz article titled These are the businesses still immune to Amazon covers a Morgan Stanley survey which looked at which consumer sectors would be most resilient to the online giant.

I was especially interested to see home furnishings fairly high on that list. Steinhoff is a big holding of ours and could fall in the firing line. Although I believe online retail will feature in this sector, buying such items is a big decision and most often requires you to see and feel the product before making a purchase.

Michael's Musings

Visa recently completed a research paper on what value moving away from cash would be worth to the global economy - Cashless Cities: Realizing the benefits of digital payments. Their conclusion was, going mostly cashless could add $470 billion to the global economy. Not bad considering that all you are doing is changing a method of payment. The gains come in the form of easing the ability to transact, lowering crime numbers and increased tax revenues.

Imagine paying R6 500 a month to rent 18 square meters! As more of the globe's population becomes urbanised, these micro-apartments will increasingly become the norm. Expect people's hobbies to move toward those that don't take up storage space; golf is probably out then - 28 crazy pictures of micro-apartments around the world

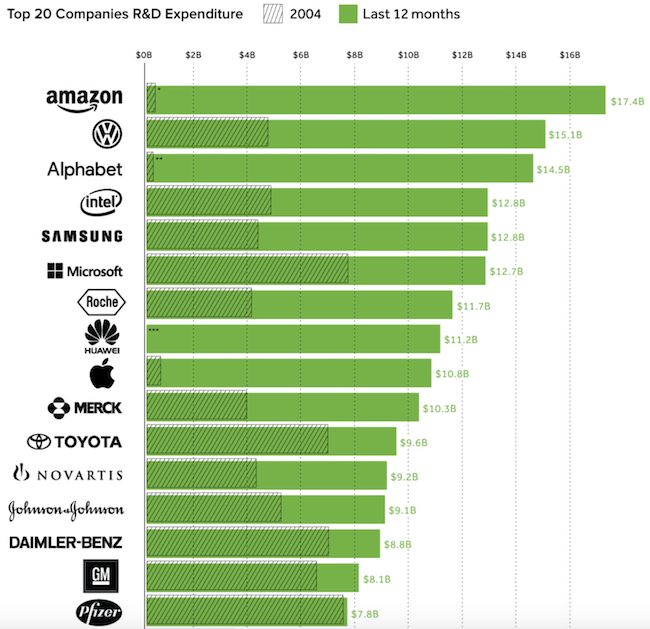

Having a large budget for R&D helps build a moat between you and your competition - The Global Leaders in R&D Spending, byCountry and Company.

Bright's Banter

The publication, Institutional Investor, has a really cool video series edition called "War Stories Over Board Games" where different investment managers play their board game of choice and talk about markets, their careers, experiences etc. over the years that they have been in the game.

My favourite so far has been Howard Marks where he talks about what to do in times of turmoil as an investor. He's famed for investing $500 million a week, from June 2008, right in the midst of the financial crisis, all the way to January 2009.

Marks says in retrospect, all you had to do to make money in the financial crisis is to have money to spend and the nerve to spend it. You didn't need caution, conservatism, risk control, patience, selectivity, discipline or any of those things; all you needed was money and nerve! He does emphasise the fact that you do not need these all the time because money and nerve will get you killed.

Here is the brie 4-minute video on a few lessons on contrarianism from Finance Royalty:

Howard Marks Confronts The Nightmare

Home again, home again, jiggety-jog. Thanks to a weaker Dollar, Gold is back above $1 300 an ounce, and platinum is heading back toward the phycological $1 00 mark. Aspen has opened down around 1% this morning, hopefully this week doesn't reverse the strong gains made last week.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment