To market to market to buy a fat pig. Yesterday the S&P 500 hit another record. No not another record high but the most number of days without a 3% drawdown. The previous record was 241 days and was set in 1996. It is amazing how calm markets have been this year. In years gone by, the likes of the crisis in Spain and the Nuclear threat, would have had a much bigger impact on the market. Remember how volatile the market was when Greece was in the middle of their debt crisis?

The Business Insider has the following to say about markets in 2017.

"Here are three other stats that illustrate the market's lull, via LPL Financial:

1) As of Friday, the S&P 500 had gone 33 straight days without a 0.5% drop, the longest streak since 1995.

2) The S&P 500 has fallen by 1% or more in a single day only four times this year, the fewest for a full year since 1964.

3) Its average daily close on an absolute basis has been 0.3% this year, the lowest since 1965."

Market Scorecard It wasn't a record high close for a change, even though all three US indexes opened in the green and at record highs. The Dow closed down 0.23%, the S&P 500 was down 0.40%, the Nasdaq was down 0.64% and the All-share was up 0.09%. Our market opened on the front foot, ticked higher for most of the morning and then at 11:00 turned around and slowly slipped back down to its opening levels. Yesterday we spoke about GE, which opened down 6% on Friday, only to close the day higher by 1%. Yesterday it opened down 2% and then finished off the day down 6.4%; it seems the market is still deciding what to make of the results and restructuring plan.

Company corner

Michael's Musings

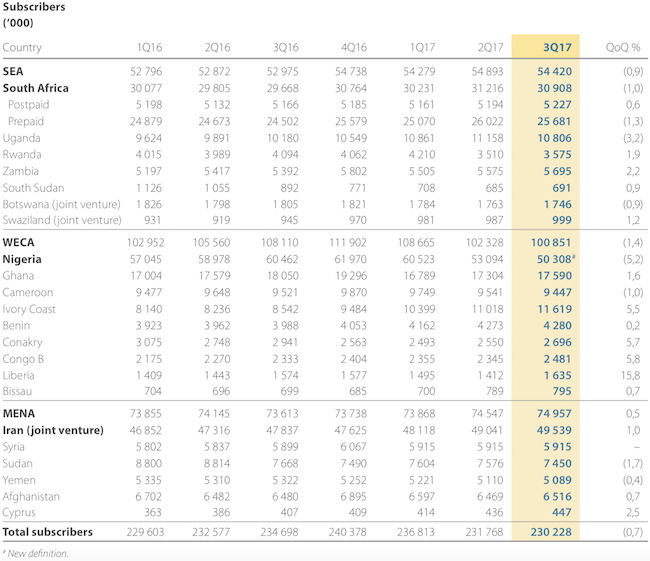

This morning, MTN released their Quarterly update for the period ended 30 September 2017. Off the bat, it looks like the things that they can control seem to be going well and the things beyond their control, like currency and regulation are hurting them.

On a constant currency basis, Group total revenue increased by 6,9%, with Group service revenue up 7,4%. Data revenue increased by 31,4% and digital revenue was up 19,6%. Probably most impressive was MTN Nigeria, who reported a 11,2% increase in total revenue driven by data revenue growth of 72,1%. Another key region for the group is Iran, which saw revenue up 16.8% and Data revenue up 64.8%!

Here is a quick look at their subscriber numbers, they had to disconnect 750 000 subscribers in Uganda due to regulatory sim registration (the equivalent of being discontinued here due to not being RICA'ed).

They also say their executive team is now fully assembled, expect their new direction and flavour to come through in reporting periods going forward. All in all, things looks to be back on track.

Another company that has had a tough 2017, Steinhoff reported that they repurchased 78 million shares. The repurchase represents around 1.8% of the company and is a sign from management that they think the shares are currently undervalued; at least in my book that is how I read it. We still have to wait a couple more months until we hear the outcome of the tax evasion case.

Linkfest, lap it up

Byron's Beats

It's lovely to see this making international news. This CNBC article titled You can get an Apple Watch for only $25.. with one small catch speaks about fitness schemes which reward health insurance clients with a free Apple watch. Does that sound familiar?

Of course it does! Discovery have a partnership with John Hancock to white label Vitality in order to get health insurance clients to look after themselves. After seeing a 20% increase in activity under the program John Hancock have extended the product to all U.S members. They are the first U.S insurers to do this.

I hope to see more of this. Discovery's Vitality program is truly unique and has the ability to become massive amongst insurers all over the globe.

Bright's Banter

Here's what I'm reading this morning:

I enjoyed this CNBC interview of Prince Alwaleed bin Talal talking about markets and of course Bitcoin! - Bitcoin 'Going To Implode' Like Enron

This guy is betting against Warren Buffett. In the past this has been a bad money making strategy. The question remains though, is this guy up to something here? - Warren Buffett's Mosquito

Bridgewater has a lot of haters and thats usually a sign of success. The latest person that Ray Dalio has to add to his haters list is Jim Grant. Without going into detail, Grant was wrong - Jim Grants Botched Bridgewater Takedown

I found this very interesting, short Ted Talk by Ray Dalio explaining the concept of radical transparency and idea meritocracy. I must say I learnt a lot about decision making here - Ted Talk On Bridgewater's Idea Meritocracy and Radical Transparency

Home again, home again, jiggety-jog. Our market is up this morning, along with most Asian markets. Investors seem happy with the MTN update, the stock is higher by 1.5%. Both the EU and Germany had positive manufactory reads out this morning; later today the US will report their manufacturing PMI number.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment