To market to market to buy a fat pig. Generally, the Medium Term Budget Policy Statement (MTBPS) is a bit of a non-event because no major policy changes are announced. Today though it will be different, rating agencies will be watching closely before their 24 November rating review. The maiden budget speech from Mr Malusi Gigaba, will be a tough one. How good will his icebreaker joke be?

Standard Bank forecast that our current revenue shortfall is around R45 billion, which could increase to over R70 billion next year. When you collect less tax than expected, there are two options. Either you can run things at a wider deficit, or you need to pull back expenditure. We already have a wide deficit and are teetering on the edge of being classified as junk by all three major rating agencies; it would seem there is only one choice, cut expenditure. Between SAA, Eskom and the SABC, our budget is already needing some TLC. All eyes will be on Gigaba for where he plans to cut costs, not an easy task for any government.

Market Scorecard. Markets returned to their green ways yesterday. The Dow was up 0.72%, the S&P 500 was up 0.16%, the Nasdaq was up 0.18% and the All-share was down 0.16%. To get the ball rolling on company news, Visa releases their 4Q numbers tonight, before Amazon, Google, Twitter, Stryker and Cerner report on Thursday. I am particularly keen to hear from Amazon how the integration of Whole Foods has gone.

Linkfest, lap it up

One thing, from Paul

It's amazing how much money is managed by firms that have a relatively low profile. For example, privately-held Edward Jones is based in St. Louis, Missouri in the central part of the USA. It has 15,000 advisors, over 7 million clients and and 1 trillion US dollars in assets under management - Edward Jones Hits $1 Trillion in Assets

Byron's Beats

Stryker, one of our US based healthcare stocks has been doing well lately. They operate in a segregated sector (medical devices) with lots of technological innovations happening at the moment. Of course they do their own R&D but being a massive player, they are also consolidating smaller businesses that have proven track records and supply agreements with hospitals.

Yesterday it was announced that they have bought a stake in a French business called VEXIM which specialised in mechanical implants for spinal injuries. Stryker have bought half the business for around 90 million Euro. This consolidation tactic is one of the reasons we own the stock, long may it continue - Stryker to acquire VEXIM

Michael's Musings

When most people hear the term blockchain they think of cryptocurrencies, it is a whole lot more than that though. Blockchain is the technology that uses computers from all over the world to store data and execute tasks; each computer gets a tiny fraction of the data to store - The Power of Smart Contracts on the Blockchain.

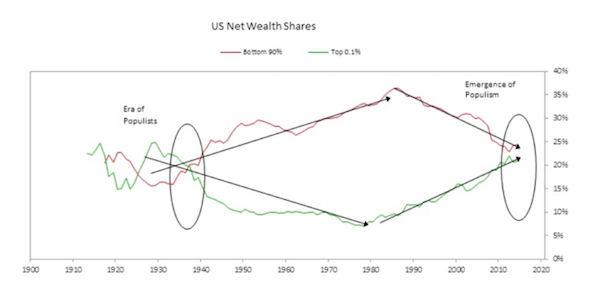

Here is a graph from the Ray Dalio piece, Bright spoke about yesterday. The graph shows that income inequality is not a new problem, at the turn of the 20th century, when there were the titans of industry like Ford, Carnegie and Rockefeller, inequality was worse - The top 0.1% of American households hold the same amount of wealth as the bottom 90%.

It is interesting to see how different nations feel about autocratic rule. Each nation's history plays a prominent role in what type of rule the people know and feel comfortable with. I watched a documentary recently on Russia; after overthrowing the Tsar, the people still expected the new communist rule to have an autocratic ruler because they were used to having an individual calling all the shots - Where Support For Autocracy Is Strongest

You will find more statistics at Statista

You will find more statistics at Statista

Bright's Banter

The future is here! Algorithms are taking over analogue processes and simplifying them using formulas. Artificial intelligent (AI) learns faster than any human, which will help us make better decisions in the future.

The newly developed computer by Deep Mind, AlphaGo Zero has beaten the old AlphaGo version in a game of Go 100: 0! This shows what you can achieve with significant development and sharp minds programming these computers - AlphaGo Zero Learning Scratch

Home again, home again, jiggety-jog. Our All-share is out the blocks today in the green; thanks to Tencent in Hong Kong being higher by 1% today, Naspers is also 1% higher. Year to date, Tencent is up 85% and Naspers is up 62%. Apart from the MTBPS, we have 3Q GDP numbers from the UK and oil inventory numbers from the US.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment