To market to market to buy a fat pig. The US market continues to creep higher, more records on the close yesterday. Here is the scorecard, the Dow was up 0.09%, the S&P 500 was up 0.12%, the Nasdaq was up 0.04% and the All-share was up 0.7%. I stand under correction, the All-share's 56 750 close is a record close. Interestingly, the list of shares at 12-month lows is longer than the list of shares at 12-month highs.

One of the stocks at a 12-month low is Taste Holdings, who has been under extreme pressure since their negative trading statement last week. The problem for them, is that they haven't been able to sell their jewellery division to help fund the expansion of the fast food division. Which means they will probably have to do another rights issue. As the share price drops, a rights issue becomes more expensive and more dilutive, which means the share price drops further.

Company corner

Bright's Banter

Citron Research a firm run by legendary short seller Andrew Left, The Bounty Hunter Of Wall Street, released a detailed report on Shopify accusing the company for playing outside the rules of the game. See the report here - Citron Exposes The Dark Side Of Shopify

Shopify is a platform provider for e-commerce businesses. They provide the backend of an e-commerce store, allowing entrepreneurs to focus more on the product that they produce and sell online.

Andrew is basically claiming that Shopify is a business dirtier than Herbalife. See his Tweet below. Another Research Firm Baird wrote their rebuttal to Citron basically rubbishing the claims and saying this pull back creates an opportunity - Citron Research Creates A Buying Opportunity . Shopify is the best performing stock of the year in the US, which normally brings very contrasting views of future share performance.

Here's another guy on Seeking Alpha defending Shopify - Shopify Response To Citron

Andrew Left has a good track record as a short seller and he's not known for shooting from the hip. This is a guy that goes for the jugular! He has a nose as sharp as a bloodhound to sniff out accounting frauds, companies that defraud and mislead investors and naughty equity analysts. He is a cross between a no nonsense detective and an obsessive forensic accountant. Let us not forget the old adage, where there's smoke there's fire.

Linkfest, lap it up

One thing, from Paul

I'm not a property investor (outside of the home that I live in in Houghton) as I prefer equities. Of course, there are those that swear by property trading, and love to buy, renovate and sell upscale residential buildings.

Mind you, I'm hearing that there are a massive number of such properties on the market right now, and not a buyer in sight? I guess that high-end buyers are waiting to see how the country's election turns out in 2019?

For example, here is a property listing on a Heritage site that I follow, for a grand old house in Westcliff, Johannesburg. It looks very nice, is called Stonecrest Manor, rests on a stand of 7,500 square metres. The seller wants R28 million - Landmark Westcliff property hits the market

Byron's Beats

There is currently a huge battle going on for the online retail market in India between Amazon and Flipkart. We have skin in the game on both sides of the battle (Flipkart is part owned by Naspers and Tencent). As this article explains, Amazon announced the Amazon Great Indian Festival Sale in order to entice clients. Flipkart then went and announced their own sale the day before Amazon! Who wins at the end of the day? The consumer of course - Flipkart Sale Dates Set Up a Clash With Amazon Great Indian Festival.

The Vodacom share price has had a torrid month. Yesterday it was announced that the Competition Commission has started a probe into abuse of market dominance. It relates to Vodacom's deal to supply government employees with their network needs. The deal is lucrative for Vodacom but Government have not really benefited from a bulk discount. Tech Central go into the details here - Vodacom shares tumble on competition prob.

I just loved this picture seen on twitter. So often "traders" just follow the momentum.

Michael's Musings

This is an amazing product, imagine how much easier traveling could become - Google has built earbuds that translate 40 languages in real time

There are an increasing number of companies being fined around their tax structures. Internet companies blur the lines between which country the transaction took place in, current rulings will set precedents for the future - Amazon has been ordered to pay Europe EUR250 million over unpaid back taxes.

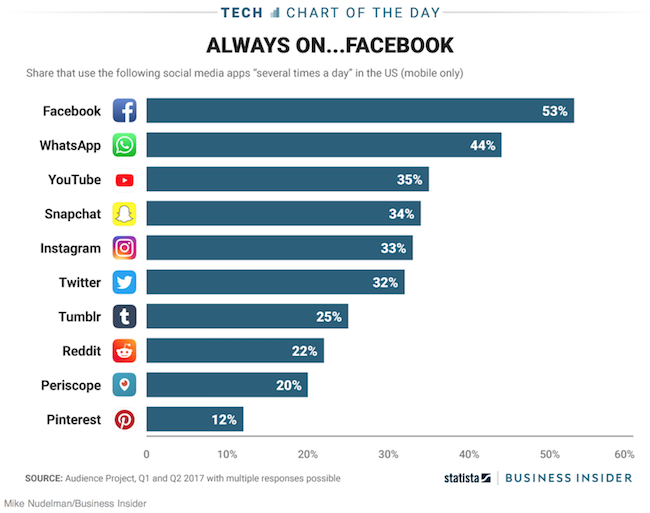

Social media is addictive. We live off the shot of dopamine we get every time someone likes our post or the curiosity of what is happening in friends lives - If you haven't checked Facebook lately, you're in the minority. I was surprised to see WhatsApp below Facebook though, most people I know use WhatsApp continuously.

Home again, home again, jiggety-jog. Our market is flat this morning, thanks to a quiet day in the US. There is also no direction from Tencent because Hong Kong is closed today. Later today, the business confidence index for South Africa is released and the US initial jobless claims number is out.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment