To market to market to buy a fat pig. Wow! Yesterdays MTBPS was ugly. While Minister Gigaba was talking the quote attributed to Margaret Thatcher came to mind.

"The problem with socialism is that eventually you run out of other people's money to spend."

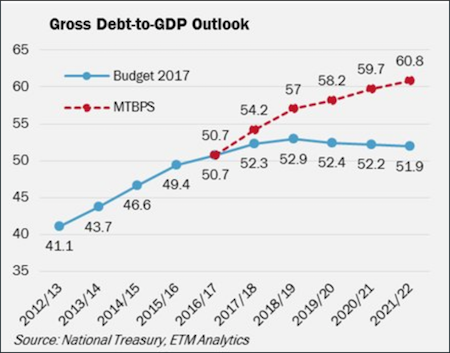

We may not be a socialistic state, but the 'chickens' of state capture, corruption, nepotism, hobbling SoE's and billions in wasteful expenditure by municipalities are coming home to roost. The problem with running out of money is that the closer you get to rock bottom, you need to borrow more to keep your head above water. Increased borrowing means an increased interest bill, which in turn leads to even more borrowing. Then hit repeat. The graph below shows how troublesome things have become in the last 6-months; with our national debt getting out of control, a debt downgrade to junk from Moody's looks like a foregone conclusion now.

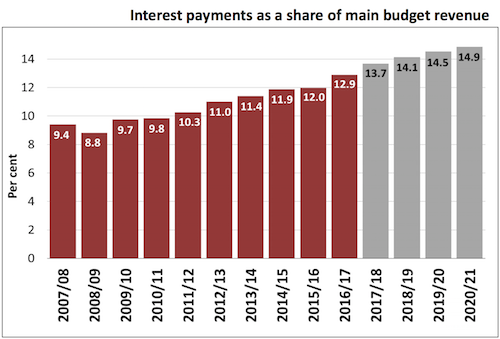

If we do get a debt downgrade, the image above and the image below are going to get worse.

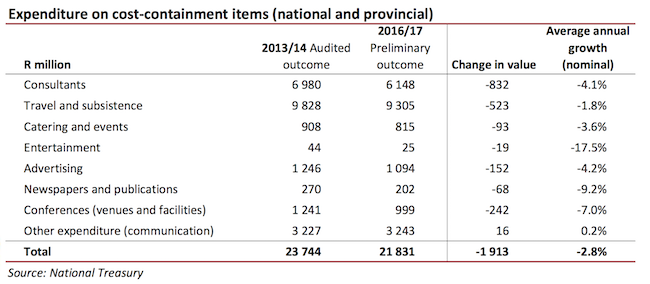

Then lastly, how serious are we about cutting costs if we still spend R9.3 billion on travel? How much does a corporate Skype account cost?

Market Scorecard US markets seem to have run out of steam for now. The Dow was down 0.48%, the S&P 500 was down 0.47%, the Nasdaq was down 0.52% and the All-share up 0.38%. Thanks to the weaker Rand, Naspers and Richemont are at all-time highs!

Company corner

Byron's Beats

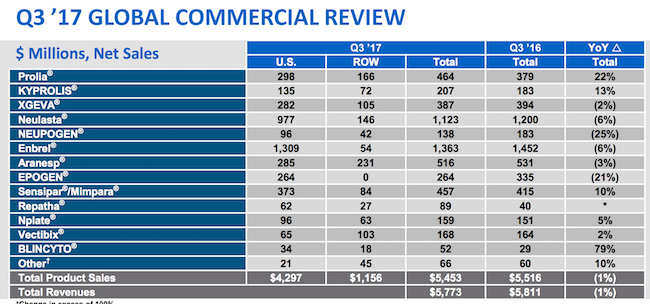

On Wednesday we had 3rd quarter results from Amgen. Remember these guys discover, develop and manufacture various human therapeutics. When looking at this company, all focus needs to be on their portfolio of therapies; what they cure, competition, FDA approval, medical aid adoption, doctor adoption, side effects, how the therapy is administered, regulation and many more factors. Fortunately, Amgen has a market cap of $130bn (30% bigger than Naspers) and boasts a portfolio of more than 13 mainstream products with annual sales ranging from $150m to $6bn.

My point here is that, yes the industry can be volatile with lots of moving parts, but Amgen is diversified enough to absorb these factors while growing within a very exciting and fast-moving sector.

Let's get into those numbers.

Currently, the portfolio is in a transition phase. Some of the blockbusters are slowing, while a few potential big sellers are showing progress. This meant that revenues declined by 1% for the period. However margins were much better, and there were fewer shares in issue. This resulted in earnings per share growing by 8% to $3.27 for the period. Expectations for the full year are for earnings per share of $12.60.

The share trades at $177 or 14 times earnings. For a company with operating margins of 55% and a cash position of $41.4bn (debt sits at $35.8bn) these are very solid fundamentals. Not to mention the 2.7% dividend yield.

In case you are interested (we do have a few Doctors as clients) here is their product mix. These therapies attempt to cure all sorts of diseases that range from arthritis, heart disease, cancer, osteoporosis, migraines and many other awful ailments you never want to have.

As you can see, Prolia which helps cure osteoporosis in women after menopause was responsible for some solid growth. They expect this drug to continue to power ahead and become a major revenue driver. Repatha which brings down cholesterol is another potential blockbuster. This drug saw sales increase 123% year on year albeit off a low base.

So far this year Amgen has spent $2.5bn on Research and Development. That should breach $3bn by the end of the year. You are buying this company for its size, diversity and ability to attract quality talent. These factors will result in a constant supply of quality therapies in a booming sector. Not all of them will be major successes but the ones that are will result in outperformance. We are conviction buy on Amgen at these attractive levels.

Linkfest, lap it up

One thing, from Paul

As you probably heard by now, Saudi Arabia has a bold new plan.

NEOM (spelled with four uppercase letters), is a planned 26,500 square km city in northwest Saudi Arabia, Jordan, and (via a proposed bridge over the Red Sea) Egypt. Presently, its just a arid, rocky piece of mountainous coast land.

It looks like a long shot to me, but given time and enough money, who knows? I'm in favour of investment over consumption!

Mind you, the copy writer who prepared the text for the website must have been on some strong drugs:

"Unrivalled in concept, unmatched in intelligence, unconstrained by history and built on humanity's greatest resource: imagination.

NEOM is a new kind of tomorrow in the making a place on earth like nothing on earth a new blueprint for sustainable life on a scale never seen before where inventiveness shapes a new, inspiring era for human civilization.

And NEOM will redefine what urban entertainment means, by turning up the dial and raising the scale. With futuristic, record-breaking theme parks. Endless natural parkland. The world's largest garden in the heart of the metropolis. A waterpark with a wave machine where Olympians will perfect their technique. It will attract tourists from thousands of miles around. And for residents, bring epic to the everyday."

Feel like moving there yet? Go and take a look for yourself - Welcome to NEOM

Michael's Musings

As millennials become the biggest spending group, their tastes will come to shape industries - Eight Travel Predictions for 2018, as Revealed by Booking.com. The use of technology to get the perfect trip, customised around your own tastes is where the future lies. We own Priceline in our offshore portfolios. They in turn own booking.com.

With the current low volatility bull market most investors get lulled into a false sense of safety. When the next bear market hits, many people won't be emotionally prepared for it, which will result in very poorly timed selling. One thing I have learnt is that the market can do things that you think will never happen - What the Charts Don't Tell You

Bright's Banter

We were promised flying cars but Tesla can't even give us a fully autonomous vehicle. Well…not fully autonomous, just a car that can keep the correct distance, change lanes, take off-ramps and on-ramps, park itself etc.

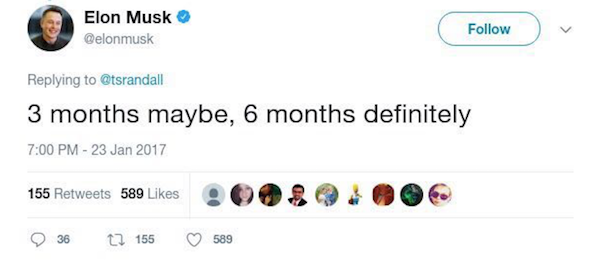

Customers who were interested in this self driving car had to pay an additional $8000 for the service on their Model X and Model S. Unfortunately the cars still do not have autopilot! Elon Musk in a tweet (see below) said it'll be available in 3 months maybe, 6 months definitely - Can Tesla Make Up For Autopilot's Lost Year

Home again, home again, jiggety-jog. After yesterday, banks and retail are under pressure this morning; dual listed stocks though are flying. On the cards today for international news: ECB rate decisions and their plan with their huge balance sheet and then initial jobless claims in the US.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment