To market to market to buy a fat pig. Yesterday the IMF released their World Economic Outlook report, which gives an update on their forecasts of growth for this year and for next year. For the globe as a whole, the report was positive. Last year global growth came in at 3.2%, the IMF forecasts that for 2017 it will be 3.6% and for 2018 it will be 3.7%. Added to that, 2017 is on track to be the first time in a decade that every region grows. Growth solves a multitude of global problems, it is good to see the engine is ticking over smoothly.

Unfortunately, the South African growth forecast was lowered from 1% to 0.7% for 2017 and for 2018 it was lowered to 1.1% from 1.2%. With global growth on the up, blaming the rest of the world and financial crisis of 2008 for our lack of growth isn't remotely a valid excuse anymore. Our lack of growth is a home grown problem and until we accept that fact, things can't change. When you think that 17.2 million South Africans go to bed hungry every night, I feel a mixture of anger and sadness around all the own goals that we score. If history has taught us anything though, it is that us South Africans are a resilient and resourceful bunch.

Market scorecard. After the blip of red on Monday, US markets were back to their green ways on Tuesday. The Dow was up 0.31%, the S&P 500 was up 0.23%, the Nasdaq was up 0.11% and the All-share was up 0.17%. Reading a report on Naspers this morning, generated by a major US investment bank, their estimate is that the Naspers share price will rise between 20% and 120% over the next 12-months. The focus of the report was that Naspers is currently trading at a 42% discount to their NAV. The price target is an educated guess at best and these guys are wrong all the time, so don't take it to heart. What is not a guess is the current discount to NAV though.

Mark Mobius of Franklin Templeton was saying, forget about selling/unbundling the Tencent stake, rather the company should just buy back shares to take advantage of the massive NAV discount. If Naspers went down that route, the NAV gap should close over time, and not to mention that the return on their own shares could be better than many of the other companies they are looking at investing in.

Company corner

Byron's Beats

Nvidia, the graphics chip maker, is soaring to all time highs. Yesterday it closed at $188.93 a share, up 77% year to date. Over 5 years it is up 1320%. The reason for this? Gaming, Artificial intelligence, self driving vehicles, data centres and cryptocurrencies all require graphic processing chips. Nvidia is one of the leaders in a sector that is booming. Yesterday Nvidia released a statement titled Nvidia Announces World's First AI Computer to Make Robotaxis a reality. Robotaxis, is that even a word? I am sure it will be soon! Here is an extract from the release.

"NVIDIA DRIVE PX Pegasus will help make possible a new class of vehicles that can operate without a driver -- fully autonomous vehicles without steering wheels, pedals or mirrors, and interiors that feel like a living room or office. They will arrive on demand to safely whisk passengers to their destinations, bringing mobility to everyone, including the elderly and disabled."

Linkfest, lap it up

One thing, from Paul

What really makes older people happy? Is having a lot of money the most important thing? Or is being healthy and having good relationships with those around you more important?

To find out, researchers at the University of Michigan ran a survey of over 26,000 Americans over the age of 50, interviewing them every two years, starting from 1992. The results suggest that having good spousal and friend relationships have the greatest impact on creating life satisfaction during retirement. However, being physically and mentally healthy comes before everything else (those in poor health can't concentrate on much else). As for money, having enough to indulge in leisure spending leads to higher satisfaction, but other types of spending are less significant. Also interesting was that relationships with grown-up children are not really that indicative of happiness amongst older people.

You can read the summary paper here - Spending, Relationship Quality, and Life Satisfaction in Retirement

Michael's Musings

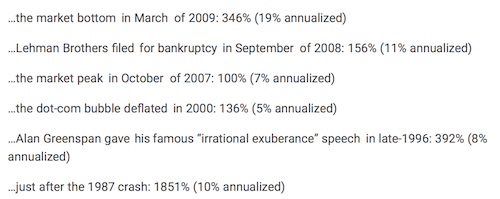

With regards to the market and statistics in general, the point where you draw a line in the sand has a very big impact on the results that you generate - Reference Points.

With the surge in the price of bitcoin, it is becoming more profitable for hackers to gain access to computers for their computing power instead of the potential data they can steal - Forget stealing data - these hackers hijacked Amazon cloud accounts to mine bitcoin.

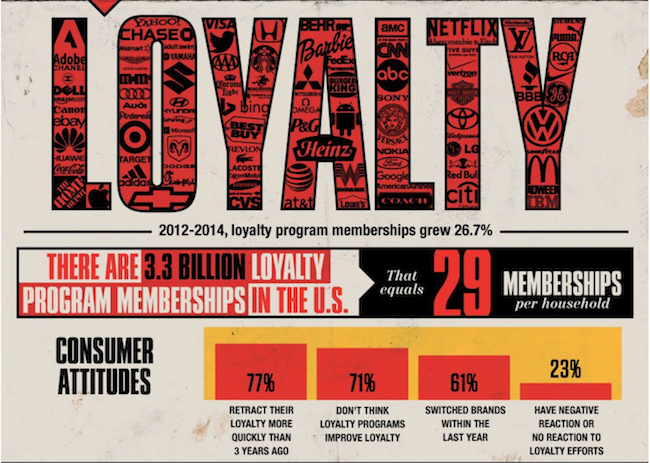

A brand signifies a quality standard, a set of values or a lifestyle association. With the number of brands increasing and competition heating up, companies are having to work harder to get their brand to stand out from the pack; good news for the consumer, not so good news for company's bottom line - Is Brand Loyalty Dead?

Home again, home again, jiggety-jog. Asian markets are flat to green this morning, with the Nikkei reaching a 21-year high. Data out of the US today includes, FOMC minutes and JOLTs (Job Opening and Labor Turnover) numbers. Dischem was up over 8% yesterday after a favourable trading statement, lets see how they go today.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment