"Stryker reported results for their third quarter last Thursday, after the market closed. This is the kind of business that has changed significantly, keeping relevant and up to date as medical science has evolved. Knee and hip operations are more prevalent than any other time in history."

To market to market to buy a fat pig Friday was another day that the equity markets slid from underneath us. It seems that politics is to blame at the fringes (stronger Rand, which is a good thing), perhaps a semblance of relief that the fellow with the keys to the treasury is doing such a good job. CNBC had an interview with the minister of finance, live at the JSE on Friday, it was really good. Good in the way that he still held it together, stressed teamwork is the key, he was funny. He seemed to carry the aura of a person in charge of their respective domain. Of course, you and I know that a cabinet shuffle could happen at any time. So, we have to live with the situation and know that politics, as much as it makes you crazy, also takes care of itself. We do not have any control over it. Politics, like many other things when investing, is one of the big "things" that you can't even closely control.

This short piece is a must read - Book Review: Is Forecasting A General Skillset? It is about making forecasts and looking at professionals and amateurs alike. And there are some key points, like " ... simplicity is essential to forecasting" and "Consistently, the best forecasters don't use sophisticated statistical approaches, and anything beyond basic data crunching is usually a misapprehension of reality." Another set of lines from the piece, for more background: "Investing is a polyvalent, polymathic enterprise - you need to touch upon statistics, economics, history, psychology, political science, to name a few. Yet, what we train today are specialists in narrow fields who generally can't see the bigger picture."

Which leads us to the very last piece that nails the conclusion, at the end of the article: "It doesn't matter whether the market is up 12% or 16% in any given year; what matters is that it's up, and in sufficient magnitude to make certain portfolio themes function the way they ought to. To spend time trying to figure out the difference between a few percentage points of return is to miss the forest for the trees and expend tremendous resources on effectively nothing." Basically, spending hours and days trying to build complicated models that may miss by a little, and then wondering why they miss is a waste of time. Rather get the big picture right and then know that at the fringes there is very little that you can do about it, to get a perfect forecast. Like the weather, which is extremely unpredictable, so are markets in the short term.

Enough of that, a quick market scoreboard - the Jozi all share sank two-thirds of a percent, lead lower by financials. In what was a pretty broad based sell off, AB InBev, after a very average trading update, was down over four percent on the day. At the other end of the table, on a sparsely populated winners side, was Tiger Brands. Their trading update which looked very decent, saw to it that the share price climbed nearly two and a half percent on the day. The other bigger news on the day was that Dischem was looking to sell 27.5 percent of the business to qualifying investors. Management, one investor (deep value Cape Town fellow, you guess!) and the founding family would be the other shareholders. Nice, it is good to have choices. At the top end of the range the company may well be worth 20 billion Rand, valuing the company at more than the market currently values Barloworld, Tongaat or Famous Brands. That is the type of company that they would be keeping. And twice the size of Cashbuild. How many other private businesses out there can you think of which are at that size and scale?

Over the seas and far away in New York, New York, stocks were rattled by a mid session FBI probe into Clinton emails, uncertainty = sell first and then ask questions later. By the time all was said and done, the nerds of NASDAQ had lost half a percent, the broader market S&P 500 closed down just under one-third of a percent, whilst the Dow Industrials fell a smidgen, down 0.05 percent. The big news from over the weekend was that General Electric and Baker Hughes have neared a 30 billion Dollar deal. Both stocks were up Friday, and whilst GE initially suggested that there was not too much going on ("We are in discussion with Baker Hughes on potential partnerships. While nothing is concluded, none of these options include an outright purchase."), Mr. Market seems to be ok with a deal. GE and Baker Hughes will have a combined investor webcast this afternoon. Deals = confidence.

Company corner

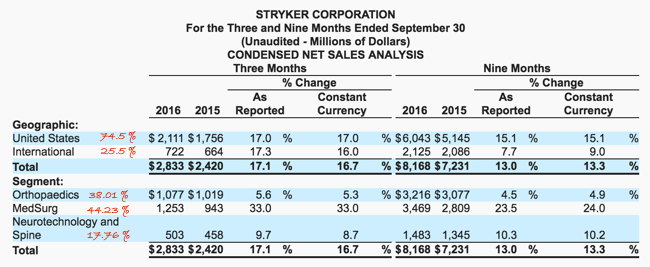

Stryker reported results for their third quarter last Thursday, after the market closed. This is the kind of business that has changed significantly, keeping relevant and up to date as medical science has evolved. Knee and hip operations are more prevalent than any other time in history. More and more each and every day! Complicated stuff for us mere mortals. When you think of the business, think of a company that has three divisions, Medical and Surgical (MedSurg), which includes all the power tools, the hospital beds, the ambulance cot (beds) to more hardcore software for complicated procedures. There is also a wide array of surgical equipment, cement mixers, waste management (blood and the like), as well as even cleaners and detergents.

Then there is the more complicated hips, knees, soft tissue and computer assisted repair (amongst others) business, the orthopedics business. This division includes newer technologies like the Mako Robotic-Arm assisted surgery device. The whole aim is to make sure that the quality is maintained, each and every operation looks like the last one. See? Knee replacements are like big Macs. Only kidding, obviously you want and need the consistency time and time again, maintain quality. The last knee implant must look like the next. Eliminating human error. The question is, with the technology available to us, with regards to the precision afforded to us by fine tuned machines, are they (the machines) as good as the surgeon? Time will tell.

Lastly, there is the Neurotechnology and Spine division. This is the division that I find incredible, cutting edge and incredibly futuristic. This stuff blows my mind - > Interbody/Vertebral Body Replacement. I am speechless that parts in humans can be 3D printed (Cranial replacement) to last.

So that is the split. As per the last quarter (below) 38.01 percent orthopedics, 44.23 percent Medsurg, and the balance (17.76 percent) Neurotechnology. And then, North America is still the main part of this business. Which is why I really like it, there are huge growth prospects for this business around the globe.

The company guided forward for the full year in a tighter range, at the top end. So not too much of a spectacular change, the stock still trades on around 19.3 times forward (to the end of the year), the dividend is not why you own it, a paltry 1.33 percent yield currently. Mind you, the dividend has doubled in the last five years, that tells you a lot. This is a very exciting space to be invested, if you think about it at the simplest level, people are living longer and require solutions from science in order to be able to replace parts that have been subjected to wear and tear. As science evolves, there will be more parts and more solutions, more equipment to do the surgeries. The company also has the ability to do small deals and add to their portfolio where they see fit. We continue to recommend the stock as a solid long term investment and are currently buying.

Linkfest, lap it up

As time goes by, technology keeps getting better and our ability to communicate improves. The next major step in communication will be the shift from 4G to 5G - This video shows the difference between 4G and 5G

This new computer from Microsoft looks great - The Surface Dial is a crazy puck that controls Microsoft's new PC.The test will come with its functionality and user friendliness though. As we discussed last week, IBM saved money by using Macs instead of PC's running windows due to the huge IT support cost that comes with Windows based machines.

I have seen much debate recently about passive vs active investing The Pitfalls of the Passive Investing Marketing Pitch. The main point of the article is that if you think an ETF is for you, make sure you know what you own. You might be owning a unit trust in a different name and it still has multiple layers of fees that you don't see.

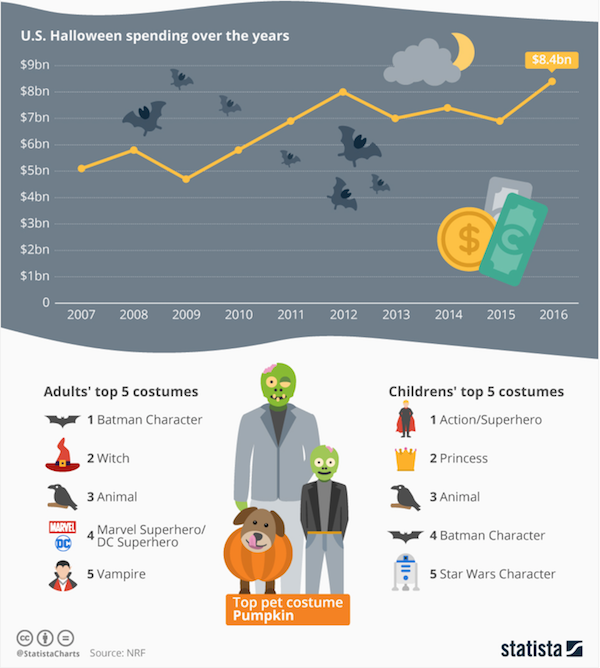

Today is halloween so here are some commercial numbers from the US - Halloween Is Frightfully Lucrative. Making the tradition go mainstream is a huge win for marketers, the amount of money spent on sweets and costumes is mind blowing.

Home again, home again, jiggety-jog. Halloween today. No scares Monday. Sadly politics will weigh on markets, with two of the not so best candidates in the US pit against one another in a fight to the close. There are of course non-farm payrolls this week Friday and earnings continue. Facebook, Alibaba, Starbucks report numbers, as do many, many others. From an interest point of view we have Coach, Whole Foods and Solar City, Activision Blizzard and GoPro too. Those are all "interesting". Never a dull day!

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063