To market, to market to buy a fat pig. European markets this morning are slightly lower, perhaps the lower GDP did not help, Spain is off two thirds of a percent, perhaps the El Clasico draw in the first semi final of the Copa del Rey is tugging peoples hearts. Oh wait, that came on the evening of the day that Catalonia seeks 9 bn euros from Spanish bailout fund. Simple solution. Sell Messi and Xavi and hey presto, problem solved. Any idea of a Spanish break up seems to have been rubbished with this idea. At least that is the way I see it. Or (oohhhh, this is very controversial) give Messi and Xavi to Real Madrid and that cost is absorbed at a national level. No, no, that would definitely cause a civil war, easier just to accept the bailout and the terms. Even if it means hardships.

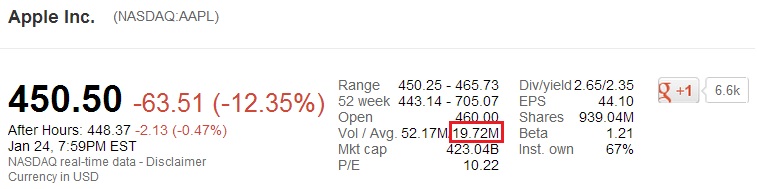

The Israelis bombed Syria on the same day that it was announced that their long serving central bank governor, Stanley Fischer would be stepping down. Perhaps the country of his birth, Zambia, falling out of the AFCON in the group stages was too much to bear. And about the bombing, gee, don't ask me on these matters I have no idea and it is seemingly dangerous to have an opinion. New Blackberry phones, models Z&Q 10 were released, with much fanfare. And RIM now is to be known as Blackberry. And not the tablet that they launched, remember that fine piece? I never even got to see one. The name change makes sense, the lack of apps does not necessarily help the case, and the lack of a keyboard, I thought that is why people liked that phone. Apple's giant hedge fund cash reserves are enough to buy RIM 20 times over. The market participants after a bit of a tear sent RIM down 12 percent in the spot market and a further two percent after hours. Poor Thorsten Heins is battling on. But I guess the market speculators/participants told me what they think.

Mayday, mayday. Yesterday we regurgitated an Atlantic Wire piece that was from the AFP that suggested that Zimbabwean finance minister had made a comment that the country had run out of money. Apparently somebody, somewhere got that wrong. The reason why I know this is because a journalist friend told me that there was an interview on CNBC, the political exchange show that Karima Brown hosts. The long and the short of it is that I suspect Zimbabwe have a whole lot more than 217 Dollars left, or whatever it was suggested. A pretty big accusation of calling AFP wrong, if that is the case. Here goes: State of Zimbabwe's Finances with Minister Tendai Biti.

"Rubbish story". Not enough money to fund the referendum. I laughed at the way that Minister Biti compared Zimbabwe to South Africa and Nigeria, not close sir, not even close. Only by continent and border. What do you feel about Zimbabwe asking for a cash injection? Minister Biti suggests this is closer than you think. How do you feel about that? If the election and referendum is going to cost 200 million US Dollars, Zimbabwe's "part", as Minister Biti said, what is the full amount that he is looking for? He can't unfortunately give details. Who would fund an election in Zimbabwe? Are you kidding me? Well done to Karima for having pushed him so hard. Poor Biti unfortunately is government and the opposition MDC, so I am not too sure whether he took kindly to the insinuations that the "bailout" money would be spent on other things. The fact of the matter is that Zimbabwe cannot afford either the referendum or the elections right now. And I am guessing that there is only one fellow (clue: fit as a fiddle) who is smiling now. Again, how do you feel about funding a (potentially farcical) election?

- Byron beats the streets. Last year City Lodge came out with a trading update which suggested that normalised earnings per share for the six month period are expected to grow between 20% and 35% from the previous comparable period. That is great news but the estimation is wide. Yesterday we got some more clarity from the company.

"Further to the announcement released on the Stock Exchange News Service of the JSE Limited on 12 December 2012, shareholders are advised that normalised headline earnings per share, which excludes the costs and effects of the BEE deal, are anticipated to be between 27% and 32% higher than the previous year.

Diluted / undiluted headline and basic earnings per share for the six months ended 31 December 2012, which include the costs and effects of the BEE deal, are anticipated to be between 60% and 65% higher than the previous year."

Ignoring the effects of the BEE deal, Normalised headline earnings per share for the 6 month period to December 2012 came to 224c. Let's take the middle of the range 30% and we get half year earnings of 291c. Last year the second half was very similar to the first half earnings wise. Historically though, the first half which includes the December period is usually much better. However, as this trend shows, the company is growing fast and I think it would be safe to say that as the company continues to grow, we may see a similar thing happen this year whereby earnings are similar for the two halves.

To predict forward earnings I will double this figure of 291c. Like I explained above by doubling this figure I am assuming growth in the weaker period. That gives us 582c earnings for the year. The share price has done really well over the last 6 months having been as low as R75 in June last year to R108 today. This means the stock trades at 18.5 times current year earnings predictions.

This probably seems expensive but as we have pointed out many times about this stock, it has a property underpin which the market cap regularly trades at a discount to. Probably not at the moment, let's check it out. In last year's financial results released in June directors current estimated replacement value of their property was R3.8bn. According to the listed property index, property has grown 20% in the last 6 months. Add 20% to R3.8bn and we get R4.56bn. At the current share price the market cap of the company sits at R4.7bn.

So you can assume that movement in the share price is attributable to both earnings and the property index. Interestingly it also shows you why the property market has picked up, higher occupancy means higher yields, so earnings and asset value come hand in hand for the stock. We are very glad we were patient with this one and continue to use it as a good entry into the property market. At the same time it is also a nice indication that locals are travelling (as Famous Brands suggests) as well as foreign travellers visiting our beautiful country.

New York, New York. 40o 43' 0" N, 74o 0' 0" W There was good news, bad news, middle of the road news, but mostly enough for the daily participants to "take some off the table". Which is not code for anything. After what has been a terrific rally over the last month, with the S&P 500 up 7.1 percent from the last trading day of 2012. Fiscal cliff averted, all has been saved. I suspect that the re-rating is justified seeing as politicians have been at each other's throats for some time now. There is seemingly the thinking that with politicians doing what is in the best interests of America, that is a positive. Because much of the concerns around policy decisions guiding the direction in the short term, at least the lawmakers are sitting around the table and talking.

What certainly got the tongues wagging was a big miss in GDP by the US, a negative print. Yes, - 0.1 percent. That was the bad. The biggest part of that was a monster fall in defense (American English) spending, which accounted for a 42.4 billion Dollar reduction. 42.4 billion Dollars annualised is 169.6 billion Dollars. Now, in the context of a 15.676 trillion Dollars economy, that is not that much. But...... Here is the ranking tables of countries in that output, I have hacked a table from this Wiki entry, List of countries by GDP (nominal).

OK, but Rick Santelli had a little thrombosis when Steve Liesman said, oh, if you exclude this, or include that. The reason for another Santelli outburst is for one reason only, he reads the headline print. GROSS DOMESTIC PRODUCT: FOURTH QUARTER AND ANNUAL 2012 (ADVANCE ESTIMATE) is the .pdf link. Here is the video of that Santelli outburst: 'Let's See You Spin This One Into Gold!' I agree with Rick, if government defense spending is lower, it is lower. On set, Mark Zandi, who is a regular guest, he is also shaking his head. Liesman says that the things that matter are business and consumer spending which are trending better. I guess in the long run Liesman is right. I strangely thought, this is what people want, not so? Government to spend less on stuff like defense?

But the US economy is huge. An overall 2.2 percent increase in money terms is 289.7 billion Dollars. Which is nearly the entire economic output of Greece. Yes, read that line again. For all the anxiety about Greece last year, the year before, and the year before that. So, in a sense (this sounds crude) Greece could actually register zero economic output and the net outcome would be zero. Of course it is about the debt, both countries have plenty of that. A negative surprise is not welcome however, this is sort of like putting lipstick on a cute piglet. Bill McBride does a nice summary: Comments on Q4 GDP and Investment. Nice conclusion, but that is working off a relatively low base.

The only good news from yesterday was a positive ADP read. ADP of course are the payroll people who are always the first to report the monthly job changes, and a tantalizing entree to the real labor (again, Americaa English spelling) department numbers which will be on Friday. Excellent. For the full report, visit this page: ADP National Employment Report Shows Solid Job Gains Adding 192,000 Jobs in January. December however was revised down by 30 thousand jobs, that was not really encouraging. Most of the additions were "main street" additions, small and medium business added the bulk whilst big businesses actually showed that they shed 2000 jobs. The summary that you need is from the el-chiefo at ADP: "U.S. private sector employment got off to a good start in 2013, as 192,000 jobs were added during the month of January," noted Carlos A. Rodriguez, president and chief executive officer of ADP. "According to the ADP National Employment Report, private sector employers created an average of 183,000 new jobs per month during the last three months. This is an encouraging sign of steady improvement in the job market." Yes, agreed, encouraging signs against the poor GDP numbers.

Facebook had their annual and fourth quarter numbers yesterday. Like Amazon.com this is a company that is on a crazy upward trajectory, so sometimes it might be difficult for some to judge the stock reaction. Both the instant numbers (which is a little like drinking instant coffee, you can tell, I am a snob in this department), top line and bottom line beat expectations, but there was a marked surge in costs. Costs that were increased by adding more infrastructure as well as more staffers in order to be able to continue to innovate. Because ultimately that is what you are buying here. Costs and expenses increased a whopping 82 percent in the quarter. The company on a GAAP basis made nothing last year, on a per share basis it clocked one cent. A penny for 2012. On a non-GAAP basis the company earned 56 US cents per share. So, basically the multiple is infinite. For the time being.

What folks were looking at were ad revenues from their mobile business (remember the angst around that) and that had grown 40 percent plus. As you were. Facebook Reports Fourth Quarter and Full Year 2012 Results, is where you can find the nice blue and white layout. Nobody wants anything from you, there are no ads there, it just lays out the basics. More and more people are using their mobiles to access Facebook, 680 million in total, a massive 57 percent year-over-year increase. That was pretty telling. It of course means that folks have also upgraded their handsets across the globe. And not really to the Blackberry, which has lost market share. I do hear that the Facebook app on the old generation Blackberrys did not work that well either.

The most difficult question to answer is how do you value a company like this? Uniquely, Facebook knows more about their audience than anybody else out there. They know what you like, where you have been, who your friends are, what photos you post, who is in those photos, what your activity is, what mood you are in, who you are in a relationship with, your birthday, and the list goes on. The simple burning question is, how do you monetize a user base of one billion plus people? One billion folks use their Facebook accounts at least once a month, "active accounts" according to the company. The market is paying roughly 67 Dollars per user, the market cap of Facebook of course is one billion times that. I suspect that people who are really active, committed to the platform types are going to make all the difference. There are 618 million active daily users, roughly one in 11 folks on the planet. An advertisers dream. Like the ebook adoption, advertisers and payers for the services of targeted groups alike will take time to adapt to the platform. I suspect that the classified section in future will almost likely appear on this platform.

The valuation at current and even next years levels is still difficult to wrap your head around, a 50 plus multiple. And that is for two years out. You are not buying fresh air here. You are buying a business that grew really, really quickly. Growth rates in terms of absolute subscribers will slow. I can't think of anyone who has not got a Facebook account. But then again, there are loads of people being born all the time. Maybe not in Japan, but elsewhere in the world. Even in the US, population growth rates are 3 million roughly per annum, those people will all need Facebook accounts, when they are old enough of course. Obviously the user fatigue, onerous (or lax) security issues and risk of competition still apply. But it feels like a Microsoft type scenario 15 odd years ago. Everyone has an account, like Microsoft dominated software in the PC market. The stock is not for everyone. Heck, Buffett (in the words of Taylor Swift), is never, never ever going to get together with this stock. Let alone back together.

Crow's nest. Lower here, that US GDP miss is leaning on us here. Lower to start with and waiting for earnings to continue to roll in. All those anxieties about earnings, remember those?

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440