Jozi, Jozi 26o 12' 16" S, 28o 2' 44" E The market here at the southern tip of Africa essentially ended the day flat, but that was not the real story. Well, flat is being slightly generous, eighteen and a half points lower on the session for the all share index. Being a drag were the mining stocks and specifically BHP Billiton and Impala Platinum. Both for different reasons. BHP Billiton production facilities were dealing with a tropical storm (Narelle) in the Western Australia region, and as such had to shut both petroleum and iron ore operations. Of course they were not alone, with other Australian mining giants such as Rio Tinto, Woodside and Fortescue also having to deal with the same storm. But there was another storm that BHP Billiton had to deal with, a downgrade from Bank of America Merrill Lynch to underperform and Macquarie to neutral was hardly encouraging, coinciding with the crazy graphics of dust storms that I saw. Unrelated strangely to the tropical storm. Just a storm, a red one -> Storm delivers Onslow a red-dust sunset.

Impala Platinum sank nearly one and a half percent, but are still trading near 52 week highs after a heroic rally from July last year. Heroic and epic. Amplats are back at 500 Rands a share, if you were wondering. And their review of their mines are still pending, many I have spoken to are worried, but I guess that is human nature, we worry, we are cautious. But then that is always nicely balanced with the optimists amongst us. I consider myself a cautious optimist.

It is however quite hard to be an optimist when you look at the trading statement released by Amplats this morning however. This is for the year to end December 2012, a year that was the worst for miners in terms of labour relations for as long as many can remember. Sis. I am going to copy and paste the Trading Statement: "Headline earnings per share ("HEPS") for the period is expected to decrease to a loss of between 491 cents and 628 cents from a profit of 1,365 cents reported for the year ended 31 December 2011."

It gets worse, because the company are using this as an opportunity and perhaps this is a sign of what will come with the operational review: "Basic earnings for the period includes losses of R463million resulting from the revaluation of certain investments and R6,606 million (after-tax R4,756 million) for the write down in the carrying value of various projects and other assets, not in use, that are considered not economically viable in the current market environment."

So, that means "Basic earnings per share for the period is expected to decrease to a loss of between 2,487 cents and 2,624 cents from a profit of 1,374 cents for the comparative period."

This is a shock, but not a big one, there were certain expectations that these were going to look ugly. Well, the write down is something that will no doubt be fleshed out in the results, but the operational review (which is late I guess, but perhaps that is as a result of that review timeline coinciding with Cynthia Carroll resigning, too much happening) should reveal the real weighty issues facing the company. Read those lines: "The losses in production resulted in an increase in unit cash operating cost in 2012, due to the retained fixed cost base which further negatively impacted on HEPS for the period." 306 thousand ounces of lost production, according to Amplats. Which is 4.365 billion Rands of lost revenue at a current platinum price of 1634 Dollars per ounce, and 8.73 Rands to one Dollar. Wow, that is a huge number....... Lost export revenue. Costs are too high. I am expecting the long knives to be sharpened at 55 Marshall Street. Which does not really bode well for job creation in South Africa. Expect the full results, as per the announcement three weeks today.

New York, New York. 40o 43' 0" N, 74o 0' 0" W Markets closed flat to lower on Friday. Basic materials, read resource stocks, were the biggest losers on Friday. Technology grabbed the headlines though, Byron will discuss in a little more detail later. Technology, imagine a world without broadband, mobile phones, WiFi, personal computers and laptops. That was 20 years ago. Even less really, many people only adopted PC's and also converted in the workplace less than two decades ago. And remember those awesome 386's, before Windows 95, which was a deal breaker. Dial-up, that sucked a lot, that whining and tinny noise when you tried to make a connection to download your seven emails a day. I consider myself new-age, when I met my wife, I asked her for her email address, that was the year 2000. She honestly thought that by not asking for her mobile number (she had a funny and clunky NEC number) I wouldn't "call". See she is wrong, but only sometimes you see.

I guess what I am trying to say is that that there are perfect examples around us of how it changes dramatically over a generation, or in this case just over half a generation.

- Byron beats the streets. There is no doubt that Apple has lost market share. It was inevitable. When you have those kinds of margins as first movers in the high end smartphone market, it is standard economics 101 that competitors will see those abnormal returns and try and get their piece of the pie. Samsung have been worthy competitors responsible for 31.3% of shipments in the third quarter of 2012 compared to Apple's 14.6%. For Apple however it was never about market share of shipments, it was market share of profits of which they pulled in over 60% at the end of last year.

Of course as shipments market share decreases so will the share of profits and this is why investors have been concerned. On top of this The WSJ released an article yesterday which suggested that orders for components for the iPhone 5 have been cut due to weaker demand. Here is the article titled Apple Cuts Orders for iPhone Parts.

It is one of those articles that quotes "people close to the matter" which I always take with a pinch of salt but The WSJ is a credible publication and this kind of information is bad news. I'm not too worried about market share because firstly, the smartphone market is growing very fast so even if you are losing market share, you can still be growing nicely and secondly Apple's exclusivity has allowed it to maintain growing profits. But this is bad news because if Apple are missing their own forecasts, it really does throw a spanner in the works.

Even if this article speaks the truth I am still adamant Apple is a great investment at these levels. Their brand is still a huge pull and there are talks that a cheaper iPhone is being made in order to get hold of people who love Apple but cannot afford the phones, especially in the developing world. I am all for this because even if they sacrifice margins, they could introduce millions of people to the Apple world which includes massive content consumption and an immediate incentive to integrate iPads and Mac Books. Once you are in the Apple world, it is hard to get out.

I know we are far behind here in South Africa but since iTunes has been introduced here, I am even more sucked in as a client. Music is a global language which everyone loves and will never go out of fashion. iTunes alone is the 12th biggest tech company in the world and as that platform grows it will work hand in hand with the hardware. I feel content will be become more and more significant for Apple in the future.

Back to the hardware, I have read great reviews on the iPad mini and apparently it is flying off the shelves. I have spoken before about the fundamentals behind the share price and how cheap it is looking. We continue to use this weakness to add to the stock and wait in anticipation for results on the 23rd of January where we will get much needed clarity on this latest quarter.

I don't like it, you don't like, I am guessing that there are very few people who like it. What I am referring to is the US federal debt situation. It is huge, it is colossal, it is a number in excess of 16 trillion Dollars. Why is it there in the first place? Well, simple really, the alternative, if government had not stepped in during those dark days of late 2008, what would have transpired? Would we have seen a wasteland that the purists might have referred to as the market having taken care of the situation itself? Probably. And with the Federal Reserve Governor having been a student of the Great Depression, he knew what the consequences were not only back home in the US, but also for social stability globally.

In case you needed reminding, the aftermath of the stock market crash of 1929 that led to the Great Depression saw a deflationary spiral, a breakdown of trade internationally, US exports by volume halved (in monetary terms sank over two thirds), unemployment peaked at 25 percent in 1933, bank deposits were uninsured and folks lost billions as 2 out of every 5 banks fell over completely. The Fed was powerless (and relatively new), Congress froze and it took years to recover. Now, I can hear you make the argument about asset prices re-rating, make no mistake the equities market was grossly overvalued before getting routed in the late twenties. Credit had been too easy, but who could blame people for thinking that they lived in a brave new world. You could own a motor vehicle at relatively inexpensive prices, electrification had taken place, folks could listen to news around the world with their wireless. Leverage however was a new science, and stock prices were catapulted to some crazy valuations. Companies however were doing really well in the late 20's, earnings in the Dow Jones Industrial Average were growing some one third per annum from 1926 to 1929, you would be crazy to believe that it was not going to continue.

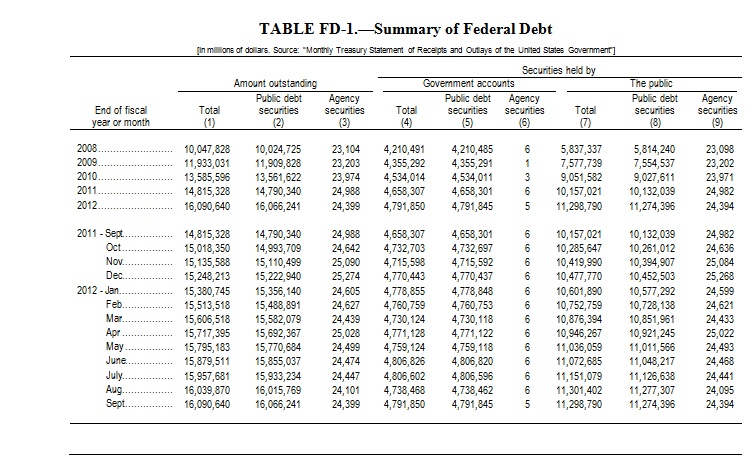

But, as in most corrections, and this was one was severe and ruthless, too much excess was exposed. And the people who suffered most were ordinary Americans. Thanks for the history lesson, but where is this all going? Well, that was the one option that the powers that be could have taken, that route. I am not suggesting that the same would have taken place, I am not suggesting that those with too much leverage should have been called out. No, that should still have happened. There were "victims" of the past financial crisis, 3.9 million odd houses have been foreclosed by the banks. That means that a lot of families are without a place they used to call home. Perhaps in this case many of these were not primary homes, but still, I can't imagine the pain of losing a house. California and Florida were worst affected. So, forget for a moment all the financial jobs lost during the crisis, think about these people. I am guessing that is what the concerted effort was to save the banking system. The federal overspending took place to step in where business had run away (very simple way of looking at it) which has now seen US government debt balloon to very uncomfortable levels. Check it out, a table hacked from the Treasury bulletin - December 2012 website.

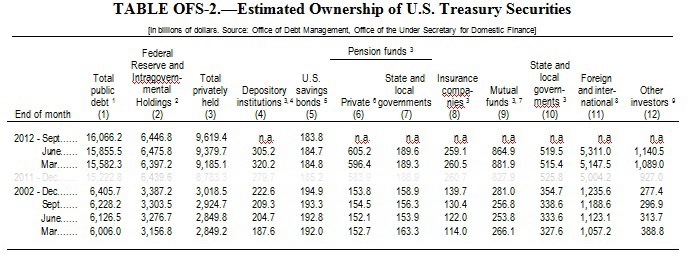

OK, so that is "nice", the debt has clearly exploded in the 2008 to present era, but in truth this is nothing new. The US federal debt has been expanding at a rapid rate. So, who owns these securities? I did another hack-job of the ownership of US government debt, you can find a bigger breakdown of the foreign ownership here -> MAJOR FOREIGN HOLDERS OF TREASURY SECURITIES, but this is overall.

It turns out that it is not China that owns US government debt, but rather many different people and investment companies. More debt is owned in the US than externally owned, even though politically one would have been led to believe that the opposite is true. So, where am I going with all of this? Well, this is a long winded way of getting to what is perhaps the next big battle in Washington DC, raising the debt ceiling. The WSJ had a piece over the weekend: Ugly Choices Loom Over Debt Clash. The actual date of when the debt ceiling will be hit is sometime between the day after Valentines day (which is the same as "the day after tomorrow" movie for some sadly) and the beginning of March. Two weeks, more or less.

The idea of the trillion Dollar coin has been booted into touch, via Bloomberg from yesterday -> Treasury, Fed Oppose Using Platinum Coin to Avoid Debt Ceiling. But, if you read the story above from the WSJ, the US government spends 40 percent more than it takes in. So, tax receipts have to rise. And how do tax receipts rise? Well, at least the politicians are one step closer to figuring that out. Even if they appear very far away. Many things that could change, have to change. Including the debt ceiling. Because, according to Wikipedia, the US has been without debt or a deficit for only one percent of their existence, if you take the treaty of Paris signed in 1783 as the starting point. So, what is the point of the debt ceiling then? According to Wiki: "The debt ceiling has been raised 74 times since March 1962, including 18 times under Ronald Reagan, eight times under Bill Clinton, seven times under George W. Bush and three times (to August 2011) under Barack Obama."

The debt ceiling was raised 18 times under Ronald Reagan? WHAT? But now we are led to believe that the US politicians are serious about the debt issues. I suspect lots of scrumming, mostly mauling and perhaps some good old fashioned rucking (when you could mountaineer the ball out of the ruck) in solving this solution. And let us be clear here. Who wants to be the politician that was responsible for social security cheques not finding their way to the recipients? Who wants to be the politician who is responsible for that. Even though, according to a slide show that I saw on CNBC, the social security fund owns just a little less than 3 trillion Dollars worth, and is in fact one of the largest holders. I am guessing that the Social Security fund could actually sell treasuries to meet their onerous obligations. The fight is on to settle the debt ceiling debate and I am presuming that it will happen at the 11th hour, or perhaps even thereafter. Angst. Expect it!

Crow's nest. We are higher to start with. Again. Another day in Jozi and another record high. If the Protea's can clean up the second half in PE quickly, we can return to earnings season with great excitement.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment