To market, to market to buy a fat pig. Whilst folks in Davos tell us how cold it is, the fellows in the Northern North America are also finding the weather tough. Colder. And the fellows over in Northern China are also seeing tankers getting stuck in the ice in the sea. And over here in Jozi, the "real feel" as per the phone apps was somewhere close to 40 degrees, even at 4 in the afternoon. Yip, Robin Williams once had a few lines in a movie of how hot it is. "Fool, it's hot! I told you again! Were you born on the sun?" Remember that line? This message is PG, so the rest can't be repeated.

When last did you hear about the issues in Europe? Yeah, I am talking about the same old sovereign debt issues that plagued the area for the better part of three years. Paul and I were looking at bond yields of Germany and Italy, and it is extremely surprising that during the height of the financial crisis that Italian bond yields still carried a "you can trust this one" rating. The 10 year was yielding 3.71 percent in the middle of October 2010. But then in late November a year later the yield was over 7 percent and everyone was freaking out. And now? The yield is back to around 4.2 percent. Wow. There is an election in March, there is undoubtedly going to be a coalition and no doubt Mario Monti will be part of the new government, if the polls are to be believed. Silvio Berlusconi might pull a rabbit out of the hat, but I suspect that is a long shot.

I think that we can stay talking about peripheral (Europe) bond yields. Portugal ten year government bonds were yielding over 17 percent this time last year. Yesterday? 6 percent. In July last year the Spanish ten year government debt was yielding 7.6 percent, two weeks ago that was under 5 percent. It is a little higher now, over 5 percent. There were some sensible people who did not join the seething masses of zombies and villagers who were chasing after each other oblivious that they were in a collective group. Grexit this, Spain bailout that, Italy finished here, France even under threat far over there. What everyone forgot was that Europeans want this to work. So badly that the ECB governor got the ball rolling with his now famous "we will do whatever it takes" speech. So the problems have not gone away. But anyone who thinks that they are not going to be chased away with a rather large stick with bazooka capabilities is wrong. Same problems, committed to fix them. And that is why the zombies and villagers have gone back to lie down. Will it flare up again? Perhaps. Should you think that it is the end of the world. No. Turns out the collective biggest economy in the world is committed to working it out!

Jozi, Jozi 26o 12' 16" S, 28o 2' 44" E Our local market rocked to another all time high as the Rand weakened and global markets kept re-rating in the absence of any bad news. Less bad news equals fewer nervous folks. And now the polls are starting to suggest that folks are really bullish on equities. Really? What did you eat over the festive period? Human nature certainly dictates whether or not something that seemed expensive yesterday might seem cheap today. Locally the stocks that caught a serious bid were the likes of SABMiller, Naspers, Richemont and British American Tobacco, buoyed by a weaker currency. That is good for stocks, but not good for the ordinary folks on the street. Err.... surely that is you and I?

There were some strong warning shots fired by the MPC, led by the master on the bridge, reserve bank governor Gill Marcus. The full Statement of the Monetary Policy Committee can be viewed at the SARB website. They need a little sunshine over there in Midrand, when you issue lines like these in the statement: "Downside risks to the outlook persist as the structural problems in many countries, and in the Eurozone in particular, are still unresolved." But we just spoke about that..... A bit later in the message the bank suggests that the Euro region economic growth will remain stagnant, and do actually recognise that lots has been done. I wonder, what that confidence does to real people?

Sadly, the governor tells it like it is here in Mzansi. If you think that that is slang, then try out the Wiki entry for Mzansi and see where that resolves. "The inflation forecast of the Bank reflects a further deterioration in the inflation outlook for 2013 compared with the previous forecast." Sniff. Why? Well -> "The rand exchange rate continues to pose an upside risk to the inflation outlook." So, the moral of the story is that you must be careful what you wish for! I was just saying to Byron that for some quarters of local manufacturing this does a lot to counter cheaper imports. Sadly for many consumers, the cost of imported goods rises.

"...financing of the deficit may be more challenging despite relatively high domestic nominal bond yields, as sentiment towards South Africa has deteriorated, and non-residents already hold over one-third of the stock of outstanding government bonds." So there you go, even though the line from the government is that South Africa is open and welcoming (but we may or may not talk about removing your mining licences) people are voting with their feet. And foreigners have been selling local equities. Well, at least in January, in November and December there were foreign purchases. Schizophrenic flows.

The manufacturing and mining sectors are still under some pressure, and that is set to continue. But there is nothing new in there. These however are the two lines that the business sector will run with in South Africa: "The MPC is mindful of the danger of a possible wage-price spiral and further employment losses should unaffordable real wage demands be granted while economic growth remains constrained. The risk to inflation should this scenario play itself out are significant in the absence of productivity gains." So, whilst the unions in South Africa counter that argument that economists put forward that productivity is at a multi decade low, the Reserve Bank suggests that Loane Sharpe and his mates are right. Loane's presentation of the facts are always hilarious, the way he can do so with a toned down expression. I have only ever spoken to the guy a few times, but he seems like a really likeable chap.

So, in the short term the MPC are worried about inflation, as we should all be. Because inflation is the scourge of the poor, it erodes their purchasing power. And with current relations between business and labour stretched to breaking point I suspect the unemployment situation in South Africa is not going to get better any time soon. I am still looking for some government department to come up with wholesale suggestions for small business creation and various breaks for small business creation in South Africa. Why doesn't that exist? Small businesses is the life line of many an economy. There are large underserviced areas from a small business point of view. We can leave it there.

New York, New York. 40o 43' 0" N, 74o 0' 0" W The S&P 500 crossed the 1500 point for the first time since it slid below there in December of 2007. Five years plus ago. Apple was a huge drag on the broader index which eventually ended as close to flat as one could possibly imagine. Down a whopping 12 percent is where Apple finished, we are reminded that this is a very widely owned stock and if the majors are pushing and getting out at any level, it will have an impact. 52 million shares traded yesterday, that is around 5.4 percent of the entire outstanding shares (938 million) of Apple. 5.4 percent? In one day? At that run rate the entire share capital of the company would swap hands in less than 19 trading days. Talk about making up your mind!

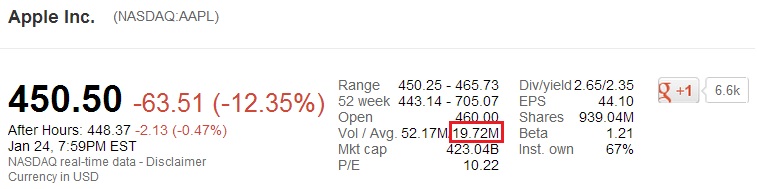

But on closer inspection I saw that Apple trades on a normal basis, 19.72 million shares. True story, check out Google finance, where I have circled:

19.72 million shares trade each and every day? That is 2.1 percent of the volume trades each and every day. According to the NYSE Number of Trading Days 2013 pdf, there are 252 trading days in a year. So, if I multiply the average volume by number of trading days in a year I get to 4.969 billion shares trade a year. That is roughly 5.3 times the number of shares of Apple, which swap hands. Without using an enormous amount of expletives, WTF are people doing? Over what I consider a medium term as an investment, 5 years, the shares would have traded over 26 times their outstanding shares. No wonder those people who are hard wired to chopping and changing their views and flip flopping all the time. Nonsense. Idiots. Morons. Churning washing machines. Outrage. We continue to stay long. And all you folks doing market messages, please don't ever talk about investors again. These are short term market participants looking for what, I am not too sure. Perhaps their clients should ask them the same questions!

- Byron beats the streets. Earnings season has brought us another set of numbers, this time from Starbucks who have been a lot more resilient than the other fast food/drink type businesses. The numbers were for their fiscal first quarter. Here are the financial highlights: Net revenues increased 11% to a record $3.8bn. Comparable store sales increased 6%, regionally the company saw 7% in the US, 11% in China and -1% in Europe. Importantly margins increased by 40 basis points to 16.6% thanks to a drop in the coffee price. This all amounted to an EPS increase of 14% to 57c. 212 new stores were opened globally including 3 stores in India (in my last message about Starbucks I mentioned that the queues at the Mumbai Starbucks were so long that hawkers were selling tea to the people waiting in the queue).

Earnings for 2013 are expected to come in at $2.14, $2.66 for 2014 and $3.23 for 2015. That is strong growth but the share price certainly expects it, trading at $54.58 which is 16.9 times 2015 earnings. So why so expensive? The growth story is a no brainer. People love coffee and the margins are massive. It is still new to the Asian culture but is becoming more and more integrated as people work more and crave that caffeine boost. It is also an aspirational brand. I always say this but did you know that in China, people make sure they drink their Starbucks coffee with the brand facing outward so that others can see they are drinking Starbucks?

They are also a company with strong ambitions and innovation. Their loyalty programmes have been very successful and recently they have entered the tea business. They are also using their leading brand in coffee to compete with the Nespresso machines. These have become extremely popular amongst the aspiring masses, especially here in SA. The model is great, sell the expensive coffee machine and then lock in clients with the delicious coffee pods. The Starbucks version is called Verismo, check it out here it looks great. They have sold 150 000 machines since the launch.

Here is what CEO Howard Schultz had to say: "Solid growth in our U.S. retail business, further expansion of our Channel Development initiatives and continued successful execution against our expansion plans throughout China and Asia Pacific all contributed to the record results we announced today. Starbucks has never been better positioned to achieve the goals we have set for ourselves around the world and I have never been more optimistic about our future."

After looking at these earnings are I am very happy to carry on adding to this stock. It has also sparked a debate in the office after seeing this article in the WSJ the other day headed Is This the End of the Soft-Drink era? It talks about how soda sales in the developed world have slowed as people become more health and weight conscious. It is certainly a concern as Coke is one of our core holdings. In the office here none of us drink many soda drinks for that exact reason. But we do drink lots of coffee. It is certainly a trend I can see picking up momentum.

After a lengthy debate we decided to start weaning down our Coke exposure and shift that into Starbucks. If you are happy with that idea give us a call and we will do the swap. Otherwise we will contact you in due course.

Crow's nest. We will cover the Anglo production report over the weekend and have it in Monday's message. The market seems to have received it really well, it looks like a big beat on all divisions. Excellent. Mr. Market is lower here after having had a ripper yesterday.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment