To market, to market to buy a fat pig. There was a lot on the go yesterday, people talking about record inflows into equity markets. And also, did you see this? Hedge-Fund Leverage Rises to Most Since 2004 in New Year. But the key as ever for us around here is earnings. And with it being US earnings season, which is just starting to sink in as companies give us the real juicy pieces that we wait diligently for. However, we are not susceptible to quarteritis around here. We just enjoy earnings season. There is of course the debt limit battle looming, that is a mere month away or so from being more than just a sideshow. I guess the fact that people are talking now seriously is better than leaving it until the very last minute. But, mark my words, that is what the heel dragging politicians will do. If you don't have an ego you might as well avoid this as a career. German support for Angela Merkel seems to be heading in the right direction, at least that is what we were led to believe. The WSJ leads with -> Obama Escalates Debt Fight. Turns out that the man is very clever. It is politicking of course, pointing at the Republicans as holding the whole country to ransom.

Over in Europe, the powers that be decided to block the proposed takeover of TNT by global titan UPS -> TNT slumps as UPS pulls bid on EU veto. TNT down a whopping 42 percent, UPS up fractionally. It turns out, according to the Reuters story that both FedEx and DHL had lobbied the commission to send the deal proposed documentation into the dustbin and hit the reject button. Hmmm... TNT has the small pleasure of getting 200 million Euros by way of a break fee from UPS. Global logistics, parcel delivery, it is not easy out there.

Swatch bought the jewellery division of Harry Winston Diamond Corporation, which strangely impacts BHP Billiton positively. How? Because the remaining mining company, Harry Winston now would have the cash to acquire the Ekati diamond mine in Canada, which BHP Billiton have up for sale. Harry Winston in November agreed to purchase the BHP Billiton mine in November for a mere 500 million Dollars. Nice.

Jozi, Jozi 26o 12' 16" S, 28o 2' 44" E Retailers took a caning, largely due to a big fall in both Shoprite and Woolies, Mr Price was crushed too. Shoprite released an operating update -> SHOPRITE CONTINUES STRONG GROWTH which showed that sales had grown by only 13.8 percent. I use the word only, because that is what Mr. Market decided, sending the stock down nearly six percent on nearly four times the daily traded average. Wow. Forward, the stock trades on a 26 multiple. Now, that is wildly expensive by any South African retail measure. But. If you were faced with the task of trying to find the next best retailer on the planet, that operated in previously untouched markets, where would you start? Well, Africa. And that introduces it nicely for Byron.

- Byron beats the streets. As Sasha mentioned above, yesterday we received an operating update from Shoprite which shed some more light on the retail sector. As he also mentioned, the market did not receive the news too well pushing down the whole retail sector which is now down 5.5% for the year. That is not what we are used to from a sector which has been flying since it took a knock in 2008, down 20.2% that year. In 2009 it was up 26.2%, 2010 up 55.8%, 2011 up 14.7% and last year it was up 45%.

Here is what Shoprite had to say:

- "For the six months ending December 2012 the Group grew turnover by about 13,8% to R46,7 billion. Growth on a like-for-like basis was 6,9%.

The South African supermarket operation increased sales by 11,5% and by 6,2% on a like-for-like basis. For the month of December 2012 sales were 10,8% higher than for the corresponding period. Internal food inflation was on average 4,3% compared to the estimated official figure of 5,9%.

The rand remained weaker against most non-RSA currencies resulting in the Group's non-RSA supermarkets achieving a sales growth of 28,2% and, on a like- for-like basis, of 13,4%. At constant currencies a rand turnover growth of 23,5% was achieved."

As you can see the numbers are very similar to Massmart who grew turnover by 14.6% in the six month period, 7.3% on a comparable basis. Interestingly Shoprite's turnover was R10bn more than Massmart's R37bn yet its market cap is comfortably more than double that of Massmart's. Shoprite is valued at R107bn while Massmart is just North of R40bn.

Why is that? As I have mentioned before, Massmart have taken a hit on earnings because of the costs of the Wal-Mart transaction plus certain social commitments forced on them by the authorities. They are focusing a lot of time and money on expansion.

Back to Shoprite, see how well Africa is doing, growing 23.5%. Last year non-RSA supermarkets were responsible for 11% of sales. This was from 131 non-RSA stores. Total stores for the group amount to 1740 according to last year's full year results. After opening 18 non-RSA stores in the last financial year they have pin pointed over 30 opportunities to open new stores this year, especially in Angola and Nigeria. It is a costly exercise because unlike here in SA where shopping malls are built by property developers, in areas where there is a big lack of infrastructure, Shoprite and Massmart have to build the malls themselves, or at least put forward a lot of money to help the developers.

Last year capital expenditure came in at R3.1bn compared to net profits of R3bn. So you can see the company is still in expansion mode. Interestingly, Massmart had a very similar ratio for 2012. They spent R1.3bn on capex compared to R1.36bn in profits. The market may be initially down on this news, the share price is expecting a lot. But I am not worried about the long term growth of both Shoprite and Massmart.

The operational review at Amplats happened sooner than most folks expected, later than originally telegraphed. And you can find all of it right here -> Anglo American Platinum takes action to create a sustainable, competitive and profitable platinum business. It is a tough read, because the economic realities are laid out. Four shafts in the Rustenburg region are to be put on care and maintenance, Khuseleka 1 and 2 and Khomanani 1 and 2. Production will therefore be ratcheted back by as much as 400 thousand ounces per annum. The new annual production target is 2.1 to 2.3 million ounces per annum. This is more realistic I suspect and away from the production at all costs.

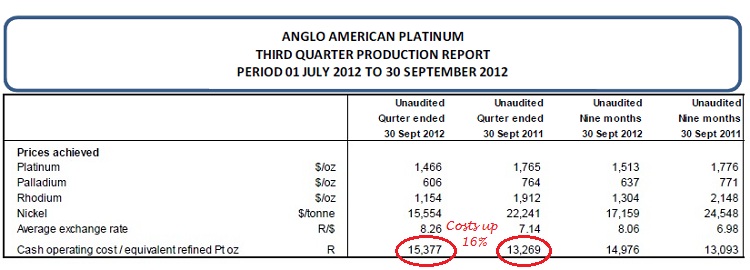

But it is not just those four shafts. "The Rustenburg processing operations will also be reconfigured to align with the revised mining footprint, which may include closing the Waterval UG2 Concentrator and No. 2 Smelting Furnace." And it does not stop there either. Unfortunately the Union mine is up for sale. I say unfortunately, because I suspect that the selling price will not be what shareholders would have probably anticipated. It is by no means a small deal, the THIRD QUARTER PRODUCTION REPORT suggests that the Union Operations had for 9 months produced 174 thousand ounces. So, based on the three quarter year production, the annual run rate was roughly 230 thousand ounces. I hacked that specific production report, I can't believe that they spelt quarter wrong, and that nobody picked that up.

So. Amplats have had to think about the future of the business. And the hard task of being able to create value for their shareholders, after all, shareholders are the people who own the business, and in this case, Anglo American own nearly four fifths of Anglo Platinum, whilst the very distant second biggest shareholder is the GEPF, the Government Employees Pension Fund, with a little over six percent of the business.

There are always losers as businesses seek to optimize their businesses. And in this case it is the jobs of 14 thousand folks, most of them in the Rustenburg area. But all is not lost for these folks, as per the release: "the Company will target the creation of at least 14,000 jobs - an equivalent number of jobs to those that may be affected by the restructuring. The job creation initiatives will focus on housing, infrastructure and small business development in Rustenburg and the labour-sending areas" The sad realities are that there is both lost revenue for South Africa (at current levels I worked out 5.9 billion Rands for 400 thousand ounces), but even worse against the backdrop of unacceptably high unemployment, job losses.

If you add in the Harmony announcement from earlier this month, that amounts to close to 20 thousand jobs "lost" in the mining sector so far this year. And the closure (care and maintenance) of six shafts, two of course from Harmony. I have always maintained that this would be the point where all involved parties would now be forced to sit down and get serious. Because now it impacts everyone. Labour is losing revenue as members will probably be unable to maintain membership, government is losing potential tax revenue, and shareholders have to scale back their expectations for the business in the coming years. Amplats are up nearly a percent, but perhaps more importantly the platinum price is up over two percent. That is just today. And now, for the first time in an absolute age the platinum price has opened some daylight between itself and the gold price. Which is also slightly higher, 1690 Dollars per fine ounce versus 1680 Dollars per fine ounce for the Gold price. I await the responses from government and the unions.

New York, New York. 40o 43' 0" N, 74o 0' 0" W There was some excitement around in some patches of the market, the news that Dell was looking to go private certainly had some tongues wagging and also sent the share price up 13 percent on the session, over three and a half percent in the aftermarket. See -> Dell in Talks to Go Private, Shares Surge. That might sound like good news, but as Mr. T would say "I pity the fool that has owned Dell shares", because the stock is down nearly 55 percent over the last 10 years. Yes, ten years. But, if you were in all those years back, when the company listed, then according to Google finance, the return since listing is basically everything you see in the share price. If you adjust the price for the splits, backwards of course, your entry price 25 odd years ago is 0.001 cents.

The other big news of course was the Apple components orders story, Byron covered that yesterday. The stock took more pain and trades at close to 500 USD now. That is a price from over 11 months ago, so you are getting a years discount, in terms of price. One guy did make a good point, with a quote in Barron's suggesting that with 200 odd of the worlds biggest hedge funds owning the stock, there are bound to be some pretty big reactionary moves. As ever, we see this as an opportunity.

Crow's nest. Stocks are higher here in Jozi for starters, I just caught wind of a Mining: Production and sales number. It does not make for pretty reading. German GDP growth was average, slightly less than expectations. But, futures are slightly higher, if not a whole lot.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment