To market, to market to buy a fat pig. Chinese economic data that beat expectations sent the market higher on the day, benefitting here locally of course were the commodity stocks. We discussed the economic miracle that is and was China over the last decade and a half, that amazing fact about collective GDP in the last three years which were as much as the prior 11 years. There were results from General Electric, who are a pretty decent barometer of global growth, and it was a beat. That was a good outcome, the general commentary about the world's fastest growing big economy were generally upbeat. In North Africa there were still the disastrous and ongoing news of employees stuck in the middle of someone else's ideology. My mother was actually born in Algeria, she spoke of violence as a child and the civil war. Seemingly the violence has not ended.

Barack Obama was sworn in for a second term over the weekend, the celebrations will take place today, it is one of ten federal holidays in the USA. As such the markets will be closed, which is not exactly the best news for us here, we enjoy those markets being open. Bad weather across Europe and the UK led to many a Facebook friend posting lovely pictures of their snowmen, but also travel chaos. I bet you can say that the rain over the weekend was much more fun than being covered in snow. Talking snow, the annual WEF event in Davos starts later this week, I suspect that all I get out of it is a measurement of the confidence of the globe. I suspect that it will be much better this time around.

Jozi, Jozi 26o 12' 16" S, 28o 2' 44" E We were led higher as a result of rebounding commodity stocks, some of which had taken a serious beating in the last week. There were some great conversations around in terms of the Amplats announcements from last week and the subsequent reaction from both labour, the government and the broader public conversation. It was pretty interesting to hear Peter Major, the fellow has been around for some time, and his views on the matter. The whole idea that the platinum industry used to employ only 50 thousand people thirty odd years ago. That is now 150 thousand, which is a 50 thousand decrease from the high point. Business created the jobs. The services jobs created around the company. The jobs that support many more people. Watch this good piece: Panel Discussion: Realities in SA Mining Sector. Make up your own mind.

Richemont have released a trading update for the nine months to end December 2012, and from the initial flash, they seem to have missed sales expectations. At least that is what the screens say in front of me. The stock has been on a tear. The stock is up nearly 70 percent over the last year. And every single time that I have spoken to clients about the company the inevitable question comes up asking, is there any more juice left in the share price? To answer that question one is perhaps best placed to try and understand a few things about the company and their customer base. The company falls into an investing theme that we like a lot that is called aspirational consumerism. The idea that across the globe there are more upper middle class people who are able afford luxury. In China a culture of gifting exists, whereby to seal a deal of most sorts gifts are exchanged.

I might not have a single smart watch, and might not be that sort of person, but many, many people love not only the timepiece but also the longer term emotional attachment. I was once (rightfully) admonished for being a cynic on their product and the buyers thereof. The fact is that most people like nice things. Tutankhamun over 3300 years ago had a gold mask made (along with the matching curse) because it was possibly the *nicest* way of showing off at the time. King Tut had many beautiful artefacts and treasures, amazing for only a ten year reign and bearing in mind that the fellow did not make it to 20 years of age!

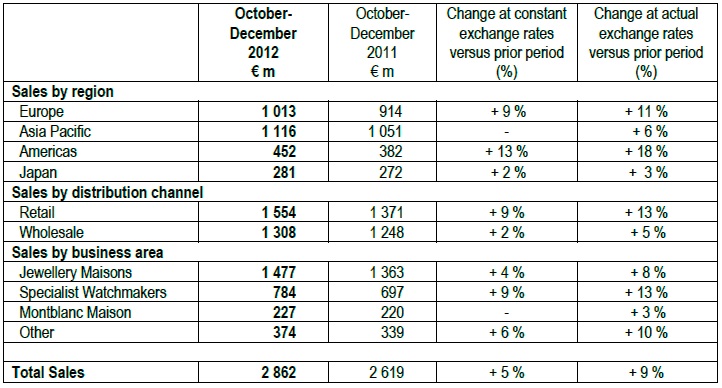

Off the subject, here is the skinny of the announcement, which can be found here -> TRADING STATEMENT FOR THE THIRD QUARTER ENDED 31 DECEMBER 2012: "Following several years of exceptional growth in the Asia Pacific region, in particular China, sales were flat compared to the demanding comparative figures for the same quarter last year." Boom. Rupert (Johann) the bear(ish) warned of slowing sales, in fact everyone has warned of slowing sales in mainland China. Check out the sales table:

I suspect however that this report will be met negatively by the market and perhaps we could see a short term slump, not too dissimilar to that of Burberry. And it turns out that Burberry, after a weak outlook are doing better than most folks anticipated. Out of the blocks the stock fell five percent here in Johannesburg. Slowing Chinese growth points to Chinese consumption going in the wrong direction, at least in the short term. But, as Richemont says: "At this stage, it is unclear how business patterns may develop and how the business in the Asia Pacific region will evolve in the near future. Richemont takes a long-term view in managing its business and will continue to invest in the development of its Maisons." Regardless of the short term demand story, the company will continue to invest. I suspect that anxiety over the Chinese growth story has abated a little, watch Chinese consumption patterns closely. Because strangely enough, notwithstanding Richemont having seen explosive growth in the region, the Chinese authorities having been trying their utmost to convince their general populous to shift to a consumption based mindset. We continue to accumulate the stock, and will use current weakness as an opportunity.

In unrelated news to the sales update, over the weekend there was an announcement that Richemont had entered into a JV with Chinese luxury goods retailer Chow Tai Fook. Now, I can understand you scratching your head, but Chow Tai Fook has a retail network in excess of 1700 stores in 390 Chinese cities. China includes Macau (Chinese Vegas!) and Hong Kong. Chow Tai Fook plans to have over 2000 shops by the end of next year. Just to put it into perspective, in terms of outlets, Chow Tai Fook has as many stores as Shoprite has in both South Africa and across the rest of the continent. As per the Shoprite website, 1740 stores in total. Shoprite's annual revenue in 2012 is around 9.4 billion Dollars at the current exchange rate. Chow Tai Fook is lower at 7.3 billion Dollars, but you get where I am going here. Both companies are very well established brands in their relative markets, of roughly an equal size and scale. The market affords a higher earnings multiple to Shoprite, even though Chow Tai Fook has a bigger market cap (much more profitable selling watches and jewellery).

The deal between Chow Tai Fook and Richemont will see the Chinese outfit sell the Richemont brand Baume & Mercier in mainland China. Chow Tai Fook already sells several Richemont brands already, including Cartier. I suspect that this is a smart move for both companies, Richemont will immediately gain a fresh partner in the wholesale market and Chow Tai Fook will offer what is a very exclusive, but yet affordable brand. The watches retail from anywhere under 1000 USD to comfortably 15 times that price. It is probably fair to say that this falls into the category of affordable luxury and probably does appeal to a new entrant into that "aspirational consumer" of luxury items. Sadly, I am not a consumer, I don't even wear a watch. Neither does Byron or Paul.

New York, New York. 40o 43' 0" N, 74o 0' 0" W Tech stocks sank, courtesy of Intel which sounded some alarm bells from the PC business, whilst blue chips and the broader market were able to register gains in the last hour of the trading session. The big talking point of the day was undoubtedly the General Electric results. More on that in a second. Byron pointed us to an interesting article over the weekend, it was well publicised in our circles. On Thursday on CNBC, the fellow who coined the phrase the "New Normal", Mohamed El-Erian, suggested that might be ending. Then I guess instead of suggesting a structural change back then in 2009, perhaps he should have called it the "short term different". Surely three to four years is a short time in the investment world? Or am I barking up the wrong tree here? Talking trees, I nearly fell out of one this weekend, no really, I was removing some dead wood from a ghastly tree that we have to keep. Because the kids like climbing it, and because it has a swing in it.

Talking of someone who made an even bigger long term call, Jim Cramer in August of 2007 was going nuts, pulling whatever hair he had left out, the famous piece in which he went off about the Fed knowing nothing about the real inner workings of Wall Street. Bear Stearns was at 110 bucks a share, it nearly got sold for 2 in March of the next year, but ended up on the chopping block at ten bucks. A full 100 Dollars a share lower than where it was at the time. John Carney over the weekend wrote a wonderful piece: Jim Cramer Was Right-They Knew Nothing! Now, having seen how crazy Jim actually was (and still is), it is easy to see why the Fed could have laughed at him. But the point that is perhaps well made by John Carney is that the Fed are actually no better at predicting than Wall Street. Perhaps the lessons learnt are to listen to everyone a little closer.

Time to cover the worlds most recognizable industrial company, and an iconic brand that spans every continent.

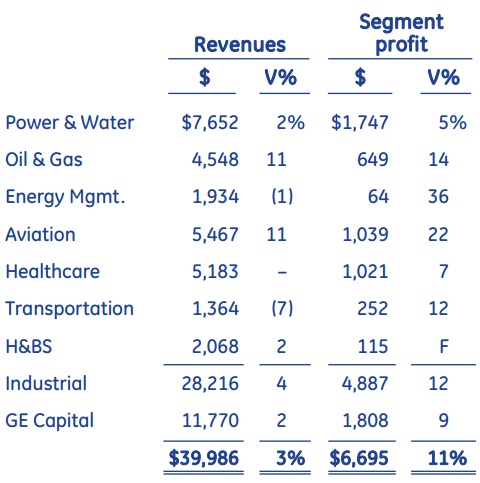

- Byron beats the streets. The very first headline I saw which covered GE's 4th quarter results which came out on Friday looked like this from The FT. GE lifted by strong emerging markets growth. I sense a pattern here. To get a better idea of how the big conglomerate is made up in terms of revenue and profit I hacked this table from their 4th quarter presentation.

Every division here is one I would be happy to invest in except maybe GE capital. You know our long term view on big banks. This is a division they are actually trying wither down while there are certainly good synergies between GE capital and the industrial businesses. And if you were not in the know, H&BS stands for Home and Business Solutions.

As far as developing markets are concerned, here is what the CEO Jeff Immelt had to say in the presentation.

"We ended the year with a strong quarter despite the mixed global economic environment. The outlook for developed markets remains uncertain, but we are seeing growth in China and the resource rich countries. With our largest backlog in history and a substantial amount of cash generated by our businesses in the fourth quarter, we have great momentum going into 2013."

And further down the presentation this was said about the developing world.

"Industrial segment growth market revenues were up 9% for the quarter, excluding FX. For the year, Industrial segment growth market revenues increased 11%, driven by double-digit growth in Russia, Australia/New Zealand, Latin America, China, Sub-Saharan Africa and ASEAN."

So what did the numbers look like? For the full year the company made $1.52 per share or $16.1bn which was up 8% from last year. The quarterly number came in at 44 cents which was slightly above the expectations of 43 cents, pushing the share price up 3% on the day. Expectations for 2013 average around $1.68. Trading at $22 the stock trades on 13.1 times this coming years earnings which is neither cheap nor expensive in my opinion.

If the global economy grows, GE will not disappoint. But on top of that they are extremely innovative. If you browse through their website you will immediately pick up on that and it is hard not to be impressed. The world is getting more and more energy hungry, in fact I saw a tweet just yesterday that suggested that there were still 1.6bn people living without electricity. I cannot even imagine life without a smartphone, let alone the basics that electricity provides. The base is still low and as people become wealthier, the demand for GE products will grow. The stock remains a core part of our New York Portfolios. Here is the full report if you would like a further read.

Crow's nest. Market here are lower as a result of a big sell off in Richemont. Globally markets are a little higher. With a US holiday in place today that means lower volumes across the globe. Oh dear.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment