"That is what Aspen has become, a massive business operating on all the continents, of course most companies do not have a business in Antarctica. What is interesting about the local business is that when the currency had weakened, Aspen maintained their ARV contract with government even though they were losing money, it is/was part of their social contract with the country. Feels not so great as a shareholder, but as Saad said in the interview, they will get it back in time, when/if the currency goes the other way, so it feels good as a shareholder in that a public company is committed to greater society. And that part ties into what we said about companies able to reach a size and scale (thanks to the free market system) in that they are in a position to operate a low margin business."

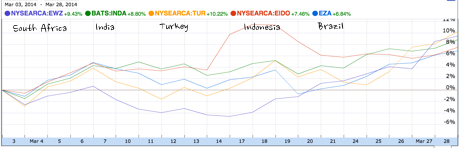

To market, to market to buy a fat pig. I saw that somebody (the BusinessInsider) remembered, I certainly did not remember the "generational low" birthday of the equities market in the US yesterday, the day that the S&P 500 touched an intraday devilish low of 666.79 back on the 6th of March 2009. Five years on to the day, the S&P 500 closed last evening at an all time high at 1877 and a bit, away from the intraday high of 1881.94. By my count that is 1215.15 points from the intraday lows on that sorry day to the intraday highs of yesterday, exactly five years on.

The thing is, there must be some people out there who said that this is it, the market is going much lower on that day. In fact I remember that the "man who predicted the financial crisis" Nouriel Roubini said that the market of course was going lower. I was ironically thinking of Roubini yesterday when I saw the ECB president, Mario Draghi delivering his press conference post the decision to leave rates on hold in the Eurozone. Yes, Roubini had predicted that the US government would nationalise more banks as the markets continued to fall for the rest of 2009. Making predictions is a dangerous business, even if you are credited with being the person that predicted a housing crash. Admittedly he (Roubini) beat on that drum for years, so I guess it is true what they say about an old clock.

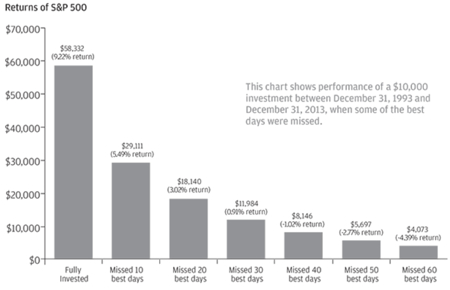

But the lessons that perhaps the meltdown of 2008/2009 had is that in the midst of the selling and panic it is hard to stay focused on the end goal. Because owning a business is one thing, but seeing the value of that business on a screen, with a quoted price (sounds like Cluedo) continue to slide heavily day in and day out, seemingly without respite, that is very hard to suck up. For the record we did not sell a single share in anger, if there were people wanting to cash out because they were spooked, we tried to convince them not to, this would pass. It feels bad whilst you are in the storm, the little surety that you do have is that these events are few and far between as far as an investing history is concerned.

The problem is that history has examples of pre crisis highs not being passed or taking an entire generation, so it is easy to see why ordinary investors can lose the faith. The Japanese asset price bubble from the last day of the 1980's to present still sees the Nikkei 225 comfortably below its all time high. 6 March 2009 the Japanese index closed at 7173 points, currently at 15256 points. But 38957.44 is the all time high of that index, dated to December 29th 1989. Wow. That was a long, long time ago in a land very, very far away. Since then the sun has struggled to rise in the land of the rising sun. So when does 15256 points, the current level, reach the all time highs of 38957.44 points again? Another decade? Perhaps more.

Another good example of hot markets that failed for a generation again to reach their high water mark again was the Great Depression stock market sell off. 25 years is certainly a long time to wait to get back to the levels last seen. The Dow Jones Industrial Average high of 3 September 1929 would not be seen until 23 November 1954. Of course there was also a major war in-between to take into account. However, it is important to note that one Dollar in 1929 was the equivalent of 1.57 Dollars in 1954, so on an inflation adjusted basis it took even more time. You could have, if you subscribed to Dollar cost averaging you might have definitely been in the pound seat by the time you retired.

But the more recent example is the dot com bubble. The Nerds of NASDAQ printed an intraday high of 5132.52 points on the 10th of March 2000. The intraday low on the 6th of March 2009 was 1265.52 points. Heck, it would have felt absolutely awful back then, it did feel bad, I remember it well. Currently however the NASDAQ level is 4352.13 points, we need another fabulous year like last year just to reach the highs of 2000. A Dollar in 2000 however is not a Dollar in terms of purchasing power in 2014. 1 Dollar of purchasing power in 2000 is equal to 1.36 Dollars in 2014.

Inflation, that pesky little thing that eats into your purchasing power. Which is why of course you must continue to own stocks, which almost always outperform inflation. I was doing an informal tutorial with my daughters last evening, my eldest said that she had a one cent coin from 1991 (Two Cape Sparrows on the front according to the SA Mint site), but in terms of current circulation a five cent coin has not been minted since 1 April 2012. What is quite interesting about our coins is that different languages are used when the coins are minted in a particular year, with a rotation of the official languages using two at a time. A Ten Rand coin would eliminate one of the big five notes, hopefully that is in no way connected to the extinction of the Rhino.

OK, but I think the most important point to make is that when markets enter bubble territory the valuations are very expensive, relative to historic norms. Or growth rates are overestimated. Future earnings are way too optimistic. Do I think that we are there? Hell no. But others use Shiller P/E, which suggests the market is 54.5 percent higher than the long term average, but that uses very depressed earnings that suggested that based on actual earnings from Q1 2009 the market was valued at 123 times earnings.

Yowsers, but stocks anticipated that profitability would quickly return and it did. Using a huge distorted period that during that time was compared to the worst draw down since the great depression. Fair enough, but surely if those were generational lows and the indices were too skewed to financials, the massive amounts written off by the banks, nearly 1 trillion Euros over the period surely skews this? Yardeni suggests that the market trades on 15 and a bit times forward. Time will tell, but I think that stocks individually should be separated from the rest of the index. Apple trades on a cheaper multiple than Starbucks for instance, should it? The market says so.

Stay the course, own the quality, that theme has been beaten into us. Do not get spooked by sell offs, they always feel bad. The reason why I think that many people are looking for corrections are because we have had two very big ones by historic standards over the last 15 years at a global level, the dot com bubble bursting and the US mortgage crisis which spread to a European sovereign crisis. What is next? A Chinese credit meltdown?

It is possible and could well happen, the Chinese are painfully aware that the infrastructure boom needs to shift to a more sustained consumer sustained economy. It is happening, it just needs to be managed. Having large growth rates off increasing bases, last year the official statistics suggested Chinese GDP was 56,884.5 billion yuan, an increase of 7.7 percent from the previous year. With expectations of around 7.5 percent, the size of the Chinese economy is set to be 61,150.8 billion yuan, or just shy of 10 trillion Dollars. Nearly there guys, nearly there. Of course this is presuming that there are no shocks to the system, there are still signs of strain, with the first corporate default (a small solar company) in mainland China today of all days.

Aspen released half year results to end December yesterday afternoon. First question, why healthcare, why generics, why this company? Well, the whole idea that there are more middle class entrants globally with more access to therapies that they can afford, and that have become more affordable over time. There is no doubt that healthcare is just as much a demographics story as an other adoption of technologies that people want and need. I for one have no problem with expensive therapies, because the more adoption of these therapies, the cheaper that they become and that means that humankind gets to live healthier and fuller lives. That is why healthcare, that is why this company answered.

You would remember that comparison a few weeks ago of the developed world 150 years ago and now, and how childbirth and infant mortality rates plunging are a direct result of advanced healthcare. Sadly, as Warren Buffett puts it bluntly, it matters whether or not you win the ovarian lottery or not. It is far better to be born in Stockholm today than it is in say, ummmm Timbuktu? With all due respect of course to Mali, it is not Sweden, and not everyone has an even chance in life.

And that is where I think that generic pharma companies fall into the equation, the fact that they are profitable is great, because that means that they will continue to roll out cheaper therapies to customers that previously could not afford it. You might well know that the major pharma companies spend over 100 billion Dollars a year in research and development, their medicines justify the price. Unfortunately, because it is so incredibly emotional, healthcare that is, it feels awful when you have to fork out huge savings for the saving of a life. But then again, what is a life worth?

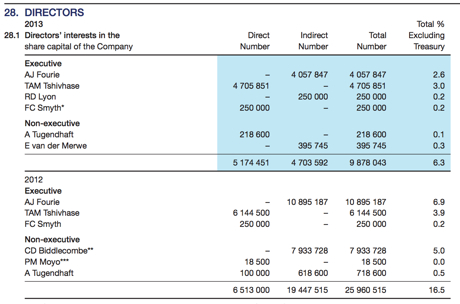

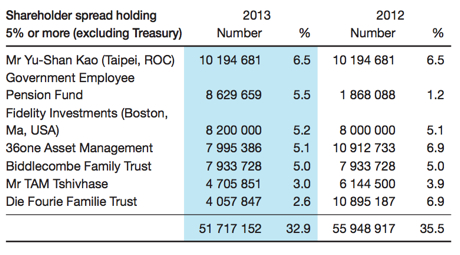

OK, we are close to existential argument domain, and that in itself is tricky and comes with a giant fat avoid!! So let us stick to the company that has certainly created an extraordinary amount of wealth for its shareholders, which includes some of the smartest management that there is. Talking of which, I was told that Stephen Saad, founder and CEO, has travelled on Kulula internally in South Africa, and as you know, there is only one class there. That tells me that the man in his official capacity as CEO is focused on the costs of the company, he should after all, he is a big shareholder, he owns bucket loads of shares. Which he acquired at 55 odd cents. What!!! He owns 12.1 percent of the company, 55 132 421 shares in total. At 281.5 ZAR a share he is worth 15.519 billion Rand. More than 1 billion Dollars. Another reason to own the company, the chief has your best interests at heart.

Bronwyn Nielsen had a great interview with Stephen Saad last evening -> ASPEN H1 REVENUE UP 33%. You can see a couple of things from this interview, manufacturing of course all in South Africa (the bulk) is a bit of a problem, but it has worked recently for the company as the Rand weakened significantly last year. This year, since the bottom of around 11.30 to the USD to somewhere around 10.60 currently. 71 percent of operating profits however are as a result of their offshore businesses. 32 percent Asia Pacific, that region is growing quickly, with early stage businesses in the Philippines, Taiwan and Malaysia. One of the most exciting however are the Latin American businesses, as well as the recent Russian business. Yes, Russia is an exciting and big opportunity.

That is what Aspen has become, a massive business operating on all the continents, of course most companies do not have a business in Antarctica. What is interesting about the local business is that when the currency had weakened, Aspen maintained their ARV contract with government even though they were losing money, it is/was part of their social contract with the country. Feels not so great as a shareholder, but as Saad said in the interview, they will get it back in time, when/if the currency goes the other way, so it feels good as a shareholder in that a public company is committed to greater society. And that part ties into what we said about companies able to reach a size and scale (thanks to the free market system) in that they are in a position to operate a low margin business.

An amazing business with loads more irons in the fire, including the exciting biopharma space (extracting mucous from pigs stomachs to produce therapies, as well as urine from pregnant women to help with fertility drugs), to the less exciting but has just as good prospects, infant formula business in Latin America. There is loads on the go, which means that the company is difficult to value at any one given time. The market research analysts in aggregate has the full year EPS number to June at over 11 ZAR, which means that Aspen trades on 25 times forward at current levels. Not cheap. Sometimes however, for quality businesses, you have to pay up.

Aspen has been perpetually expensive, even when the company was one tenth of the current share price. The yield is negligible and will remain that way as long as debt levels remain high as a result of acquisitions (gearing over 50 percent currently), but that may change as the company matures.

So what to do as a shareholder? The company has a great management team an entrepreneurial nature, decisions are made by those empowered to make them. That is a huge positive to find a company of this size and scale (but still small by global standards) with these growth prospects. We continue to add, the company ticks all of the boxes of a core part of ones local portfolio.

Michael's musings: IPO Boom

This year has seen the highest number of IPO's in the US since 2007. The number is currently 42 that have gone public, and there are many more in the pipeline. So why so many listings this year? There are a couple of reasons, the first is that the evaluations on companies is higher than it is has been for the last 5 years, making it advantageous to list now. Another reason is that legislation has changed to make it more attractive for smaller companies to list.

Having more IPO's is great news for investors and the economy. For investors, the more companies that are out there the more options that you have and the more diversification you can have in your portfolio. Another good thing is there are now more companies out there for all the money flowing into the market on a regular basis from retirement saving. With more investment options it should mean that less of a premium is paid on the earnings of other companies, making buying companies cheaper.

Out of the 42 IPO's this year, 23 have been in the Health care and Biotech space. These companies are now able to raise cash at higher rates than over the last 5 years, which they are putting into growing and R&D. I don't know about you, but the more money that is spent in the medical space the better, I'm hoping that by the time I am due for a major "old age" related operation, medicine has got to the point where it will be non-invasive. A pill adapted to my DNA or a couple of Nano bots crawling around me doing their thing, less pain (I would hope) and more efficient.

Just under 66% of the IPO's were for companies that have turnover less than $50 million, which makes them very small with great potential. I would not be putting my money in a small company unless I had intimate knowledge of the company and industry, otherwise I think that the risks are too high and approach gambling. IPO's are risky where a number of these companies will probably not be around in the next decade, but a couple could turn out to be the next Aspen or Apple at which point they will be changing the world.

Home again, home again, jiggety-jog. Markets are flat here mid morning, the Russians are faced with prospects of being isolated by their mani trading partners or to comply, I wonder what move next, but I would think that it is smartest to back down. And remember, or don't forget should I say rather, today is non farm payrolls, it could as a result of the weather turn out to be a damp squib.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Email us

Follow Sasha, Byron and Michael on Twitter

011 022 5440