To market, to market to buy a fat pig. We had to be in catch up mode here in Jozi, so whilst there were markets "under pressure" across the globe as a result of a weaker Chinese PMI number (that was more than balanced by improving European data, PMI manufacturing and services data improving) we bucked the trend here in the city founded on gold. My eldest daughter told me when practicing her Zulu last evening at homework time that Joburg used to have gold "a long time ago", hence the name eGoli. I had to explain to her that there were still a fair share of gold mines around the province and the city. Perhaps she was thinking about Kromdraai! Westonaria is still inside of the border of Gauteng, the province that houses the most people in the country. But yet it (Gauteng) covers only 1.5 percent of all the land mass in South Africa. An estimated 12.7 million people live here, another 40 million live in the other eight provinces. This is certainly where all the economic action happens!

Gauteng employs (in the official reports) more people than the whole of KZN and the Western Cape put together, according to the last Quarterly Labour Force Survey, Quarter 4, 2013. Mining sadly contributes only 3.3 percent to the entire Gauteng economy, in the North West it is as much as one third, this current quarter is going to be a disaster for that province. Equally, mining contributes nearly 30 percent to Limpopo province's economy. And just over one quarter to the Northern Cape's economy. And just under one quarter to the economy of Mpumulanga province.

Gauteng? We are all about Financial services, government services, retail and manufacturing. Some would argue too much government, not enough private services. Gauteng contributes nearly 35 percent to all economic output in South Africa, whilst the Western Cape contributes 14 percent and KwaZulu Natal 15.8 percent. So 1.5 percent of the land mass, with approximately 24 percent of the population of South Africa account for 35 percent of the countries economy. Respect Gautengers. And at least they can say (for now) that we have two good rugby teams, along with three good football teams. Dale "crazy eyes" Steyn is from Phalaborwa. Which is home to the widest man made hole in Africa. I have played cricket in that town on that cricket field that is not far from that mine and if I remember right, it is marginally inside of the park. The local team said that a cricket practice was interrupted by lions at the bottom end of the field. I can't say whether or not that was the truth. Anyhows, Dale Steyn is awesome. That is all.

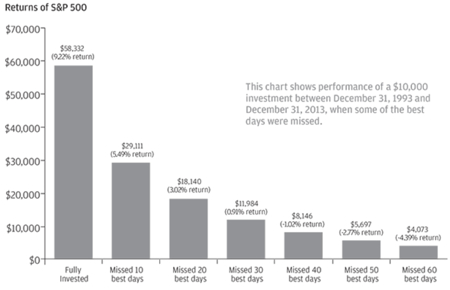

Back to the markets in Jozi, industrials and in particular Naspers which roared ahead over five and a half percent after a torrid week from the 10th to the 15th of March. And through to Thursday last week, we should rather say a torrid two weeks. We are back to levels, as of yesterday, last seen on Valentines day this year. So around five weeks ago for those of you who are NOT hopeless romantics. Now this is going to take a turn, talking about hopeless romantics, this chart over the last twenty years is from a JP Morgan piece of work, via the Business Insider page How A Few Poorly-Timed Trades Can Torpedo Two Decades Of Healthy Returns titled Guide to retirement. The chart in question (BI's chart of the day), which is designed to show one thing only; it is better to be invested at all times rather than trying to "time" the market.

The chart (number 29) of the presentation has some powerful and useful insights. It is titled common misconceptions when dealing with retirement.

But what I really wanted to show you was the chart that the Business Insider had centred their piece on, the JP Morgan slide show on the one chart that showed if you had been "jobbing" the market i.e. trading all of the time trying to get in and out at "opportune moments" is hard at the best of times. It turns out that the mom and pop approach, and in fact the approach over here at Vestact is that it is far better to be fully invested all of the time when owning equities. Check it out, the difference over a twenty year period of missing only the ten best days in the equities market is astonishing. Your average return over twenty years, if you stayed fully invested would be 9.22 percent per annum, if you missed just ten of the best days trying to time the market, you would have only a 5.49 percent per annum return.

The moral of the story is twofold. Trading is exceptionally hard, and like golf or tennis, there are the superstars of their fields, this one is no different. In other words the chances of you being a scratch golfer are probably better than you ever making money actually participating in tournaments. The same could be said with the trading types that exist everywhere. The second one is far simpler to understand. And goes to the core of our investment philosophy. Sometimes doing nothing is the very best thing to do. It makes you the most money over time.

Famous Brands have announced a relatively small transaction this morning, but for many well to do Joburgers, Durbanites and Capetonians, even the lovely folks of Port Elizabeth and Bloemfontein will know the frozen yoghurt franchise Wakaberry. Frozen yoghurt is perceptually healthier and perhaps even tastier than Ice Cream. Depending of course on the size of the cup that you choose and depending of course on the toppings that you put on your frozen yoghurt, that may not be entirely true. I have been only once to the store in Lonehill and enjoyed it immensely, I can't say whether I felt better for having chosen the "healthier" option or not. Currently all food that falls in the "junk" category is banned from the menu, courtesy of my lent decisions. Sigh. Sad but true.

The quantum of the transaction, for a 70 percent stake in a business founded by husband and wife (Ken and Michele Fourie) as well as a fellow by the name of David Clark. It was established in Durban, May 2011 and currently has 33 outlets, looking for over 40 by the end of the year, with "new opportunities" and "coming soon" franchises in places like Parkhurst, Blouberg, Richards Bay, Kimberly as well as Midrand and East London. They (the website) calls it the Froyo (Frozen yoghurt) culture. And whilst we were originally singing, badly I might add, that Shakira slash Freshly Ground World Cup anthem, believe it or not the name of the shops/brands were actually inspired by that very song.

This is of course classic Famous Brands. Not too dissimilar to Warren Buffett really, finding a family run smaller franchise opportunity with the recent examples being Vovo Telo, Tashas and Giramundo, keep them in the business and grow the base with the folks passionate about the brand keeping their best business practices each and every day. Also, as the company points out, they look for new categories and the market leader. Kevin Hedderwick in the release: Tip of the iceberg as Famous Brands enters joint venture with WakaberryTM Frozen Yoghurt Bar says that Wakaberry has the ability to become a "Superbrand" in this country. Good. We continue to add to the stock where we see fit, the quality remains. Ironically, for a company with such amazing brand footprint, the market cap is 10.3 billion Rand. That puts them in the ranking tables alongside Oceana and Murray & Roberts. But I guess with Adcock Ingram, who is now smaller than Famous Brands, it is bigger than I thought!

Byron beats the streets on the coolest product in a long time yet

Last night we received an announcement from 2 of our recommended stocks listed on the NYSE. Its very exciting actually, Google Glasses have struck up a relationship with Sunglass manufacturer Luxottica. Remember I did a write up on Luxottica, the manufacturer of brands such as Oakley, Ray-Ban and Arnette sunglasses in a piece titled Lifting the shades on eyewear.

Basically you will now be able to buy Ray Ban framed Google Glasses (if you do not know what Google Glasses are, Google it). This adds a certain cool factor to these glasses which lets be honest can look very nerdy. I think it is a great deal for both businesses. Luxottica will get a whole new set of clients and it brings in a technological element to their business exposure (the stock was up over 3% following the announcement). Google will get the much needed cool factor plus access to the millions of existing Luxottica clients through their well established retail networks such as Sunglass Hut.

I guess the most important question to ask is whether these Google glasses will be a success? I see huge potential. Starting on a commercial basis many professions could benefit from such a device. Engineers, Doctors and Architects come to mind immediately.

Then there is an activity element that I find very exciting. It was actually a client of ours who Tweeted this a few months back. It's titled 'Race Yourself' turns Google Glass into Virtual Reality Fitness Motivation. Basically you go for a jog which sets the initial pace. The next day you run the same route but this time you are chased by virtual zombies projected by your Google Glasses at the same pace as your run the previous day. How cool is that! This would fit in well with Luxottica's sports range with frames built for activities (Oakley).

All in all a great deal for both exciting businesses, we continue to add to both.

Michael's musings: Gold

Over the last couple of months I have come across a couple of articles predicting that the market would collapse and drop by about 40% this year. Here are a few examples, all rather doomsday:

Why the Next Stock Market Crash Will Happen Any Day Now

Or this one is a classic: These 38 "Prime Season Dates" Could Crash Proof Your Portfolio

Another one, gold bull extraordinaire: Don't write off gold just yet: Jim Rickards

Their solution (often) is to buy gold or by extension gold stocks. Here at Vestact we don't see the market crashing this year; companies are reporting record earnings which explains the rise in stock prices over the last couple of years.

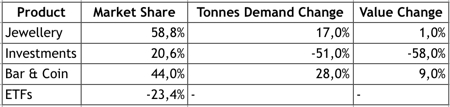

The focus of this piece however is on gold, is it really a hedge against the "end of the world"? What are the current demand and supply forces of gold; which ultimately determine the price of the commodity. Demand for gold fell by 15% last year, mostly due to ETF's selling their reserves. Here is a summary of the gold market:

*Bar & Coins and ETFs both fall under the investments category.

A few things to note from these stats. The first is how even though jewellery demand was up 17% for the year, the value of jewellery demanded was only up 1%, in other words a large part of the increased demand was due to the lower prices of gold. Also the biggest buyer of coins and gold bars was China; from what I can tell it comes down to their saving nature and gold is seen as a vital part of any portfolio, the people would rather have a commodity in their hands than a piece of paper.

The big selling from the ETFs is due to investors thinking that the economy is not as bad as previously thought and that QE is not causing great amounts of inflation (at the moment there are some concerns of deflation).

One assumption of buying gold for a market crash is that gold will do well under such circumstances. Having a look at the last 3 big crashes (1987, 2000 and 2008), the gold price does rise after the 1987 crash, it does go sideways during 2000 and in 2008 it fell sharply. It was only when the FED announced their QE program that the gold price started to tick up again. During times of great distress the price of gold does better than other assets, but probably not to the degree that most people think. A large part of gold demand is for jewellery, which when there is a crash the demand drops off. This drop in demand needs to be taken up by ETFs and people buying gold bars before the price of gold rises.

The next assumption is that gold stocks will do just as well as the gold price. This assumption does not hold during times of crisis though. The gold stock index over the last three crashes has done worse than the gold price, which is worrying if you are buying gold stocks as a hedge against a market crash. This probably comes down to all stocks suffering when the general market gets hit. Also not all gold stocks are equal, some are far better quality than others, so if you do like the product that they sell, make sure that you are buying the best in the sector.

My view on buying gold, is to rather buy a gold ETF. That way you have direct exposure to gold and don't have company risk associated with your investment.

The stock I would rather buy though when it comes to gold is Richemont. A large chunk of gold demand goes to jewellery, and as people get richer they will buy more jewellery; an added plus for Richemont is that high end jewellery is also considered a safe haven.

Home again, home again, jiggety-jog. Most stocks are up. The Russian/Ukraine crisis seems to be dissipating, I read that as much as 60 to 70 billion Dollars in this quarter could make its way out. Someone else (methinks a blogger type that I read) said not to worry, the Russian government owns around 60 percent of the equities market there. Perhaps they could own it all. Ah well.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

011 022 5440

No comments:

Post a Comment