To market, to market to buy a fat pig. Thursday was a lifetime away. I suppose if you were born on Thursday, then yes. But you know what I mean, sometimes being "away" from the markets means that there is a little time for reflection, some time for you to see whether or not it matters that you are sitting at your desk. And each and every time the answer is that life goes on without you. Quit this existential stuff now!

Markets locally on Thursday ended the day off around one third of a percent, after having started the day in a worse place. Worse of course for the bulls, not necessarily the bears. It must be just as tiring to be a relentless pessimist as it is to be an eternal optimist. There is always a sense that "things" are going against you, when the truth is that the collective swing the value of equity markets one way or another. It was futures closeout on Thursday, which meant a broader market midday auction, I swear that we are so far away from the "trading" aspect of the market that we took a couple of minutes to figure out what was going on. We knew it was closeout, Michael (who has some trading experience) had to point out to us what was happening!

But that is the opposite end of the market to where we sit, believing that the stock prices over a longer dated period will reflect the quality of the business. Often in having the conversation with clients about timing the markets, I always fall back to an argument of it matters what you buy in the end, rather than when you buy, provided of course that you plan to stay invested for as long as you can. Sasol listed at a buck back in 1979, it probably isn't the best example, because oil prices and the currency fluctuate, but if you had been really patient all this time, you would have been well rewarded.

Perhaps a company like Tiger Brands is a better example, a food business that sells into an ever richer (relative to yesteryear) and increasing population. The same products, slightly tweaked (jungle bars and jungle crunch are examples) for the modern market. However, there is nothing "transformative" about Tiger Brands and their products, the company is never going to attract a subset of investors that think the stock is "hot", because how can you really shake things up when selling food products? Better examples of that are businesses like Amazon.com, but you are paying a speculative price for the best estimate of future earnings.

Tiger Brands trades on a forward multiple of less than 15 times earnings, with a dividend yield of 3.6 percent, pretty much inline with their market peers, Pioneer Foods and AVI. However, Amazon.com, which is changing the future of retail as we know it, trades on a price to book of nearly 17 times, a price to earnings multiple of nearly 95 times forward, but yet the analyst community suggest that the company is still a buy. Because of course you could get everything delivered to your front door in half an hour, from having had your order processed and paid for to actually receiving the goods. One manufactures goods, the other is changing the future of retail as you know it, and as such the market collective are affording the companies very, very different ratings.

Over to the close Friday in the US, the S&P 500 started the day at an intraday record high, but ended the session lower by around one three tenths of a percent. A 17 point swing in the day feels like the collective Arsenal fan base Saturday afternoon. So much anticipation, so much disappointment, do not worry, here is to Arsene Wenger's next 1000 games, although that would probably mean that the guy would have to be there until he is 80, that sounds too hard!! What is pretty interesting is that the Dow Jones peaked at the end of last year, but yet the S&P 500 printed a new intraday high Friday. Why? Well the broader market is always going to be a fairer reflection of the collective, and the Dow Jones is a "chosen" index by journalists, whose predecessors (Charles Henry Dow) made up an index to get relevant with the times in industrial America.

Of course the same fellows who chose the constituents of the Dow Jones Industrial Average try and keep it relevant, Nike, Visa and Goldman Sachs were added in September of 2013 at the expense of Alcoa, Bank of America corp. and Hewlett Packard, but surely the S&P 500 is a "better" measure, where the broader market participants decide what value to give the companies right now. Ten years ago Eastman Kodak was in the Dow Jones Industrial Average, granted that the shuffle saw them dropped on the 8th of April 2004, but the stock had already gone from a high of 91.50 USD in 1997 to 25.44 by the time they were booted to bankruptcy in January 2012 and subsequent emergence in September 2013. The all-time high share price for Eastman Kodak was around 105 Dollars in October 1987. And it is basically zero now. Kodak were once synonymous with photographs and memories, now they want to be a high tech printing company and touch screen technology, as well as smart packaging. Michael told me all of this, remember that he once had a look at Eastman Kodak, last year. It all ties in *nicely* to the Tiger/Amazon comparison. Buy quality, but for crying in a bucket, pay attention at all times.

Year to date the Dow Jones Industrial Average is down 1.65 percent, the S&P 500 is up 0.98 percent, whilst the NASDAQ is up 2.4 percent, so no guesses as to which sector has been driving the market year to date. Another week and the year will be one quarter finished, time really does speed up as you get older. A bean counter once had a sensible argument as to why perceptually you believe time does speed up as you add years onto your life and the reason is that when you are one, adding another year (doubling to two) is basically another 100 percent from where you were initially. But when you are 49, adding a year is roughly only two percent (thereabouts). As such, his conclusion was the older you get, the more time seems to rush by. Of course we all know that a day is a day, regardless of whether you are ten or ninety years old. But a good explanation, I thought.

Talking about Nike being a Dow constituent earlier, the company reported results on Thursday evening after the market had closed. Initially the market reacted positively to the number, that were an earnings beat, but the guidance about the stronger Dollar impacting on sales through to 2015 put a lid on that enthusiasm. This was for the third quarter to end February, that is why the results feel out of whack with the rest of the market, Nike's year end is May. Perhaps there is a lot to be said for breathing that fresh Oregon air. A relatively small state population wise, ranked 39 out of the US states from a density point of view suggests that there are wide open spaces to test the best athletic gear in the world. Nike headquarters are not even in Beaverton, which itself is around 10km from the state capital of Portland. I guess with fresh air and blue skies, the Nike engineers can do their stuff. In late September I wrote a detailed piece about the company, for a refresher -> Nike runs hard!

Nike owns Converse (since 2003) and Hurley (since 2002), but they are smaller contributors to the company's overall sales, no doubt they will grow in years to come. I guess the association with hip lifestyle slash skateboarder means that the market is smallish. Hurley sponsor a whole host of athletes that I have never heard of! I suppose I should pay more attention, but I have never surfed and my skateboarding leaves a lot to be desired. The strength of the parent company Nike however is their footwear, I have used Nike to run for nearly 15 years. I have never had a problem with injuries, but perhaps that is because I run too slowly!!

North America is still Nike's most profitable region, about as profitable as their Western Europe, Greater Japan and Emerging markets regions put together. Japan is a tough market, the company generates only around 20 million Dollars a quarter in EBIT from that country. Japanese Dollar revenues were hit hard by the strengthening Dollar, down 9 percent, with apparel sales falling 16 percent in Dollar terms. Overall on a 9 month basis revenues in Dollar terms increased over 9 percent to 19.092 billion Dollars, EBIT increased by 13 percent to 2.665 billion Dollars. The company as you can see, is very profitable. People in emerging markets are still buying sports apparel at a breakneck speed, excluding currency changes apparel sales grew 31 percent in the quarter. Nike would want Manchester United to improve their season and get a Champions League berth, I am pretty sure that it really matters to their sales. I suppose the weekend results (even though they themselves won) did not go in their direction.

The World Cup is 79 days away and some hours from kick off, that should get you through winter!! Nike sponsors the hosts and France, as well as England and the Netherlands. Adidas host the rest of the real contenders, Argentina, Germany and Spain, whilst Puma sponsors Italy, Uruguay, Cameroon, Ghana and the Ivory Coast. So if you are a Nike shareholder, you would want all those countries to do really well. England have a tough group, group D, where they find themselves with Uruguay and Italy as well as Costa Rica. Poor Costa Rica. Who are sponsored by Lotto, the Italian sportswear manufacturer. Interestingly Manchester United and Barcelona (ha-ha, what a victory last evening against their arch rivals!!!) sell more shirts than any other football club and both are sponsored by Nike.

Perhaps that is a good note to end off on, the fact that the market is dominated by Adidas and Nike, collective they have 26 percent of the global sporting goods market. Which might sound a little light to many people, Nike has around 14.6 percent and Adidas 11.4 percent. So there is ironically a lot more room for dominance by both these apparel and footwear (and equipment) manufacturers. Nike have only been in football for 20 years, pushing a lot later in a cycle where Adidas have had double the time in football. Nike dominate in North America with all their premium products at uniquely American sports, baseball, gridiron football, basketball and ice hockey are pretty niche sports, but there are of course many different codes of sports (and equipment) that Nike do not participate in. Gym equipment, big ticket items such as treadmills, stationary bikes, even bikes themselves would all attract a premium if they were Nike manufactured, I have no doubt.

But sticking to their knitting and being a high margin and quality business is possibly much better for shareholders, which of course include a significant holding by Phil Knight, the founder. If he converted his shares away from the ones with voting rights (he has around 75.6 percent of the A shares) to B's, he would own roughly 15.8 percent of the company. Yowsers. He does from time to time sell and donate money to charitable causes, and whilst this may be a problem, the company does also embark on pretty aggressive share buybacks.

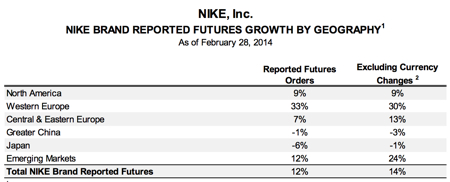

So where to from here? In their annual report 2013 .pdf the company says that they are a growth company. The current results report has a segment titled future growth by geography, and the 2014 predictions, are muted, in terms of shorter term growth prospect. "Futures orders by geography and in total for NIKE Brand athletic footwear and apparel scheduled for delivery from March 2014 through July 2014, excluding NIKE Golf and Hurley." Here it is, the table:

So, a growth company with low double digit growth, on a 25 earnings multiple. That I think is the part that spooked the market Friday, sending the stock down 5 percent. So whilst the earnings actual (76 cents per share for the third quarter) beat expectations, many lowered their earnings for the full year. So this is how currency movements (violent ones at that) can have a marked impact on the sales of a global business, like Nike. Notwithstanding that, we really do like the aspirational consumer element to this company, they make quality products that both rich and middle income people want and do buy. We continue to add to the stock on weakness.

Byron beats the streets on TenCent, and the impact on Naspers

If you are an investor in Naspers you would know or at least should know that their Tencent stake is extremely influential on their share price. In fact if you plot the Tencent share price to the Naspers one the correlation will be very strong. I was asked on CNBC the other day whether management would be worried about the share price movements of Naspers in relation to the volatile Tencent price. My short answer was no, management would not be focusing on the share price, they will be focusing on operations within the business and whether they still think Tencent is a good asset under the Naspers umbrella. If you look at the direction of the Naspers business model, Tencent fits in perfectly with the mix. I expect them to hold that stake for many years to come, if not forever.

I am not going to go into the details of the valuations of Naspers, Sasha updates that very six months or so. Today I am going to look at the Tencent 2013 full year results which were released last week.

If you are uncertain of the Tencent business model I have covered the company before where I look at the details of the business here Tencent Q1 2013 Results.

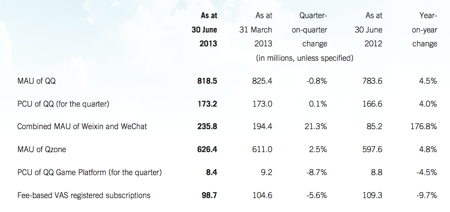

But for a better idea here is a table which shows you the trends of their users. MAU stands for Monthly Average Users and PCU stands for Peak Concurrent Users (peak users at one given time).

Revenues for the full year increased 38% to $9.9bn while operating profits increased 24% to $3.1bn. Wow those margins are huge. The reason the share price fell so much on the day was because for the fourth quarter operating profit actually decreased 1%.

There was valid reasoning for that however. They are busy migrating their main QQ platform from a primarily PC experience to a mobile one which has been expensive. It is imperative that they stay ahead of the times.

Operationally here is what management had to say about the year.

"In 2013, we accelerated the mobilisation of our services and reinforced our leadership in mobile applications in China. Building on our strengths in communications and social platforms on mobile devices, we expanded the user base of various mobile applications, such as news, music and utilities, and launched new services on our core mobile platforms, such as Game Center and Weixin Payment, which enhanced user engagement, while opening up monetisation opportunities. We also extended our leadership in online games and open platforms, while expanding our online advertising business and our eCommerce transactions business."

On paper it is a fantastic business and it has done extremely well. Trading at 41 times 2014 earnings it is however expensive. As a Naspers investor you can look at the Tencent results directly but also be assured that the Naspers fantastic management team are doing the same thing in more detail and understanding it far better than you and I. The asset is being monitored by trusty hands. We continue to add to this amazing array of businesses.

Home again, home again, jiggety-jog. We have to catch up, and whilst there is added anxiety about Chinese PMI numbers, European similar numbers were better than anticipated. We are up over half a percent today.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

011 022 5440

No comments:

Post a Comment