To market to market to buy a fat pig. Yesterday was one of those days that you will always remember. I remember when African Bank went to zero, it probably spent more time that day in volatility auctions than trading freely. Other days that come to mind would be the day after Brexit and then the day after QE was announced (that was a good day).

It was carnage for Dr Christo Wiese in particular, where over and above the Steinhoff train wreck, all his other companies also sold off heavily too. Shoprite was down 5.9%, Brait was down 5.2%, Invicta was down 3.1%, Tradehold was down 3.2% and Pallinghurst was down 2%.

I suspect that over the coming days we will get SENS announcements from some or all those companies saying that Wiese has sold some of his shares. What the above graph doesn't capture is that Wiese owned some of his shares using debt, or the use of leverage to boast his returns with an appreciating share price. The problem with leverage is that it bites hard when a share drops, more so because as soon as the share drops the bank lending you money tells you to sell your shares to pay their debt.

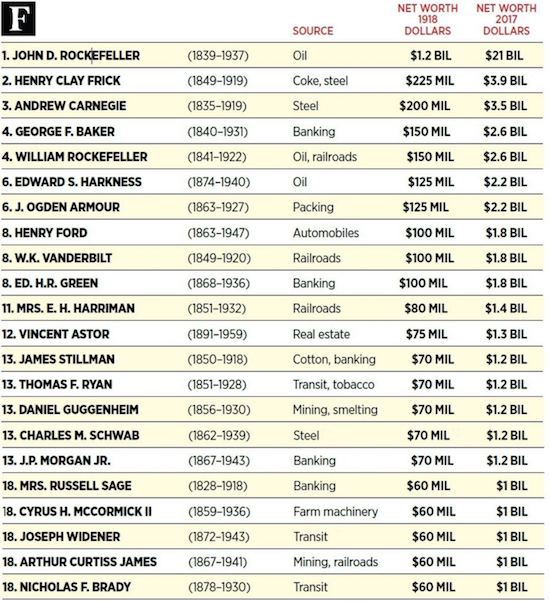

In September 2016, Steinhoff issued a whole bunch of shares to help them pay for the US purchase of Mattress Firm. Wiese bought 314 million more shares at a price of EUR 5.055 per share, for a total value of EUR 1.587 billion. Wiese may be one of the richest men in the world but to come up with EUR 1.6 billion im cash is not easy. To raise the money for the new shares he had to borrow it. To do that he had to use existing shares as collateral.

"have pledged to Citigroup, Goldman Sachs, HSBC and Nomura International Plc (together the "Financing Banks"), 628 million ordinary shares. . . Rand Merchant Bank, a division of FirstRand Bank Limited, provided additional facilities to companies controlled by Dr Christo Wiese."

He bought his shares at EUR 5.055, last night the stock closed at EUR 1.14; his collateral went from being worth EUR 3.14 billion to now only being worth EUR 715 million. I don't know how much he borrowed from the investment banks but if it is more than those shares are worth, he might be a forced seller. Selling now means that he is locking in his losses. Ouch!

To add insult to injury, less than a month ago Wiese bought 2 000 000 more shares at R61.46. He bought them through a single stock future, meaning more leverage. I have seen a number of people saying after the fact, that it was clear Steinhoff was going to implode. Wiese, a seasoned business man and Steinhoff insider wouldn't have bought R 123 000 000 worth of stock (using debt), if he thought the company was on the brink of implosion. Having a dispute with a business partner is not uncommon. Going to court over tax structuring is not ideal but again not uncommon for a multinational company. When operating in just one country, tax codes are pretty black and white. When you start operating across the globe, things get very grey and loop holes appear.

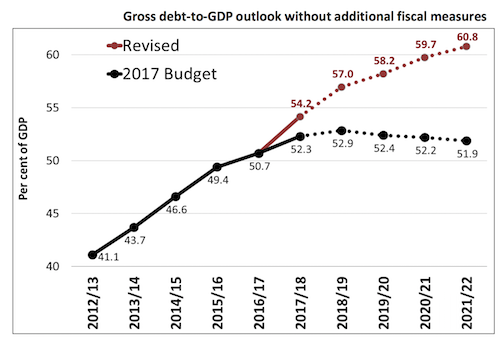

It currently looks like the reason for Jooste's resignation relates to Steinhoff overstating the strength of their balance sheet, allowing them to get better financing rates.

Market Scorecard. US markets fluctuated between green and red the whole day. The Dow was down 0.16%, the S&P 500 was down 0.01%, the Nasdaq was up 0.21% and the All-share was down 1.64%.

Linkfest, lap it up

Byron's Beats

What did Steinhoff do wrong? Or more specifically (at this stage) Markus Jooste. It is still up in the air at the moment because nothing official has come out but there are many theories doing the rounds.

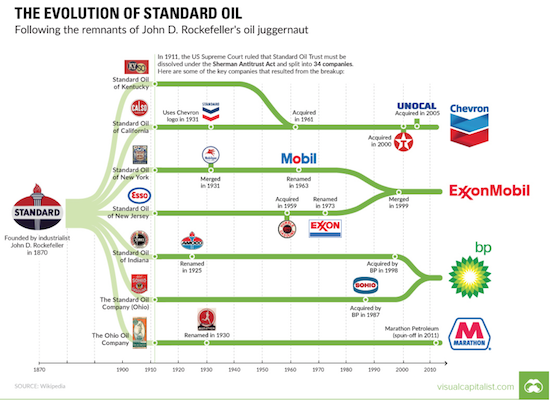

From what I can gather, one of the main dodgy tactics was to create off balance sheet entities to house non preforming assets or to purchase intangible assets from Steinhoff. This is a simple explanation, it is far more complicated than just that.

Another allegation suggested that the reporting on Conforama was incorrect. Throughout the period they owned that asset, they actually had a JV partner who was sharing all the profits yet they indicated to the market that they owned that asset outright.

We will have to wait for the external investigation to find out exactly what happened.

When you make investment decisions there is an element of trust you place in the management team. Christo Wiese, one of South Africa's smartest businessmen had put the majority of his wealth into this company. As Chairman you would expect (and trust) he knew exactly what was going on behind the scenes. Clearly this was not the case

Michael's Musings

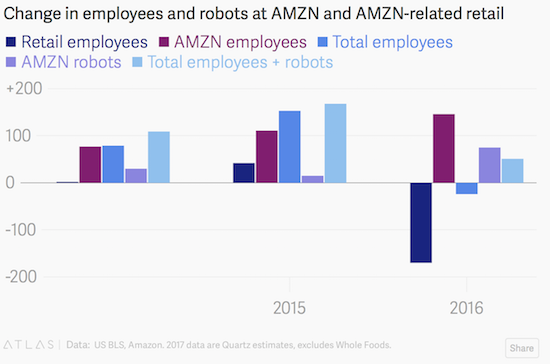

It is amazing how quickly things have changed in the retail space. As a consumer, being able to order online and have it delivered to my desk is a huge win - There are 170,000 fewer retail jobs in 2017 - and 75,000 more Amazon robots.

Bright's Banter

Volkswagen executive Oliver Schmidt has been sentenced to seven years in prison after admitting guilt under a plea agreement in August. He's the eighth executive to be charged in the VW emissions scandal.

It get's worse, the German authorities are also launching their own fresh investigations on other VW vehicles potentially breaking environmental laws - VW Executives Gets Seven Years For US Emissions Fraud

Wal-mart or Wal-mart Stores has finally changed its name to Walmart. The company's name change is inspired by its move to push online shopping so it can compete with the likes of Amazon. Walmart's push online is so aggressive not even a hyphen can stand in its way - Wal-mart Changes Its Name To Walmart In Push Online

Home again, home again, jiggety-jog. Steinhoff is down again this morning, along with other Wiese companies. On the local data front we have mining production and gold production reads. Then internationally the EU publishes their GDP for the 3Q, growth of 2.5% is expected.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063