To market to market to buy a fat pig. When asked for advice on which stocks to buy by non-clients, my first piece of advice is to not follow blindly what you watch and read in the media. The first problem with following the media is that you have no idea around the time frame of the commentator. There have been times when I have been on TV with a short-term trader. Unless you know that my views are from someone with a time frame of longer than five years and the person sitting across the table from me only has a time frame of around a month, you are going to get very conflicting advice.

The second problem, and particularly with written media, is that the journalist is not always familiar with the company they are writing about. A perfect example of that can be seen in an article written this morning about Steinhoff Africa Retail, aka Star's results. The headline reads 'Dark days for Steinhoff Africa after 10% drop', the only problem is that the journalist has confused Steinhoff International Holdings with Steinhoff Africa. For your man on the street, this is an understandable mistake, it is not a mistake you want a person 'in the know' making though.

The key is to make your own mind up about any particular stock and investment strategy. There are many successful strategies out there and many companies that are worth investing in, just don't flip-flop based on what the media says.

Market Scorecard. After a closer reading of the 500 page Senate tax legislation, it looks like someone forgot to lower the alternative minimum tax rate. This means companies with a high R&D spend, like Tech firms, won't be getting much of a tax break based on the current proposal. This Bloomberg article gives a good breakdown of its implications, Senate's 'Unpleasant Surprise'Hurts Tax Breaks for Tech, Others. The Dow was up 0.24%, the S&P 500 was down 0.11%, the Nasdaq was down 1.05% and the All-share was up 0.27%.

Company corner

Michael's Musings

It was another bad day for Steinhoff. After their SENS announcement yesterday saying that tomorrows release won't be audited numbers, the share price proceeded to fall 10%. With the pending court case decision around Steinhoff's tax situation, it would seem that the auditors are reluctant to sign off on numbers that may need to be changed in the next couple of weeks.

Management says that there is no 'fire' behind the current 'smoke' surrounding the stock. With yesterdays announcement, some investors have decided to bail out, not waiting to see if there is in fact fire.

In tomorrow's unaudited numbers, one of the key things we will be looking at is how their Mattress Firm turnaround is going. During the last set of numbers, Mattress Firm was in the middle of their turnaround, having a negative impact on their profits.

Linkfest, lap it up

One thing, from Paul

According to Bloomberg, total global equity market capitalisation is closing in on $100 trillion. Here is how that looks in a graph:

The interesting thing to note is how significant the moves have been in the last decade. We've gone from the early boom on the back of the commodities "supercycle" in October 2007 ($62 trillion), to the very dark days of the global financial crisis in February 2009 ($27 trillion) and then the rally to the present highs. Of course, I remember all of those days well. The euphoria and the dismay. I've had a front row seat!

Byron's Beats

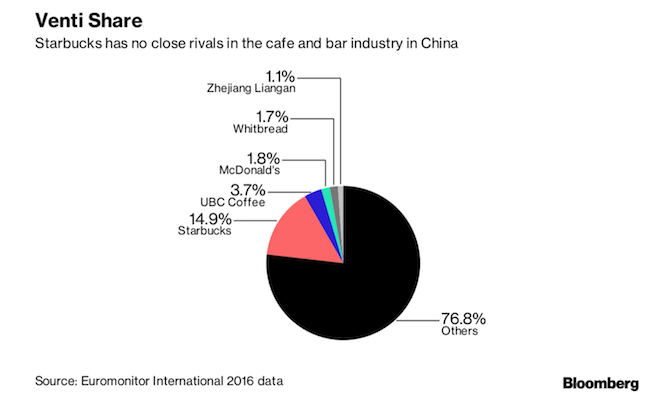

Starbucks has earmarked China as a massive growth driver for the business. You can see from the image below how big they are already versus other franchised competitors.

Former CEO and now chairman Howard Schultz has brought it upon himself to open up flagship stores around the world. This Bloomberg article talks about the world's biggest Starbucks which is set to open in Shanghai. The store is a whopping 30 000 square feet (half the size of a soccer pitch).

Starbucks is not just about the coffee, it is about the experience. I am very excited about this concept store initiative.

World's Biggest Starbucks to Open in Shanghai.

Bright's Banter

The series "House of Cards" season finale will continue without Kevin Spacey.

The final season of House of Cards will only have eight episodes as opposed to the usual 13 episodes in a normal season. A fellow by the name of Robin Wright will take Kevin Spacey's role, playing the husband of Claire Underwood.

The shooting was suspended in October after a number of sexual assault allegations surfaced against Spacey. Roughly 15 men have accused Spacey of wrongdoing, of whom five were teenagers when the incidents allegedly occurred.

I can't wait to see how they assassinate this character TF outta the show! The world is a better place without sex offenders!

'House of Cards' Sixth and Final Season Shooting to Resume in Early 2018, Without Kevin Spacey

Home again, home again, jiggety-jog. At 11:30 this morning Stats SA releases our 3Q GDP read, the forecast is for growth of 0.8%. The Rand is looking strong this morning breaking below the phycological $/R13.50 level.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment