To market to market to buy a fat pig. American politics is driving markets at the moment. Another Trump advisor, Michael Flynn, has been linked to Russia. He pleaded guilty to lying to the FBI, while they investigate Russia's involvement in the 2016 US elections. Markets tanked on the news.

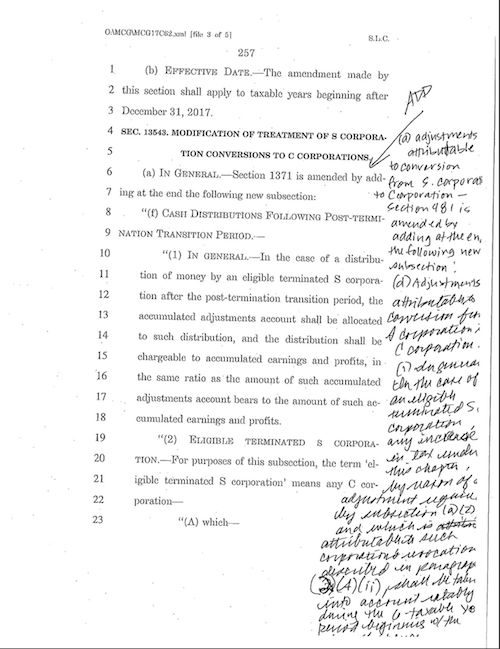

More significant though is that the Senate passed their version of the tax bill. They managed to get the bill through without needing to increase corporate tax from the initially proposed 20%. Considering that tax legislation is arguably the most far-reaching and important legislation a government will pass, you would think it is something you would take your time deciding on. Well, at least enough time to read the bill before passing it. Here is a picture posted by a Democrat Senator showing that some of the changes to the bill were made so late, that they didn't even have enough time to type them all up. Worse is the fact that not all the words are legible.

As a South African owning US stocks, the only thing that really matters to me is what the corporate tax rate is. 20% is much better than 35%. Long term though a strong US is good for everyone, as such it would be nice for lawmakers to take at least a weekend to read through all their amendments and think what the long-term implications could be. From here, the Senate and the House need to agree on a final version of the bill before Trump then signs it into law. Both the Senate and the House's bills are similar, meaning things are still on track for a final version to be through by the end of the year.

Market Scorecard. Even though markets tanked n the Flynn news, they mostly recovered by the end of the session. The Dow was down 0.17%, the S&P 500 was down 0.20%, the Nasdaq was down 0.38% and the All-share was down 0.54%. Friday on the local market, Naspers had another red day, down over 4%. Tencent in Hong Kong is up 2% today, Naspers should be well in the green to get the week going.

Company corner

Byron's Beats

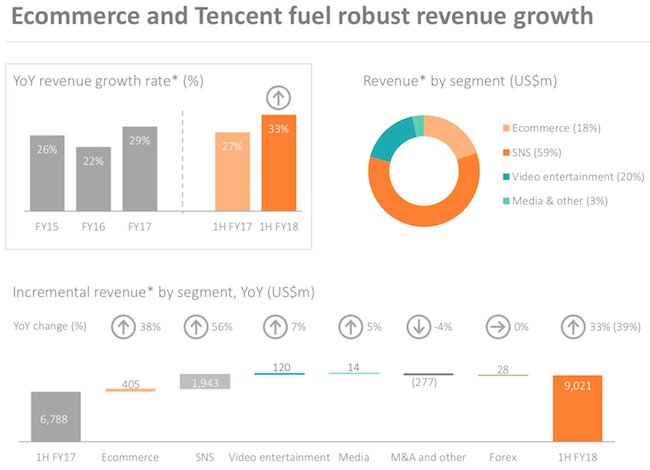

Last week we received interim 6 month results from Naspers. Being by far the biggest company on the JSE, this event now attracts a lot of attention. As expected, the results looked stellar on the back of another incredible period for Tencent. Let us take a look at the numbers which remember, are now reported in dollars.

Revenues increased by 33% to $9bn. This resulted in a big leap in core headline earnings per share, up 65% to $3.50. In Rands that equates to R48 a share. Let's assume they grow earnings by a very conservative 10% in the second half. That would mean they would make around R100 a share. Currently trading at R3531 a share, the stock trades at 35 times earnings. I remember a time when Naspers traded at 150 times earnings. Despite the phenomenal rise in the share price, the stock has actually become cheaper related to earnings. People often forget that.

Here is a nice visual of their revenue mix. SNS (social network services) includes Tencent and Mail.ru

We often cover Tencent separately, in light of that I want to focus on the rest of the business.

Ecommerce grew revenues by 15%. This division includes Etail, Travel, Payments, Classifieds and Food Delivery. All areas with great potential, especially in the untapped developing markets. Classifieds (OLX) have just become profitable. Etail which includes Takealot and Flipkart will suck funds for a while to come. That makes sense, building distribution centres and sorting out logistics is capital intensive. We can see how long it has taken Amazon to build scale. But once you have that scale, you are almost untouchable. Flipkart has a 70% market share of online retail in India.

The Ecommerce division used up around $318m whilst the Video Entertainment division made around $234m. They are still using the old profitable video business to fund the new exciting ecommerce division.

Video entertainment had a decent period. Trading profits grew by 4%. The Rand has stabilised to the dollar but many of their operations throughout the continent suffered on the back of weak currencies. Showmax is doing nicely in South Africa and also has a solid presence in Poland. Maybe they got there before Netflix?

All in all these numbers look solid. We are comfortable that the rest of business is on the right track, continuing to grow and become more influential within the massive shadow of Tencent.

The current allegations against Multichoice are upsetting. Their silence on the matter has also been disappointing although they did announce on Friday that they have implemented an internal investigation. As a Naspers shareholder, I wouldn't be too concerned, the rest of the business is far too big and separated to be heavily influenced. As a concerned South African however I will follow this story closely. If the allegations are true, I hope we see some heads roll and the consequences dealt with accordingly.

Michael's Musings

On Friday morning, AdvTech released the following SENS, Voluntary disclosure of fraud. One of the head office financial managers had been stealing from the group since 2015. In total the cash stolen was around R 5 million, which they should be able to recover through insurance and from the individual. As part of the SENS announcement, they stated revenue figures had been inflated and expenses were understated, resulting in a R35 million once off adjustment.

I'm not sure how the financial manager was stealing, but in my mind if you are stealing you would decrease revenue and increase expenses, creating a gap for you to take money? This incident shows the risks that come from owning and running a business, it is the reason why equity holders demand a higher return on their investment. The once off adjustment is rather small in AdvTech's life, around 1% of their revenue.

Linkfest, lap it up

One thing, from Paul

This week on Blunders: Multichoice is paying big bucks for bum content; Winter Olympics coming up on the North Korean border; Takelot crashes on Black Friday: and fancy app Expensify uses humans behind the scenes - Blunders - Episode 81

Bright's Banter

Pharmacy-retail giant CVS Health agreed to a $69 billion acquisition of health insurer Aetna in one of the biggest M&A deals of the year.

CVS is trying to get ahead of Amazon's expected move into the pharmaceuticals business , which has several pharmacy-retail companies tucking their tails between their legs.

Aetna is one of America's oldest health-insurance groups and CVS is one of America's largest pharmacy-retail companys making this one a very big deal indeed - CVS To Buy Aetna Reshaping Health Care Industry

Vestact in the Media

Forbes has written a nice detailed piece on Discovery and their new bank, Michael gets a few comments mentioned - Bank On This Man.

Home again, home again, jiggety-jog. Following Asian markets, our market is off to a green start too. Nothing major on the news front today. Steinhoff announced this morning that their audited numbers would not be released this week as expected but sometime in January. They will however release unaudited numbers on Wednesday. Not what you want to hear as a shareholder.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment