To market to market to buy a fat pig. On Friday night, while eating supper my phone had a notification pop up saying that Jeff Bezos's NAV had just crossed $100 billion, the first time since 1999 when Bill Gates crossed that mark. Bill Gates is currently second on the Bloomberg Billionaires Index, he would be worth well north of $100 billion if he hadn't given so much away already. Then the most famous investor of the last three generations, Warren Buffett is sitting in third. His NAV would also be higher than $100 billion if he hadn't given away so much.

Looking through the list, Jack Ma and Pony Ma (no relation) are in the global top-20 thanks to the 2017 performance of Alibaba and Tencent respectively. I was somewhat surprised to see Steve Ballmer, the ex-CEO of Microsoft sitting at number 23, with a NAV of $34 billion. Then someone I haven't noticed on the list before is Jorge Paulo Lemann, the founder of 3G Capital; the company behind AB InBev and Kraft Heinz. Lemann is number 27 with a NAV of $31 billion.

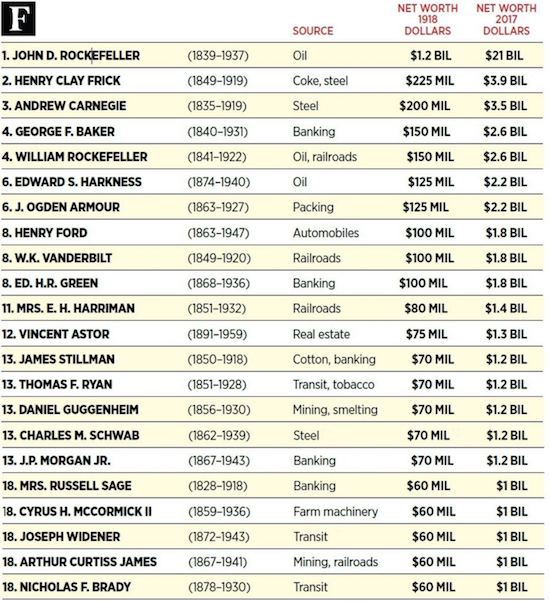

Having a look at the list I wondered where John D Rockefeller, the first dollar billionaire, would feature. Here is the first ever Forbes list from way back in 1918, where you can see their respective NAVs in 2017 Dollars. To get an idea of his wealth, have a look at the gap between Rockefeller and Frick, it is huge! On a side note, if you visit NYC, go visit Frick's house next to the park on E 70th Street. They have turned it into a museum and is well worth the money.

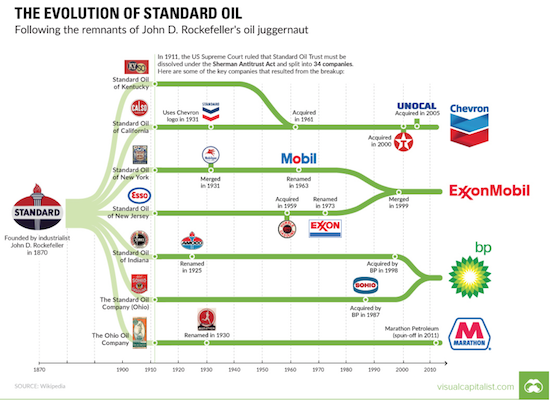

Just based on the inflation-adjusted number, he would land around number 40 on today's list. Seems a bit low considering that at his death, his NAV was around 1.5% of US GDP. His companies also controlled 90% of the oil and refining industry in the US. Most articles I read peg his wealth at around $300 billion, if he was around today. You probably know that Standard Oil was forced to break up into 34 companies, Visual Capitalist had a nice graph of where those companies ended up.

At his death, his NAV was around $1.4 billion. What I didn't know until today though was that he took tithing seriously and he looked to give away 10% of his earnings. His charitable giving totalled over $500 million while he was still alive; more than a third of his final NAV. Here is what encyclopedia.com had to say.

"Rockefeller, from his first employment as a clerk, sought to give away one-tenth of his earnings to charity. His donations grew with his fortune, and he also gave time and energy to philanthropic (charity-related) causes. At first he depended on the Baptist Church for advice. The Church wanted its own university, and in 1892, the University of Chicago opened. The university was Rockefeller's first major philanthropic creation, and he gave it over $80 million during his lifetime. Rockefeller chose New York City for his Rockefeller Institute of Medical Research (now Rockefeller University), chartered in 1901. In 1902 he established the General Education Board.

The total of Rockefeller's lifetime philanthropies has been estimated at about $550 million. Eventually the amounts involved became so huge (his fortune reached $900 million by 1913) that he developed a staff of specialists to help him."

Rockefeller made his money due to his tireless pursuit of efficiency and cost cutting, which in part resulted in the price of kerosene going from 58 cents to eight cents a gallon. A very good outcome for the consumer. Then through their giving, people like Rockefeller, Gates, Buffett, Bezos and Zuckerberg are a huge win for society. They create companies that make our lives better and then they use the wealth they have created to make society better.

Market Scorecard. Markets were very muted yesterday, when the day came to a close markets were mixed. The Dow was up 0.10%, the S&P 500 was down 0.04%, the Nasdaq was down 0.15% and the All-share was down 0.28%. Sitting at 12-month highs are Clicks and Dischem, interesting that the two major players in the pharmacy retail sectors are both soaring. In an environment where retail growth is muted, you would think for one company to do well it would be because they are stealing market share from the other. Another stock at 12-month highs was Standard Bank, which benefited from Moody's not downgrading us.

Linkfest, lap it up

One thing, from Paul

Amazon is a top holding in our Vestact US client portfolios. It has done incredibly well, hitting a new all time, intra-day high yesterday above $1,200 per share.

At that price level, founder and CEO Jeff Bezos is worth more than $100 billion, and is the richest person in the world, by quite a margin. Well done to him!

The reason for the surge appears to be that Amazon surpassed its expectations for sales on the Black Friday/Cyber Monday shopping weekend.

I was interested to see that the top selling items by value over the past weekend were the following: (1) Amazon Echo Dot, (2) Fire TV Stick with Alexa Voice Remote, (3) TP-Link Smart Plug, (4) Instant Pot DUO80 Pressure Cooker and (5) 23andMe DNA Test.

The top three are Amazon's own products. What's that last one? The 23andMe testers allows users to capture a saliva sample which gets sent in to a lab. After a few weeks the company issues a report showing the users' own ancestry, and their propensity to contract certain genetically indicated diseases.

More about those top sellers here.

Byron's Beats

Yesterday Mediclinic announced their designate CEO. Remember current CEO Danie Meintjies plans to step down next year after 8 years at the helm. Dr Ronnie van der Merwe will be the man in charge no later than August 2018 . He is an insider and currently the Chief Clinical Officer. I must say, his CV is impressive. See this from the announcement.

"Dr Van der Merwe obtained qualifications in Advanced Management (Harvard Business School, USA), a Fellowship in Anaesthesia (College of Anaesthesiologists, South Africa) where he was the recipient of the Jack Abelsohn Medal and a Bachelor of Medicine and Bachelor of Surgery (University of Stellenbosch, South Africa)."

He has been at Mediclinic since 1999 and has been Chief Clinical Officer since 2007. The business looks like it will be in good hands. Although those hands will certainly be very full.

Bright's Banter

Money laundering seems to be a big problem for Airbnb. The company has to navigate real-life versions of Walter White and Jesse Pinkman from Breaking Bad, as well as guys like Marty Byrde from Netflix's award winning series Ozark. If you have watched any of these series, you'll know that these guys are pretty bad ass.

People, just like the ones named above, are using Russian crime forums to scout, price, and share Airbnb listings made specifically for the purpose of cleaning cash from stolen/cloned credit cards. These scammers claim that this has been ongoing "since like foreverrrr". These scammers have managed to go around the authentication process in order to reach their goal.

These people are so good at scamming that they even work out the competitive rental for the area, manufacture fake reviews, online interactions etc. just to make it all look legit. Talk about going the extra mile! I'm sure you're gonna enjoy this read.

Inside Airbnb's Russian Money Laundering Problem

Vestact in the Media

Bright chats to Power FM about Sasol's BEE shares. If you own their BEE shares or are thinking of buying them, make sure you give it a listen - Bright from Vestact.

Business Day gives us a mention in the following article Tiger Brands eyes Africa expansion.

Home again, home again, jiggety-jog. Our market is off to a red start, probably in part due to the strong Rand. The only data out today of some note is the US consumer confidence number.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment