To market to market to buy a fat pig. As part of Trump's drive to remove regulation and government involvement in the private sector, it was announced yesterday that Obama 'net neutrality' laws are on their way out. Net neutrality is where internet service providers are not allowed to favour some web-pages over others. Here is the Wikipedia page on Net neutrality, where they give a more detailed breakdown and examples.

As this article points out, F.C.C. Plans Net Neutrality Repeal in a Victory for Telecoms, removing net neutrality is a win for telecom companies because they can charge more for the infrastructure that they have built. They can go to the consumer and ask them to pay more so that Netflix viewing is smooth. The Telecom companies can then also go to Netflix and ask Netflix to pay up so that their data moves easier over the telecom's network instead of a Netflix competitor like Hulu.

There are good arguments for and against net neutrality, where telecom companies win on the one side, and internet companies win on the other side. Living in South Africa, this is a debate we have never had. It is commonplace when signing up for an internet line, for your option to be 'throttled' and the other more expensive options to run smoothly. That is normal right?

Market Scorecard. It was another great day out for global stock markets. The Dow was up 0.69%, the S&P 500 was up 0.65%, the Nasdaq 1.06% and the All-share was up 1.18%. It is amazing to think that Naspers is up 60% since July; this is not a small cap company that just landed a new contract, this is the biggest stock on our market! Just Wow.

Linkfest, lap it up

One thing, from Paul

I updated the 'About Us' page on the Vestact website yesterday afternoon, which required me to check in on the performance of our model portfolios in both the Johannesburg and the New York markets. We have been managing money locally in Rands for nearly 15 years, and offshore in US Dollars for just under 13 years.

Since 2003, the compound annual return of our model Johannesburg portfolio is 18.8 percent after fees. This is solidly above the return on the JSE Alsi 40 over the same period of 15.3 percent.

The compound annual return of our model New York portfolio since 2006 is 10.4 percent in dollars and after fees. This is well above the return of the S&P 500 over the same period of 6.1 percent.

Read the whole thing here, which also discusses our approach to stock picking and holding through the cycles. There is a nice picture of the team!

Byron's Beats

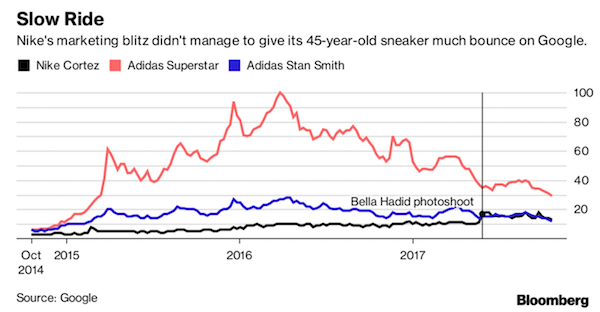

Nike has lost a fair amount of market share to Adidas over the last 2 years. Most of that has been within the teen age group, ironically with it's old school trends. This Bloomberg article titled How Adidas Beat Nike at the Old School Game explains the various trends of the Adidas Superstar, Adidas Stan Smith and the Nike Cortez.

To put this all into context, when Nike was just getting started in the 60's, Adidas was the market behemoth. However, Nike slowly became a cultural phenomena and overtook their larger rival. Nike is still twice the size of Adidas and comfortably the market leader. This recent trend is actually more Adidas coming off a low base after a torrid period.

As you can see, these trends come and go. The sector is growing and all these businesses will probably do well over the long run. We still feel the Nike brand is superior and will generally dominate the trends more than the rest.

Michael's Musings

Not only does Amazon make it cheaper and easier to shop but they employ an army of people - Amazon holiday hiring is reaching sky-high levels - this year's tally will be about 120,000. What is even more amazing is that between July and September this year, Amazon increased their staff count by 159 500 people; a chunk would have come from Whole Foods.

Not owning a car and not having a human behind the wheel is the future, Uber is making plans to get that future here sooner rather than later - Uber plans to purchase 24,000 self-driving cars from Volvo in a potential multi-billion dollar deal

Bright's Banter

Taylor Swift... a marketing genius or just a really good vocalist? I think both!

To promote her new album "Reputation" she had a one week streaming blackout and the album sold 1.29 million copies becoming an instant bestseller. "Reputation" joins an exclusive group of six albums to hit 1 million sales in a week in this decade. That is mind blowing.

Your boy likes Taylor Swift tunes, so don't be shocked when you hear bangers like "ready for it" and "look what you made me do" when I drive past you in traffic.

Home again, home again, jiggety-jog. Later today we will get a CPI read for Mzanzi, where the forecast is for CPI to drop to 4.8% from 5.1%. If inflation comes down I think it is safe to say that the MPC won't increase rates tomorrow. Tomorrow is Thanksgiving in the US, so they are releasing the initial jobless claims today.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment