To market to market to buy a fat pig. Friday was Naspers day. Thanks in part to Tencent rising 3% on Friday, Naspers was up over 4% at a stage and closed up 3.6%. What is amazing is that we still have 6-weeks left of the year and the stock is up 90%; it only needs another two days like Friday and it will have doubled for the year. Stocks that double in a year are normally your smaller caps, it is wild to think that a one trillion Rand company can double. The current market cap is R 1.7 trillion.

After the market closed on Friday, Naspers released a trading statement for their last 6-months:

"We expect core headline earnings per share to be between 62% (132 US cents) and 67% (142 US cents) higher than the comparable period's 212 US cents."

Based on the above Naspers will sit on a P/E around 40, which is still high but with all the underlying growth it seems reasonable. We prefer to value Naspers as an internet investment holding company, where their NAV is a more important determinant of what the share price should be. We roll this number out regularly, it has been a while since we quoted it though. Naspers' shareholding in Tencent is currently worth R2.3 trillion, which means Naspers market cap of R1.7 trillion is R600 billion lower. That is before we take into account their other listed investments of Mail.Ru worth R14 billion, Make My trip also worth R14bn and Delivery Hero worth R25 billion. We will see their detailed 6-month numbers next week Wednesday.

Market Scorecard. It was a divergent day for markets globally on Friday, US markets opened in the red and stayed there for the day where our market opened well in the green and just pushed higher. The Dow was down 0.43%, the S&P 500 was down 0.26%, the Nasdaq was down 0.15% and the All-share was up 0.97%. Discovery had a good day out breaking R160 a share for the first time and Woolies was up 3% recovering some of their recent loses.

Company corner

Byron's Beats

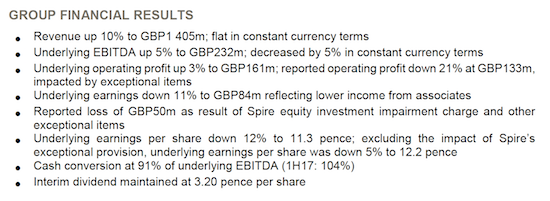

Last week Thursday we received interim results from Mediclinic. It was a very busy 6 months for the business as they tried to turn around the Middle Eastern division whilst dealing with tough conditions in South Africa and Switzerland. Here are the financial highlights for the 6 month period.

As you can see, it certainly isn't easy but if you strip out a few once offs as well as the write down from the Spire asset, things are slowly improving.

Unfortunately the share price has taken more heat. The market had high expectations for Mediclinic following an incredible growth patch and then the London listing. What we have seen here is a rerating for the company as these expectations have not been met.

The underlying fundamentals are still strong and the company is reinvesting a lot of capital into their hospitals to keep them world class.

There is also the pending Spire transaction which, as of this morning has been taken off the table. Maybe this is not such a bad thing. Running hospitals is an expensive business. It seems Mediclinic already have their hands full. The share had popped 6% on the news but has since pulled back.

We are monitoring this one closely, we are still happy to be patient and see what they can achieve over the next 6 months. Stay tuned.

Linkfest, lap it up

One thing, from Paul

This week on Blunders: Da Vinci for $450m sure, but Twombly for $50m?; Wors outfit gets eaten; Japanese apologise profusely for train that leaves 20 seconds early; and tough times for cops on the American rust belt - Blunders - Episode 79.

Michael's Musings

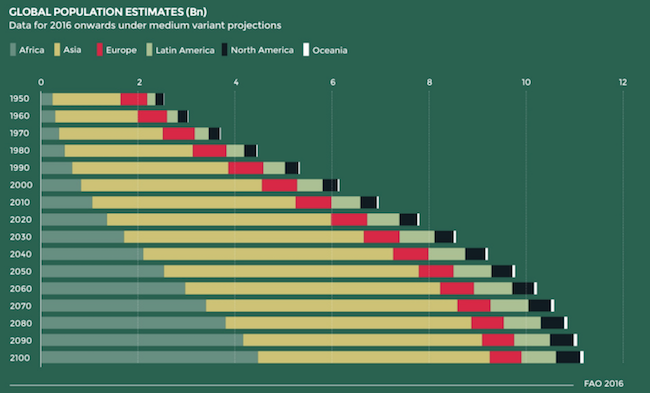

Africa's rising population will either be a huge opportunity or a burden. People represent potential customers and are a production input, generally speaking more people means more GDP in that particular area - Visualizing a Rapidly Changing Global Diet.

Home again, home again, jiggety-jog. Asian markets are a mixed bag this morning, Tencent is up around 2% though, which means a green Naspers and probably a green All-share. It is a big week for interest rates locally, tomorrow the MPC sits down for three days to decide what they are going to do with Repo and then on Friday evening we will find out what happens to our debt rating globally. I suspect the MPC will leave things as they are, we are still well within our inflation band and they will want to monitor the movement of the Rand over the next few months.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment