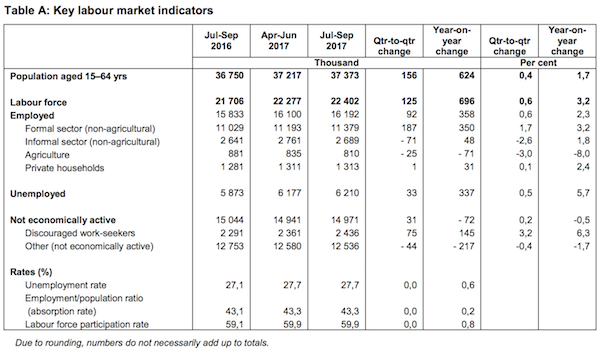

To market to market to buy a fat pig. Yesterday Stats SA released the Quarterly Labour Force Survey (QLFS), showing that our unemployment rate stayed constant at 27.7%. The good news is that over the last year, 358 000 more South African's have a job; there are still 6.4 million people looking for a job and that number jumps to 8.6 million if you include 'Discouraged work-seekers'. To be considered unemployed, you need to have actively looked for a job in the last month. When you add the people who have given up looking for a job to the official number of unemployed people, our unemployment rate sits at 38%! That means out of every five people who want to work, only three are able to find a job.

As we have seen coming through in our GDP data, the area of most growth is 'Finance and Business Services', where over the last year 140 000 jobs were added. It is no surprise to see that employment in the construction sector dropped over the last year, down by 127 000 people. Construction attracts long-term capital investment, with business confidence at multi-decade lows there are fewer people deploying long-term capital at the moment.

Market Scorecard. US markets have continued their recent trend of not following a down day with another down day, I can't remember the last time the US had two down days in a row. The Dow was up 0.12%, the S&P 500 was up 0.09%, the Nasdaq was up 0.43% and the All-share was up 0.17%.

Company corner

Bright's Banter

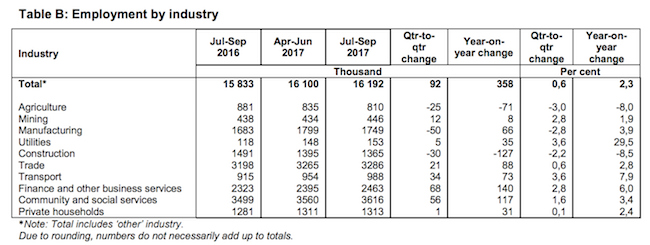

Stryker 3Q numbers

- Completed the purchase of NOVADAQ Technologies on the 1st of September 2017

- Acquired French company Vexim on the 24th of October 2017 to be completed in Q4

- Sage recalls and hurricane impact expected to result in approximately $45 Million in lost sales in Q4

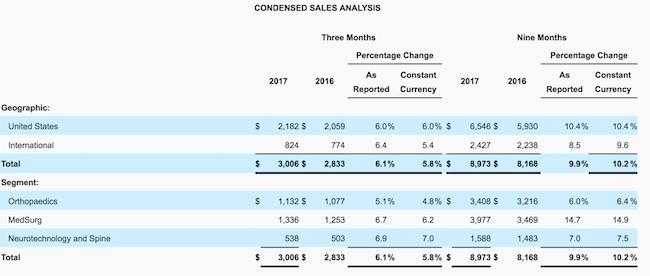

On Friday the 27th of October Stryker reported better than expected numbers for the third quarter and that sent the share price soaring over 7% on the day. A good day for Vestact clients that hold this counter in our offshore portfolios. They also increased its guidance for the 2017 full year with expected sales between 6.5% to 7% and earnings of $6.45 to $6.50.

How did the company do compared to Wall Street's Expectations?

1) Third-Quarter Net Sales grew by 6.1% to $3 Billion (5.8% in constant currency) which beat expectations by $30 Million

- Orthopaedics grew by 5.1%

- MedSurg grew by 6.7%

- Neurotechnology and Spine grew by 6.9%

2) Third-Quarter Net Earnings Per Share grew by 21.3% to $1.14

3) Third-Quarter Adjusted Net Earnings Per Share grew by 9.4% to $1.52, a modest beat of $0.02

All three reporting division of Stryker did well in the third quarter notwithstanding the negative impact of the Sage product recalls in their MedSurg division and the hurricane that halted production in the quarter. Production volumes were also up throughout the company. Mako Robots which are mostly used in knee surgeries are still driving sales in a big way as the company sold 33 Mako Robots of which 23 were installed in the U.S. Total knee procedures increased more than 50%.

On the 1st of September 2017 Stryker acquired NOVADAQ for a purchase price of $678 million. We wrote a comprehensive piece here on what NOVADAQ does and how it complements the Stryker's Endoscopy's portfolio. NOVADAQ is said to have contributed positively to Endoscopy sales as those were up 13.4%.

Stryker also acquired a French company VEXIM for EUR183 Million in exchange for 50.7% of the shares in the company. VEXIM is a specialist in design of minimally invasive spine surgery medical devices. The prominent brand is called SpineJack which the company describes as a mechanical expandable VCF implant for vertebral fracture reduction and stabilisation. This spine technology will complement the Stryker interventional spine business and transform its position in the space.

Stryker is still our preferred company in the medical devices space because the business has the margins of an iPhone, strong brands which drive volumes and better market positioning over competitors like Medtronic, Thermo Fisher, or Zimmer. Their devices are still the favourite across the medical community.

Linkfest, lap it up

One thing, from Paul

Do you subscribe to the Business Day online? If not, you should. Its cheap (R120 a month I think, you put in your credit card details), and allows you access to daily articles, plus the weekly in-depth Financial Mail articles.

Analysis of our news stories of the day by top analysts, that's worth supporting. Like this piece from my UCT contemporary, Nusas comrade, Business Day deputy editor Carol Paton - Structural changes will save SA, not Gigaba's grim vision

She is writing here about the aftermath of the mid-term budget policy speech last week.

"Last Wednesday was a difficult day for Finance Minister Malusi Gigaba. He knew he had bad news to deliver to the nation; this was not going to be his moment of glory.

"He struggled through the pre-budget parliamentary briefing, muddling concepts and dropping words and phrases such as "spending cuts" and "fiscal stimulus", apparently without noticing the contradictions.

"But if Wednesday was bad, Thursday was much worse as the extent of the fallout over the medium-term budget policy statement became known. The market reeled.

"These are big political decisions that require courage and unity of purpose at the top of government. With the December conference looming there is not a single voice in the Cabinet that would make any decision that might affect the ANC's political base. Apart from this, courage, unity and commitment are in short supply in this Cabinet.

"The outlook then is not good for Gigaba or SA. Come February, chances are we will be staring at the same set of numbers, possibly made even worse by a November credit ratings downgrade."

Sobering stuff!

Michael's Musings

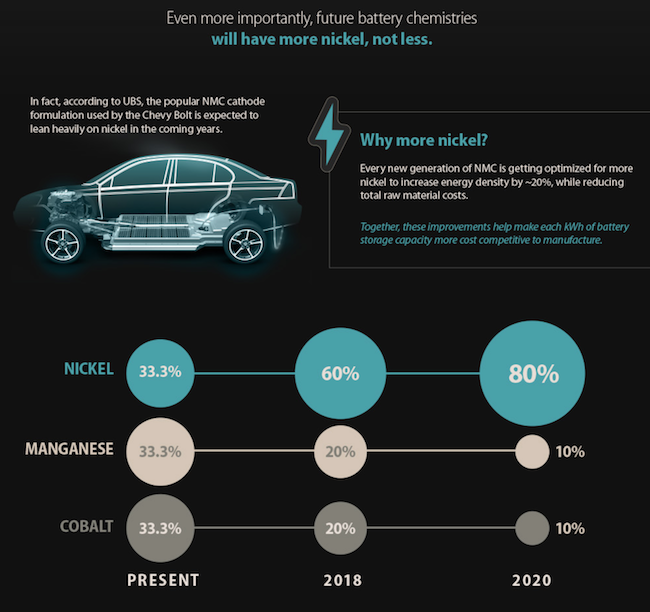

As we move toward more renewable energy, much has been written about lithium and cobalt. This is the first time I have seen someone write about nickel, which is surprising given how much of the battery is made up of nickel - Nickel: The Secret Driver of the Battery Revolution.

Home again, home again, jiggety-jog. It is a lovely green start to our market, up over 1% and with in touching distance of 60 000 points. Naspers have also broken through the R3 500 a share level, go you good thing! Then this evening the US Fed announces if they will raise rates. The market is expecting nothing to change tonight but that a rate rise will happen in the middle of December. Sticking with the Fed, Trump is expected to announce the next chairperson by the end of the week.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment