To market to market to buy a fat pig. Thursday has finally arrived; for some it means we find out what the MPC decides to do, for others Black Friday deals open at midnight and for me, the Ashes cricket summer has kicked off. As a South African, choosing between England and Australia is like having to choose between eating brussel sprouts and cabbage. For entertainment value, not much beats live sport. How many more years until e-sport gets the same global following as cricket, rugby, football, and basketball?

Our inflation number published by Stats SA was inline with expectations, a reading of 4.8%. Having a look at the basket, meat prices are up 15.5%, both wine and water are up 7.2%, fuel is up 10.8% and packaged holidays are up 12%. Surely in the age of discount airlines and the internet, people will find travel cheaper, not more expensive? Talking about prices going down, telecommunication equipment was down 14.6%, home appliances were down 3%, fruit was down 3.5%, and thanks to good rainfall bread and cereals were down by 3%.

Even though inflation came down, don't expect a rate cut this afternoon. Remember at the last MPC meeting, we were one vote away from a rate rise. This is also the last meeting of the year before we hear what happens to our debt and before we hear who the new leader of the ANC will be. I think they will leave rates as they are and then assess where South Africa is in the new year after those two big pieces of information have come out.

Market Scorecard. Wow, what an all over the place day yesterday was. We have gone from very little volatility to 2% stock price moves being the flavour of the day. Yesterday, Naspers was down 4.6%, back to its level from Friday and Richemont was down 1.5%. On the upside though there was Tiger Brands and Kumba up 3%, Steinhoff, Sasol and Aspen were up 2%. The Dow was down 0.27%, the S&P 500 was down 0.08%, the Nasdaq was up 0.07% and the All-share was down 0.75%. With Naspers having such a big weighting, if it is down 4%, the rest of the market has some very heavy lifting to do to get the All-share into the green.

Linkfest, lap it up

One thing, from Paul

We are all anxiously awaiting the forthcoming National Elective Conference of the African National Conference. Whether or not you like their policies, the fact is that they have won over 60% of the vote in recent national elections. So whoever they pick as their next leader will have a good chance of being our head-of state (President) after the general election in early 2019.

The constitution of our post-Apartheid state vests great power in our President. He or she really only answers to the majority party in Parliament. The President appoints all cabinet ministers, heads of state agencies, legal system leaders and heads of state enterprises, mostly without any process of approval or review. So it really matters what happens at this event at Nasrec in mid-December..

According to overnight reporting, the conference is going ahead, and delegates are almost all nominated. There are still some concerns that the whole thing may be delayed by legal challenges, but that seems to be receding - ANC Leadership Race: December conference likely togo ahead despite branch meeting worries

As investors and part of the pro-business lobby, we would be happier if Cyril Ramaphosa were to win, and less excited if Nkosazana Dlamini-Zuma were to come out on top. According to the SAIRR, Ramaphosa has his nose in front. However, they caution that this is based on leaks about how delegates will vote and may be "fake news". Also, note that in terms of the ANC's rules, delegates can change their minds and vote independently on the floor at the event. Keep tuned! (Ramaphosa Is Leading SouthAfrica's ANC Race for Presidency)

Byron's Beats

Jensen Huang may not be a household name like Elon Musk or Jeff Bezos but he is fast making a big impression on Wall Street. Jensen is the CEO of Graphics Chip maker Nvidia. This article goes through 4 quotes from Jensen that investors should know about Nvidia. This one about the automotive segment caught my eye, especially on the back of Uber's recent order of 24 000 self driving vehicles from Volvo.

"Automotive segment should hit the ground running in a few years. We're building this future of autonomous driving. We expect robotaxis, using our technology, to hit the road in just a couple of years." Huang

Here is the full article. 4 Things NVIDIA's CEO Wants Investors to Know.

Michael's Musings

If you are looking at raising funds to study or just feel you are poor at decision making, why not consider an IPO of yourself. Sell shares in yourself, raising money for yourself and giving complete strangers the power to make all the important decisions in your life - The man who sold shares of himself. Some of the decisions made for Mike was who to date, if he could propose and that he should become vegetarian.

Weird to think that it has been just over 10-years since the market high before the 2008 crash. Here is how an investment back then would look today - A Decade Later: What $1K Invested in These Stocks is Worth Today.

Bright's Banter

First things first, we are thankful to have you as a client here at Vestact. If you are not a client, we are thankful that you read our daily message and we hope that we will win your hard earned Rands one day. Happy Thanksgiving to you and your family!

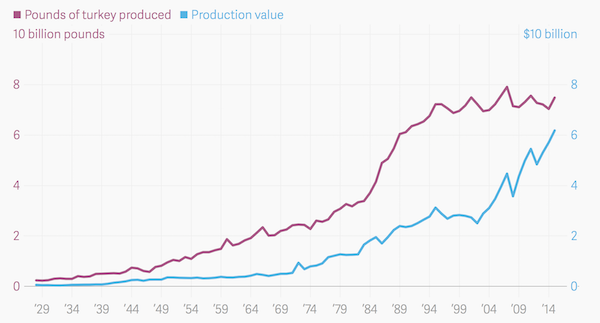

Now back to the Turkey. America slaughtered an eye popping 244 million birds this year, a flabbergasting number I know! According to the US Department of Agriculture, the turkey industry has helped families plate 3.4 billion kilos of meat so far this year. How much meat can you eat though? Not enough it seems.

The cost of a live turkey is at it's lowest since 2013 thanks to a large number of birds in cold storage, this is almost twice last years numbers. This means a 7.3 kilo bird costs around $22.38 on average across the US.

What are you thankful for this year?

Vestact in the Media

Byron chats to Fifi and Karabo on Closing Bell about healthcare stocks - SA's healthcare stocks are bleeding, here's why.

We get a mention in this Business Day article talking about Naspers - JSE within 100 points of record high as Naspers touches R4,000 per share

Home again, home again, jiggety-jog. The man with a moustache much better than mine, Lesetja Kganyago will let us know the interest rate decision around 15:00 this afternoon. Cerner was up 5% last night on rumours that they are partnering with Amazon. We will let you know when the partnership is officially announced and the exact details.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment