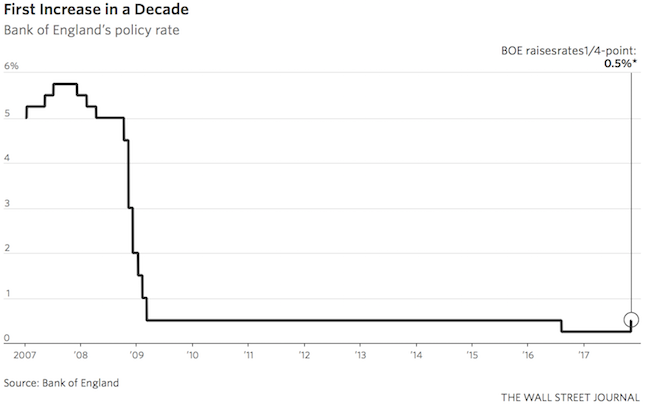

To market to market to buy a fat pig. It was a rather busy day on the international news front yesterday. Out first was the Bank of England's decision to raise rates for the first time in a decade, from 0.25% to 0.5%. Going forward though the bank only expects interest rates to reach 1% by the end of 2020. Lower for longer. As long as interest rates sit below historical averages, equity valuations will sit above historical averages.

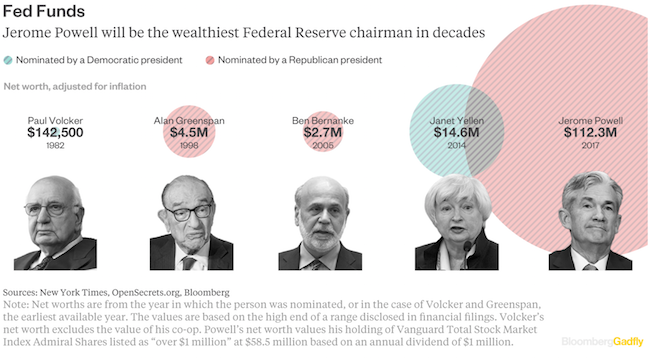

Next on the list, was the widely expected nomination of Jerome Powell by Trump as the next Fed Chair. He is an ex-investment banker and private equity guy who has spent time working in the US Treasury and has been on the Fed's board of governors since 2012. He is seen as a more 'dovish' candidate for the job, meaning the chances of lower interest rates for longer is on the cards. Even though Powell is a registered Republican, he has worked on bi-partisan projects and was initially nominated to the Fed board by Obama in 2011. The first time since 1988 that a president nominated a member of the opposition party for the role. Having both public and private sector experience is a definite advantage. The only criticism I have been able to find of him is his NAV; the argument is that having over $50 million in the stock market could influence his decisions and that he won't be sensitive to the 'average Joe' on the street.

Then the last significant piece of news is the GOP's proposed changes to the US tax system, Analysis: Winners and losers in the GOP tax plan. For us, there are two main changes to consider. The first is that corporate tax is being cut from 35% to 20%. Then more importantly for most of our tech holdings, the tax for bringing offshore cash back to the US will be taxed at a reduced 12% instead of the current 35%.

Market scorecard. With all the big news out of the US yesterday, the markets spent time in the red as well as the green, as they digested the implications for companies. At the end of the day though the Dow managed to finish at a record high. The Dow was up 0.35%, the S&P 500 was up 0.02%, the Nasdaq was down 0.02% and the All-share was down 0.31%. Apple had their full-year numbers out last night, beating expectations for top and bottom lines. The stock is up over 3% in after-hours trading, taking their market cap to just shy of $900 billion. We did the maths this morning, their profits for the last 3-months is enough to buy Shoprite in its entirety and still have around R20 billion in change!. Sticking with Apple, their iPhone X (ten) goes on sale today; news outlets are showing queues outside stores.

Company corner

Bright's Banter

Amazon's 3Q Numbers

In his new book, The Four, Prof. Scott Galloway says that Amazon appeals to our consumptive gut, taking in stuff we need to survive and sending it to our bodies. The notion of "more" is hardwired into us. Even when things are too much, there is still a desire for more. When it comes to consumption; throughout history the penalty for too little has been starvation and malnutrition which is a terrible death. The penalty for too much is lethargy, gluttony, diabetes but has a pretty long lag. Open your cupboards, open your closets you have ten to a hundred times more than you really need. It's really crazy when you think about how much stuff we have, but its so hardwired in our DNA! The ultimate business strategy is more for less. It has been the business strategy of China, Walmart, and now Amazon.

Here are some astonishing statistics: 44% of U.S. households have a gun and about half of U.S. households have a landline. However, about 64% of these same households have Amazon Prime and spend about $1400 per month on Amazon. This now means more households have a relationship with Amazon Prime than have a landline phone. If this trend continues, more people are going to have a pipeline of stuff to their house from Prime vis-a-vis than have cable television.

Amazon is about selection, convenience and value to the consumer.

Amazon the everything store reported better than expected third-quarter numbers on the 26th of October 2017 sending the shares surging 8% higher in the after-hours trade.

How did the company do compared to Wall Street's expectations?

- Made $43.7 Billion in Sales, up 34%, beat by $1.6 Billion

- Made $256 Million in Profit

- Earning Per Share of $0.52, beat by $0.49

The cloud business Amazon Web Services (AWS) is still a big growth area for Amazon which netted Sales of $4.6 Billion, growing 42% year-on-year which was the same rate as last quarter (Q2).

All eyes were on the $13.7 Billion acquisition of Whole Foods which was completed in August. We were ahead of the results when we wrote about the increased traffic in the the month of October here . Foot traffic to Whole Foods has increased tremendously, up 17% year-on-year following the acquisition. The biggest losers were Sprouts, Trader Joe's, Sam's Club, Target, CostCo, Kroger and Walmart in that order. Whole Foods had Sales of $1.3 Billion for the quarter and we expect these to accelerate with store optimisation as they move more into digital.

Another big winner for the company has been Prime Video, the original content streaming services competitor to Netflix. In the past three years Prime Video has gone from nothing to being the third biggest video streaming platform today. Prime Video now on the Microsoft's Xbox One!

The fourth quarter is going to be a big one for Amazon as it includes the December holidays. Amazon expects to make between $56 Billion and $60.5 Billion in Sales including Whole Foods and favourable exchange rates. That translates to 28% to 38% growth compared to last year.

The Amazon story has been the most fascinating. This is the only 800 pound gorilla we know that's still investing 100 cents to the dollar back into consumer experience. No company can compete with that kind of re-investment pace at the moment as it is a very rare occurrence in business. It truly defines Jeff Bezos ethos of "your margin is my opportunity."

Linkfest, lap it up

Michael's Musings

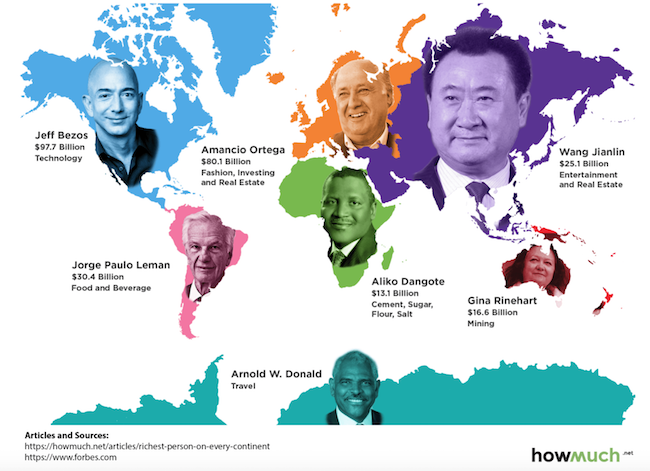

Ever wondered who the richest person on each continent is? Well now you can know - The Richest Person on Each Continent. Lehmann (misspelt on the image) is the main person behind 3G Capital, the company who put together the titan that is AB InBev.

Home again, home again, jiggety-jog. Our market is off to a green start this morning, following the direction of Asian markets. It is jobs day again in the US; we will get the initial read on unemployment and the number of jobs created in October. The data will also show us how much September's numbers were impacted by the hurricanes moving through the East Coast.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment