To market to market to buy a fat pig. Friday was US Jobs day where their unemployment rate clocked another improvement, coming in at 4.1%, the lowest since December 2000. October and November 2000 both had an unemployment rate of 3.9%. If we get to that number you will have to go back to the 60's to find a better unemployment rate. During October the US economy added 261 000 jobs, lower than the 310 000 expected by economists.

Typically, a dropping unemployment number is coupled with rising wages. Economics 101, lower supply of labour and a rising demand for labour means companies need to pay more to attract the talent that they need. Even though they are around the lowest unemployment rate in nearly two decades, average wages increased 2.4% YoY, slightly above inflation. When I was last in the US, I remember seeing signs that said 'help wanted', where in South Africa we are used to seeing signs saying the opposite, 'job needed'. There is a bit of a chicken and egg situation in the US. They have weak labour laws because of low unemployment, and they have low unemployment because they have weak labour laws. A company is more likely to hire if they know that they can lay off the person during an economic downturn or if they turn out to be a poor employee. The jobs number on Friday still had influences from the hurricanes that went through in September.

Market Scorecard. It was a green day across the board on Friday; our local market is half a percent away from the phycological 60 000 mark. The Dow was up 0.10%, the S&P 500 was up 0.31%, the Nasdaq was up 0.74% and the All-share was up 0.52%.. Lonmin was down 28% on Friday after a production report, saying that they may have solvency issues going forward. The company desperately needs the platinum price to pick itself up; a weaker Rand is helping. Their FY numbers were meant to be out in 2-weeks, but management has said they are delaying their release. We will have to wait a bit longer to get a better idea of the internal financials.

Company corner

Bright's Banter

Alphabet 3Q results

Stick with the theme of Prof. Scott Galloway here. In his book The Four he says that GOOGLE is a modern man's God. Where our advantage lies as a species is that we have a superior brain to all other animals.. A brain that is so robust it can ask incredibly complex, nuanced questions but our brain isn't robust enough to answer these questions. As society becomes more affluent and educated, its dependence on a super-being decreases and church attendance goes down. Our questions don't get any easier or simpler. GOOGLE appeals to our need for a super-being as it creates a cerebral attraction to the need for answers to everything thats occupying our thoughts.

You can type in anything on the GOOGLE search box and you're guaranteed to get back an answer.

The cash flush one-trick pony Alphabet reported mouth watering third-quarter numbers on the 26th of October 2017 sending the shares soaring 2.5% higher in late trade on the day.

How did the company do compared to Wall Street Expectations?

-Made a record in Revenues of $27.8 Billion, up 23.8% fastest acceleration in growth since the financial year 2012

-Operating income jumped 35% year-on-year to $7.8 Billion

-Earnings Per Share of $9.57, beat by $1.24

Alphabet's search business GOOGLE sales were up 21% to $24.1 Billion and still accounts for 87% of all the group sales, thanks to strong advertising revenues and a hawk-like eye on cost control efforts by Ruth Porat and her team. Cost-per-click also accelerated at a faster rate than ad revenues as traffic acquisition costs went up 71%. This came from expensive sources which now are mostly mobile. The company spent $3.5 Billion, 25% more than last year in capital expenditure in order to improve customer experience.

"Other Revenues" jumped 40% reporting $3.4 Billion in sales. That includes sales from the Cloud Business, Google Pixel Phone, YouTube Red, Google Play Music etc. Only $302 Million of sales came from "Other Bets" or what the company used to refer to as their "Moonshot" ideas. This includes self-driving car company Waymo, smart-home hardware provider Nest, and their fiber-to-home business Fiber.

You will find more statistics at Statista

You will find more statistics at Statista

There has been a lot of regulatory scrutiny involving U.S. big tech firms, particularly in Communist Europe. They either hate the companies because they are too big and should be broken up, they are monopolies, they are tax efficient, and more recently the issue of fake news. The latter is a real problem for FACEBOOK and GOOGLE. Probably more for Facebook than Google because of the Russian's hand in the 2016 U.S. elections which took place on the Facebook platform. We can only hope for less fines going forward but it doesn't seem so.

Alphabet shares are up 31.6% year-to-date valuing the company at $719 Billion. The current price-to-earnings ratio of 35 and a forward price-to-earnings ratio of around 27 is the cheapest the company has been in a very long time. We are still buyers of Alphabet as we still see some value in the Video and Cloud Businesses but most importantly more growth on the Search Business as more people move to mobile and seek more answers.

Linkfest, lap it up

Michael's Musings

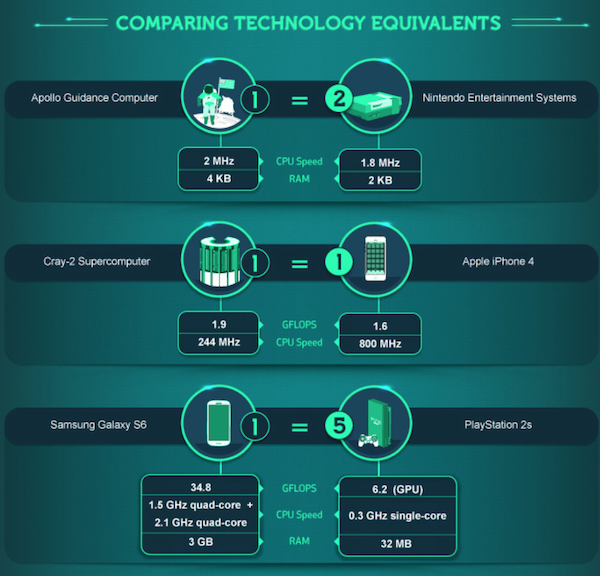

Research has shown that the human mind can't comprehend compounding growth, a perfect example of this is the massive exponential growth in computing power - Visualising the Trillion-FoldIncrease in Computing Power. Imagine telling someone in the 50's that computers would be a trillion times more powerful in the year 2017!

Are you looking for a reason why stocks are at a record high?; probably more importantly a theory for where stocks will go from here? Barry has come up with a number of explanations where bulls and bears can pick and choose the explanations that fit best into their idea of the future - How to Tell the Bulls From the Bears.

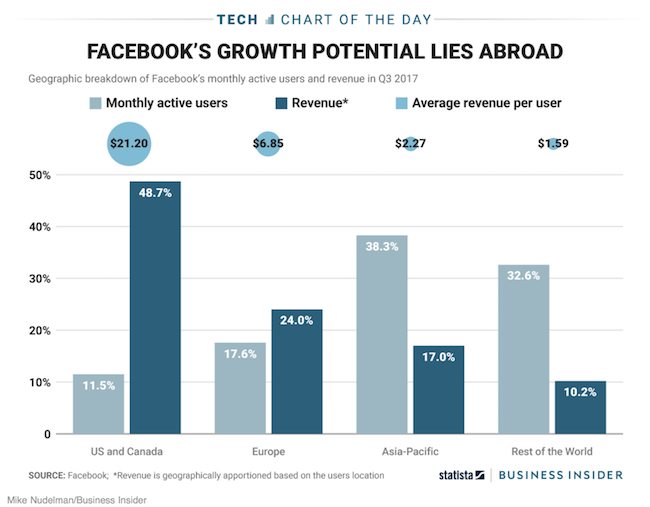

Facebook is up 745% over the last 5-years. One of the main reasons for the appreciation of the share price is future earnings growth expectations. Having a look at the graph below, there is still huge growth potential in all their territories outside of North America. Europe has a high GDP per capita, it should have a similar ARPU to that of the US, meaning there is potential for a three fold increase in revenue from Europe alone - To keep its revenue growing, Facebook needs to look outside the US

Home again, home again, jiggety-jog. Tencent is up 1.4% this morning and the Rand is slightly weaker than it was on Monday, expect Naspers to be strong out of the blocks on the open. Later today, there are results from Priceline, the world's biggest online travel company.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment