To market to market to buy a fat pig. The downgrade that many people have been calling is scheduled for next week Friday, after our market closes. Having a look at our current bond yields and the currency, I'm not so sure that a downgrade is a foregone conclusion. There is no doubt that the current trajectory of our budget deficit is horrible given our anaemic growth, but if confidence returns and GDP growth spikes, our deficit situation looks very different.

Wayne McCurrie's tweet from yesterday shows that investors still want our bonds at current levels; the yields on our bonds were much higher last year than they are currently. We were saying in the office yesterday, that our current saving grace is that global interest rates are at historical lows, meaning our risky debt attracts an interest rate of less than 10%.

Market Scorecard. GE had another painful day, down a further 6% which didn't help US markets in general. The Dow was down 0.13%, the S&P 500 was down 0.23%, the Nasdaq was down 0.29% and the All-share was down 0.51%. Brait released their 6 month numbers this morning, which seem inline with market expectations. We will have a breakdown of them tomorrow.

Company corner

Bright's Banter

Bidcorp had a markets day on Monday where the management spoke to shareholders and analysts like us and analysts get to ask management some tough questions.

The company said that trading in the first quarter has been reasonably positive in their core foodservice business. All their businesses performed well in their local currencies. Management is putting efforts to down scale in non-core, underperforming Logistics businesses in the U.K. as trading remains tough. The U.K. logistics business is not a material player in the groups overall business.

The company continues to see organic growth in the Foodservice business and opportunities for bolt-on opportunities in all their different geographies. This is on the back of increasing inflation in some of their product categories such as dairy.

In my last meeting with David Cleasby, one of the things he said was that the company will focus more on increasing the basket of goods purchased by its customers. If they can convince the customer to add more products to their basket, that becomes pure margin as the delivery truck was coming in that direction anyway. In the update the company makes reference to this point where it emphasises the fact that they have been focusing on the correct segment of the markets (growing segments I'm guessing), adding value to the clients offering through innovation and improved service delivery. This is when they use their system to help chefs improve their menus for example.

The main takeaway here is that Bidcorp bought a few businesses to expand into new territories, which is their preferred strategy. These acquisitions cost the company R608 Million in aggregate and the company expects earnings of R104 Million from these business if they continue to perform as planned.

Linkfest, lap it up

One thing, from Paul

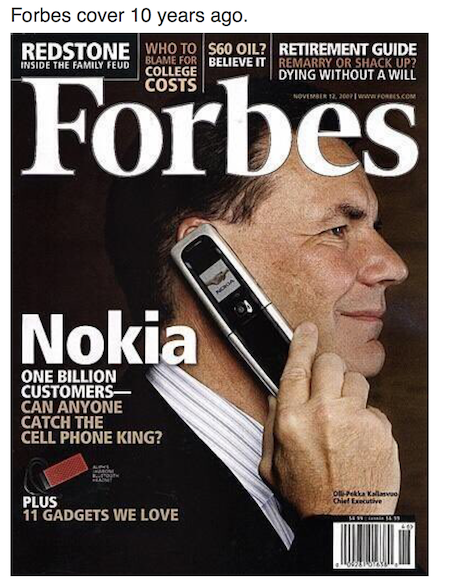

This Forbes magazine cover from 10 years ago has been going around the world, because it is a good example of corporate hubris. A big, dominant product provider that seemed to have an unassailable lead over its competitors. See what it says there: "Can Anyone Catch the Cellphone King?". I guess that they did not see Apple and Samsung coming!

We actually held Nokia in New York client portfolios until June 2010, when we sold Nokia and switched everybody into Apple. At that point Apple was about to launch the iPhone 4 and Nokia was already taking strain. As I said in my year-end message in December 2010.

"During the year we finally made the switch from Nokia which did poorly for some years (and was also down 19.9 percent in 2010), into Apple which continues to go from strength to strength. In retrospect, we should have made the transfer much sooner."

Turns out it was not too late. From that date to now, Nokia fell another 42% and Apple is up 350%.

Michael's Musings

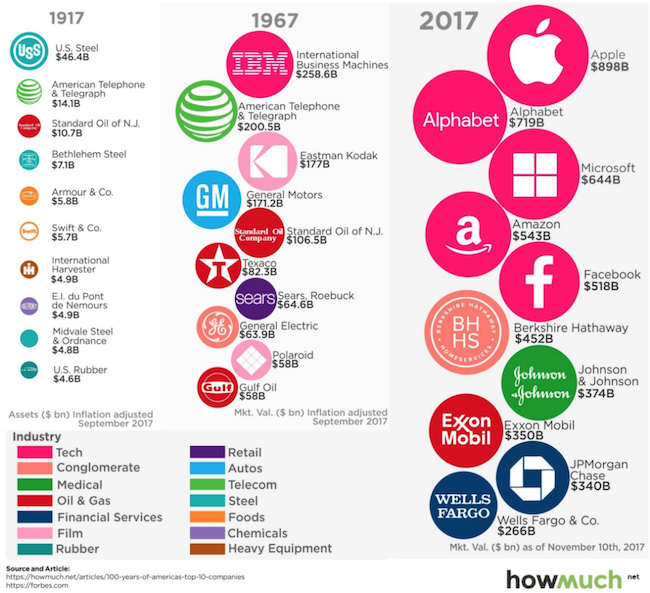

If I have the choice between reading fiction or the history of markets, companies and the people who built them, the latter generally wins - Most Valuable U.S. Companies Over 100 Years. Having a look at the list, only Standard Oil (Exxon) appears on all three; Exxon happens to be the only stock on the 2017 list that I don't own.

Until Elon Musk can crack using rockets to travel around the globe we will have to make due with the A380's and Dreamliners. The current tough decision for airline execs, is whether to go for the dreamliner which is more cost effective or do you go with the A380 which allows you to transport more people to airports where there are limited parking spaces. Going forward that decision might be made for them - We may have just witnessed the end of the Airbus A380 superjumbo. It is interesting to me that the airline industry has not had a major change since the 747 first took off in 1969.

Home again, home again, jiggety-jog. Asian markets are all well in the red this morning, and Tencent is down around 1%. Expect a red open for the All-share. Very big news out today, we will find out if we are hosting the 2023 Rugby World Cup at around 15:00. Holding thumbs!

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment