To market to market to buy a fat pig. The Paradise Papers will be a talking point for the coming weeks as more details emerge. The latest big name revealed is Apple, who went 'tax haven shopping' after their setup in Ireland ran into issues - (Apple had five burning questions about the best tax haven for its billions). These multinational companies spend millions to ensure that they are structuring their tax affairs legally. The problem is that tax codes can be open to interpretation, as seen with Apple and Ireland. The EU feels that Apple pushed things too far and should pay Ireland $13 billion, Ireland is appealing the decision. When a country doesn't want $13 billion in tax revenues, you know how subjective tax codes can be.

As I said on CNBC yesterday, it is management's job to pay as little tax as possible legally, and it is government's job to decide what the tax codes should be. The problem for governments at the moment is the ambiguity in the way tax codes and treaties that have been drawn up. Loop holes are being closed and standardisation of definitions are being implemented. We have also seen that large financial institutions have had pressure put on them not to do business with entities linked to tax havens. If you want to read further about the initial names linked to the papers, here is a brief summary - Here's a guide to the major revelations in the Paradise Papers. What is interesting to me is how many of the 'big guns' are intertwined in many business deals.

Market Scorecard. Our market powered through the 60 000 mark yesterday on the open, meaning it has taken just under 3-years to climb 20% from 50 000 points to 60 000. The Dow was up 0.04%, the S&P 500 was up 0.13%, the Nasdaq was up 0.33% and the All-share was up 0.57%/. Lonmin was down another 5.9% yesterday, but after being one of the best-performing stocks for October it is still trading higher than it was in September.

Company corner

Byron's Beats

Last week we received third-quarter numbers from Cerner which disappointed the market. The share dropped 9% on the news as forward guidance was revised down. We should put that drop into perspective. Even after that fall, the share price is up 38% so far this year. It all depends on where you draw the line in the sand. Having said that, this has been a volatile ride. This business is a high margin software company with high expectations. A volatile ride usually comes with that package.

Bookings for the quarter came in at $1.1bn. This was much lower than expectations because a few large contracts will now only be included in the fourth quarter numbers. When these bookings reflect, it should result in an all-time high bookings for the full year. It has been a good year with some big government institutions signing up for their healthcare software services.

Revenues came in at $1.276bn which was 8% higher than the comparative quarter; $928 million of that came from support, maintenance and services. You can see that this is a retention business. Once you have signed up a hospital or an institution, their annuity business is a key driver of Cerner's future profits.

Another important factor to note is that only $142 million of these revenues came from outside the US. The potential to expand globally is massive.

Earnings for the year are expected to come in at around $2.42 per share, putting the company at 27 times forward earnings. The business does have gross margins of 83% and very impressive cash flows which explains the high multiple somewhat.

We remain buy rated on this stock as it continues to secure solid government contracts in the US. We will do a more detailed analysis of the full year when those numbers come out next quarter.

Linkfest, lap it up

One thing, from Paul

The biggest aggregate client position in our New York business is Apple. Not surprising really, because it is a must-own stock and has done really well in recent months. The total value of our Apple holding at Fidelity Clearing & Custody Solutions (where the shares are held in safe custody) is $15.1 million.

At its current share price of $174.25, Apple has a market value of just a whisker over $900 billion. That makes it the most valuable listed company in the world. It is the first time that any listed company has breached that mark. Well done Tim Cook. Onwards to $1 trillion!

The reason that the stock is trading so well is that this coming holiday season will probably be the biggest ever, as shoppers go mad for its new iPhone X. Those have the new larger OLED screens and cost over $1,000 each. They are selling out as they hit the stores, but Apple's formidable production system will soon have them available for sale around the world.

This article provides some updates on the opening iPhone X weekend - Apple iPhone X draws lines, and some activation errors on AT&T and Verizon services

Michael's Musings

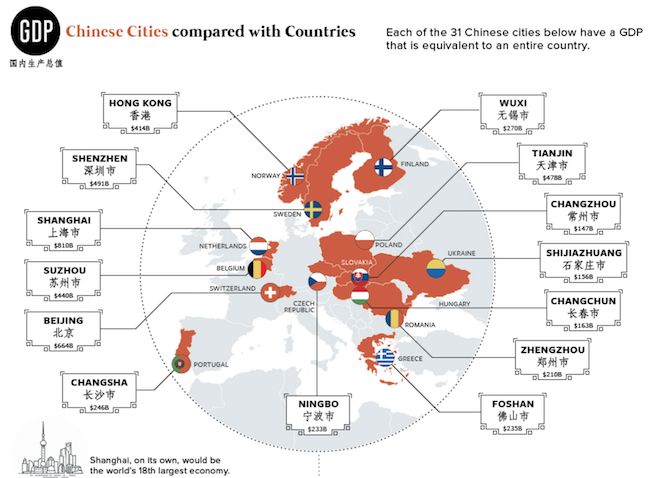

We sometimes forget how massive China really is. The following graphic shows how China's biggest 31 cities are a similar size to certain countries - 31 Chinese Cities With Economies as Big as Countries.

A question that is as important as when to buy is when to sell. Given that we are not market timers, and don't try jump in and out of the market, we look to sell when something has fundamentally changed at the company - The Question of When to Sell Isn't So Simple. The last point that Barry makes is important, even a well-timed sell and then corresponding buy can be break-even at best due to taxes and transaction costs. How much does a stock need to drop before your losses would be more than the taxes and costs incurred in selling?

Bright's Banter

One of my favourite quotes from Howard Marks taken straight from his book The Most Important Thing

"When people say flatly, 'we only buy A' or 'A is a superior asset class,' that sounds a lot like 'we'd buy A at any price; and we'd buy it before B, C or D at any price.' That just has to be a mistake. No asset class or investment has the birthright of a high return. It's only attractive if it's priced right.

Hopefully, if I offered to sell you my car, you'd ask the price before saying yes or no. Deciding on an investment without carefully considering the fairness of its price is just as silly. But when people decide without disciplined consideration of valuation that they want to own something, as they did with tech stocks in the late 1990s---or that they simply won't own something, as they did with junk bonds in the 1970s and early 1980s---that's just what they're doing.

Bottom line: there's no such thing as a good or bad idea regardless of price!"

In the following article, Howard Marks explains why passive investing is not the silver bullet you have been looking for! - Howard Marks On Passive Investing

Home again, home again, jiggety-jog. Tencent is up over 3% in Hong Kong, expect a raging Naspers when the bell goes at 9:00 our time! There is CPI data out of the EU around lunch time and then this afternoon, the JOLTs number from the US. As the US reaches full employment, the JOLTs data becomes more important.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment