To market to market to buy a fat pig. Saturday was the 11th of November, also know as singles day, 11/11. If you haven't heard of it before, it is an annual day where people in China celebrate/commiserate being single. In 2009, Alibaba commercialised it and turned it into their major shopping day of the year. The day has taken off and now is the biggest shopping day globally. I even got an email this morning from an RSA retailer telling me all the specials I could take advantage of today.

This year, Alibaba was eyeing $25 billion in sales in a 24-hour period. What is mind blowing is that they managed to surpass that goal, raking in $25.3 billion! Last year they had sales of $17.8 billion, it took them 13-hours to reach that milestone this year. Globally the other big shopping days are almost upon us, Black Friday and Cyber Monday. For comparisons, Alibaba racked up more than double the sales in their 24-hours than Black Friday and Cyber Monday did combined in the US last year. A new innovation introduced this year, was 'smile to pay' on the Tmall e-commerce site; Jack Ma demonstrates face-recognition payment tech

Market Scorecard. US markets set a new mile stone of sorts on Friday, it was the first weekly drop since early September. The Dow was down 0.17%, the S&P 500 was down 0.09%, the Nasdaq was up 0.01% and the All-share was down 0.14%.

Company corner

Michael's Musings

On Friday morning Richemont announced its unaudited consolidated results for the six month period ended 30 September 2017, showing what we mostly already knew thanks to numbers from their competitors. After having a tough couple of years, mostly due to the corruption crack down in China, they are back on the growth path. This was highlighted by a resurgent Hong Kong.

China is creating around four dollar millionaires every minute, meaning it was only a matter of time until the dent in luxury demand due to the corruption crackdown was replaced by natural demand. Interestingly the UK had double digit growth, I wonder if that is due to the weaker Pound resulting in comparatively cheaper prices for their products in London than in the rest of Europe.

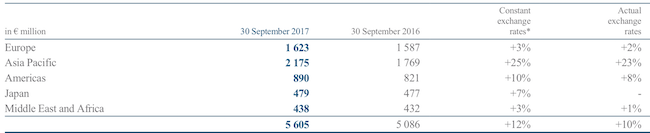

Here are the numbers, Sales were up 12%, Profit was up 80% and operating margins improved from 15.7% to 20.8%. Below are each regions sales numbers.

Management did point out that the impressive looking growth figures are in part thanks to a low base due to a number of once-offs in the last period. What is important though is that every region is showing growth and that both watches and Jewellery divisions are showing growth, 6% and 15% respectively.

The turnaround in luxury can be seen in the share price of Richemont, which is up 38% year to date, currently sitting around an all-time high. For comparison LVMH, is up 37% year to date (in Euros). Going forward, the rapid growth in global wealth is forecast to continue, which will provide a growing customer base for all the luxury brands. The trick is to stay relevant, and for Richemont owning brands that are over a century old provides a good moat.

Linkfest, lap it up

One thing, from Paul

This week on Blunders: The poorest 50% in the US has less money than the top 3. No, not the top 3%. High drama in Saudi Arabia. Facekini trends from China. Sexual harassers are on the back foot now - Blunders - Episode 78.

Byron's Beats

We often get asked if Visa will get disrupted by newer payment systems. The truth is that most of these systems still rely on Visa's switching infrastructure.

That doesn't mean that Visa can rest on its laurels. Cashless payments is a fast evolving world with many start ups and potential disruptors. That is why Visa need to spearhead these changes but keep the new technologies reliant on Visa.

In this article titled Visa bids to bring contactless transit payments to the world it talks about the successful contactless ticketing system London have adopted for their transport services.

Visa have set up a consulting program to help other cities adopt this successful system. Obviously steering the systems in Visa's direction. Our investment in a cashless society via Visa is in good hands.

Bright's Banter

Lucas Peterson shares his tips on how to travel in the most green and budget-friendly way. He's actually been to Maboneng in his most recent trip to Johannesburg, RSA. He stayed at a backpacker in downtown Jozi! What a champ! - Sustainable Travel Can Be Budget-Friendly

Home again, home again, jiggety-jog. Asian markets are mixed this morning and European futures are down, Tencent in Hong Kong is up 1.2% though which should mean a green Naspers on the open. Vodacom released their six month numbers this morning, showing that Data revenue is now higher than Voice revenue. Things to look out for this week are, numbers from Mediclinic and Brait, both shares have performed poorly recently. Then on Thursday Tesla is unveiling their new truck, which Musk says will blow your mind.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment