To market to market to buy a fat pig. US stocks had another down day yesterday; I saw a tweet from a US market commentator saying "What is this weird looking crimson colour on my screen?". The current drawdown in the market seems to be driven by a drop in commodity markets.

Market Scorecard. The Dow was down 0.59%, the S&P 500 was down 0.55%, the Nasdaq was down 0.47% and the All-share was down 0.56%. Naspers opened at an all-time high thanks to solid numbers out of Tencent yesterday. Naspers is now up 84% for the year.

Company corner

Byron's Beats

We have often spoken about how being a pessimist makes you sound smart and being an optimist makes you sound naive. I find this very ironic and somewhat strange on the back of a globe that is constantly improving in so many facets of life. The stats don't lie. Poverty levels have decreased, healthcare has drastically improved and more and people are living better lives. Of course there are a lot of negatives out there that need improving. One of those is the environment.

It has also become very fashionable to beat down on Tesla. If you think Tesla will fail you come across as smart, cautious and articulate. If you believe in the Tesla story you come across as naive and a sucker to the smokes and mirrors that Elon Musk has managed to brainwash you with. That is more recently of course because the share price is down 22% from it's highs of September. To put that into perspective the stock is still up 44% so far this year. So who is actually wrong here? You be the judge.

Let's delve into the Q3 numbers they released a few weeks back and see why the stock has been so volatile.

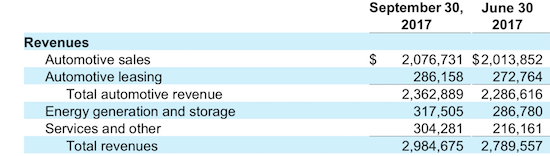

Below is the revenue mix of the business. I have popped this in to show that this company is not just a vehicle manufacturing business, it is also an energy business. Although Energy generation only contributes 10%, it is growing fast. A big power supply agreement in Western Australia is just the start of what can be a very lucrative business.

Services and Other includes sales of second hand Tesla's as well as servicing of the existing ones.

Ok lets look at the vehicle segment. During the quarter they delivered their 250 000th vehicle. They delivered 26 137 vehicles in the quarter. The problem for investors was that only 222 of those were Model 3 vehicles. Elon Musk has promised 5000 a week by Q1 2018 with a potential 10 000 a week shortly after. Wall Street is not so sure. The company experienced some heavy bottlenecks this quarter, mostly with regards to battery assembly. This is why the share price has pulled back.

I understand the market getting a little jittery about failed promises. But this is a real business trying to achieve a very tough task. Soothing Wall Street is not their concern. Amazon went through the same 'yes they can', 'no they can't' seesaw for nearly 5-years before they achieved scale.

Tesla often gets compared to other vehicle manufacturing companies. But it is not just that. It is a utility, a software business and most importantly a battery manufacturer.

When all the other big car companies manufacture electric vehicles where do you think they will come knocking to buy those batteries? Tesla are first movers and have pumped billions into mainstream battery production. Solar and battery power will be a huge part of our future.

Their cars have an amazing allure, similar to Apple. They will continue to attract a premium because they are beautiful, simple and a great product.

Their current issues revolve around supply, not demand. Demand for electric vehicles will be massive for 50 years and more because of the low base it is coming off. Even when the other big vehicle players go mainstream.

Short term "investors" might be concerned about these bottlenecks but if you are patient I believe Elon Musk and his team will succeed. They have already achieved the impossible in a short space of time. As you can see, it is volatile but continue to hold tight.

As a side note, Elon Musk is making a very exciting announcement today about the Tesla Semi Truck. Jeepers he likes to keep his hands full. Rumour has it that these electric trucks will be able to follow each other like a train with only one driver needed to operate the first truck. Sounds amazing!

Michael's Musings

Yesterday Brait released their 6-month trading update which has been keenly awaited due to their poor performance over the last 18-months. Since January 2016, the stock is down 70%. In February, after management wrote-down the New Look asset by R10 billion to R8 billion, I said most of the pain from New Look had been felt. I was wrong. Management has now written off the remaining R8 billion, so that their carrying value of New Look sits at zero. Due to the further write-down, Brait's NAV now sits at R66.62 per share. A 36.6% decline since September 2016.

A quick observation about the Brait share price. If you bought in 2012 you are still up 130%, which in most peoples books is a good return. See the graph below, where I drew a line from starting share price to the current share price. It doesn't look too bad? This is of little consolation if you bought in the last 2-years. It highlights though, your perception of a company and their performance is heavily influenced by when you bought.

Moving onto the numbers, we will start with New Look. Revenue was down 4.5%, life for like sales were down 8.6%, third-party e-commerce sales were up 17% and interestingly their own e-commerce sales were down 7.6%. The company says it best of what has gone wrong:

- its product positioning had moved away from its successful broad appeal, becoming too young and edgy.

- its customer messaging had become overly fashionable and in the process, no longer highlighting New Look's value proposition;

- excessive product options and increased complexity throughout the organisation resulted in the business being late to certain trends and as a result not clearing ranges by season end;

- reduced flexibility and speed as well as an increased cost base.

Management has a strategy to turn things around, which they say won't have a significant impact until next year. Going forward the carrying value of New Look can't hurt the Brait NAV but if Brait needs to put fresh capital into New Look that will have an impact. My rough calculations at the current run rate, New Look will have a couple of years worth of cash, so it doesn't look like Brait will have to pony up anymore for now.

Their other operations look solid though. Premier had a tough time due to the drought, which pushed down their profits. Their biggest asset, the Virgin Active gyms saw revenues increase and margins expand. Over the last year they added 17 new gyms, with more in the pipeline. Lastly their third biggest asset, Iceland foods, who are the leaders in frozen meals in the UK also looks to be on track. They are busy shifting to meet the changing consumer demand for instant and easy meals. Currently they are delivering 40 000 meals a week.

What to do with Brait? Currently the share trades at a 30% discount to the NAV, which is a big safety net; their other assets all look solid and are well-known brands. What is more likely, the share price going to R90 a share or to R22 a share? All things considered, it is more likely to go up than down.

Linkfest, lap it up

One thing, from Paul

Here at Vestact we are keen investors in innovative healthcare companies. As people live longer, have better health insurance or fatter life savings, spending on complex therapies is rising sharply. This theme covers companies making medical devices, pharmaceuticals and hospitals. You should buy them all.

I thought that this was a great story, out yesterday. US regulators have approved the world's first tablet with an inbuilt sensor. It can be tracked inside the stomach, relaying data on whether, and when, patients have taken vital medication. The technology has been developed over 10 years by Silicon Valley-based Proteus Digital Health.

The immediate application is for patients who are not "all there", and may not be sure whether they have actually taken their meds today. That would be especially helpful for the elderly, and those with dementia or psychotic conditions. The data shows up on an app on their phones, and can also be accessed by their doctor, caregiver or nominated family members.

The tracking devices can be attached to all sorts of orally ingested drugs, which will be positive for pharma company sales.

More detail on the FT article: US regulators approve first digital pill with tracking system

Bright's Banter

Michael once said that millennials like to spend money they do not have on experiences they do not need. This is true and probably one of the reasons why we hold companies like Priceline in our clients portfolios. There's been a surge in the number of people who aspire to travel the world, experience different cultures, unwind and meet new people. We think this trend will continue as we become more of a global village and millennials have more disposable income.

I know a lot of people who would like to go on a Greek holiday including myself, but we are not sure about the standard of living and how much the day-to-day costs would look like in Rands.

Here's a breakdown Rand for Rand from someone who went there a couple of weeks ago.

Fari is a friend I went to university with. Unlike me, she is well versed in travel. She's snorkelled in Thailand, parasailed in Mauritius, ascended the Eiffel Tower in Paris, walked the streets of London, chowed down on some Gelato in Italy, had camel rides in the deserts of Dubai and even stood on the edge of Victoria Falls in Zim. - How Much I Spent During My Trip To Greece

Home again, home again, jiggety-jog. There were numbers from Mediclinic this morning that the market doesn't seem very happy with, the stock is currently down 2%. The Rand has strengthened today against all major currencies. Then this afternoon we have initial jobless claims out of the US.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment