"There are far too many transactions in cash for the liking of governments, and even banks. Transactions via the switching networks are far easier for all considered. We continue to consider this a high growth business with huge potential upside. Risks include heightened regulation, bearing in mind that the company is waiting to do business in Europe and China. In our view this remains one of the most attractive businesses to buy."

To market to market to buy a fat pig. Pull in your guts, tighten the belt and all that, what, what. We could see that the Reserve Bank governor Lesetja Kganyago was visibly irritated yesterday at the Monetary Policy Announcement, you can peruse it at your own leisure if you missed it yesterday: Statement of the Monetary Policy Committee. The inflation outlook has definitely deteriorated and there are many things that are outside of Reserve Bank control.

The currency is one of them, the natural investment flows have been back to developing markets, in the direction of the Dollar. That means if you smell like a BRIC and walk like a BRIC and taste like a BRIC, then you may as well be a fermented durian. Those folks who have been to SouthEast Asia will know what I am talking about. A Jackfruit is 50 times the size of a durian, infinitely more tastier, especially a fermented one.

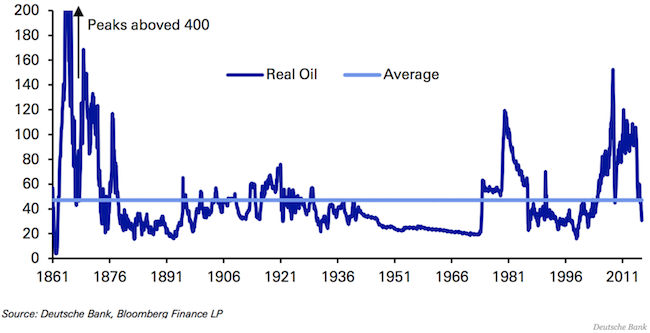

Equally commodity prices which have impacted on ourselves, Russia, Brazil, heck, a whole lot of emerging markets dependent on raw commodity exports. Even Australia. Nigeria, Saudi, Venezuela, Norway, continents apart and reliant on the new best customer on the block over the last 2 decades. As the trajectory of the demand has slowed from the Chinese, this coincided with the taps of the mega projects being turned on, and huge technological advances in the cost saving area. Ditto, lower prices.

And of course internal mistakes, the finance minister debacle late last year, that looks like what is referred to in a professional sporting context as a "schoolboy error". I suspect that at some stage ex-minister Nene will reveal all, for now we have titbits. Politics, don't try and understand it, you will end up banging your head against the wall repeatedly. Rather have control of the things that you can, with regards to investing that is. You and I as individuals have no control over the inflation rate, food prices, definitely not the weather, nor how the Reserve Bank are likely to react to these prevailing conditions. As a collective we do, lower and wiser consumption, saving of resources and so on. And most importantly, you can choose what to buy and own, that you do have control over.

Economists agree that rates are going to continue to rise in a South African context, the currency may well improve after a budget that may meet Mr. Markets idea of what is a "good one". The inflationary outlook is certainly unfavourable for now, that may change. What was a little puzzling and pleasing at the same time is that the local market rallied sharply after the announcement, banks and financials saw aggressive buying.

The theory (or so it goes) is that the Reserve Bank is not influenced by outside factors and will stick vehemently to their mandate of keeping inflation in check. In other words, reading between the lines of talking heads, no political interference. So whilst Mr. and Mrs. Consumer may be feeling down on themselves, this was apparently the "right thing to do". Ai shem. As for consumer demand, the mandate of the SARB doesn't take that into account. So, until it changes, it won't.

After the dust had settled, the Jozi market had rallied nearly one and two-thirds of a percent. The Rand benefited from the rate hike, this morning after having settled a little last evening at 16.18 to the US Dollar, 23.15 to the Pound Sterling and 17.65 to the Euro. And that is BETTER! Better than before, which is always where one draws a line in the sand. What will transpire over the coming months from a demand point of view remains to be seen, like the SARB, we are all watchers in this.

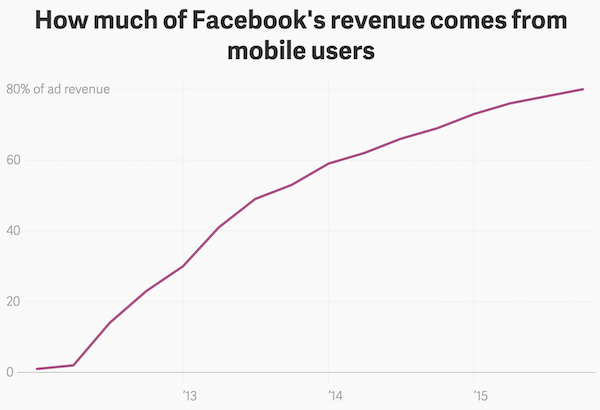

Over the seas and far away in New York, New York, markets rallied towards the end of a choppy session, twice the market was in negative territory briefly. Stocks closed out the session up a little over half a percent on the broader market S&P 500 up a smidgen, below four-fifths on the Dow Jones Industrial, whilst the nerds of NASDAQ index was up more than that, just a fraction. Driven in large part from a roaring session for Facebook, the stock was up an astonishing 15.52 percent on the day, to close out the session at 109.11. Briefly in the session the stock went through 110 Dollars, the current market capitalisation is 267 billion Dollars. Which makes the company in market capitalisation terms (and definitely according to Mr. Market) a more valuable company than Wells Fargo. Tell that to Warren Buffett, his company, Berkshire Hathaway, has a market capitalisation of 309 billion Dollars.

Alongside Facebook there was a ripping session for Alphabet (the new name for Google), that stock was up over four percent. Amazon had a stonking session too, up nearly nine percent on the day. It has given a large part of that back overnight, the results were a marginal miss and let us just say that the market is pretty unforgiving when it comes to that! Alibaba had results that looked far better than what expectations had pointed at and perhaps some insight into the Chinese economy being just fine, thanks very much. Alibaba now trades at the market multiple, 18 times earnings. Revenue growth of 32 percent year over year is apparently not good enough, 400 million active annual buyers is also not enough. Two-thirds of revenues come via mobile, that is pretty astonishing. Perhaps with 83 percent of sales being China commercial sales, the market is being cautious. Still looks like a "good one" to me.

Over to the East, where the sun rises (my mother always said it is easy, yeast and east rhyme), stocks are all higher. Even in China, and by China one generally means Shanghai. Even though Hong Kong is China too, except they use a different currency and movement to and from Hong Kong to mainland China is not that easy. Look, it is complicated. As Paul was saying yesterday, the liberalisation of the politics is something that must happen, sooner rather than later. I wonder how that election would go! The Shanghai Stock Exchange is up nearly three and three-quarters of a percent.

In Japan something rare has happened, the Bank of Japan (BoJ) has implemented negative interest rates. That is the first time for Japan, there have been various other countries that have subscribed to what is termed NIRP - Negative Interest Rate Policy. This may not be new to many readers, the European Central Bank (ECB) deposit facility has a negative interest rate of 0.3 percent. In other words you pay the banks for the pleasure of them holding your cash. The whole idea is to go out and buy other riskier assets, spend the money and boost the economy, keep deflation at bay.

In other related news, yesterday the Japanese Finance minister resigned, a scandal around him pocketing money from a construction firm. Akira Amari resigned for the way his ministry handled the scandal and refused to suggest it was a bribe, rather a political donation. Sigh. 100 thousand Dollars, was it worth it? Amari suggests that the doubt created was enough to signal his departure. Honour or just? The Nikkei in Tokyo is up 2.8 percent, the Hong Kong markets, the Hang Seng is up around 2.2 percent as we write this.

Company corner

Visa reported numbers after the bell yesterday. Visa of course is one of the largest companies on the planet that enables seamless payments on their switching networks, be it that you are transacting online, in a foreign country and paying for goods and services, or whether you simply are at your local store that offers the service. Remember checks and travellers checks? I guess in the years to come you could argue the case for a cashless society and companies with the payments systems, those who enable the merchant to speak to your financial institution across their reliable and trusted networks and "get the transaction done" are operating in the right space. And by right space, I mean that a company like this, their peers and other payment networks, will see an uptick in their business.

It is fair to say that the old line, Visa takes you places is true. So has the share price. Since the stock listed and was effectively unbundled from all the major financial institutions nearly 8 years ago, the stock is up 330 percent to settle at the close last evening at 69.35 Dollars. That represents around a 12 Dollar fall off from their recent highs, and by recent I mean around November. Yip, even for the high flying stocks that are not part of the FANG (Facebook, Amazon, Netflix and Google) grouping, the going has been tough. In fact in the recent quarter the company had repurchased 25.7 million shares at an average price of 78.52 Dollars, having used 2 billion Dollars worth of shareholder cash.

Numbers for the first quarter of their financial year 2016, here goes. Operating revenues increased 5 percent (8 percent stripping out the negative currency headwinds) over a year ago on payment volumes that changed 12 percent in constant terms, 62 percent of all of those being debit cards, the balance being credit cards. The total number of Visa embossed credit cards number 2.459 billion. And to think that to have a Visa embossed, or any other for that matter, credit card was a "thing". Remember? Now anyone has a gold or platinum card, perhaps the exclusivity has been lost in the age of the internet. Which is possibly a good thing, not so? Cash on hand at the company, nearly 25 billion Dollars. Which represents around 15 percent of the current market capitalisation. The company has whopping margins.

Which brings me to guidance that the company gave, this is for the full year ahead. They suggested that annual operating margins would be in the mid 60's percent, this is as you can imagine, an incredibly profitable business. They obviously have to spend a lot own their networks, to ensure that they can handle increased bulk. Annual adjusted Dollar EPS growth is expected to be in the low end of the mid teens range, which I interpret as around 13 to 14 percent, somewhere in that range. That then means that expectations for EPS are just above the 3 Dollars worth of earnings for the year. There will continue, as per the presentation on the investor relations page, currency headwinds, as much as a 4 percent impact. The stock then trades (based on a price in the pre market where it has moved higher to 71 Dollars) on a 23 multiple. The yield is low, around 0.8 percent. Not too generous yet!

What is still amazing to think is that the company does not have a business in China, on the conference call the chief Charlie Scharf had something interesting to say about that territory: "The strategic partnership and programs we announced, underscore our long-term commitment to China and to fulfilling the Chinese Government's goal of reducing property and promoting inclusive finance." That is pretty interesting, and does underscore the move to consumerism in China. And the deal in Europe has not been closed yet either, again Charlie on the conference call had this to say: "We've had great interactions with our Visa European colleagues. We've had a series of very positive conversations with European financial institutions and we remain confident that we're creating value and are focused on execution at this point."

I think that this business has huge scope to continue to grow. There are far too many transactions in cash for the liking of governments, and even banks. Transactions via the switching networks are far easier for all considered. We continue to consider this a high growth business with huge potential upside. Risks include heightened regulation, bearing in mind that the company is waiting to do business in Europe and China. In our view this remains one of the most attractive businesses to buy. And as such we remain conviction buyers of Visa.

Linkfest, lap it up

Given that it is Friday we decided to share some graphs instead of links. As the saying goes, a picture is worth a 1000 words.

How much of Facebook's revenue comes from mobile users

How much of Facebook's revenue comes from mobile users

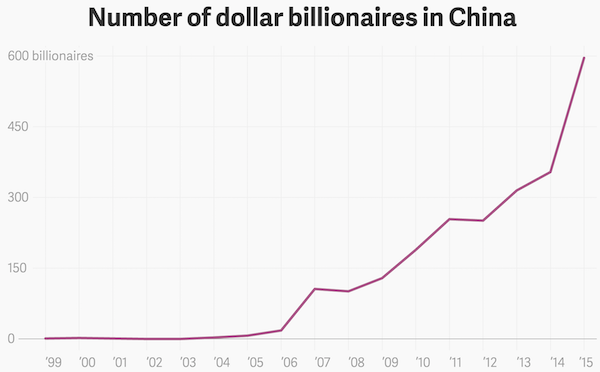

Number of dollar billionaires in China

Number of dollar billionaires in China

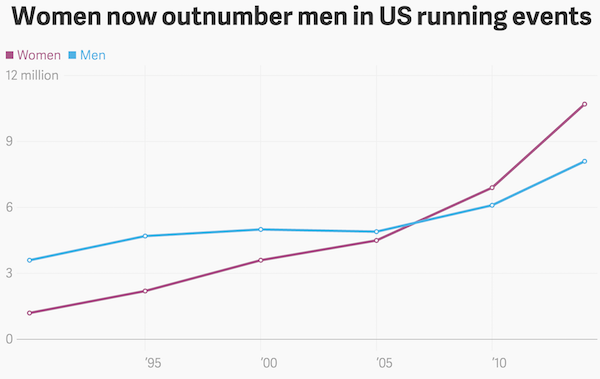

Women now outnumber men in US running events

Women now outnumber men in US running events

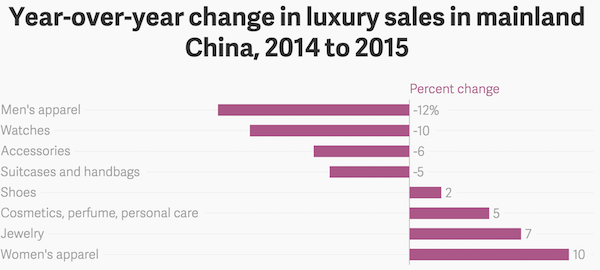

Year-over-year change in luxury sales in mainland China, 2014 to 2015

Year-over-year change in luxury sales in mainland China, 2014 to 2015

Home again, home again, jiggety-jog. Today is the close out of a horrible month for investors, good riddance. And to think that we are a week and a bit away from the Chinese year of the Monkey. The Red Fire Monkey to be more specific. Let us hope that the monkey business stays away!

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063