"The one very strange thing about continually adding to your investments, if you are a working person, is that you want to buy the same company shares at a cheaper price, that is a given. Yet, you are unlikely to commit fresh capital over time, if the value of your previous investments are lower."

To market to market to buy a fat pig. A strange old day for the local bourse, we started heavily inked in the red, and by nine thirty we were staring at the day lows. From there on out markets recovered, bar for the resource stocks, those were the laggards on the day. BHP Billiton touched a 52 week low, that is at least what my info told me. If I stared a little harder, which I did later, I noticed that the stock was actually at a level last seen in late 2008. That was back when the Democrats in the US had just recaptured the White House and Barrack Obama was fresh, last night he delivered his last state of the nation address.

Back to local, the markets eeked out a small gain, up 0.15 percent on the Jozi all share after all was said and done, resources as a collective were down just over two percent. The last decade return now on the resources ten index is about flat. True story, in Rand terms at least, resource investors from abroad would have gotten even worse Dollar based returns. I was looking at the iShares MSCI South Africa Index ETF yesterday, the main constituent of that index is Naspers, at nearly one-fifth.

In Dollar terms, ticker EZA has delivered minus 23 percent over the last decade. The last year has been particularly tough, EZA is down nearly 40 percent over the last 12 months. I wonder what the calculation would look like if you stripped out Naspers, which often trades as a proxy for Tencent, which in turn is listed in Hong Kong.

For comparisons sake, let us choose the same old usual suspects, Brazil, Turkey, India and the like, and measure their performance in Dollar terms too, a rough estimate using the same ETF issues by MSCI. In other words, ticker EWZ (Brazil), TUR (Turkey) and INP (India). EWZ over the last 10 years in Dollar terms has returned minus 48 percent. TUR does not have as much of a track record, over five years that ETF is down 47 percent.

The ticker INP (which is actually is the long and complicated name Barclays Bank Plc iPath ETNs linked to the MSCI India Total Return Index) has returned in Dollars over ten years, just over 19 percent. Over the same time, the broader US market, the S&P 500 has returned 50 percent, equally not the greatest return ever seen, or expected. Year to date, for interest sake, the S&P 500 is down over five percent.

So, all I am trying to point out is that for all emerging markets "things" have been tough, in particular in the last 18 months. Yet. Locally we saw a trading update from Cashbuild that looked pretty good. No, very good, considering that the talking heads continue to refer to a consumer under pressure. In an environment where we are likely to see the shocks of imported inflation flow through soon, we have to guess that the rates trajectory is slowly forward and upwards.

Along with the rest of the world really, Europe seems to be on hold for the foreseeable future. The jury is still out on this one, for Mr. Consumer globally they can thank their lucky stars for a plunging oil price, trading at over 12 year lows and breaching the thirty Dollar per barrel mark last evening. I noted now that a specific bank called ten dollars a barrel, Standard Chartered. Not sure about that, the demand side still looks really strong.

What to do? Stay the course. Markets fall out and in of favour. As we always point out, you don't own the market. You own individual shares of specific company's. Volatility is always part of being in equity markets. Use it to your advantage. The one very strange thing about continually adding to your investments, if you are a working person, is that you want to buy the same company shares at a cheaper price, that is a given. Yet, you are unlikely to commit fresh capital over time, if the value of your previous investments are lower.

It is entrenched in the human psyche, gathering together assets always trumps common sense over the short term, the squirrelling mentality. Yet it is completely understandable from a rationality point of view, why would you add to your investments if they continued to trend lower in price? Yet that is exactly what you should do. Spare a thought of course for those who saved for many years and experience a drawdown of sorts. Not all investors and savers are the same age, which is why it is important to continue to squirrel and be frugal when the times are good, saving is a tough old business.

Linkfest, lap it up

It is only a matter of time until our mobile carriers adopt the same system of selling phones - Two-year phone contracts are now dead at all major US carriers. This is good news for the likes of Apple through their iPhone upgrade program, where you can get a new iPhone every year.

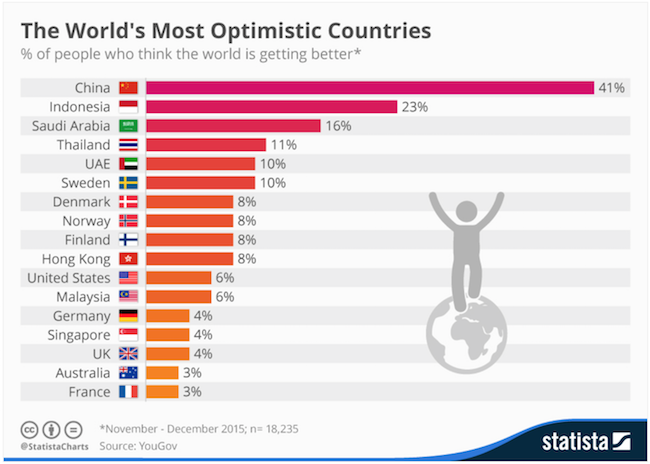

Everything is relative, if you live in a developed country where most people are rich by global standards then you may think that the world isn't getting much better. It is slightly scary that so few people think the world is not getting better, I suppose it depends what time frame you use in answering the question - The World's Most Optimistic Countries

I think the huge amount of data available on the internet about personal finance and how the system works, is a strong reason for the millennial savings rate - Millennials Are Outpacing Everyone in Retirement Savings

Home again, home again, jiggety-jog. Markets are flat to begin with, slightly higher now, the oil price has bounced off the worst levels of below 30 Dollars a barrel at one stage. Spare a thought for the budgets of Saudi Arabia, Russia and Venezuela, not to mention Nigeria and Angola.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron and Paul on Twitter

078 533 1063

No comments:

Post a Comment