"if that number is right from the World Bank, the 10.3548 trillion Dollar economy in 2014 (No questions asked here), then 6.8 percent growth on that equals 11.058 trillion Dollars, growth of 704 billion Dollars. Or put differently, China added to their already large economy their entire economic output of 1995 in one year alone."

To market to market to buy a fat pig. US markets were closed for Martin Luther King Day yesterday, the dream that he had back then is still far from being realised. Whilst the opportunities exist in theory for all Americans, in reality it is much harder. All minority groups in the US are definitely not the same, the unemployment rate of white woman (not minorities) in the US (as per the last release) is 3.9 percent, for 20 years and older. Amongst the same grouping of African American woman, the rate is at 6.9 percent, a similar pattern for men. Equally for women of hispanic descent, the unemployment rate is at 6.3 percent, aged 20 and older. I am pretty sure the same applies here in South Africa, it is however not for minorities.

Access to education is key, I believe that the internet is the greatest tool to break down these barriers that we have, to improve equality. If you look inside of the same data, Employment status of the civilian population 25 years and over by educational attainment, folks with a bachelors degree have an unemployment rate of 2.5 percent, whilst the unemployment rate in the US for those not having finished high school is around 6.7 percent. Those statistics don't tell the whole story, the ability to earn higher wages based on your skill-sets that you possess are vastly different from those who have very little or limited skills. And having access to the same opportunities depends on your background.

We know that very well here in South Africa, our students are grappling with the same issues. Our parents are grappling with the legacy of not only apartheid, but the era before that, inequality is not something that can be addressed overnight when inequality has existed for centuries. Going to meet in the lovely sterile environment of the Swiss Alps hardly seems like the ideal location to solve any of these problems. There are no easy solutions, no instant fix, no way of solving this overnight. We should all do our bit, education is still the most powerful weapon, you can never remove that from an individual. Don't complain about the state of affairs, go teach children to read, sponsor a child. Anyhow, this is a newsletter about markets, let us stick to that.

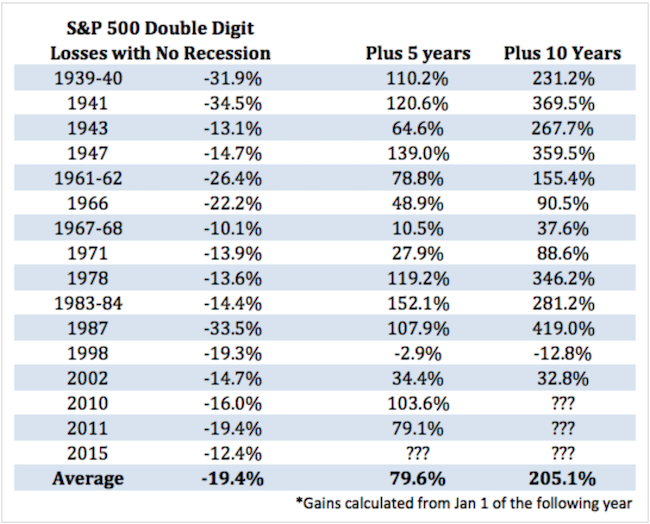

There has of course been loads of worrying, it is natural as we have said to worry about equity prices moving lower. Are we going to experience a 2008 type meltdown? That is pretty fresh in the minds of all investors. The short answer is not likely, Cullen Roche has written a good piece, titled On the Probability of Another 2008, in which he explains that the US and European banks are in far better shape than they were back then. One thing I find interesting is that he says something that we do not highlight enough, here is that paragraph: "In the last 100 years there have been 123 corrections (10%+ declines) and 32 official bear markets (20%+). That means an official bear happens once every 3 years or so and corrections happen more than once a year. So, what we're seeing really shouldn't be that frightening at all." Michael has included another link below that is related.

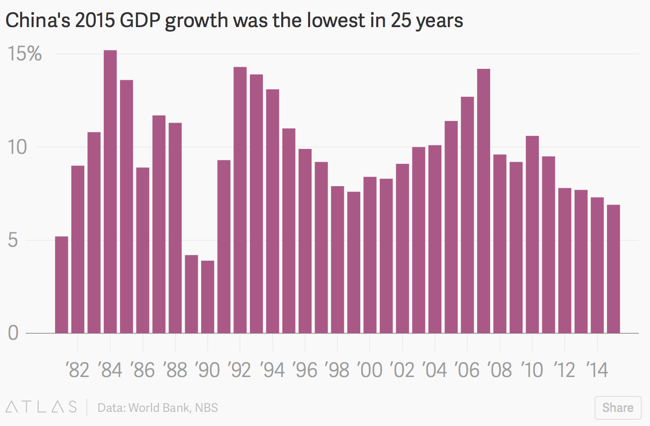

And part of the "is this another 2008" is linked to the Chinese worries, at least worries about slowing growth in that country and more importantly, the quality of their loans. Chinese GDP for the year was released today, missing expectations somewhat, down at 6.8 percent for the whole of 2015. As an email to my inbox this morning from Quartz puts it: "It sank to 6.9% in 2015, from 7.3% a year earlier, as the economy continues to cool off from a 30-year boom" The link through to the article titled China's economy hasn't grown this slowly since 1990, starts like this: "China's economy grew by 6.9% in 2015 according to official figures released today (Jan. 19). That's down from 7.3% a year earlier and well below the average 10.1% annual growth experienced in China's boom period that stretched from the early 1980s to 2010."

Whilst reading that, you may be forgiven for feeling a little down, when you look at the associated image, it hardly looks like a picture of health. See, it slides away to the right, lower.

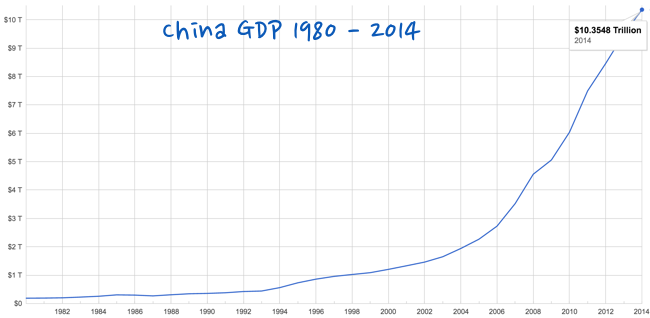

Below that image is the line: "The last time the Chinese economy grew this slowly was in both 1989 and 1990." Again, all of that is true. However, if you mix things up a little and you display from Google public data the World Bank data of Chinese Gross Domestic Product, you get something that looks a little more appealing, graphically that is. Equally, if that number is right from the World Bank, the 10.3548 trillion Dollar economy in 2014 (No questions asked here), then 6.8 percent growth on that equals 11.058 trillion Dollars, growth of 704 billion Dollars. Or put differently, China added to their already large economy their entire economic output of 1995 in one year alone. See the graph below to actually see how eye popping the growth has been, forget the growth rates.

That, my friends is how compounding works. It is going to become increasingly hard for the Chinese growth model to stay at a constant 7 percent as the base increases in size, to what you can now see is beyond 11 trillion Dollars. Just how big is 714 billion Dollars, or what China added to their entire base last year? In nominal terms it is basically the whole of Saudi Arabia, or more than the whole economic output of Switzerland. You know how everyone was worried about contagion around Greece, the addition to the Chinese economic base was three times the entire Greek output. Three times. In four months, or around 120 days, China adds another Greece. So remember perspective when worrying about something.

Linkfest, lap it up

Does this current market sell off mean that a global recession is just around the corner? It may be the case for emerging markets, particularly those economies that have large commodity exports. Looking at the largest economies around the world; the US, China and Europe all look like they will continue to grow - Stock Market Sell-Offs Without a Recession. It is fairly common place for a stock market to pull back and not be in a recession, thanks to Ben Carlson for the image.

Value investing is considered a safer approach to investing because you build in an element of "safety" because you are buying stocks that are "cheap". If you buy something that is cheap, how much cheaper can it get? The problem is that buying value recently meant that many investors piled into commodity stocks - How to avoid the value trap

Two points to note about renewable energy, the first is that in 2015 China spent just shy of the US and Europe combined on renewable energy infrastructure. Given their pollution problems it is important for China to be looking at clean ways of generating the much needed power for its economy. Here is the second point, "Even more telling is that the world has reached a turning point, and is now adding more power capacity from renewables every year than from coal, natural gas, and oil combined" - Solar and Wind Just Did the Unthinkable. As the article points out, this happened despite commodity prices crashing.

Home again, home again, jiggety-jog. The futures market in the US is pointing to a stronger start, albeit after a pretty rough start to the year. It is almost as someone flicked a switch and starting worrying about this or that, simply as the calendar changes. Yeah right, happy new year and compliments of the blah-blah. The Chinese stock market is up sharply! There should be some respite for the frazzled bulls today!

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment