"A strange metamorphosis of a company from being the transporter of goods and people via stagecoach, now you know where the logo comes from, the name comes courtesy of the founders, Henry Wells and William Fargo. Believe it or not, those same two fellows, Fargo and Wells, teamed up with a John Butterfield to found American Express."

To market to market to buy a fat pig. I recall a terrible daily workout session on SABC in the 80's in the early morning, before we had to go to school, called Body Beat. It was awful, the instructor was cheesy, the assistants helping him were just as cheesy, where was the fashion police back then? They should have been hung, drawn and quartered for being allowed to wear such bad clothes. The theme song I think was get that perfect beat boy, the instructor I remember used to scream at people, "up and down" and "up and down".

The gyrations from the session in New York was about the same yesterday, a badly dressed movie that you had seen before, with an instructor shouting "up and down" in the background. OMW (that is Oh my word), I managed to find it on YouTube, it is really cringeworthy, and how this managed to make early morning TV is beyond me: Body Beat. These may be later versions, still the "same". Wow. There was another one. Brace yourself: Body Beat. Cape Town people, help me, where was the first one filmed?

Stocks started and ended in the same place on Wall Street, the lows of the sessions were around halfway through the session, from there a heroic comeback was in order. So much so was the comeback that for a short while the nerds of NASDAQ were up, the S&P 500 was off only one-third of a percent, ending the session down 1.17 percent. The Dow Jones Industrial Average was trading down around 550 points at one stage, equally staging a strong comeback. Down over a percent and a half is hardly cause for celebration.

Moments like these call for a strong stomach, they call for remembering that this is what happens in equity markets. Panic sets in, irrationality takes over and some short term folks have to walk the proverbial margin plank. Forced to close positions that ordinarily they would not. Treasuries continue to attract a lot of attention, volatility is up 50 percent since the beginning of the year. Yet the Vix, the index that measures volatility, is "only" at 27.

Remembering that at the depth of the financial crisis it rode all the way up to 87, if memory serves. Volumes in volatility have risen sharply since 2008, rising over sixfold on options, nearly 50 fold on the VIX futures. It is a fascinating market and something that I would dearly love to understand more about. In sticking with the motto, keep life simple however, this is possibly never an option, excuse the pun. Something else that was visiting multi year lows was the oil price, last at these levels in 2003, below 27 dollars a barrel briefly. Down 25 percent year to date by the 21st of January, does that sound a little like too much and too far too soon? It might reflect a new reality of greater supply and muted demand as a result of slower growth and efficiencies.

On the local front we did not have the benefit of having simultaneous timing with the US session, most of the major bourses around the world were closed during this period. Stocks sank nearly two and three-quarters of a percent. There were no prisoners, stocks were battered from all quarters, resources again sticking out as the worst impacted of the lot, down four and a half percent by the close, some of the big names at the bottom of the scoreboard were the likes of Anglo and BHP Billiton, equally Naspers was there.

Ben Carson had a good piece titled Three Things That Matter During a Market Sell-Off that is worth a read, point three had me in stitches (relative when reading blog posts, Ben is not the Fly), it is definitely worth a copy and paste: "The majority of the people taking victory laps for "calling" the market correction would have had you out of the market for the past 50-100% or so of gains (and they’ll never get you back in). Charlatans aren’t offering advice, they’re fear-mongering to draw attention to themselves. Do your best to ignore these attention-seekers and focus on utilizing sources of advice that seek to provide context and perspective."

I think Ben nails it, it is hard to "live" through these market draw downs and feel like you are still doing the right thing, as the voices of the "I told you so" gets louder and louder, I noticed that Nouriel Roubini made a comeback yesterday, perhaps that tells you something. Surprising that we haven't seen more Marc Faber lately. Talking of doom and gloom, I watched "The Big Short" last evening, some good acting from Steve Carrel and the like, I had read the book a while back and it was a good refresher. Entertaining, whilst trying to explain the financial crisis.

Are we any where near? No, I suspect that we may, in a few weeks have seen the worst done and dusted and the confidence will return. Stocks across Asia have been equally volatile this morning, markets in the UK (i.e. the FTSE) entered what is called "bear market" territory, you know, a fall of more than 20 percent. Jeepers. That feels bad. It does not mean that you should sell, in fact you should always think the opposite. You should want to buy shares immediately when the prices get cheaper, history tells us that these opportunities come around only for a moment of what if, perhaps I should have. That sort of thing.

Company corner

Wells Fargo reported numbers last Friday, before the bell, in amongst all the bedlam (strictly speaking that word is derogatory) we have pushed the results reporting (from our side) a little out. I read their now old 2014 annual report and then their Full year and fourth quarter numbers yesterday in more detail. At face value the numbers I guess are uninspiring, for the full year for 2015 earnings and revenues grew by very low single digits, barely at all.

It was however not a bad year for shareholders however, 12.6 billion Dollars was returned over the course of the year through share buybacks and dividends. With a market capitalisation of 246 billion Dollars, that is around five percent. The yield at current levels (hopping around a little, apologies) is 3.13 percent before tax and on the full year earnings per share is 11.55 times. I guess the share price reflects exactly that, muted growth over the last year and a tough year with regards to growth prospects. And as such prices the stock accordingly.

A strange metamorphosis of a company from being the transporter of goods and people via stagecoach, now you know where the logo comes from, the name comes courtesy of the founders, Henry Wells and William Fargo. Believe it or not, those same two fellows, Fargo and Wells, teamed up with a John Butterfield to found American Express. A mailing company, located in New York. In the lead into the financial crisis the company was the only business with a triple A credit rating. This company is good enough for Buffett, it is one of the big four holdings of Berkshire Hathaway. American Express is too, perhaps Buffett knows his history better than most, perhaps it is just a coincidence.

So why hold this business? If you read through the results you get the sense that this is a business that operates along the lines of good old fashioned banking, offering the services that their clients have always been used to. In a sense mom and pop style banking. The investment is based on the premise that the US economy will continue to be strong, and that their core business will grow with the continued recovery. Whilst rates pick up, their net interest income will too, and having worked hard at keeping costs low and business simple. We continue to recommend the company and in particular find them attractive at these deflated levels.

Linkfest, lap it up

We already know that exercise has many benefits. Here is another one to add to the list, improved memory - A neuroscientist says there’s a powerful benefit to exercise that is rarely discussed. Most of the focus of exercise has been on the amount of weight that I can drop if I go for a run regularly, going forward the improvements to cognitive abilities will get more focus. The data base of information that Discovery is collecting on it’s members is getting more valuable by the day to the company and to researchers who want to find long term correlations between exercise, diet and longevity.

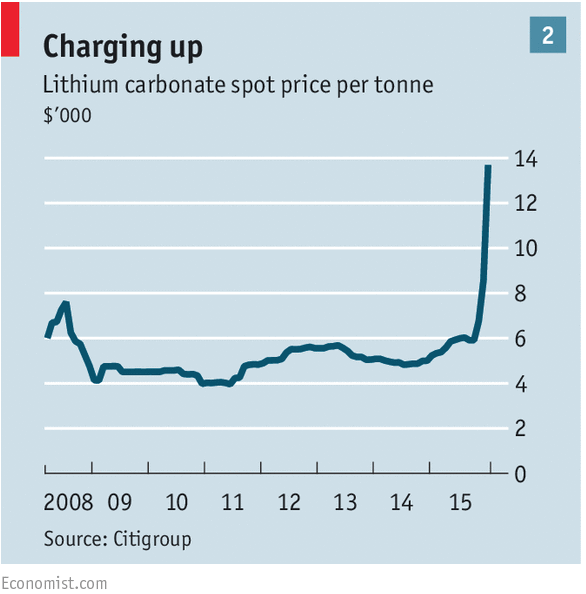

As battery demand increases so does the need for Lithium. Given the need to store solar and wind power and to power the likes of Tesla, the demand for batteries is set to soar - An increasingly precious metal. Given the huge spike in lithium prices the hunt for a lithium substitute will have begun, we may even find another element that works better in batteries.

Given the low unit cost of natural gas it is cheaper for many oil companies to burn it on site instead of pipe it - "Flaring" Wastes 3.5 Percent of the World's Natural Gas.

Home again, home again, jiggety-jog. Markets in Asia were up, now they are down. It is all over the place at the moment and very hard to call. Stick the course, keep calm and add to your portfolio’s if you have some spare change lying around.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment