"You cannot replicate hundreds of years of history and unique workmanship, brand value and prestige even in a single generation, with regards to the goods they sell. Of course you need the customers, the shift to more consumer related activity in China should continue to be really helpful for the company."

To market to market to buy a fat pig. We experienced the bulk of the overseas markets selling during our sessions yesterday, this as US markets changed their course later on in the day. Led by energy stocks, a recovering oil price had everything to do with it, that was yesterday anyhow! That has reversed some of the gains from yesterday and is currently down again. I wonder about the current levels, the calls to 10 Dollars a barrel (that last happened in an era when email was just becoming a "thing"), the marginal cost of production being not too far from here.

Equally, I wonder what this means for instability in some countries unable to meet their obligations, as their budgets have been based on higher oil prices. One of the chaps who has seen it all, Harold Hamm the CEO of Continental Resources, who is featured in "The Frackers" book by Greg Zuckerman, was interviewed a couple of days ago on Bloomberg and suggested that 60 Dollars a barrel is achievable by the end of this year. I guess you could argue that Harold is speaking his book as well as being the optimist that he always is. That chap has certainly been through the mill.

Remember the story of Harold and his second wife, who cashed possibly the largest check in history, one for 974 million Dollars. Via Forbes -> Sue Ann Arnall check, I love the way that the 77 cents wasn't even left off. Sue Ann did well not to continue to contend the settlement, a year on from this, energy prices have been crushed, Continental Resources stock is down 44.5 percent in the last 12 months.

That is about the industry norm, in terms of stock prices in the Oil and Gas exploration index. Tough out there, tougher to even predict a level for oil prices, Hamm is suggesting that the prices could double inside of a year. Either he knows about the stresses in the US industry, that he sees, or he is hoping that the marginal production globally evaporates. With Iranian sanctions about to be lifted, that country could be looking for some much needed dollar revenues by pumping as much as possible. I would argue that more production and lower growth trajectory (efficiencies, shift to alternatives) means more supply than demand.

Equally it was a tough day out for GoPro, the stock was hammered nearly 15 percent, bouncing hard off the worst of the day. Anyone have one? If so, what are they like? Good product? They certainly do look amazing and user friendly, I am just conveying what I have read. The market cap is a "mere" 1.99 billion Dollars at the closing level last night, chump change for some of the bigger companies. Apple for instance could buy this company with their cash resources 100 times over. Of course if they wanted and needed the product and thought it was really that awesome, they would have done so already.

I thought that this may be of interest, bearing in mind that we chatted about it yesterday. I was waiting for this. The headline of the story says it all: The author of the RBS 'sell everything' note has been predicting disaster for the last five years. So whilst Mr "Sell everything except high quality bonds" has been getting a lot of attention lately, it seems that he has been very wrong in the past. I am going to copy and paste the most important paragraph in the piece:

"Like the proverbial stopped clock which is right twice a day, if you are constantly predicting a stock market crash you will eventually be right, but it doesn’t make your advice very useful. When you are eventually right, you may go around saying 'I told you so', yet in the meantime great fortunes will have been made by people who ignored your advice and piled in and joined the boom."

Exactly. Keep calm and carry on, that mantra has worked well. Talking of which, I was chatting to a client whose father fought in the second world war, she was telling me that when she was born there was basically no food, her parents used to scrounge for food. Anything. Times feel tough now was her message, they are certainly MUCH better than they were back then. A quick markets wrap, locally we sank nearly a percent and a half on the Jozi all share index, financials in particular taking some heat. Over the seas and far away, stocks bounced sharply on Wall Street, by the end of the day stocks had managed a one and two-thirds of a percent gain. It has been volatile out there. Oh {insert extreme sarcasm}, does that mean that the correction is no longer a correction (less than 10 percent down from recent high), I don't know my technical terms correctly?

Company corner

Richemont fell short in a sales update that may have been somewhat shy of expectations, for the first time however it was evident that the terrorist attacks in Paris has been a part of the softer sales. The attacks of course were just over two months ago, 13 November. Those attacks certainly shook all and sundry, Paris is of course one of the most visited cities in the world. If I am not mistaken, from my reading, the Notre Dame de Paris is the most visited free place in the world, you don't have to pay to get into a church. That church took nearly 100 years to build, "things" were a little slow back then.

I read a WSJ article (Burberry, Richemont Sales Cool in Hong Kong, Paris) that suggested that various trips to Paris were cancelled, in particular from China, where the luxury goods trade has been welcome for the likes of Richemont and their peers. Ticket sales, airline tickets from China that is, dropped 54 percent. And with regards to visits to Hong Kong by luxury goods tourists, the same article points out more stringent visa requirements to visit Hong Kong. Imagine wanting to go to Cape Town, or Durban and needing a Visa?

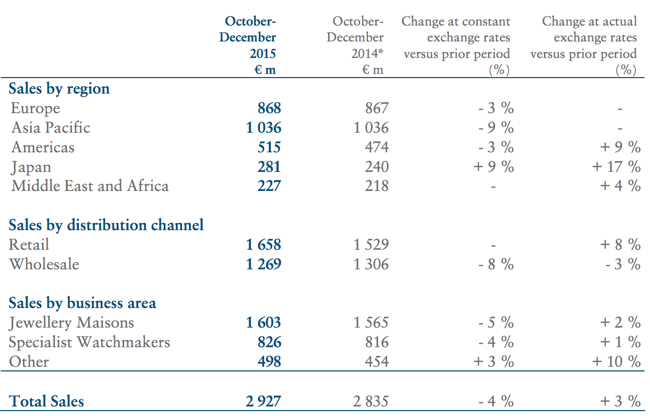

Anyhow, here is the trading update: Trading update for the third quarter ended 31 December 2015. Here is the table that is relevant:

The company points out that "the slowdown in sales largely reflected weak trading in Europe" and suggests that this "began in November and primarily reflects lower levels of tourism in the region." So the WSJ additional research corroborates this. As for the outlook, the company says "The challenging trading environment is likely to prevail in the final quarter to 31 March 2016."

So it is tough out there. I still maintain that this is one of the best that you can own here in South Africa. Currency issues aside, the company owns brands that are unique and almost irreplaceable. You cannot replicate hundreds of years of history and unique workmanship, brand value and prestige even in a single generation, with regards to the goodS they sell. Of course you need the customers, the shift to more consumer related activity in China should continue to be really helpful for the company. A lower share price in what is likely to be a lower year for profits will mean opportunities, we continue to accumulate on weakness. Be patient on this one. The stock sank over two percent on the day.

Linkfest, lap it up

I like to see how the overall market sits on a dividend yield perspective. If stocks go up and so do dividend values, thus keeping the yield the same or better, then it indicates to me that the market move was justified. Earnings numbers can be massaged where as a company you either have the cash or you don't - Another Good Quarter for Dividends

Given that the words "Bear Market" are being thrown around more regularly now, here is some insight from Ben Carlson - 10 Bear Market Truths. I have seen a number of people point out that our current bull market has go on for too long, what people forget though is that in 2011 the market pulled back 19% (who remembers this?). If it had gone another 1% the bull market would have been broken, what really is 1%?

Seeing the problems that Aravena has solved through the buildings that he has designed is inspiring - Pritzker Prize for Architecture Is Awarded to Alejandro Aravena of Chile. Here is a TED Talk that he did in 2014 - My architectural philosophy? Bring the community into the process

Home again, home again, jiggety-jog. There was also a very good trading update from Woolies yesterday, we will cover that in the next newsletter. Much of the gains from yesterday are a little undone by a lower US futures market, and an Asian session that looks sloppy, Chinese markets are down as we write this. The five day performance of the Shanghai Stock Exchange is minus 8.3 percent, year to date down 17.4 percent. Phew, there is troublesome and then there is awful. US Markets are closed Monday, the session this evening could be a little "light".

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron and Paul on Twitter

078 533 1063

No comments:

Post a Comment